CRU

September 22, 2021

CRU: Zinc Demand Growth to Moderate from 2022

Written by Helen O’Cleary

By CRU Senior Analyst Helen O’Cleary, from CRU’s Steel Sheet Products Monitor

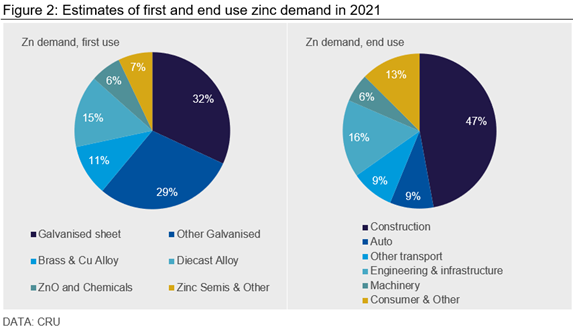

CRU recently developed a bottom-up zinc demand model to improve our medium-term demand forecasts. The model calculates demand in key regions and countries for the six major first uses of refined zinc: galvanized sheet, general galvanizing, copper-zinc alloys, die casting alloys, zinc oxide and other chemicals, and zinc semis and other products.

We combine production statistics where available and industrial production (IP) forecasts to estimate and forecast data for each of the first uses of refined zinc. Our first-use zinc demand forecasts incorporate CRU’s galvanized steel sheet and brass/bronze alloy production forecasts, while our end-use forecasts incorporate CRU’s vehicle production forecasts. In the long run, structural economic changes need to be considered for forecasts as zinc demand is dependent on the phase of economic development a country is in, but analysis has shown that there is a very strong correlation between IP and zinc demand in the medium term.

In the absence of published data for the other first uses of zinc, we collect historical data from company reports, presentations, industry associations and our market contacts to help build our view of total demand. We then combine this first-use data with net trade data to estimate total zinc demand in the medium term. We also account for yield losses in the percentage of zinc consumed as well as use of zinc scrap to get a more precise picture of the total zinc demand.

Galvanization Will Account for Around 60% of Total Zinc Demand in 2021

Galvanization of iron and steel products to prevent rusting remains the biggest use of refined zinc, which we estimate will account for ~60% or 8.3 Mt of total zinc demand in 2021. The proportion of zinc demand on a first-use basis has remained relatively constant over time. For example, even though galvanized coatings have become thinner over time and new galvanizing alloys can contain less zinc, these losses have been offset to a large extent by increased use of galvanization. Therefore, our medium-term forecasts deviate little from historical trends.

Galvanized Sheet Output to Grow by ~10 Mt in 2022-2025

CRU’s steel sheet team forecasts global galvanized sheet output will increase by ~10 Mt from 2022-2025, which will account for 250,000-300,000 t of zinc demand growth. However, Chinese production of galvanized sheet, which constitutes ~30% of the global output, is expected to decline by 4% y/y to 53 Mt in 2021 and is set to decrease further in 2022, then remain flat until 2025. We estimate that galvanized sheet as a proportion of China’s total zinc demand on a first-use basis is much lower than the rest of the world at ~20% and we expect it to decline by further 2% by the end of 2025. We expect this to be partially offset by an increase in other galvanizing products, which are expected to constitute ~41% of the total refined zinc demand in China by 2025, increasing by an average 70,000 t/y over our forecast.

Construction forms the biggest end-use sector for zinc demand and is expected to account for about 6.6 Mt of the global total in 2021.The proportion of zinc consumed on an end-use basis has remained relatively stable historically, and we expect this trend to continue. However, automotive production has been in decline since 2017 due to tighter emissions regulations in major producing countries and more recently due to supply chain disruptions from Covid-19. This has resulted in a decrease in its share of global zinc demand from 11% in 2017 to 9% in 2021.

We expect automotive end-use as a proportion of global zinc demand to recover to 10% in 2023, but downside risks to auto production remain. At the same time, we estimate that the boost in infrastructure spending from economic stimulus has led to a 1% increase in zinc demand from the sector and will lift its share of the global total to 16% in 2021.

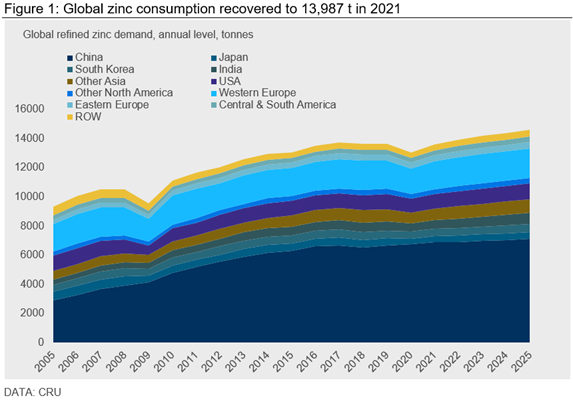

Global Refined Zinc Demand Has Rebounded This Year

Global refined zinc demand contracted by 4.8% y/y in 2020 to 13.1 Mt as economies went into lockdown to prevent rising Covid-19 cases. Refined zinc demand was hard hit in countries such as Japan and India where consumption declined by 14.9% y/y and 17.2% y/y, respectively, in 2020, to 390,000 t and 550,000 t. On the other hand, the rapid recovery of the Chinese economy from April 2020 resulted in minimal impact on its full-year zinc demand, which remained stable y/y at 6,650 t in 2020.

Economic stimulus packages and vaccination campaigns globally in 2021 have led to a global rebound, and IP is expected to grow by 8% following last year’s contraction of 4.2%. As a result, global zinc demand has not only recovered 2020’s losses but also grown relative to 2019, to 14 Mt.

We expect global zinc consumption to increase by 1.6% y/y in 2022, to 14.2 Mt, as economies continue to recover from the pandemic aided by low interest rates and infrastructure stimulus in the USA, Europe and elsewhere. Thereafter, we forecast a return to more modest growth, which we forecast will average 1.1% from 2023 to 2025 as economies stabilize to normal levels, adding ~230 t of global zinc demand every year.

China Will Continue to Be the Main Driver of Zinc Demand Growth

China has been the main driver of global refined zinc demand growth this century, with several years of double-digit growth since 2000. However, a halt to China’s construction boom and the government’s focus away from an export-oriented economy to domestic consumption has resulted in a slowdown in zinc consumption growth. We expect this trend to continue based on our Economics Team’s forecast of more modest IP growth from 2022 onwards than we have seen historically. But even at just 1% growth per annum, the Chinese market is still forecast to add more zinc demand in absolute tonnage terms than any other country over our forecast period, with demand expected to average 7 Mt/y from 2022-2025 and to reach 7.1 Mt by 2025.

Zinc demand in the world ex. China is forecast to average 7.4 Mt/y from 2022-2025, with growth set to return to a modest, decelerating path following the Covid-19-related slump in 2020 and rebound in 2021. Most developed economies will revert to marginal zinc demand growth or contraction in the coming years, but developing economies such as Turkey and India are expected to be bright spots for demand. In India, we expect demand growth to average 4.8% per annum in 2022-2025, lifting the total to 785,000 t in 2025, up from this year’s 650,000 t. In Turkey, average growth of 2.8% per annum from 2022 to 2025 is expected to lift demand to just over 300,000 t by 2025, up from 280,000 t this year. Smaller zinc-consuming countries such as Mexico and Vietnam are also expected to post decent growth.

Among the developed economies, we expect zinc demand growth in the USA to average 1.6% per annum from 2022-2025, lifting the total to 1 Mt by 2025 and to average 0.6% per annum in Europe, lifting the total to 2.4 Mt by 2025. Total ex. China zinc demand is forecast to reach 7.6 Mt by 2025, helping to lift the global total to 14.7 Mt.

Request more information about this topic.

Learn more about CRU’s services at www.crugroup.com