Analysis

October 14, 2021

AGC: 'Construction Material Costs Remain Out of Control'

Written by David Schollaert

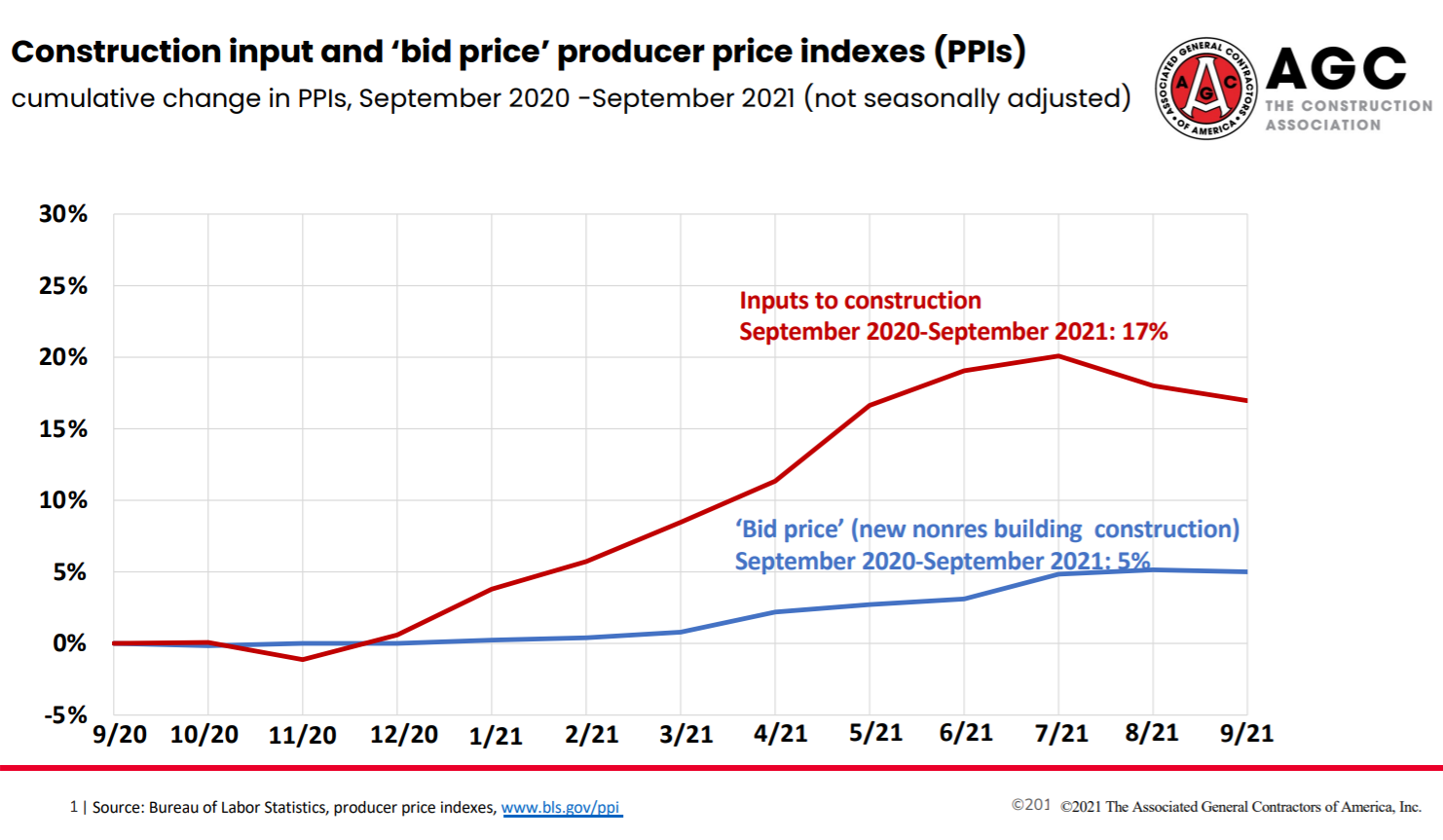

The prices contractors pay for construction materials rose further in September despite a recent decline in a few materials’ prices. The costs still far surpass the prices contractors charged in the 12-months ending in September, reports the Associated General Contractors of America (AGC) in its latest analysis of government data.

“Construction materials costs remain out of control despite a decline in some inputs last month,” said Ken Simonson, the association’s chief economist. “Meanwhile, supply bottlenecks continue to worsen.”

The producer price index for new nonresidential construction – a measure of what contractors say they would charge to erect five types of nonresidential buildings – rose 5.2% over the past 12 months, despite a decline of 0.9% month on month. The prices that producers and service providers such as distributors and transportation firms charged for construction inputs jumped 17% year on year, Simonson said.

There were double-digit percentage increases in the selling prices of most materials used in every type of construction with the exclusion of lumber and plywood, which fell 12.3% during the past 12 months.

The producer price index for steel mill products surged by 134% compared to last September. The index for copper and brass mill shapes rose 39.5% and the index for aluminum mill shapes increased 35.1%. The index for a number of other construction-related products also saw double-digit percentage increases, including plastics, gypsum, insulation, prepared asphalt and tar roofing, and siding products.

In addition to increases in materials costs, transportation and fuel costs also spiked. The index for truck transportation of freight jumped 15%, while fuel costs have also jumped.

Many contractors are experiencing extreme delays or uncertainty about delivery dates on variuous types of construction materials, as supply-chain bottlenecks continue. As a result, the AGC has urged Washington officials and the Biden administration to end tariffs on key construction materials and for an all-out effort to help ports and freight transportation businesses move goods more quickly

“The tariffs on lumber, steel, aluminum, and many construction components have added fuel to already overheated prices,” said Stephen Sandherr, AGC’s CEO. “Ending the tariffs would help immediately, while other steps should be taken to relieve supply-chain bottlenecks.”