Analysis

September 21, 2021

NAHB: Builder Confidence Up Marginally in September

Written by David Schollaert

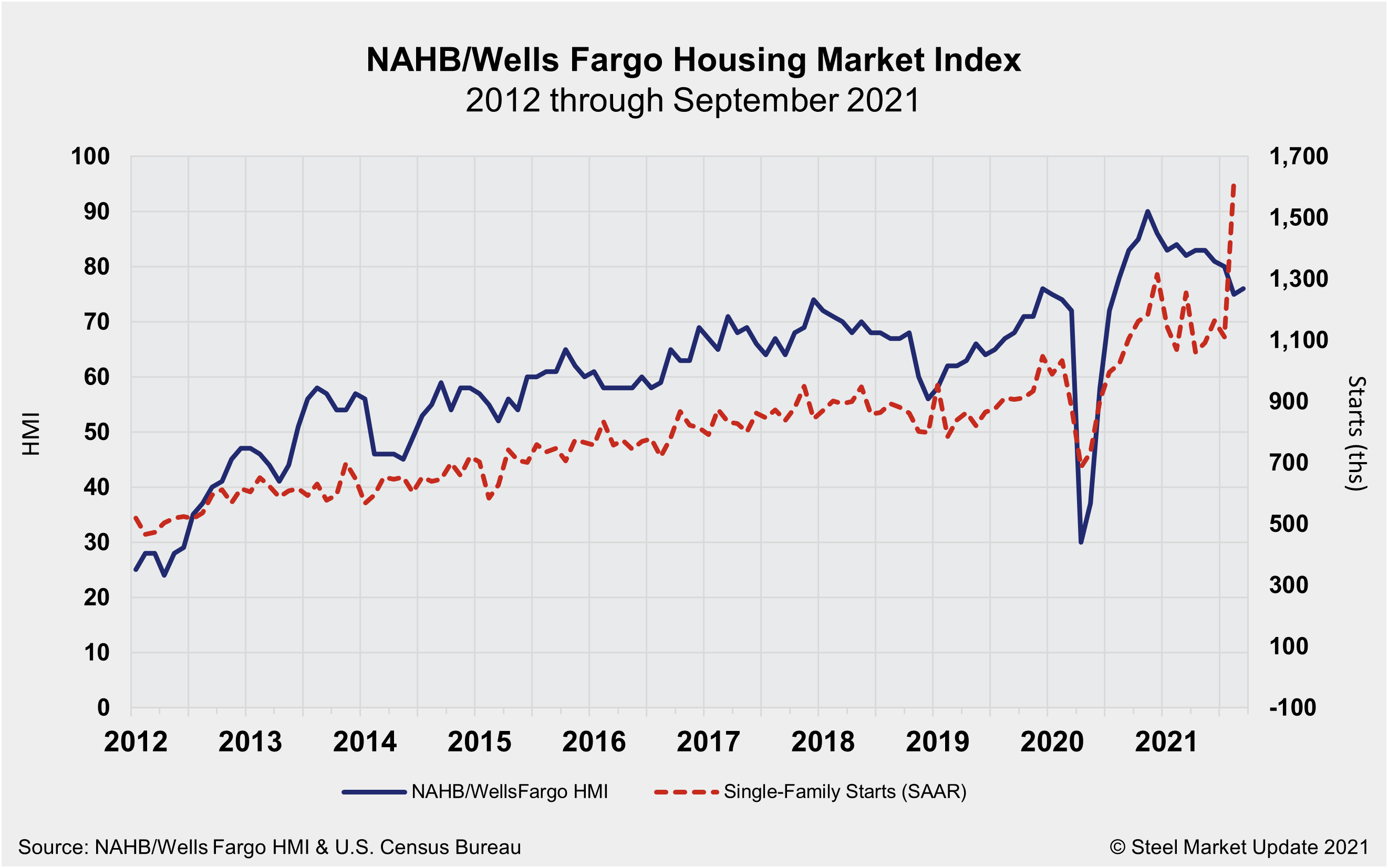

Builder confidence ended a three-month decline in September, edging up slightly following some correction in lumber prices and strong housing demand, according to the NAHB/Wells Fargo Housing Market Index (HMI).

Although the housing sector continues to struggle with supply chain disruptions and labor challenges that are impacting housing affordability, builder sentiment for newly built single-family homes inched up one point to 76 in September.

“Builder sentiment has been gradually cooling since the HMI hit an all-time high reading of 90 last November,” said Chuck Fowke, NAHB’s chairman. “The September data show stability as some building material cost challenges ease, particularly for softwood lumber. However, delivery times remain extended and the chronic construction labor shortage is expected to persist as the overall labor market recovers.”

“The single-family building market has moved off the unsustainably hot pace of construction of last fall and has reached a still hot but more stable level of activity, as reflected in the September HMI,” said Robert Dietz, NAHB’s chief economist. “While building material challenges persist, the rate of cost growth has eased for some products, but the job openings rate in construction is trending higher.”

The three major indices that make up the HMI were either steady or positive in September. The HMI gauging current sales conditions rose one point to 82, the component measuring traffic of prospective buyers posted a two-point gain to 61, and the gauge charting sales expectations in the next six months held steady at 81.

Regionally, the Northeast fell two points to 72, the South dropped two points to 80, and the West registered a two-point decline to 83, all on a three-month moving average basis. The Midwest remained unchanged at 68.

“Regionally, we continue to see growth in the South and the West, particularly the Mountain West,” said Dietz. “Exurban markets have expanded the most over the last year, although inner suburbs are now experiencing an acceleration, with townhouse construction having had the best quarter in 14 years this spring.”

By David Schollaert, David@SteelMarketUpdate.com