Analysis

September 1, 2021

North American Auto Assemblies Tumble in July

Written by David Schollaert

Auto assemblies in North America plummeted in July, revealing the extensive impact the semiconductor scarcity is having on carmakers. Regionally, the annual production rate fell 21.5% or by nearly 270,000 vehicles in July versus the prior month, according to LMC Automotive (LMCA).

The more alarming figure may be that July’s annual production rate was down 21.8% when compared to the same period last year, and the lowest mark in 15 months.

The global semiconductor chip shortage and other pandemic-related parts scarcities have wreaked havoc across the automotive industry, causing widespread production delays and extended idlings. Not a single carmaker has emerged unscathed, and the duration of the chip shortage is expected to carry on well into next year.

Vehicle production totaled 983,294 units in July, down from 1.252 million units in June. July’s performance is the third lowest since July 2011, outdone only by April and May of last year when North American production came to a complete halt at the onset of the pandemic. July’s total is 31.0% below the 2020 high of 1.424 million units last October.

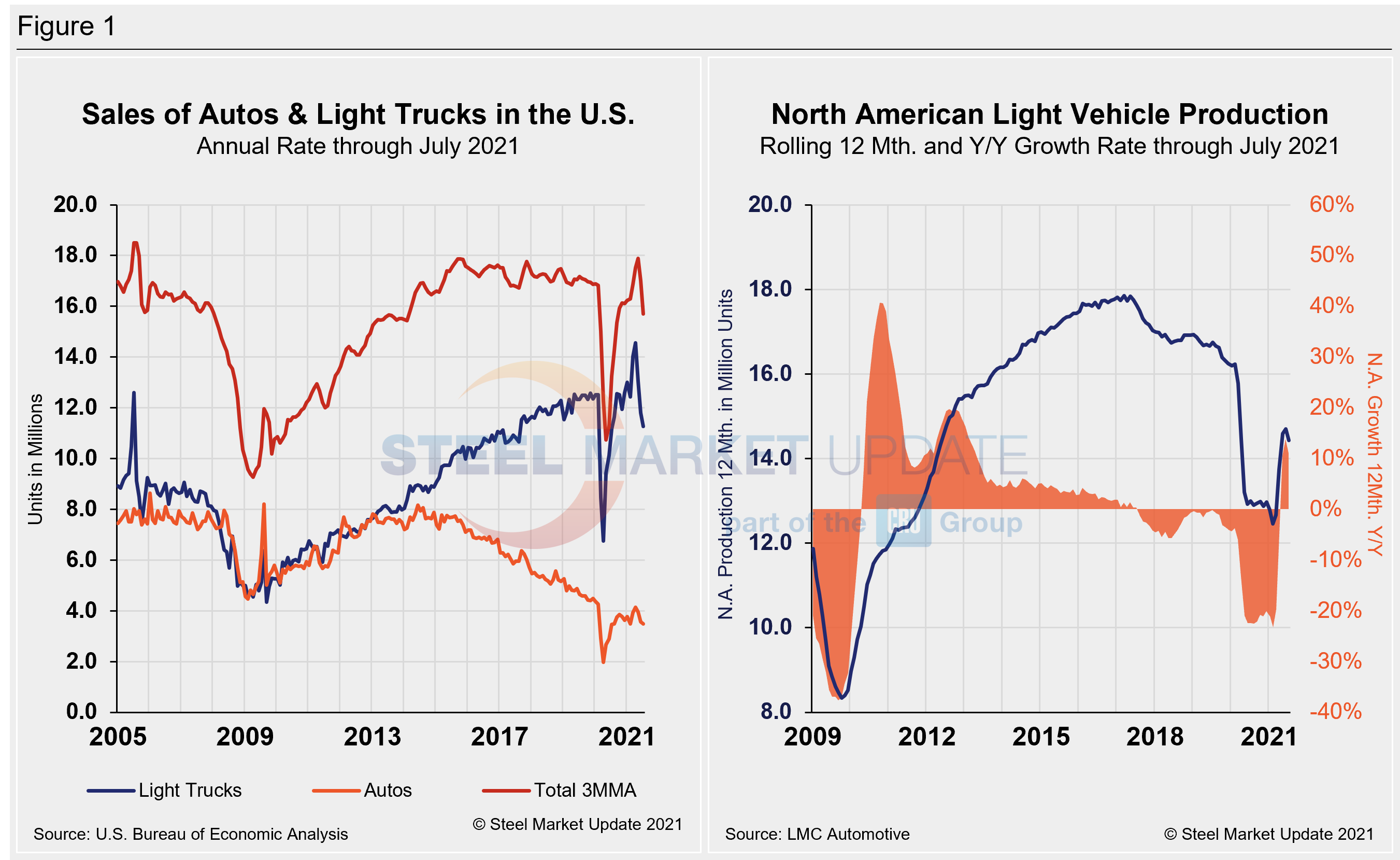

The effects of the pandemic, chip shortages and supply chain disruptions have tightened vehicle inventories, while sales also have begun to slip. The selling rate for U.S. light vehicles in July was an annualized 14.75 million units, down 4% from June and down 21.1% from the high of 18.69 million units in April.

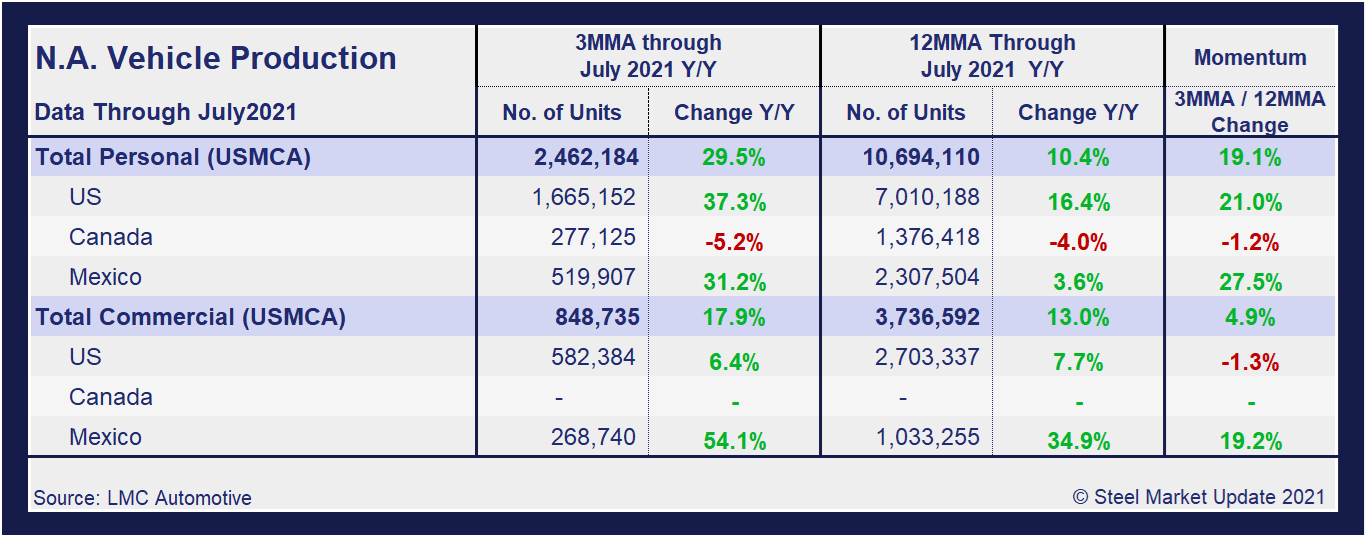

A short-term snapshot of assembly by nation and vehicle type is shown in the table below. It breaks down total North American personal and commercial vehicle production into the U.S, Canadian and Mexican components, along with the three- and 12-month growth rate for each. At the far right it shows the momentum for the total and for each of the three nations.

The rebound from COVID-19 doldrums was impressive. By June, growth rates for personal and commercial light vehicles reached 156.8% and 127.4%, respectively. Growth rates have taken a nosedive in a month’s time, however, as the massive impact of the chip shortage starts to take shape.

In three months through July, total personal vehicle assemblies in the USMCA region grew by 29.5% year over year and commercial light vehicle assemblies grew by 17.9%. June’s exaggerated growth rates of 156.8% and 127.4% for personal and commercial light vehicles have plummeted in a month’s time due to the chip shortage.

Personal Vehicle Production

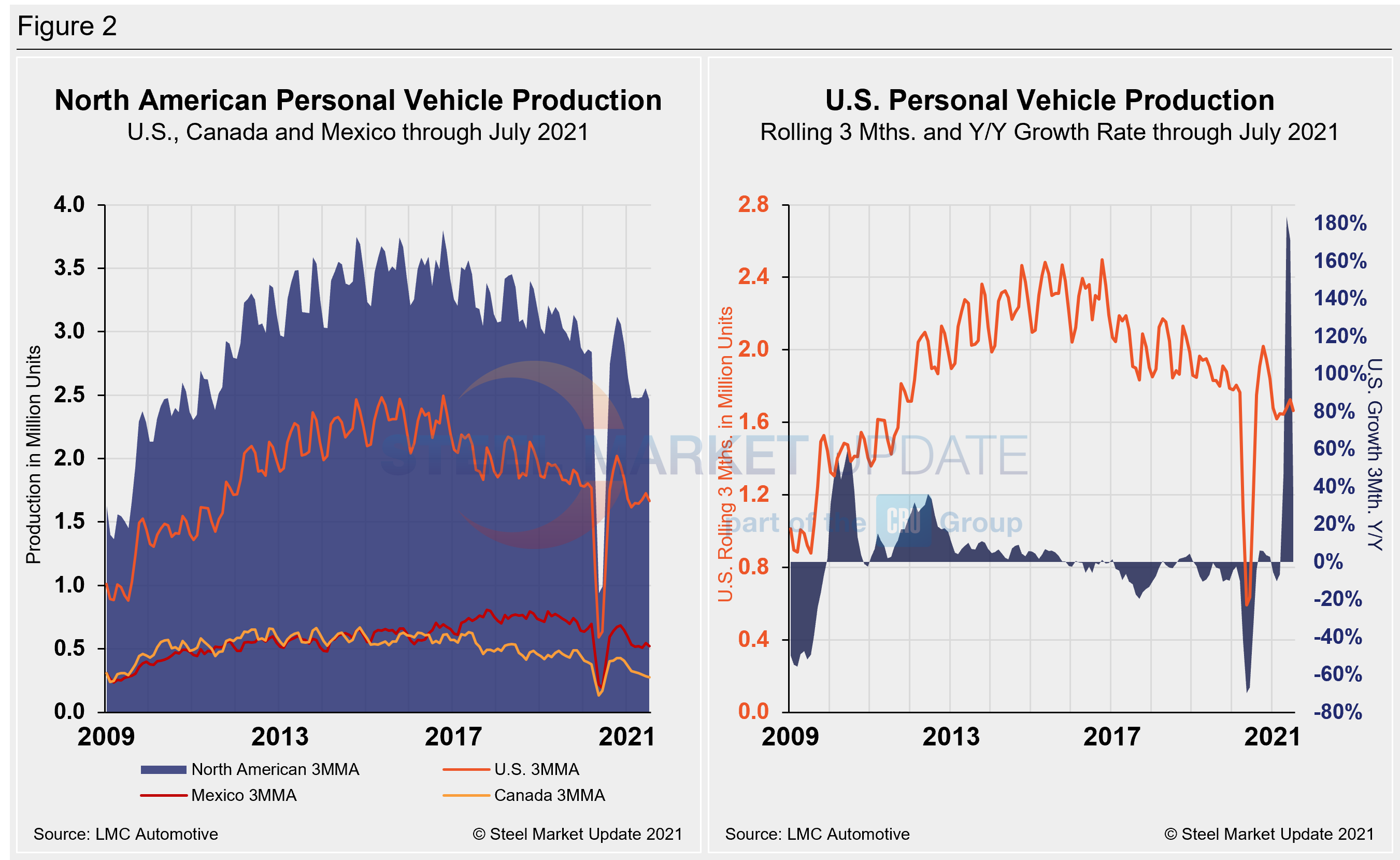

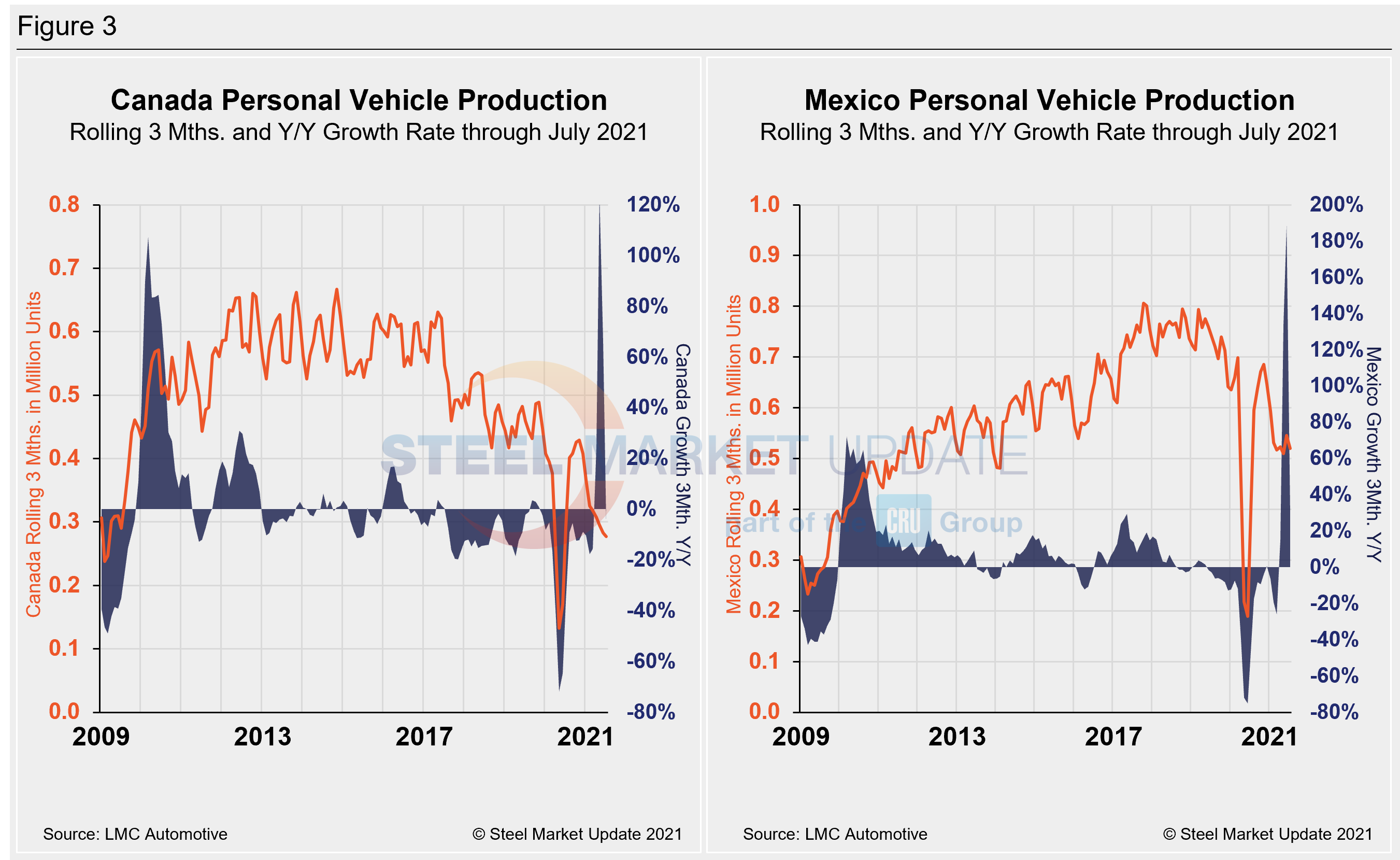

The longer-term picture on personal vehicle production across North America is shown below. The first chart in Figure 2 shows the total personal vehicle production for North America and the total for each nation. The production of personal vehicles in the U.S. and the year-over-year growth rate is displayed in the second chart. Figure 3 shows side-by-side the production of personal vehicles in Canada and Mexico, and the year-over-year growth rate.

In terms of personal vehicle production, the U.S. saw the steepest fall in growth rate in July, down 25.4% month on month. The continued effects of the chip shortage also impacted Canada and Mexico, who’s growth rates fell by 20% and 14.6%, respectively. Canada’s personal vehicle production share of the North American market edged up to 11.3% in July, compared to 11.1% the month prior. Mexico carried a 21.1% market share across the continent, down from 21.4% month on month. The U.S. held a 67.6% share of the North American market, unchanged compared to June despite producing nearly 162,000 fewer vehicles month on month in July.

Commercial Vehicle Production

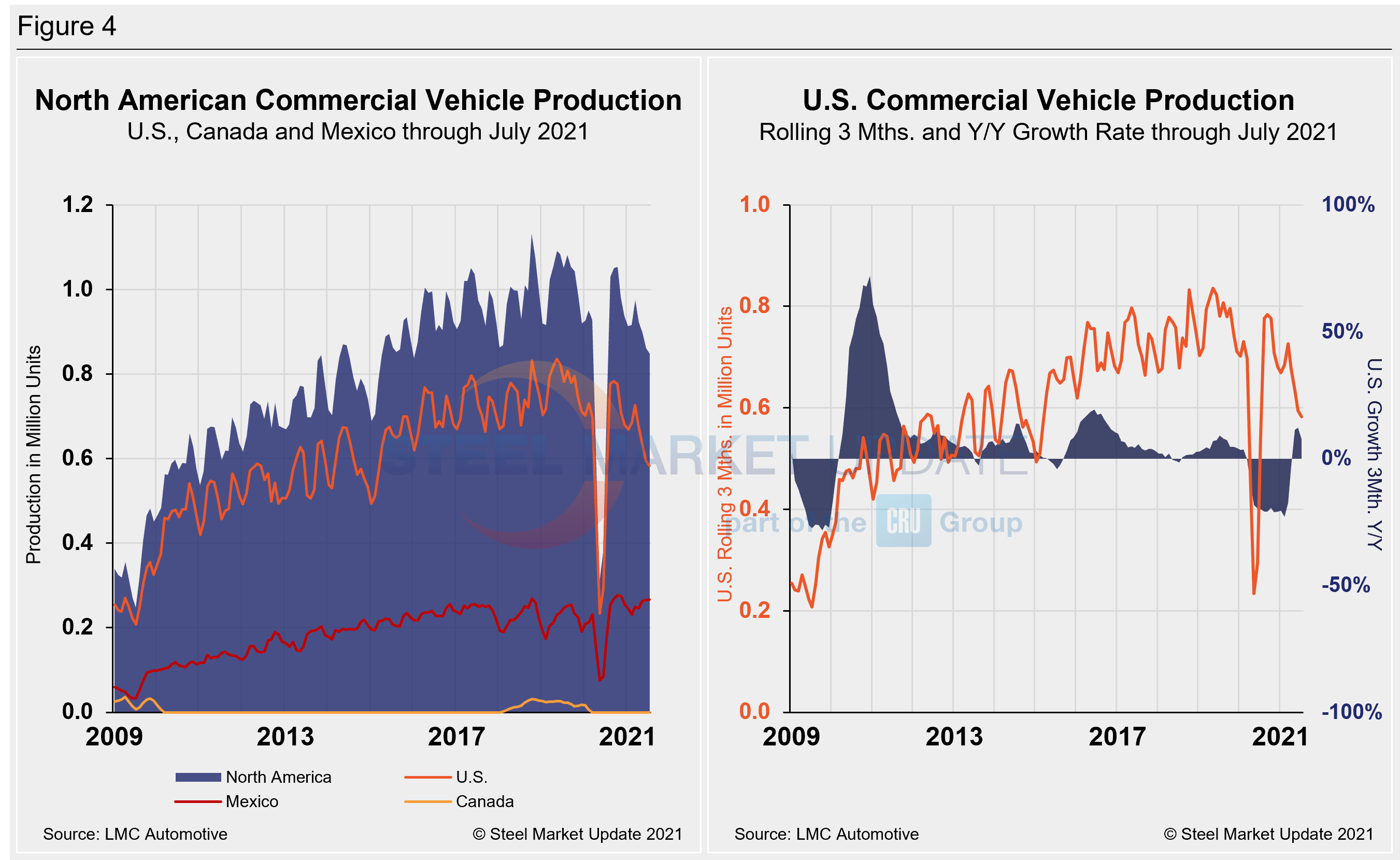

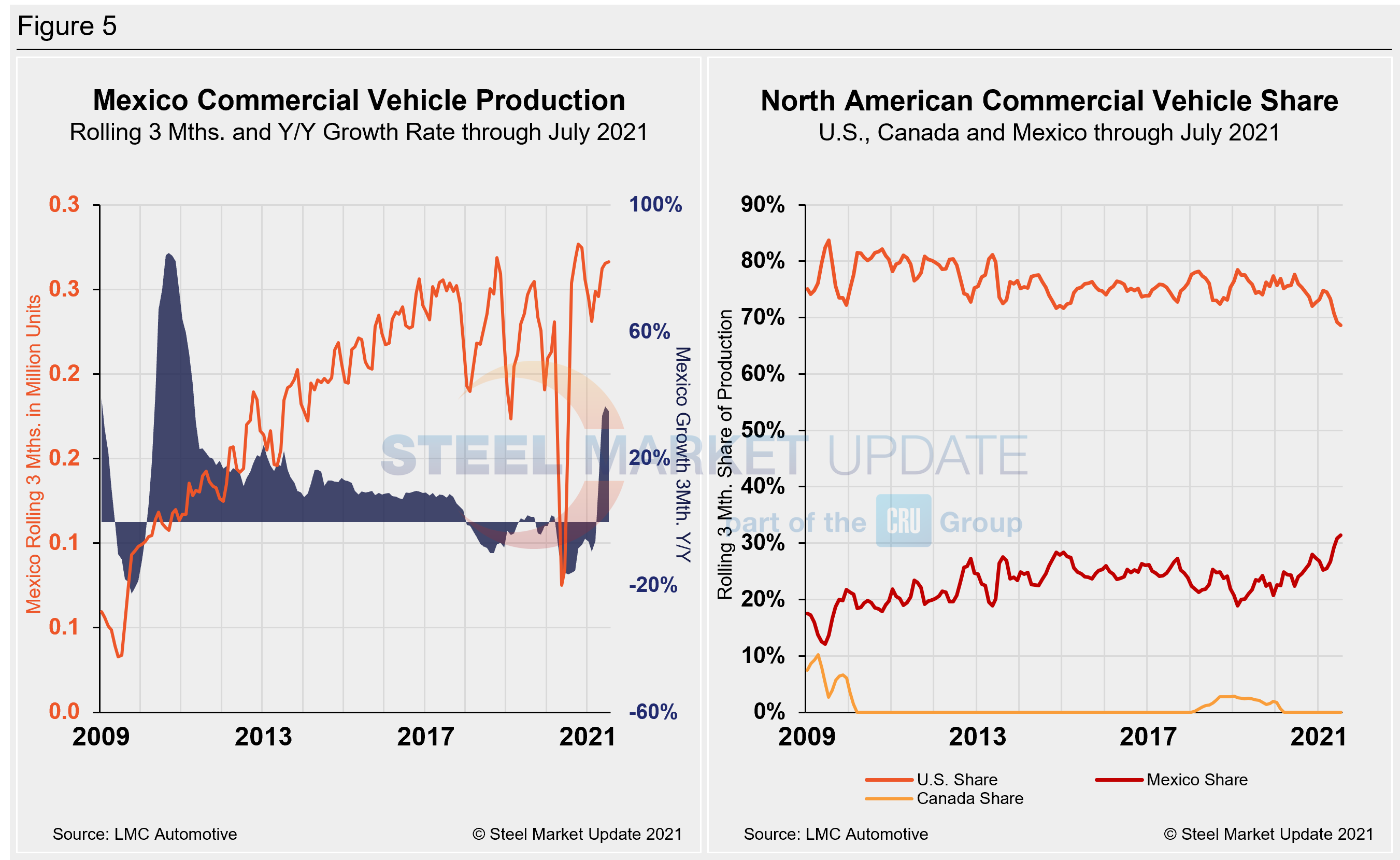

Total commercial vehicle production for North America and the total for each nation on a rolling three-month basis is shown below in the first chart in Figure 4, while the production of commercial vehicles in the U.S and the year-over-year growth rate is displayed in the second chart. Figure 5 shows the production of commercial vehicles and the year-over-year growth rate in Mexico displayed in the first chart, while the second chart shows the production share for each nation. Note that Canada has not produced a single commercial vehicle over the past 19 consecutive months.

North American commercial vehicle production was down 18.3% in July compared to the prior month, an annual rate of 17.9%. Some regional COVID-related disruptions were seen – primarily in Canada – yet production limitations were due almost entirely to the shortage of semiconductor chips and other supply-chain constraints.

The plunge in commercial vehicle assembly was driven almost exclusively by the U.S. market, which saw production decrease by 22.5% in July, to an annual growth rate of just 6.4%. Mexico saw a 7.9% decrease over the same period. The U.S. share was 68.6% in July, down nearly 10 percentage points from the most recent high of 77.6% in June 2020. Mexico’s share was up slightly to 31.4%, while Canada’s share remained at zero. Mexico currently exports just about 80% of its light vehicle production, while the U.S and Canada are the highest volume destinations for Mexican exports.

Editor’s Note: This report is based on data from LMC Automotive for automotive assemblies in the U.S., Canada and Mexico. The breakdown of assemblies is “Personal” (cars for personal use) and “Commercial” (light vehicles less than 6.0 metric tons gross vehicle weight rating; heavy trucks and buses are not included). In this report, we describe light vehicle sales in the U.S. and report in detail on assemblies in the three regions of North America.

By David Schollaert, David@SteelMarketUpdate.com