Market Data

September 1, 2021

Global Steel Production Falls Further in July

Written by David Schollaert

World crude steel production contracted for the second straight month in July after repeated months of record-breaking output, according to World Steel Association (worldsteel) data. Global production in July, at an estimated 161.7 million metric tonnes, declined 3.7% from June, but was still 4.0% higher than the same period last year.

Since March’s historic 12.7% jump, world crude steel production had been gaining momentum, peaking at 174.4 million tonnes in May. Global output has since trended down, reaching its lowest level since February. July’s total is 12.7 million tonnes lower than May’s high and 6.2 million tonnes below June’s total. Total global output in July was greatly affected by a 7.6% decrease in Chinese production, along with smaller decreases in five of the top 10 steel-producing countries, reported worldsteel.

Year-to-date, world crude steel production totaled 1.155 billion tonnes, up by 11.7% compared with the same period in 2020. Production was also up 6.6% when compared to the same pre-pandemic period in 2019.

The U.S. remained the fourth largest crude steel producer in the world in July, accounting for 7.5 million metric tonnes or 4.6% of the global total. U.S. production in July was up 5.6% compared to the prior month. Compared to the same month last year when the economy was struggling with COVID disruptions, July’s production was an improvement of 38.3%, and up 1.1% compared to the pre-pandemic period in 2019.

U.S. production through the first seven months of 2021 totaled 49.0 million tonnes, 16.9% higher than the same period one year ago but still 5.3% behind pre-pandemic levels from 2019.

China continued to produce more than half of the world’s steel at 53.7% or an estimated 86.8 million tonnes in July. Chinese production was down 7.6% month on month, and its share of steel production was also down 2.2 percentage points for the second-consecutive month. China’s steel production was up 7.0% when compared with June 2020.

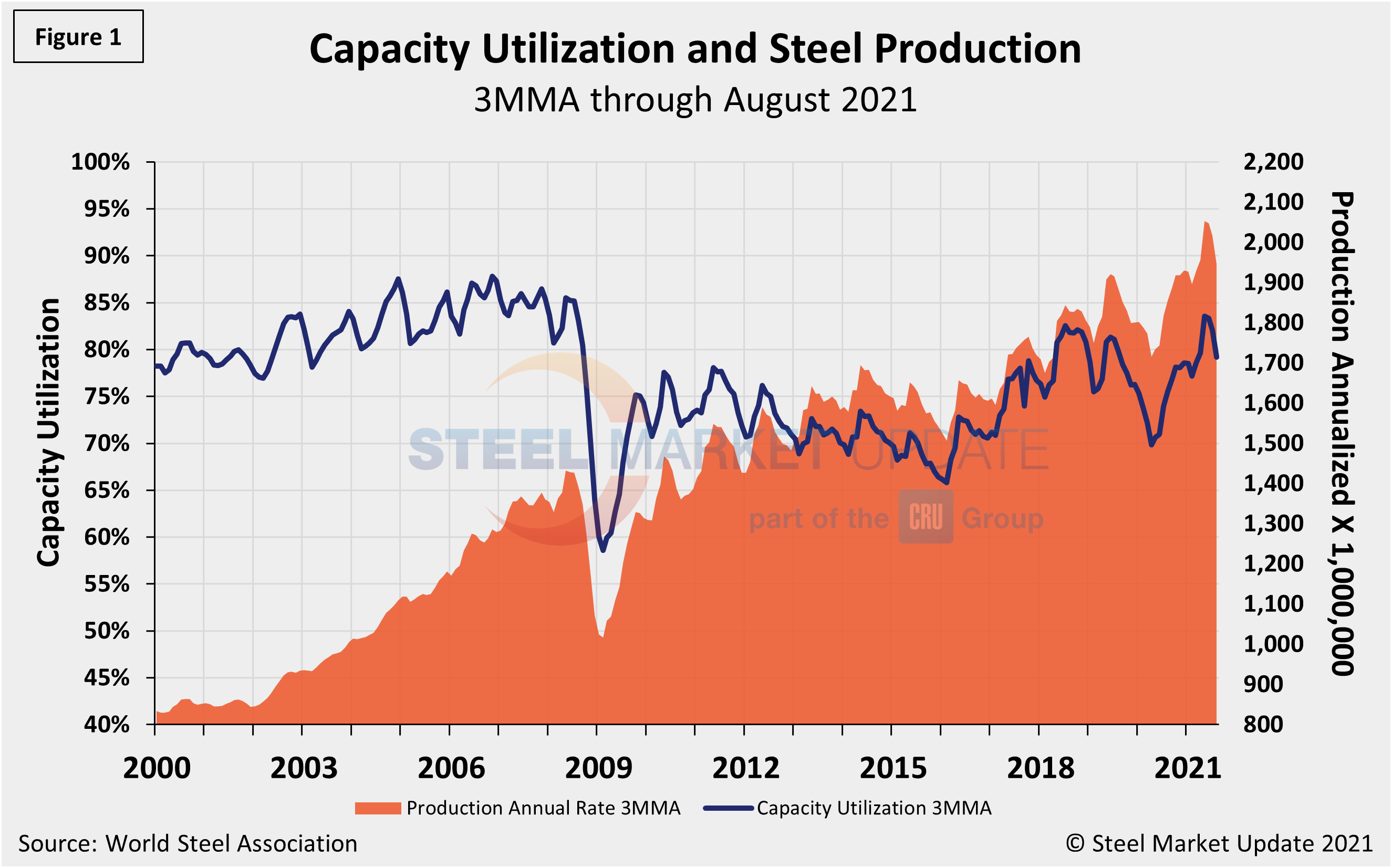

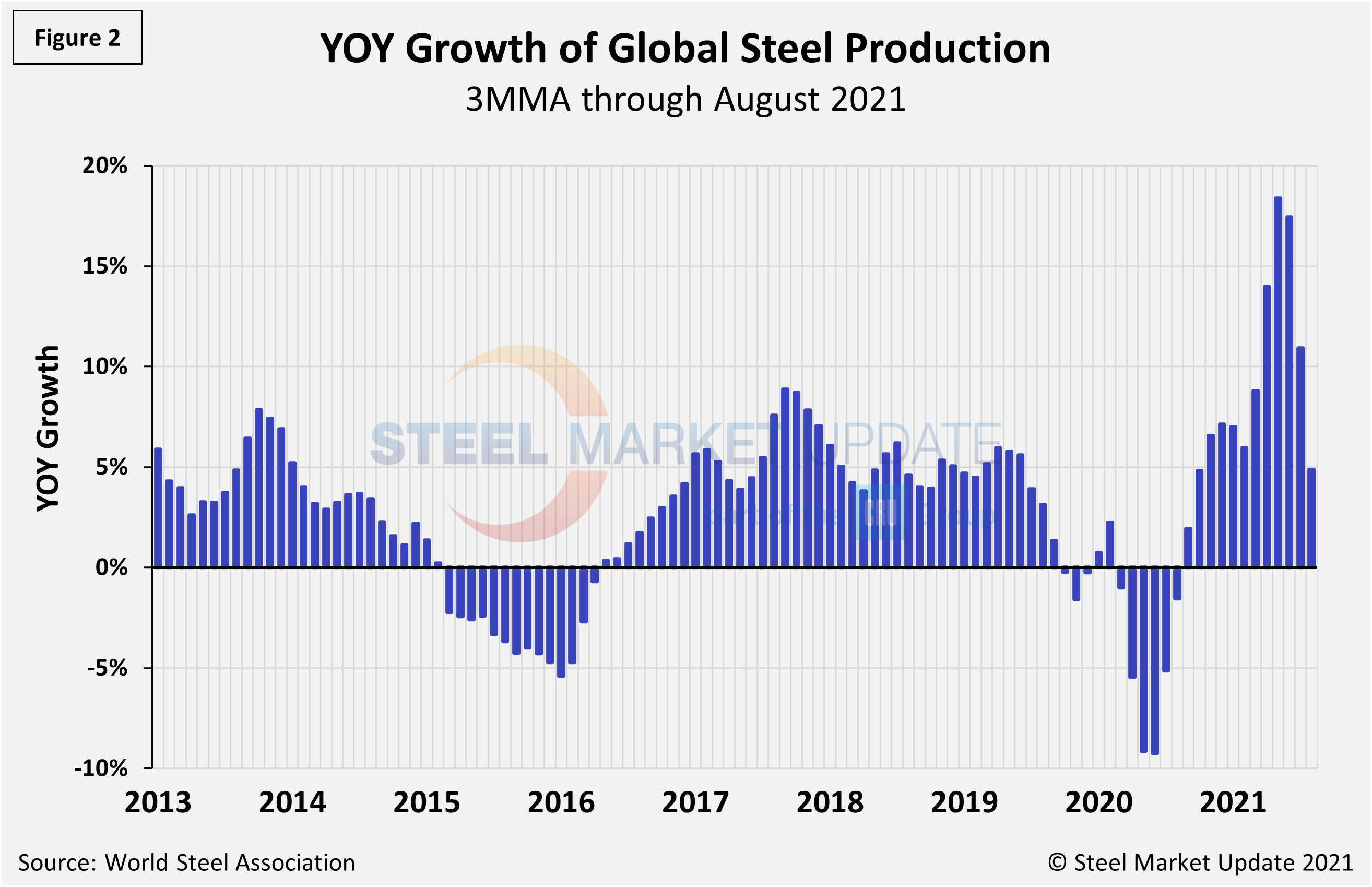

Shown below in Figure 1 is the annualized monthly global steel production on a three-month moving average (3MMA) basis and capacity utilization since January 2000 based on data from worldsteel, while Figure 2 shows the year-over-year growth rate of global production on the same 3MMA basis since January 2013. Capacity utilization in July on a 3MMA basis was 82.1%, down 1.3 percentage points from the month prior. On a tonnes-per-day basis, production in July was 5.216 million tonnes, down for the second straight month following May’s record rate of 5.813 million tonnes. Growth in three months through July on a year-over-year basis was 10.9%, a steep fall from 17.4% the month prior.

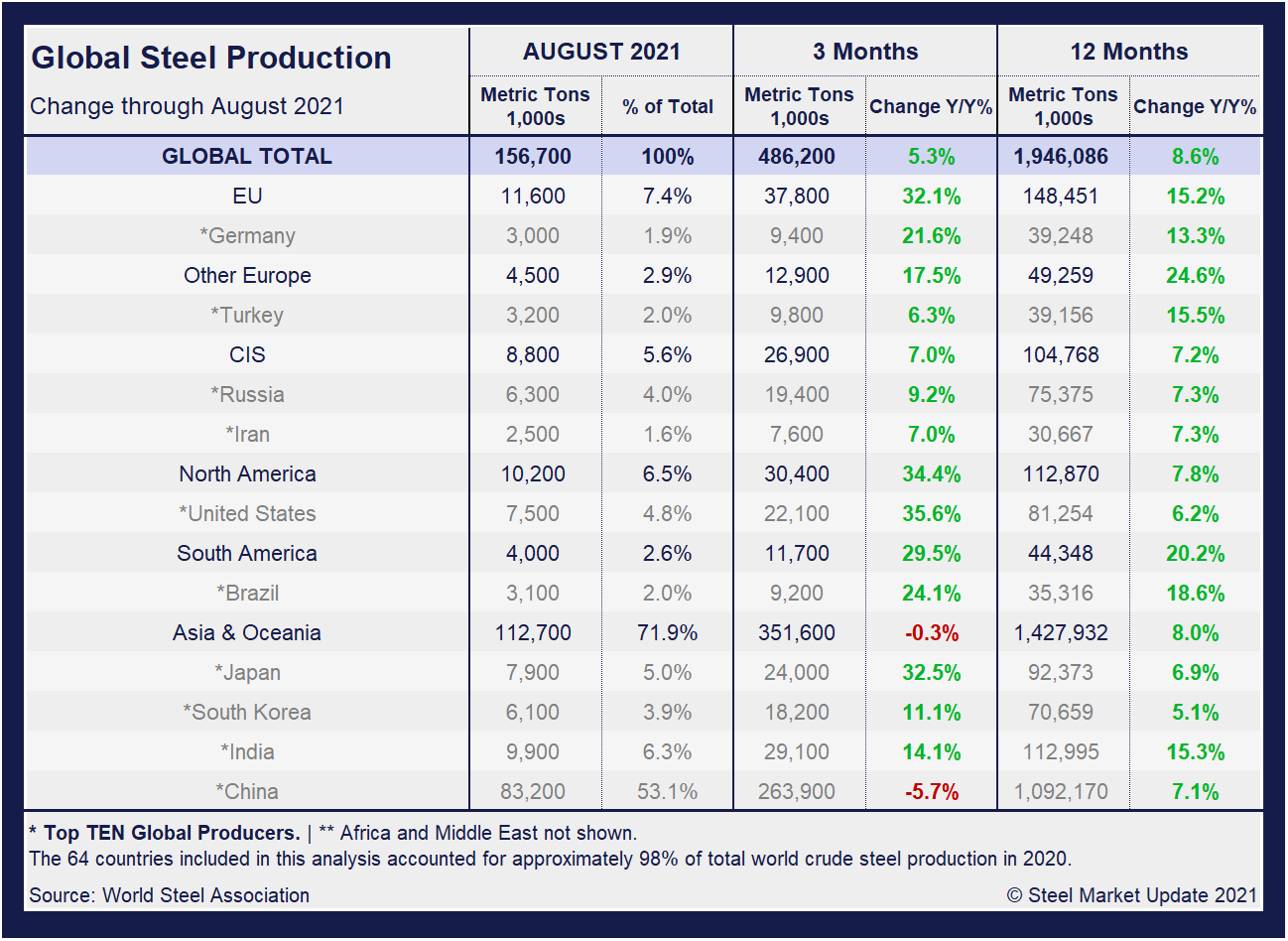

Displayed in the table below is global production broken down into regions, the production of the top 10 nations in the single month of June, and their share of the global total. It also shows the latest three months and 12 months of production through July with year-over-year growth rates for each period. Regions are shown in black font and individual nations in gray. The world overall grew 11.3% in three months, but saw a significant deceleration from the 17.9% growth the month prior. Over 12 months through July, though, growth was 8.8%, up 0.5 percentage points from June. The market has maintained positive momentum, as the three-month growth rate is higher than the 12-month growth rate.

The table shows that North American production was up 42.6% in the three months through July, but up just 2.2% year on year. The positive momentum in the North American market is significant as the economy continues to recover from the pandemic. Yet when compared to the same pre-pandemic period in 2019, present output is still down 1.9%.

China’s Crude Steel Production

China’s monthly steel production was estimated at 86.8 million tonnes in July, down from 93.9 million tonnes the month prior. The 7.1-million-tonnes month-on-month decrease marks the second consecutive decline following repeated record-breaking months of crude steel output, reaching an all-time high of 99.5 million tonnes in May.

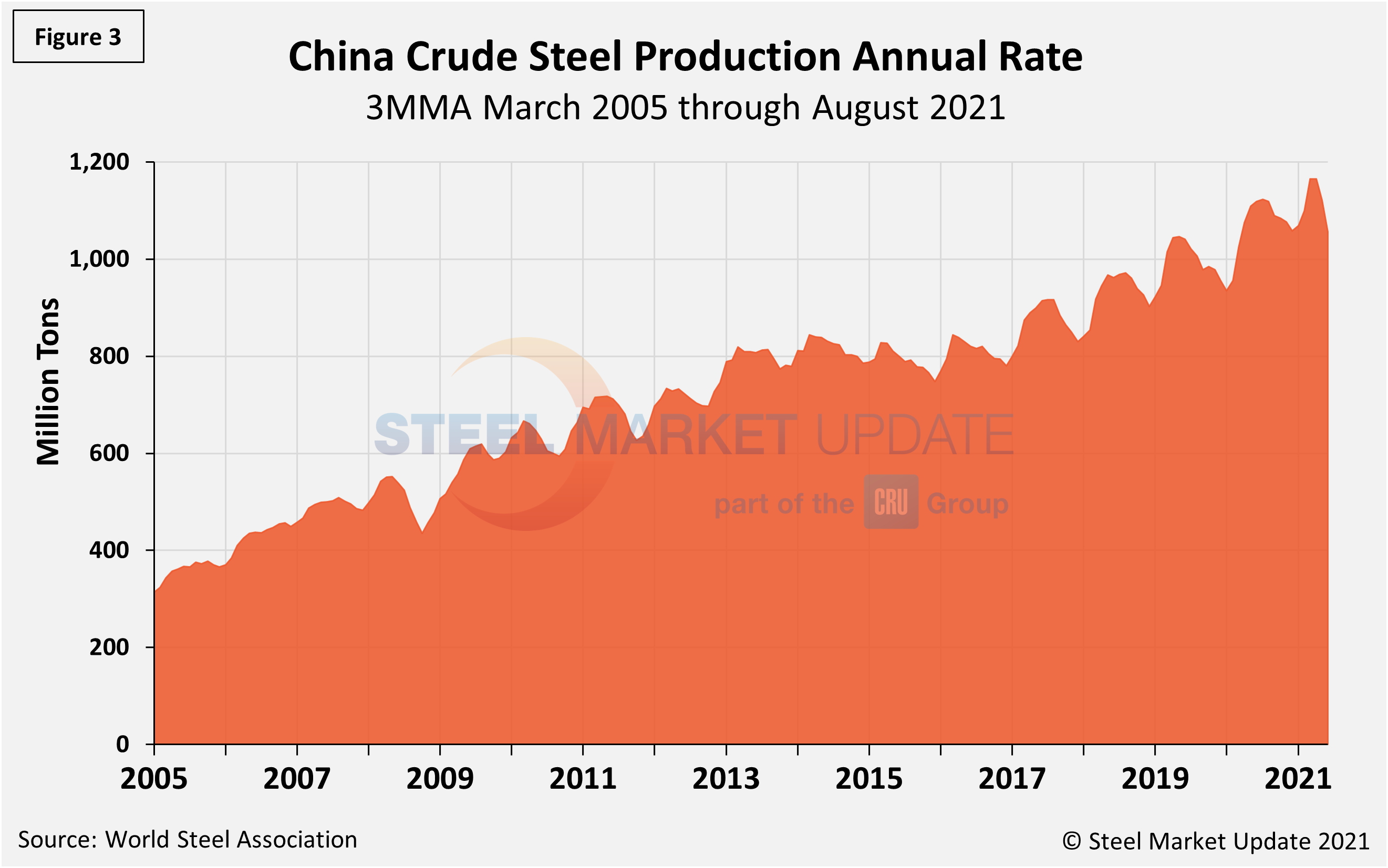

On a 3MMA basis (Figure 3), the annual rate of China’s crude steel production had maxed out at 1.123 billion metric tonnes in September 2020, then dipped month on month through February. March through May were the first increases since last September, setting a new high of 1.166 billon tonnes in May. July’s total edged down to 1.121 billion tonnes, slipping for the second time in as many months. China’s annual capacity is presently 1.128 billion metric tonnes, and its annual capacity utilization slipped to 97.9% in July, down from its all-time high of 98.4% the month prior.

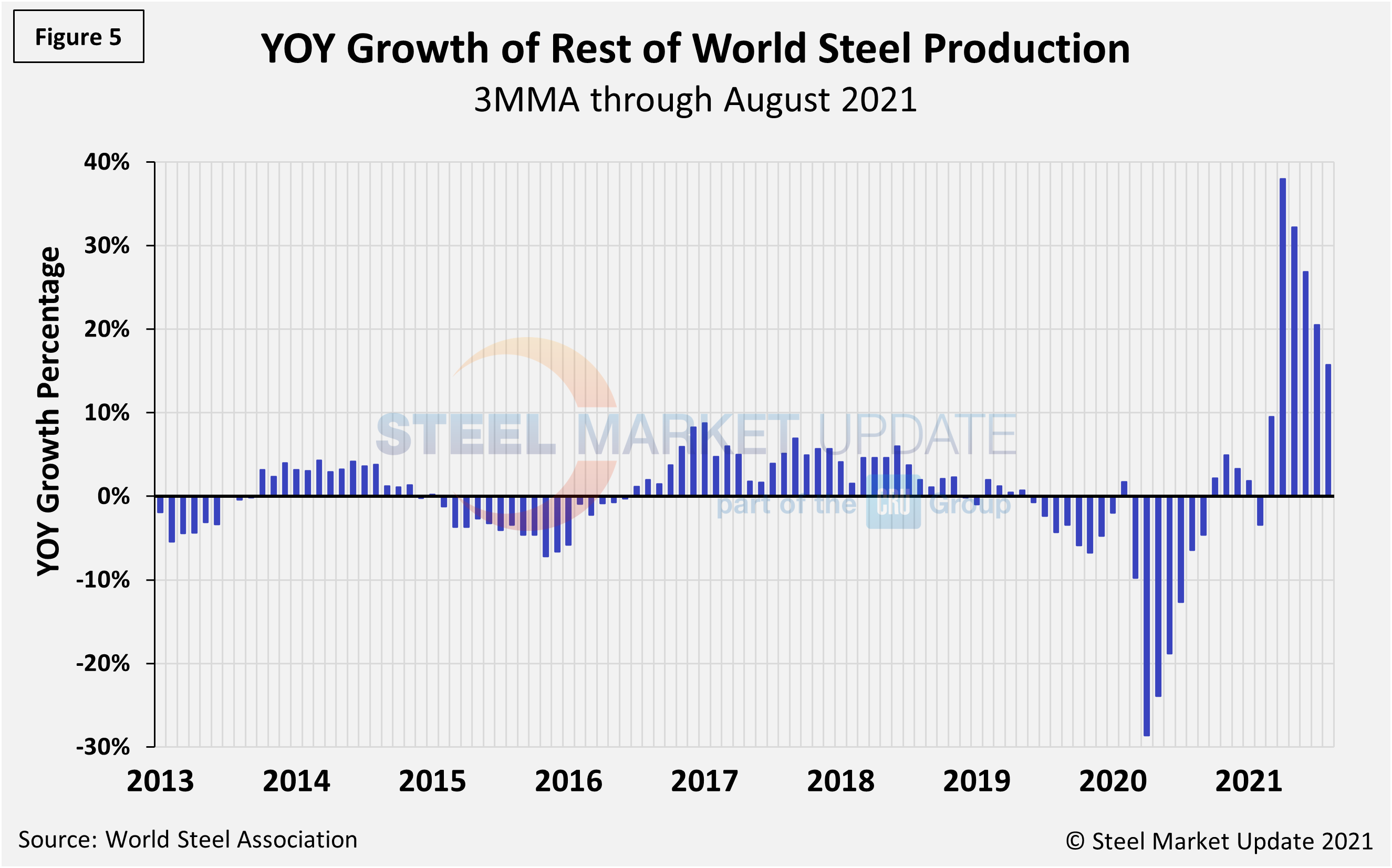

The fluctuations in China’s steel production since April 2013 are shown in Figure 4, while Figure 5 shows the growth of global steel excluding China, both on a 3MMA basis. From November 2020 through July 2021, the rest of the world’s production rose sharply, reaching a peak of 38.0% in April. Since then, the rate for the rest of the world’s annual production has decreased sequentially to 20.5% in July. China’s annual growth rate is was just 1.1% in July, a decrease from 8.3% in June, and a big decline from a high of 15.1% in April. The sharp downturn in steel production is attributable to power shortages resulting from hot weather and the Chinese government’s efforts to curb harmful air emissions from the steel industry.

By David Schollaert, David@SteelMarketUpdate.com