Market Data

July 23, 2021

Global Steel Production Eases in June

Written by David Schollaert

World crude steel production lost momentum in June after repeated months of record-breaking output, according to World Steel Association (worldsteel) data. Global production in June, at an estimated 167.9 million metric tons, declined 3.7% from May, but was still 12.0% higher than the same period last year.

Since March’s historic 12.7% jump, world crude steel production had been trending up. June’s total is 6.5 million tons lower than May’s record high of 174.4 million tons. Total global output in June was heavily affected by a 5.6% decrease in Chinese production, along with smaller decreases in seven of the top 10 steel-producing countries, reported worldsteel.

Through the first half of 2021, world crude steel production totaled 994.0 million metric tons, up by 13.5% compared with the same period in 2020. Production was also up 7.1% when compared to the same pre-pandemic period in 2019.

The U.S. remained the fourth largest crude steel producer in the world in June, accounting for 7.1 million metric tons or 4.2% of the global total. U.S. production in June was down 1.4% compared to the prior month. Compared to the same month last year when the economy was struggling with COVID disruptions, June’s production was an improvement of 43.5%. Yet June steel output in the U.S. was still down 2.0% compared the pre-pandemic period in 2019.

U.S. production through the first half of 2021 totaled 41.5 million metric tons, 13.7% higher than the same period one year ago. Although domestic steel production is on the right track, it remains behind pre-pandemic levels by 6.3%.

China continued to produce more than half of the world’s steel at 55.9% or an estimated 93.9 million metric tons in June. Chinese production was down 5.6% month on month, and its share of steel production was also down for the second-consecutive month at 55.9%, compared to 57.1% in May. China’s steel production was up 2.5% when compared with June 2020.

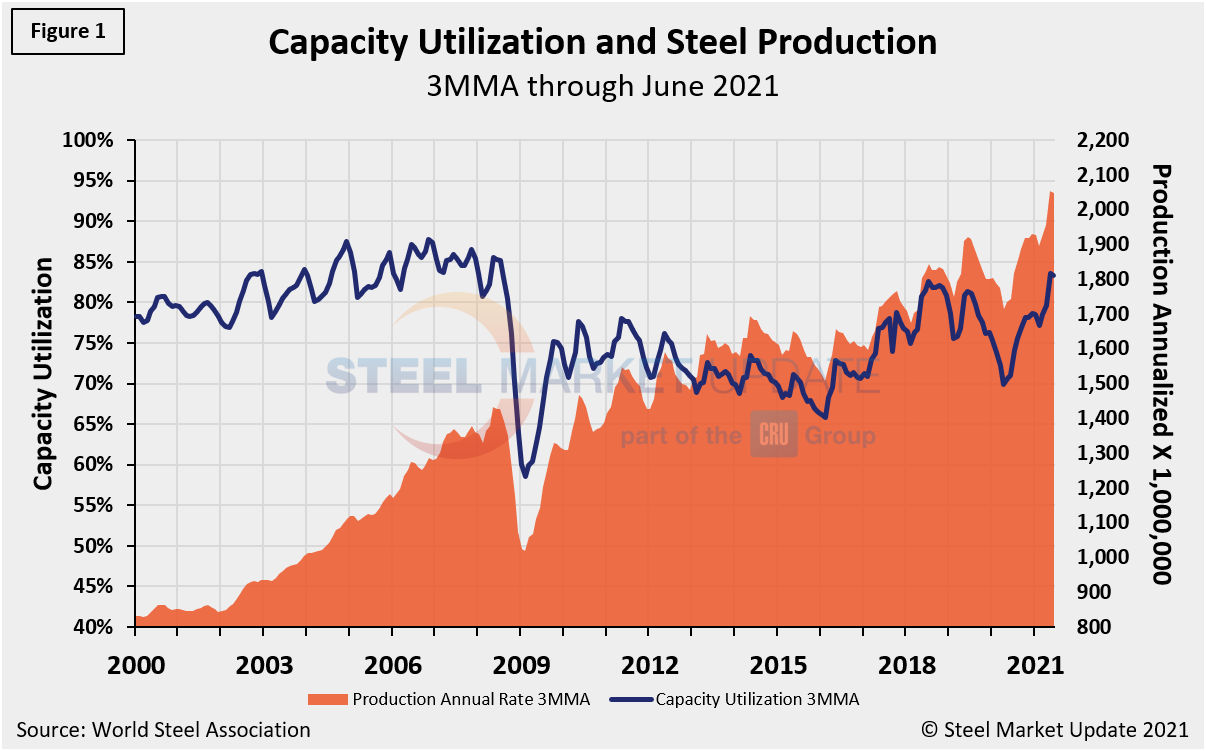

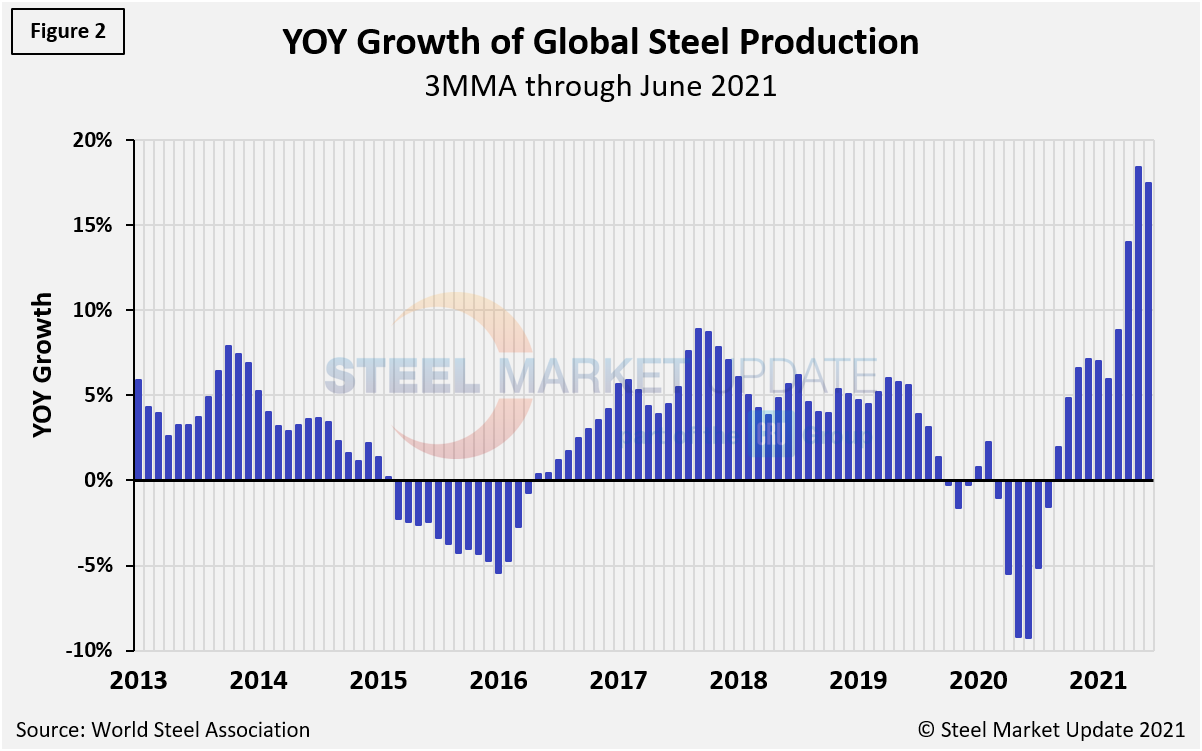

Shown below in Figure 1 is the annualized monthly global steel production on a three-month moving average (3MMA) basis and capacity utilization since January 2000 based on data from worldsteel, while Figure 2 shows the year-over-year growth rate of global production on the same 3MMA basis since January 2013. Capacity utilization in June on a 3MMA basis was 83.4%, down marginally from 83.6% the month prior. On a tons-per-day basis, production in June was 5.597 million metric tons, down from May’s record rate of 5.813 million tons. Growth in three months through June on a year-over-year basis was positive 17.4%, down from 18.4% the month prior.

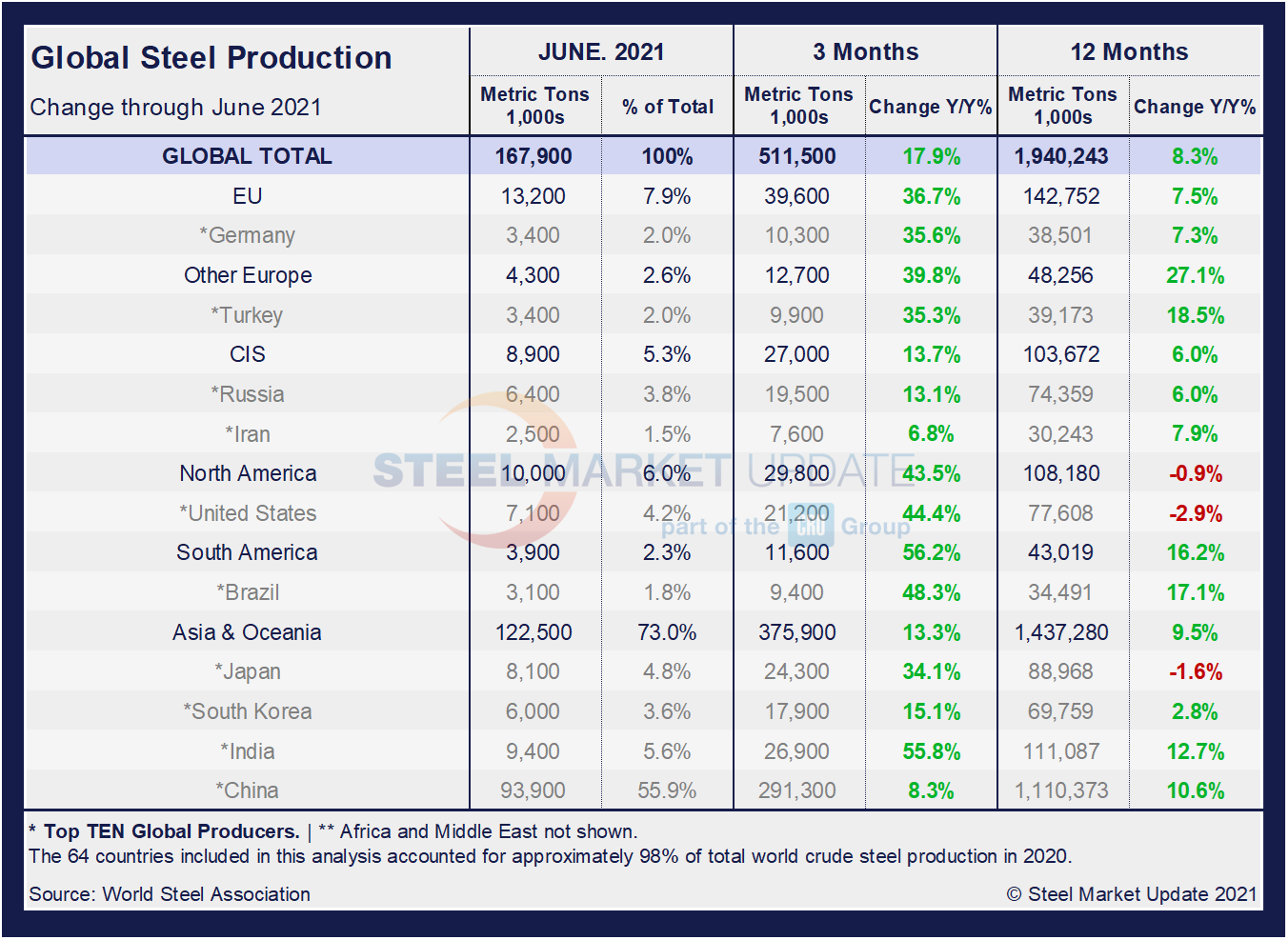

Displayed in the table below is global production broken down into regions, the production of the top 10 nations in the single month of June, and their share of the global total. It also shows the latest three months and 12 months of production through June with year-over-year growth rates for each period. Regions are shown in black font and individual nations in gray. The world overall had positive growth of 17.9% in three months, but decelerating from the 18.6% growth the month prior. Over 12 months through June, though, there was positive growth of 8.3%. The market has maintained positive momentum, as the three-month growth rate is higher than the 12-month growth rate.

The table shows that North American production was up by 43.5% in the three months through June. The positive momentum in the North American market is significant as the economy continues to recover from the pandemic. Yet when compared to the same pre-pandemic period in 2019, present output is still down 1.2%.

China’s Crude Steel Production

China’s monthly steel production was estimated at 93.9 million metric tons in June, down from 99.5 million metric tons the month prior. The 5.6-million-ton month-on-month decrease marks the first decline in four months. After repeated record-breaking months of crude steel output, obliterating the previous all-time high of 94.8 million tons set in August 2020, June’s production decrease was surprising. Nevertheless, China’s June output was still the fourth highest total year-to-date and the fifth highest total ever.

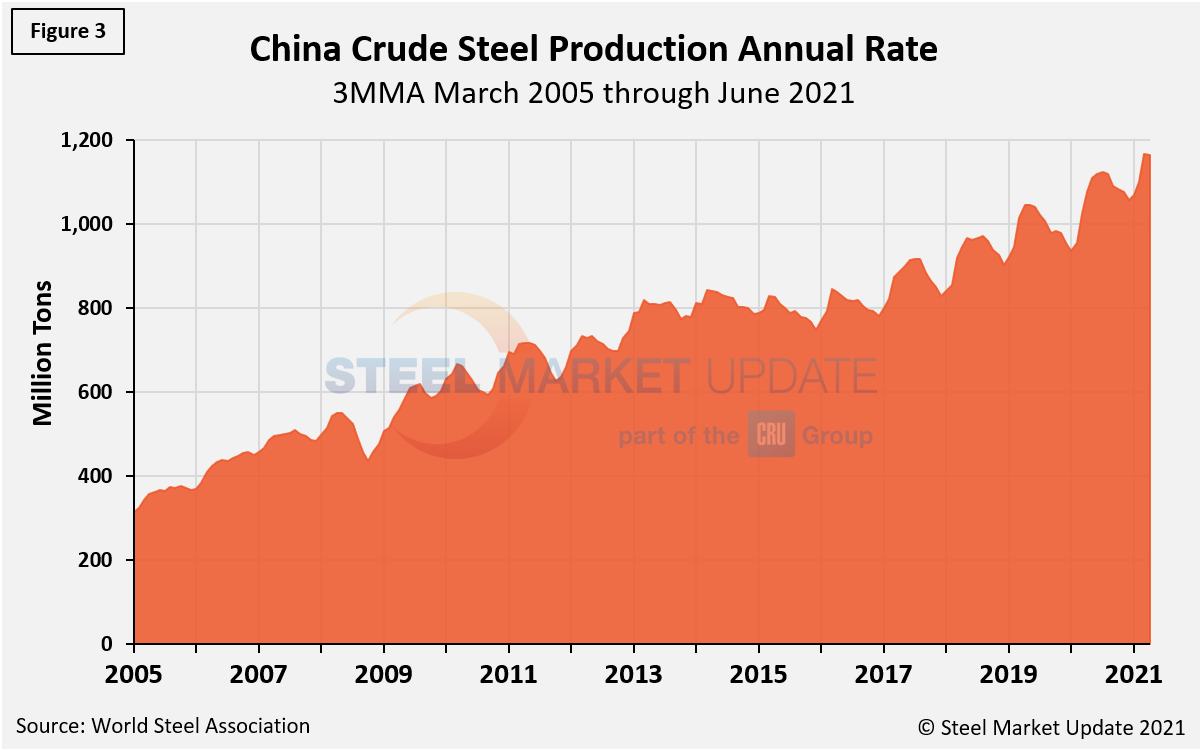

On a 3MMA basis (Figure 3), the annual rate of China’s crude steel production had maxed out at 1.123 billion metric tons in September 2020, then dipped month on month through February to 1.057 billion metric tons. March through May were the first increases since last September. June’s total edged down to 1.165 billion metric tons from 1.166 billion in May. China’s annual capacity is now 1.128 billion metric tons, a reduction from 1.164 billion tons in December 2017. China’s annual capacity utilization through June was 98.4%, up marginally from 98.2% the month prior.

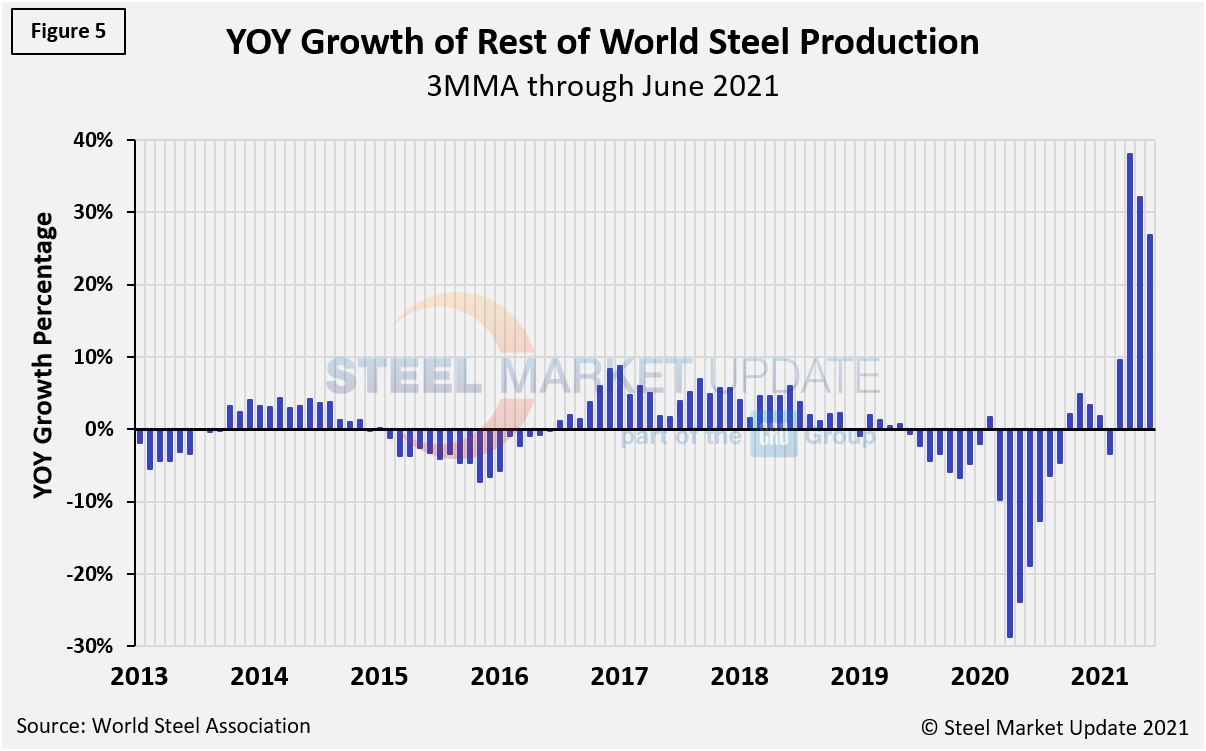

The fluctuations in China’s steel production since April 2013 are shown in Figure 4, while Figure 5 shows the growth of global steel excluding China, both on a 3MMA basis. From November 2020 through June 2021, the rest of the world’s production rose sharply, reaching its peak of 38.0% in April. Since then, the rate for the rest of the world’s annual production has edged down sequentially to 26.8% in June. China’s annual growth rate is presently at 8.3% in June, down from 13.7% in May and from a high of 15.1% in April.

By David Schollaert, David@SteelMarketUpdate.com