Analysis

August 17, 2021

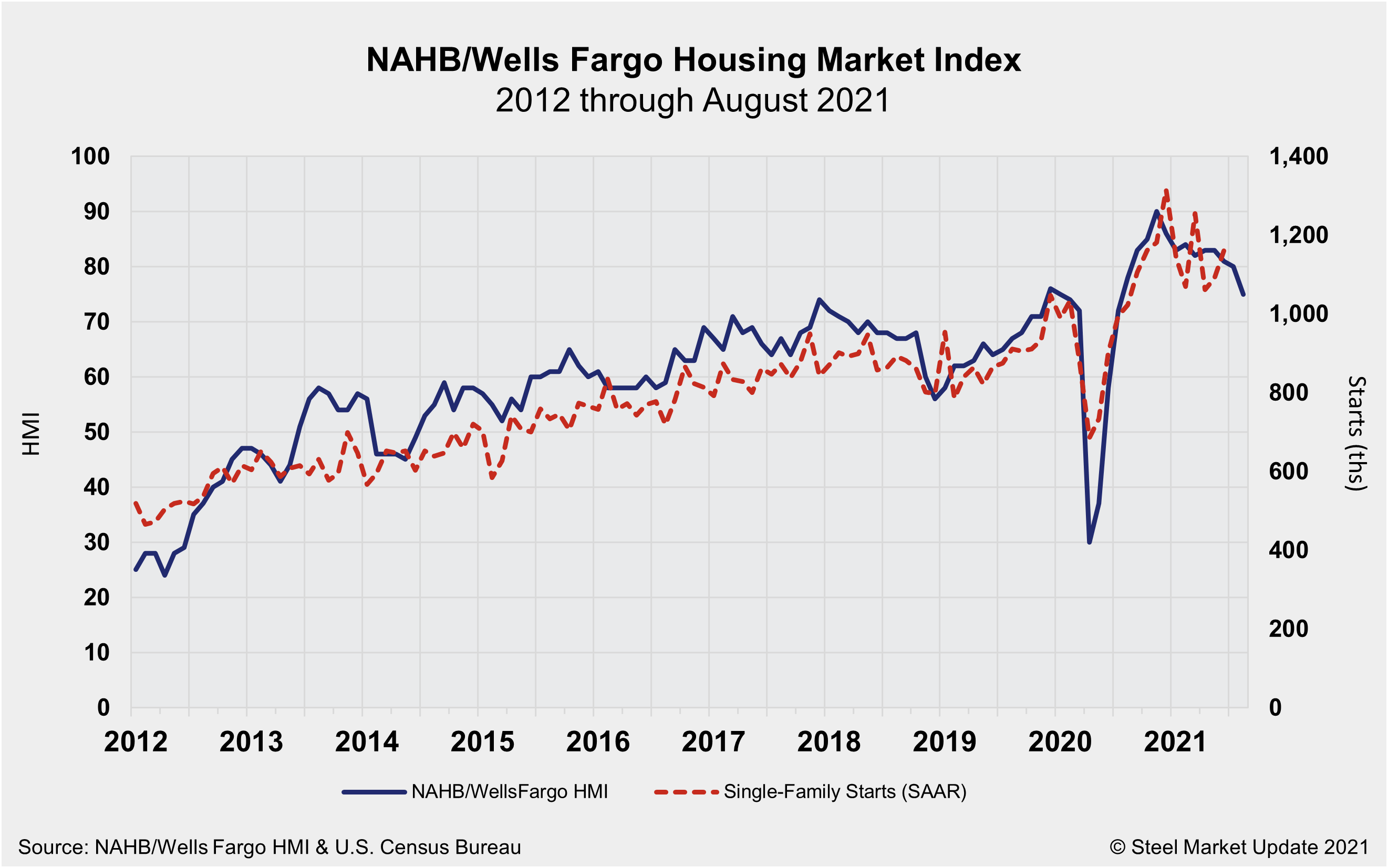

NAHB: Builder Confidence Registers a 13-Month Low

Written by David Schollaert

Builder confidence edged down in August to its lowest reading in 13 months due to higher construction costs, supply shortages and rising home prices, according to the NAHB/Wells Fargo Housing Market Index (HMI).

The index contracted for the third time in as many months, falling five points to a reading of 75 in August, as builder sentiment in the market for newly built single-family homes waned.

“Buyer traffic has fallen to its lowest reading since July 2020 as some prospective buyers are experiencing sticker shock due to higher construction costs,” said National Association of Home Builders Chairman Chuck Fowke. “Policymakers need to find long-term solutions to supply-chain issues.”

The three major indices that make up the HMI displayed mixed results in August. The HMI gauging current sales conditions fell five points to 81, the component measuring traffic of prospective buyers also posted a five-point decline to 60, and the gauge charting sales expectations in the next six months was sideways month on month at 81. (Any number over 50 indicates that more builders are optimistic in their view of current conditions.)

At a regional level, the Northeast three-month moving average HMI fell one point to 74 in August, while the Midwest dropped two points to 68. The South posted a three-point decline to 82, and the West registered a two-point drop to 85.

“While the demographics and interest for home buying remain solid, higher costs and material access issues have resulted in lower levels of home building and even put a hold on some new home sales,” said NAHB Chief Economist Robert Dietz. “While these supply-side limitations are holding back the market, our expectation is that production bottlenecks should ease over the coming months and the market should return to more normal conditions.”

By David Schollaert, David@SteelMarketUpdate.com