Market Data

August 20, 2021

Crowe Survey: COVID Gives Technology Spending a Shot in the Arm

Written by Tim Triplett

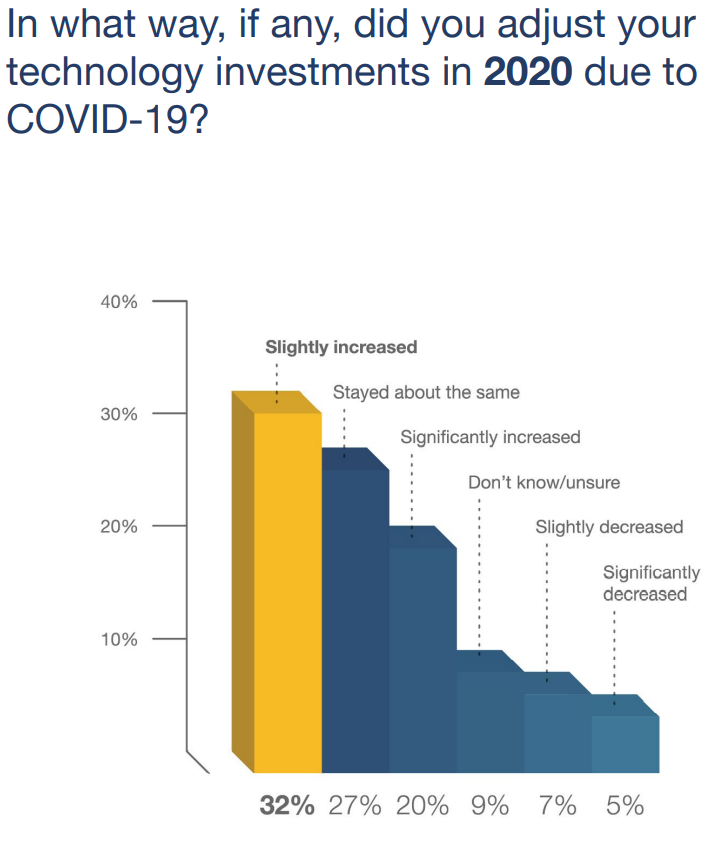

Despite the uncertainty of the pandemic year, Crowe’s 2021 Technology in Metals Survey indicates that technology remains a strategic imperative for a majority of metals industry executives. In fact, 59% of respondents increased technology spending in 2020 and 56% planned to increase spending on computers, software and other systems again in 2021.

Crowe LLP, the global accounting, consulting and technology firm, surveyed 150 metals industry executives earlier this year. What the findings make clear is that competitive companies regard technology investment as a requirement rather than an option. “Respondents to the 2021 Technology in Metals Survey drove home the importance of technology investment as a differentiator for their businesses. As steel companies consider the broader economic and societal factors that will impact their industry over the next 10 years, leaders must consider where technology can be used as a strategic tool for growth,” said Tony Barnes, managing principal of the Crowe metals industry team.

When asked to characterize the importance of new technology in their three- to five-year business strategies, nearly two-thirds (64%) of the survey respondents said it was very important, with technology investments tied to specific business strategies or outcomes. Rather than reducing their technology commitments due to the disruptions from COVID-19, more than half (52%) said they actually increased their technology investments in 2020. Looking ahead, even more (56%) said they plan to increase their technology spending in 2021 due to the pandemic.

Cybersecurity tops the list as the No. 1 technology concern among metals executives, followed closely by system obsolescence. Core business applications such as enterprise resource planning (ERP) and customer relationship management (CRM) still account for the majority of technology investments, but a growing number of companies are shifting large portions of their budgets toward more advanced applications such as data analytics, artificial intelligence (AI), and machine learning (ML), the survey found.

Click here for the full results from Crowe’s 2021 Technology in Metals Survey.