Analysis

October 3, 2021

Final Thoughts

Written by John Packard

First, I want to thank the SMU team for keeping the ship afloat and moving forward during my extended vacation. If you didn’t know, I took the month of September off, then the team did a great job during my absence.

And of course the steel market kept churning while I was away from my desk.

![]() The steel market, like life, is in constant motion. There will always be ebbs and flows to the business cycle as there are in life. Life has its own cycle that is in some ways predictable. We all are born into this world and ultimately, we cease to exist and become a distant memory. Everything that happens in between is what makes living interesting.

The steel market, like life, is in constant motion. There will always be ebbs and flows to the business cycle as there are in life. Life has its own cycle that is in some ways predictable. We all are born into this world and ultimately, we cease to exist and become a distant memory. Everything that happens in between is what makes living interesting.

My business life has focused on the cycles of the steel industry, understanding the peaks and valleys, and searching for ways to make sense of it all. I spent 32 years selling flat rolled steel before transitioning from sales to observer to educator. During my learning process, as I transitioned from steel salesman to steel guru, there were moments of clarity as I endeavored to make this industry more transparent.

I have learned not to prognosticate or pontificate but to observe and appreciate the forces in play. I learned how to separate my opinions from the facts and to share both without polluting the dialogue. The market cycle forces were pieces of a larger puzzle and learning how they fit together has been a long-term project for me. Finding and developing new puzzle pieces, communicating that information to our readers, entertaining and educating, have been and continue to be my primary focus.

During my career I embraced change because those who adapt are the ones who survive.

Success (much different than survival), in my opinion, comes from seizing opportunity and filling a need not yet appreciated. Think of the iPod which led to the iPhone. An online book seller that became the dominant force in e-commerce. Conversion from post-paint to pre-painted steels. Using financial tools to mitigate price risk.

In the case of SMU, the concept of carrying on a dialogue with those who buy and sell steel was new when I created the company. I saw a need for building trust in the data being presented. SMU was created as an educational tool to be used as individuals made buying and selling decisions.

Transition: the period or process of changing from one state to another.

I believe, and our data is indicating, that the flat rolled steel industry is in transition in many ways. Steel prices are coming under pressure.

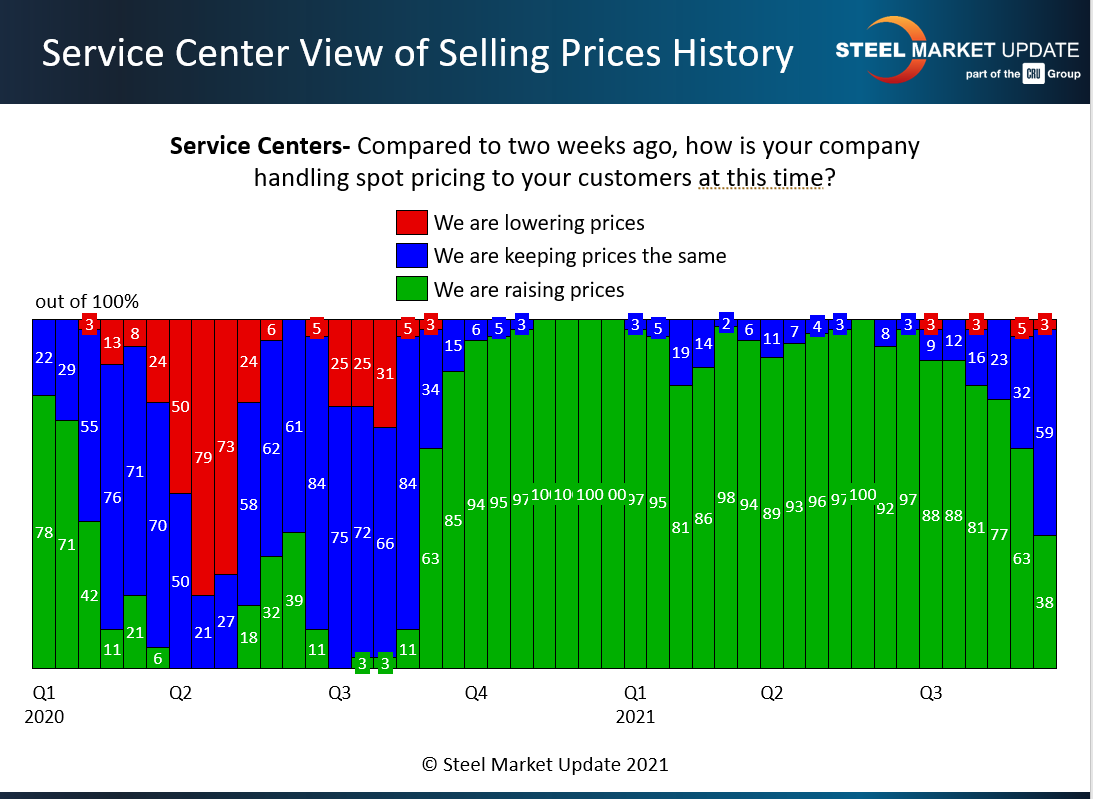

Service centers are under pressure from their end user customers, and their ability to pass on spot price increases indicates a market in transition. In our most recent analysis, 72% of the service centers polled reported either keeping spot prices the same (61%) or lowering prices (11%) to their customers.

The data is quite telling when viewed over time (see below). We have not seen the service center spot pricing reacting the way it is now since mid-third-quarter 2020. (Remember, prices bottomed at $440 per ton in mid-August 2020).

Another puzzle piece created by SMU is our analysis of service center inventories and shipments. We have been warning our data providers and our Premium members that service center inventories were rising. At the end of August, service centers held 51.6 days of flat rolled steel inventories. At the same time, the number of days of inventory on order has been shrinking. To us, this means inventories are either balanced or close to balanced.

This was confirmed to me in a discussion with a hot rolled steel buyer last week when I was told their inventories were in balance and, “we’re not testing the mills [for lower pricing] as we’re afraid they may say yes. I’m not sure there is such a thing as a good deal at these prices.”

Our sheet Price Momentum Indicators are at Neutral with an expectation that prices will be dropping in the coming days and weeks.

On a personal note, earlier this month I turned 70. Birthdays mean different things to people as they go through life. The idea of a day being created just for you carries joy during your youth, angst in those “middle” years, and trepidation when you reach my age. The question of “what’s next?” becomes inevitable.

I decided long ago not to wear out my welcome. I knew the time would come when I would need to transition from workaholic to something a little more balanced.

Steel Market Update has grown and matured to the point where I can take my hands off the wheel, and it continues to exist and serve its purpose. My role as the leader of SMU is changing at my request. I am now a consultant to the company and not a full-time employee. I will continue to work with the SMU team, write articles, develop new products, and be involved in our workshops and conferences. For most of you, the changes being made will go unnoticed.

I am looking forward to this new chapter in my life.

I can still be reached at my SMU email address. I have also added a new personal email for those who wish to interact with me away from the industry. My phone remains the same, as does my address.

You will continue to receive high-quality and unique content from the SMU team.

As always, your business is truly appreciated by everyone at Steel Market Update.

John Packard – John@SteelMarketUpdate.com