Analysis

October 14, 2021

AGC: September Construction Employment Up, Still Lags Pre-COVID Levels

Written by David Schollaert

Construction employment totaled 7,447,000 jobs on a seasonally adjusted basis in September, an increase of 22,000 month on month, reports the Associated General Contractors of America (AGC) in its latest analysis of government data.

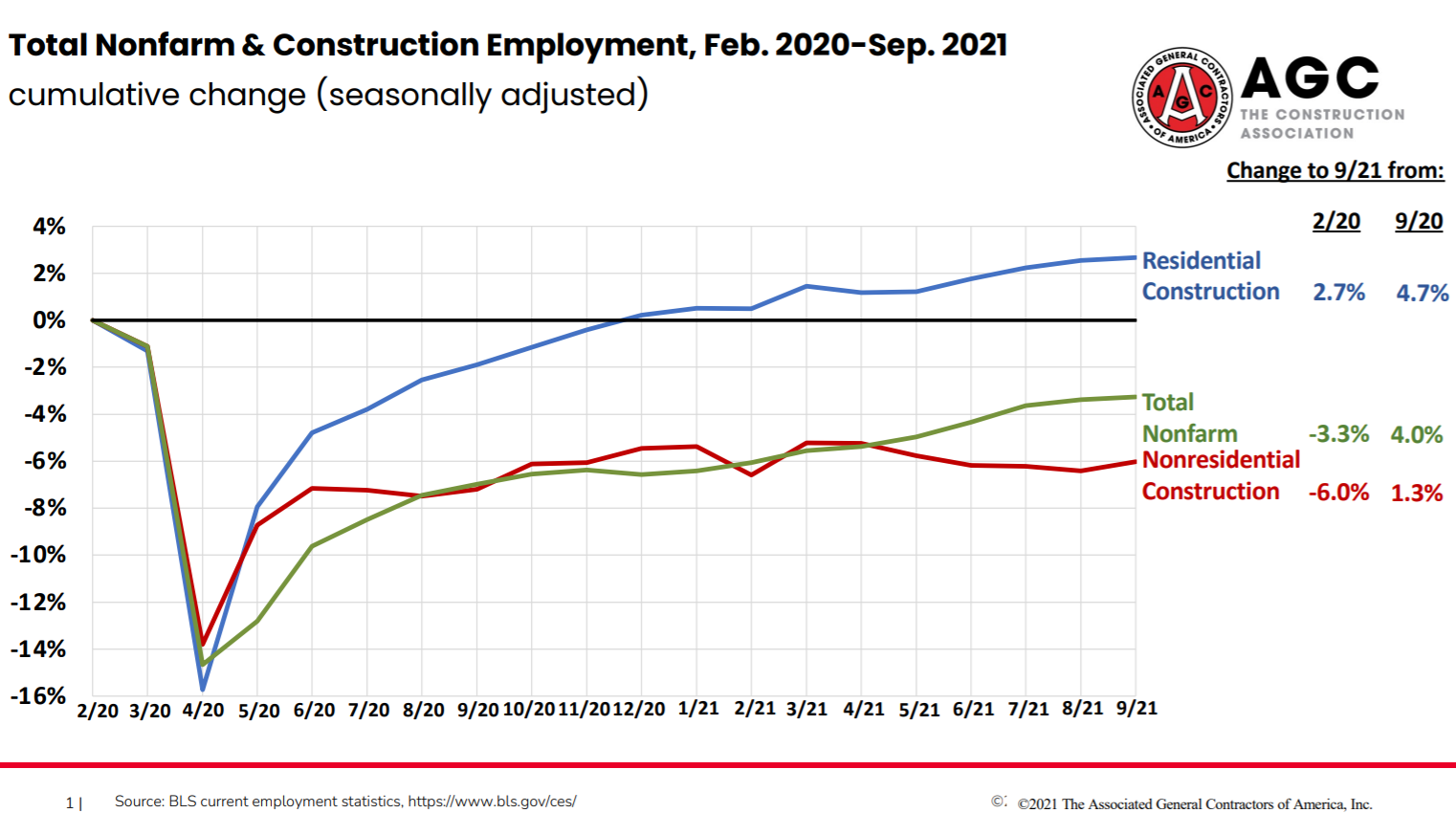

September’s total was 201,000 or 2.6% below the pre-pandemic peak from February 2020. Residential construction employment expanded by 3,400 in September, driving total employment in the subsector 2.7% higher than February 2020’s pre-pandemic total at 80,000. Nonresidential construction employment rose by 18,600, the first increase in six months, to a total of 281,000, still 6.0% below the February 2020 level.

Nonresidential employment has regained only 56% of the jobs it lost between February and April 2020, compared to 78% for total nonfarm payroll employment and 117% for residential construction, AGC said.

A total of 444,000 former construction workers were unemployed in September, down 37% year on year. The industry’s unemployment rate in September was 4.5%, not seasonally adjusted, the third-lowest September rate in 22 years, and much improved from the 7.1% unemployment rate seen one year ago.

“While it is refreshing to see job gains in both residential and nonresidential construction, nonresidential building and infrastructure employment remains far below its pre-pandemic peak,” said Ken Simonson, AGC’s chief economist. “It will take more than a few months of gains to match the overall economy.”

Average hourly earnings in construction totaled $33.25 in September, seasonally adjusted, a 4.5% increase year on year, and a 7.8% premium over the nonfarm average. The construction premium was 10.5% back in September 2018. The premium has waned as low-wage employers such as restaurants and warehouses raise starting pay.

Simonson cited an unending series of supply-chain bottlenecks, as well as extreme price increases and long lead times for a variety of construction materials, as threats to further growth of nonresidential construction. Several project owners are postponing projects because of excessive cost increases and lead times, the AGC said.

The AGC has again urged the Biden administration to remove tariffs and import quotas on a range of key construction materials to help address supply-chain disruptions. They added that Congress can help offset declining nonresidential demand for construction by passing the bipartisan infrastructure bill that has already cleared the Senate.

“Both parties in the House should make passing the infrastructure bill a top priority because it is the best way to create new construction careers and make our economy more efficient,” said Stephen Sandherr, AGC’s CEO. “If the president acts to address supply-chain problems and Congress passes the infrastructure bill, construction employment is likely to surge.”