Analysis

September 22, 2021

CRU: Evergrande Default Risk Will Have Limited Impact on Steel Demand

Written by Kevin Bai

By CRU Analysts Zhenzhen Jiang and Kevin Bai, from CRU’s Steelmaking Raw Materials Monitor

Evergrande, the second-largest property developer in China, has grown to be the most indebted, accumulating more than RMB1.97 tn in liabilities since China rolled out the “three red lines” policies. Market investors are concerned that Evergrande will collapse and default on part of its debts, leading to greater concern over the negative impact the situation may have on construction activity and steel demand in the Chinese domestic market. In this Insight, we take a closer look at potential risks associated with Evergrande’s housing projects and assess their impact on construction steel demand. This follows analysis by CRU’s Economics team, which discussed the development of the crisis, the risks that may emerge if default occurs and some possible outcomes. In terms of the impact on overall steel demand, we find there is limited impact, though the overall policy environment means that construction demand will weaken in the coming years. The decline in construction steel demand due to these policies has been included in our base case for some time now.

Limited Impact on Steel If Evergrande Ceases Trading

An outright collapse of the Evergrande business will hit real estate activity, as works on existing projects could stop and potentially remain unfinished. This would lead to slower construction steel demand. Some market participants believe that this disruption may deteriorate construction steel demand beyond the remainder of this year, lasting longer into the medium term.

As stated in our Economics team analysis, we believe it is very unlikely for the government to fully bail out Evergrande, because the government wants developers and their investors to learn the lesson that they are exposed to risks. Our most likely scenario here is a coordinated resolution where Evergrande’s projects are transferred to other developers, with financial incentives. Investors in this scenario still incur significant losses.

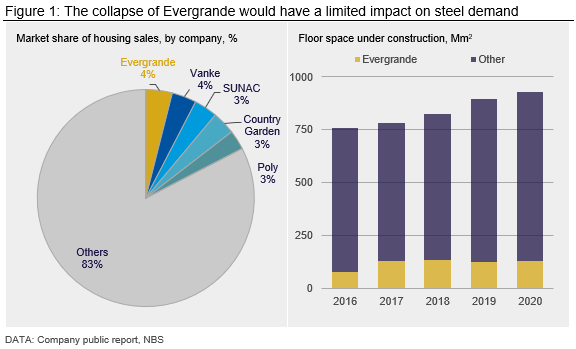

We believe the impact on steel demand from this scenario is limited. Based on public statistics for 2020, the market share of Evergrande is less than 5% (Figure 1), which will not trigger a systematic risk in the housing projects under construction. Moreover, according to the annual report in 2020, existing Evergrande housing projects totaled 132 Mm2, or up to 2% of annual real estate housing projects under construction. By our estimates, even if all of Evergrande’s projects remain unfinished, the total reduction in steel demand remains restricted at ~33 Mt over the next few years.

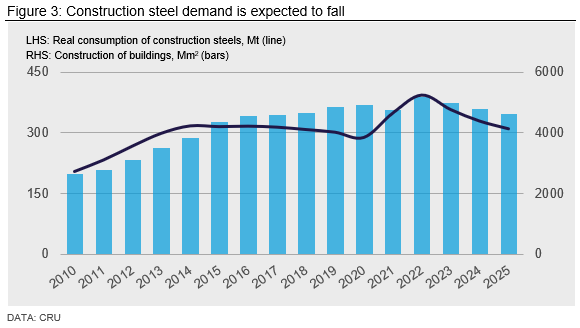

Weak Construction Steel Demand Ahead

While the direct effect of the Evergrande crisis on the Chinese steel market is restricted, we believe construction steel demand in China will remain weak in the coming years. This is due to policies that have progressively tightened controls on financial liquidity and land supply in the housing market. We expect all these policies will remain in place despite the Evergrande crisis.

This policy tightening started in earnest after the government stated that “housing is for living, not for speculation” in 2016 and have been aimed at stabilizing the housing market to prevent a bubble bursting. Restrictions on property developers’ debt financing were then implemented in 2018, followed by the “three red lines” policies. This year, the land auction scheme and mortgage qualification were introduced.

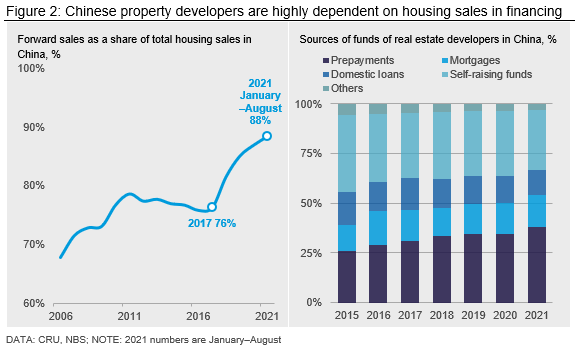

Due to the controls placed on debt financing, property developers have adopted a “high turn-over mode” since 2018. This approach meant developers increased sales of properties ahead of a majority of construction being completed, generally once only 20% of the project is finished. The revenue from the pre-sale and relevant prepayment and mortgage become the major financing support for the remainder of the construction activities. Forward sales already accounted for two-thirds of the property market, though from 2018 onwards this has risen sharply to nearly 90% this year.

The Evergrande crisis could increase concerns about this approach and reduce the potential buying interest for forward housing delivery as buyers become more cautious. This is expected to accelerate the contraction in housing sales, which will restrict developers’ ability to finance future housing developments. Consequently, this will further drag down the construction steel demand in the future. This construction has been included in our base case for some time now.

Given the real estate sector has already weakened this year, we expect steel demand from residential construction will continue to decline and we maintain a bearish outlook in the years ahead. In the short-term, the crisis may lead to buyers requiring faster completion of housing projects, which would provide some support for steel demand.

Request more information about this topic.

Learn more about CRU’s services at www.crugroup.com