Market Data

October 1, 2021

Steel Product Shipments and Inventories Through July

Written by David Schollaert

U.S. steel product shipments grew for the third straight month in July, up 2.8% from the prior month. Following some irregularity to start the year after bottoming out in May 2020, steel product shipments have been on a steady upward trend.

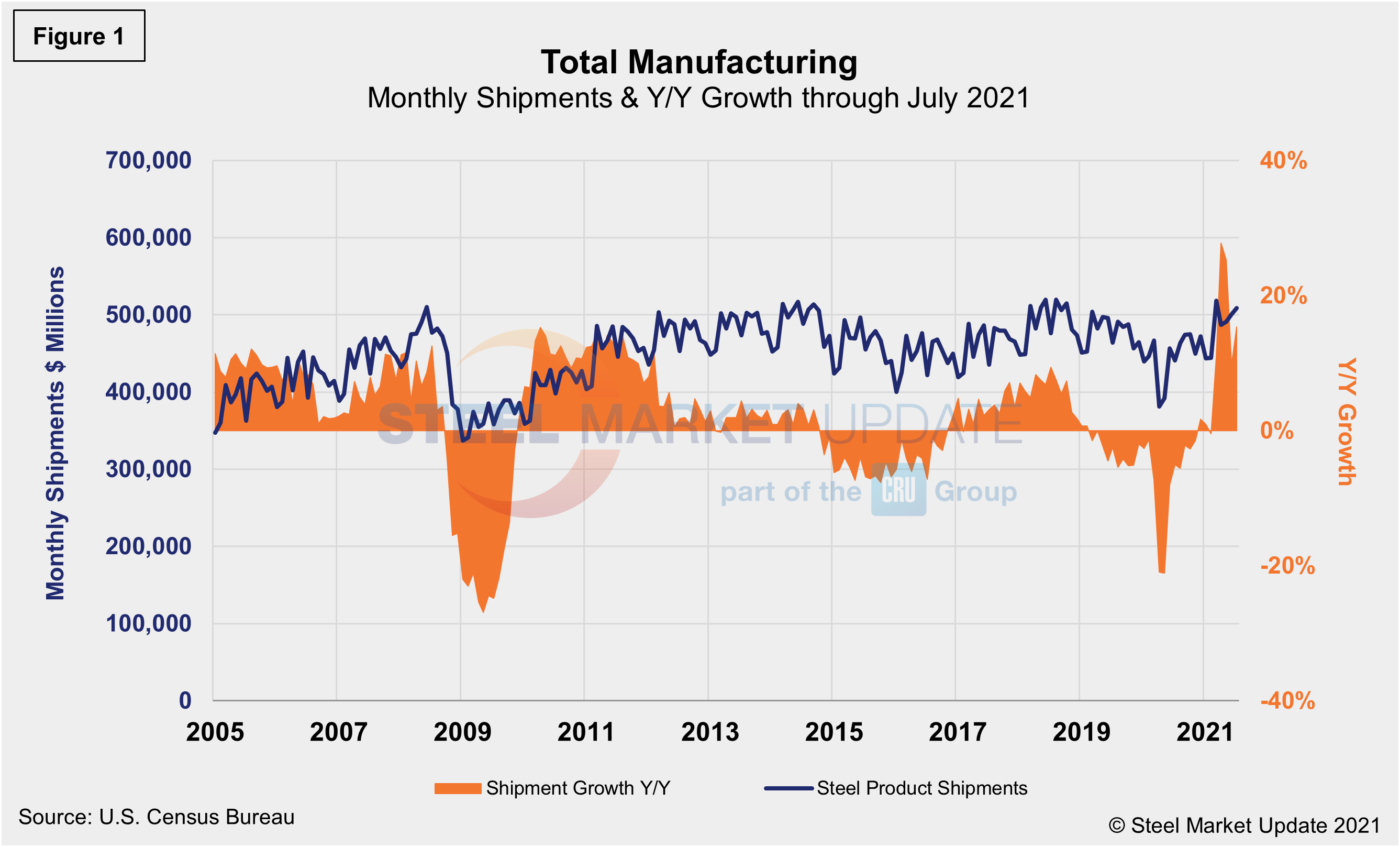

Mill outages, factory curtailments, seasonal disruptions, and COVID-related closures slowed steel products’ shipments to historic lows in 2020 with little resurgence at the beginning of 2021. Shipments of manufactured durable goods saw a similar trend over the same period. The trend carried through much of the first quarter, though the marketplace has been on a steady rise since.

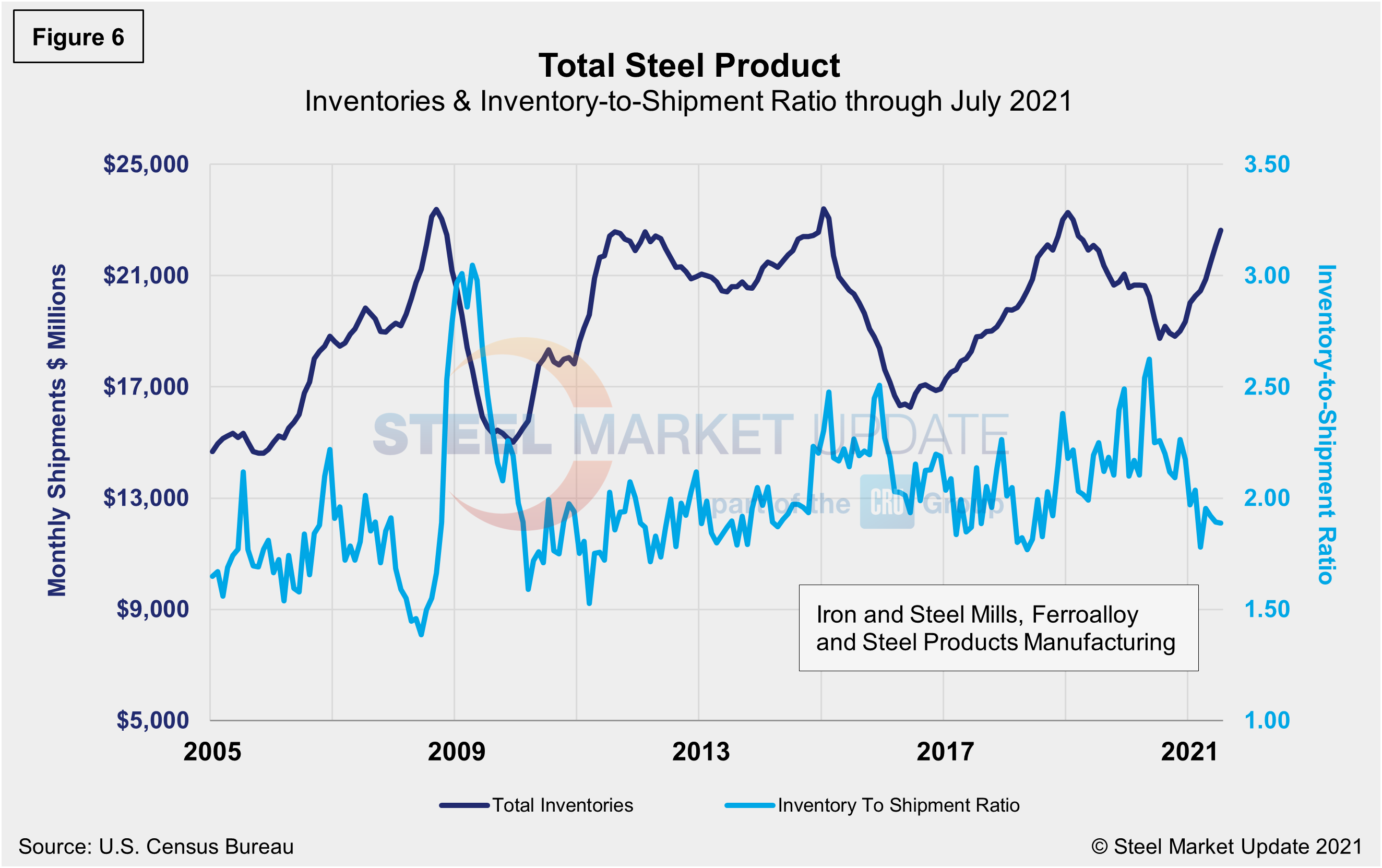

Manufacturing inventories have been largely stable on a steady rise since January, according to the latest available Census Bureau data on inventories, shipments and new orders for total U.S. manufacturing and steel products. In July, total manufacturing inventories were up 0.5% versus the month prior, but up 6.1% and 5.6% when compared to the same 2020 and 2019 months, respectively. Steel product inventories have seen slightly stronger growth over the same period. July’s total is up 2.6% from the month prior, and up 20.7% year on year. The strong recovery in steel product inventories has rebounded above the 2019 pre-pandemic year by 3.4%.

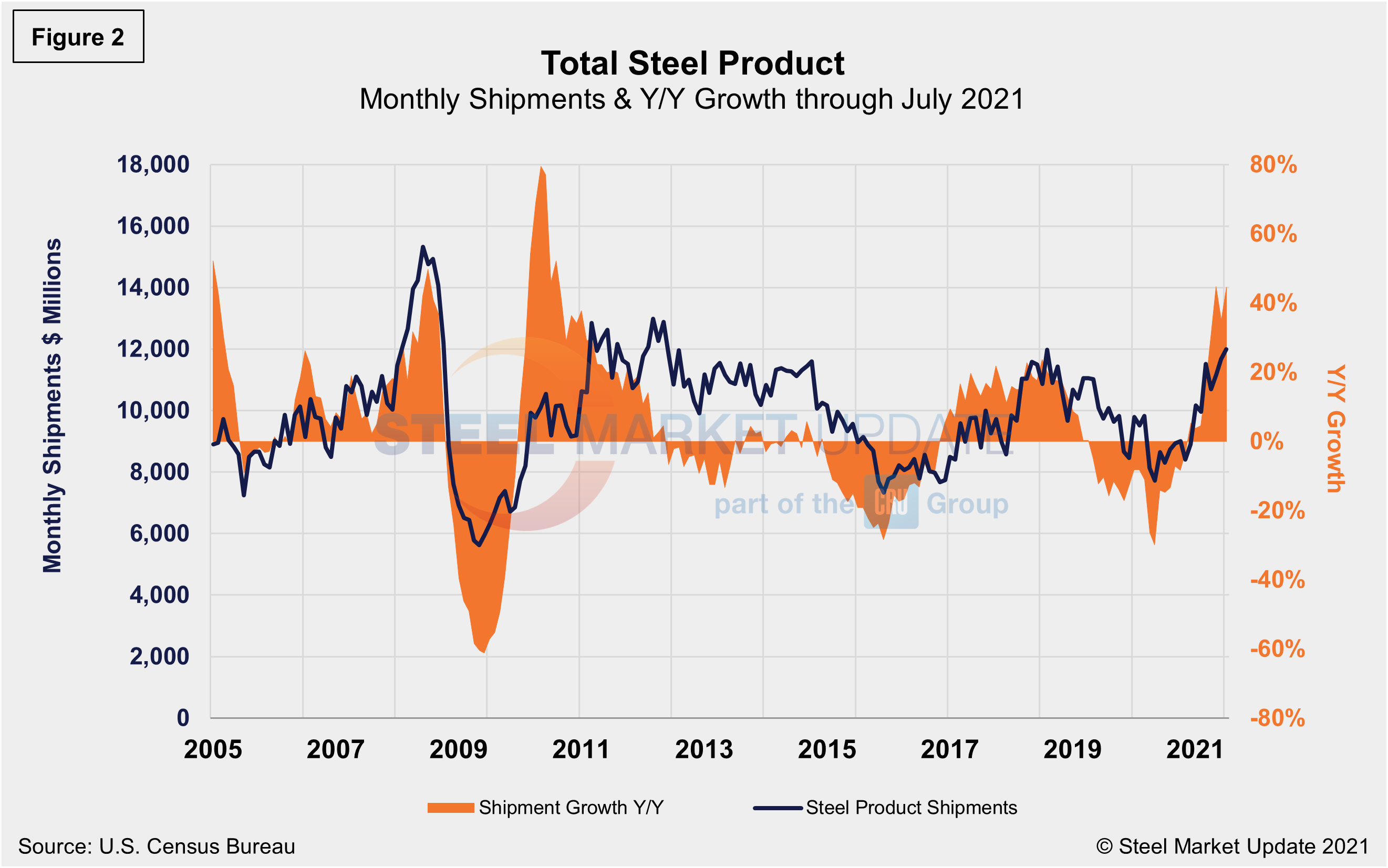

Total shipments and inventories are reported in millions of dollars, seasonally adjusted. Total steel shipments in July were 44.5% higher than in the same year-ago period and 23.1% higher when compared to the same pre-pandemic period in 2019. Year over year through July, total manufactured product shipments rose by 15.3%, and were up 9.5% when compared to the first seven months of 2019. During the first wave of the global pandemic last April, total manufacturing shipments plunged by 19.4% and steel product shipments fell by 21.4% compared with the prior year. Both have steadily recovered since. Figure 1 and Figure 2 show the history of both since 2005.

Monthly steel product shipments through July are detailed in Figure 2. Shipments of steel products totaled $11.994 billion in July, up from $10.666 billion in June, and up from year-ago levels when shipments were $8.301 billion. Shipments of steel products had most recently peaked in August 2018 at $11.980 billion, then began a 20-month decline through May 2020. Although the growth rate declined from 23.6% in July 2018 to 3.8% through January 2021, the steady growth since has pushed shipments of steel products to their highest level to date.

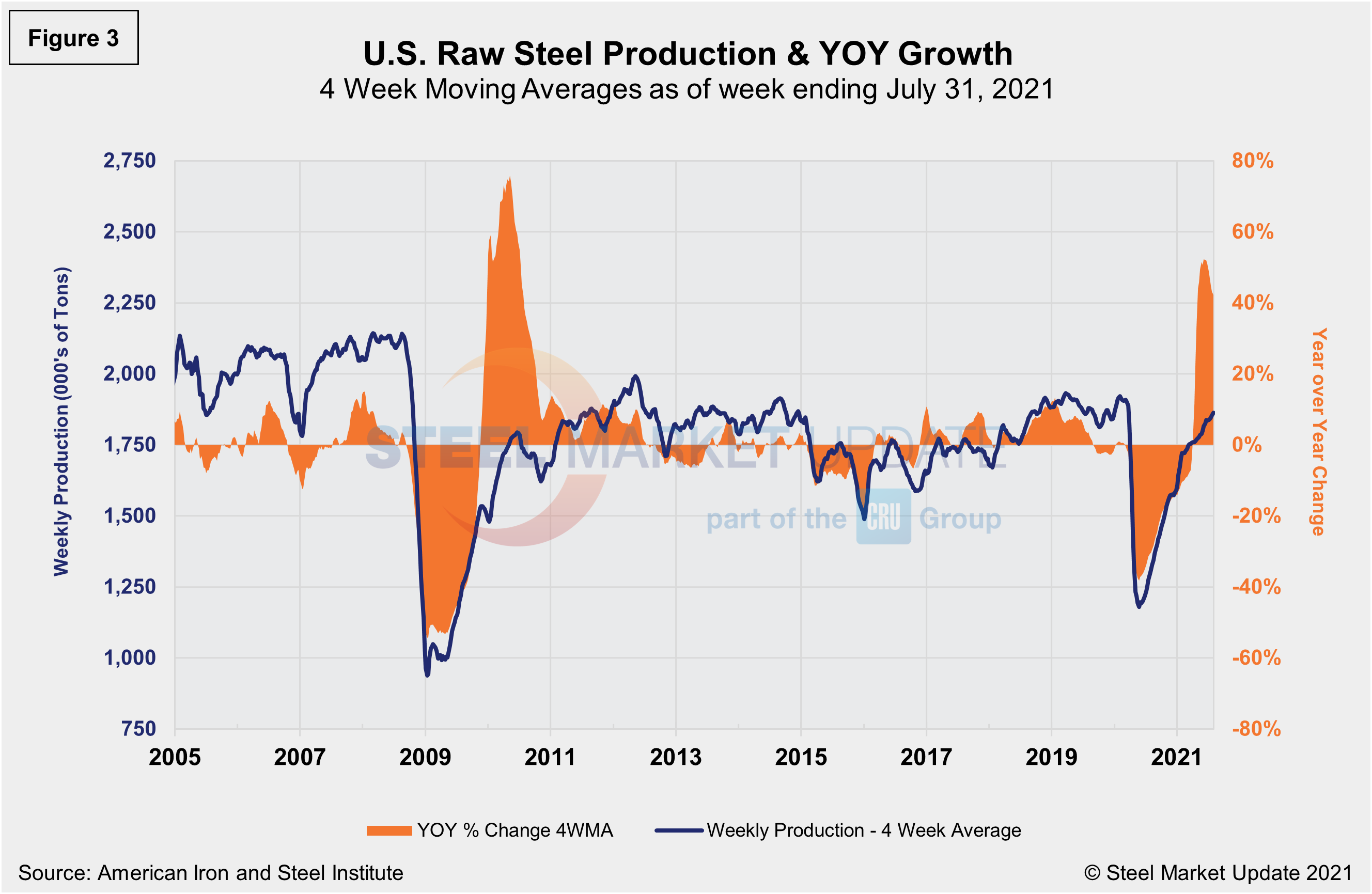

The Census data in Figure 2 compares well over the long term with the American Iron and Steel Institute (AISI) weekly crude steel production shown in Figure 3. Figure 2 is in dollars and Figure 3 is in tons, but they paint a similar picture. Since the freefall following the first wave of the pandemic, steel production has rebounded, according to AISI data shown on a four-week moving average basis. Crude steel production was up 42.2% in the week ending July 31 compared the same period a year ago.

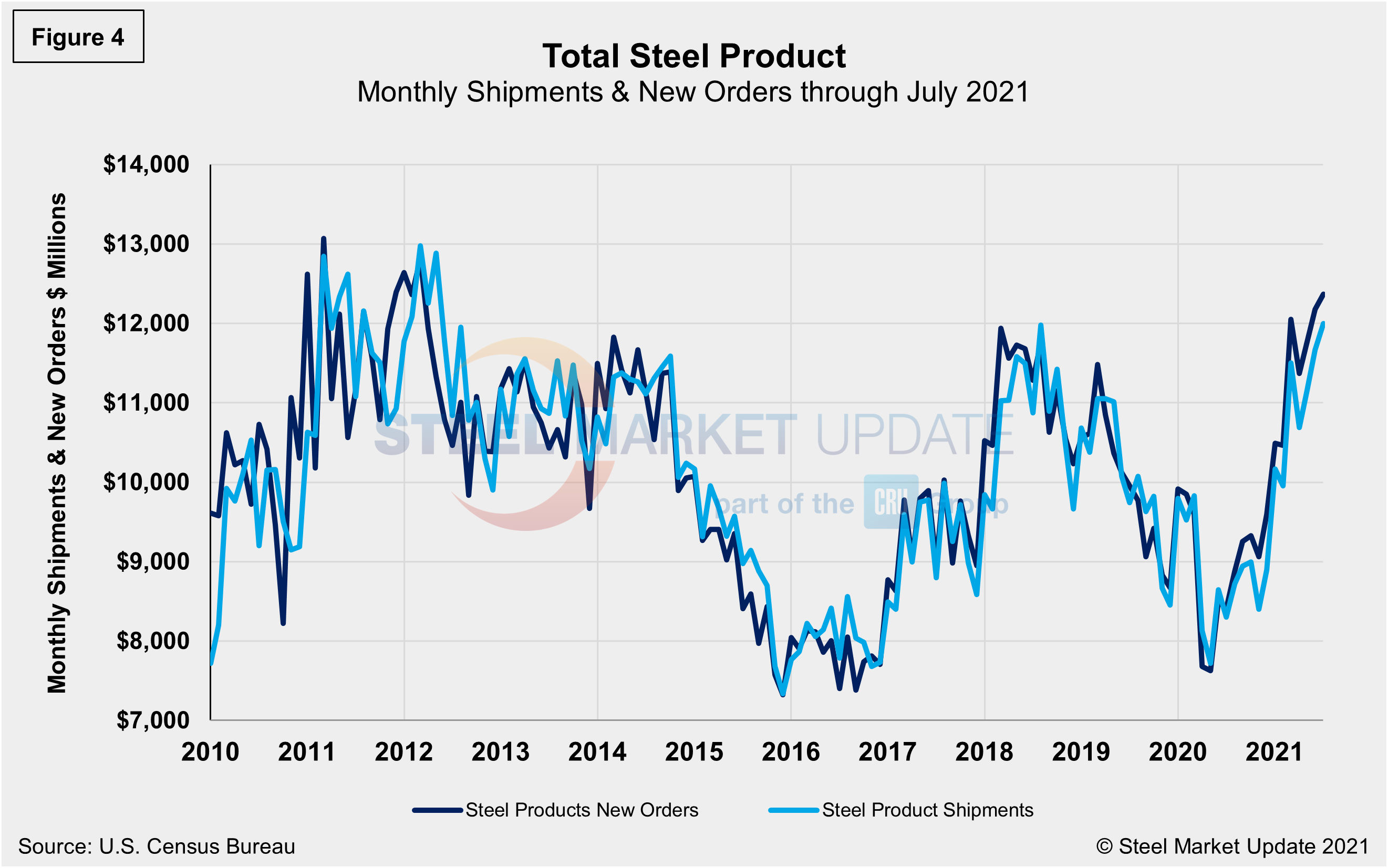

Steel product shipments and new orders on a monthly basis since 2010 are shown in Figure 4. New orders and shipments saw similar declines last April but were back in balance by June. Since then, however, new orders have exceeded shipments and continue to steadily outpace them. In July, even though steel product shipments increased at a faster rate month on month than new orders—2.8% versus 1.6%, respectively—shipments were still $375 million less.

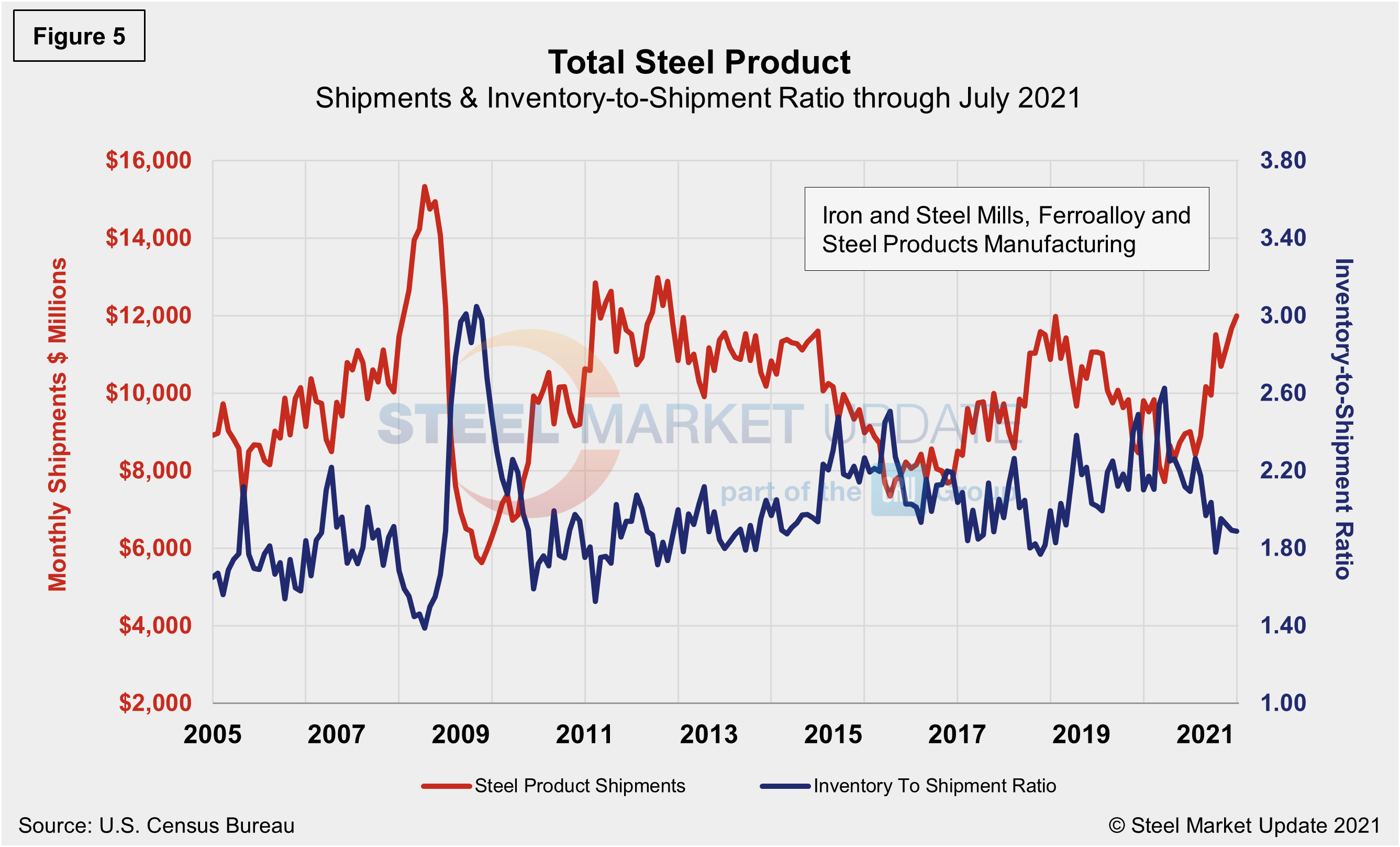

The same total shipment line as in Figure 2 is shown below in Figure 5, but now includes the inventory-to-shipment (IS) ratio. The IS ratio is a measure of how much inventory is necessary to support the level of shipments. Thus the lower the IS ratio, the better. The IS ratio for steel products shot up in May 2020 to 2.62% as shipments declined due to supply-chain disruptions from COVID-19-related mitigation efforts. Now, a little more than a year removed, the IS ratio was at 1.89%, but unchanged from the month prior. Although sideways month on month through July, demand was still outpacing supply.

The IS ratio had been inconsistent through the first few months in 2021, reflecting weather-related delays, temporary disruptions, and maintenance outages. Total inventories were up 20.7% in July when compared to the same year-ago period, while shipments were down 4.1% during the same period. These dynamics highlight a continued tight spot market for steel. Overall, steel shipments have improved by nearly 55.4% since May 2020, when the market reached bottom. Total inventory in millions of dollars is displayed in Figure 6 and echoes the inventory-to-shipment ratio shown in Figure 5.

By David Schollaert, David@SteelMarketUpdate.com