CRU

August 26, 2021

CRU: Longs Prices Fall as Covid-19 Pushes Demand Down in Asia

Written by James Campbell

By CRU Principal Analyst James Campbell, from CRU’s Steel Long Products Monitor

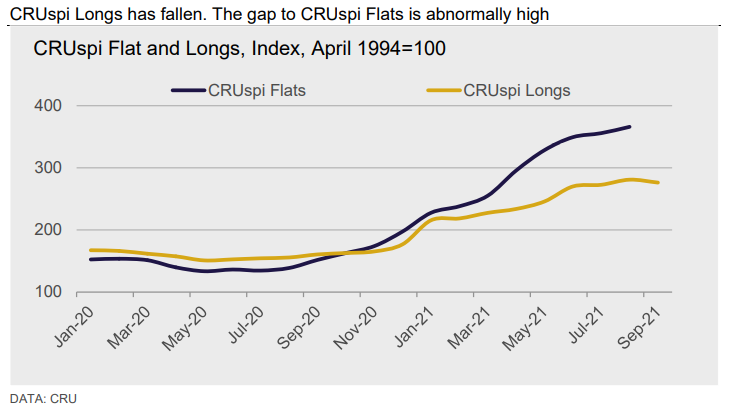

Long product prices have fallen in most regions this month as demand was lower than expected. Part of the weakness was seasonal, but parts of Asia were also affected by further outbreaks of Covid-19. Except for the USA, the tight supply seen in H1 has eased. Some markets are even oversupplied. For now, this includes China. However, production cuts in China are gathering pace and this could quickly change, with global implications.

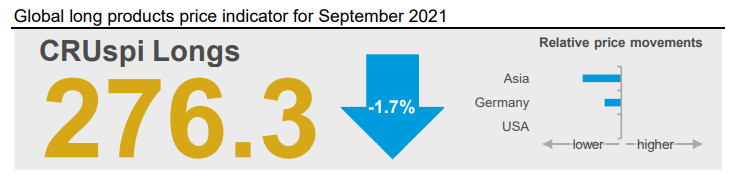

Overall, the Global Long Products Price Indicator (CRUspi Longs) fell by 1.7% m/m to 276.3 in September 2021. Price falls were assessed in Europe and Asia. U.S. rebar and structural prices were stable, but wire rod increased.

Demand Weaker than Expected – Even in China

Demand was less than expected over the last month and this has affected buying activity in many regions. Of most note is the change in China. Recent economic indicators were weaker than anticipated, suggesting only some of the slowdown in demand currently seen is seasonal. Demand in the country has fallen more than supply. This is noteworthy as domestic supply in China is currently restricted.

The previously announced output cuts announced by the government are now being enacted by provincial governments. Supply has also been restricted by unattractive margins and power shortages. Further restrictions were announced recently in Tangshan around the winter Beijing Olympics. It looks unlikely these restrictions will disappear in the near term.

Covid-19 Strikes Again

Covid-19 was a major factor affecting demand in China. China was not alone. Demand in Southeast Asia has been so weak that production in some Vietnamese mills was driven by export orders alone. This resulted in increased availability of billet, lowering costs for rerollers. Covid-19 restrictions had a similar effect on construction activity in Iran and the result the same: increased availability of billet.

Widespread Price Falls

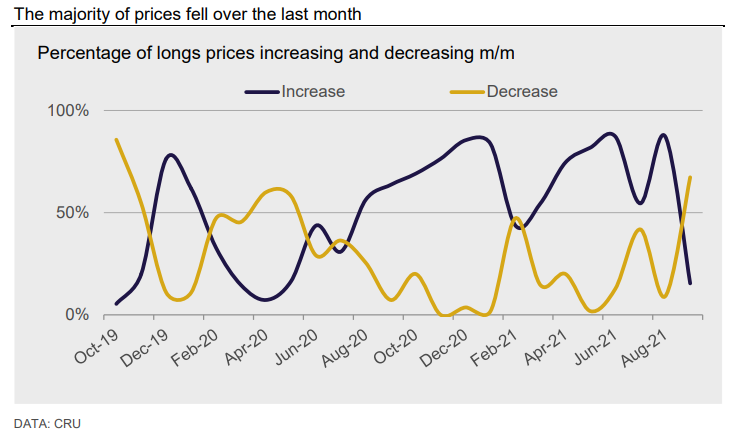

Weaker demand and increased billet availability led prices lower in many regions. Overall, of the prices we publish, the majority, 67%, fell. Only 15% increased this month, compared to 87% last month. The main price rises to note were for rebar in India, wire rod in China and wire rod/merchant bar in the USA.

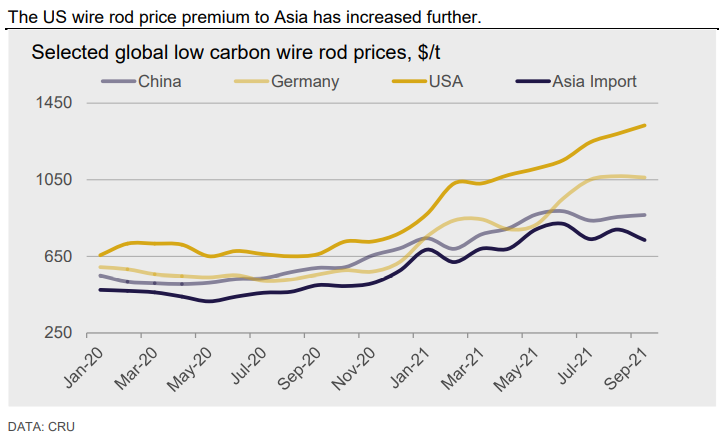

The USA remains the strongest market and wire rod remains the strongest product: U.S. wire rod prices are now $600 /t higher than those in Asia. German prices are also significantly higher than those in Asia, although the premium is half that of the U.S. market.

Outlook: Chinese Policy Could Disrupt the Market

Our current base case is for lower prices in the final quarter of 2021; we are close to the peak in Europe and the USA. In the USA, supply of wire rod is likely to remain tight in the near term. Increases to capacity are being invested in but are unlikely to have a meaningful impact until late Q4. European buying activity is usually strong in September, supported by restocking. This year, that restocking looks to be smaller as previously ordered material – including arrears – is delivered. The stock cycle could have a bigger impact in Q4 than domestic supply availability, particularly as the winter approaches.

The future direction on price is highly uncertain, particularly in Asia. Much depends on how China balances supply cuts with falling demand. An imbalance either way would likely have global implications to finished steel prices, semi-finished prices and raw materials.

Request more information about this topic.

Learn more about CRU’s services at www.crugroup.com