Market Data

July 22, 2021

Mill Lead Times/Negotiations: Little Relief Yet

Written by Tim Triplett

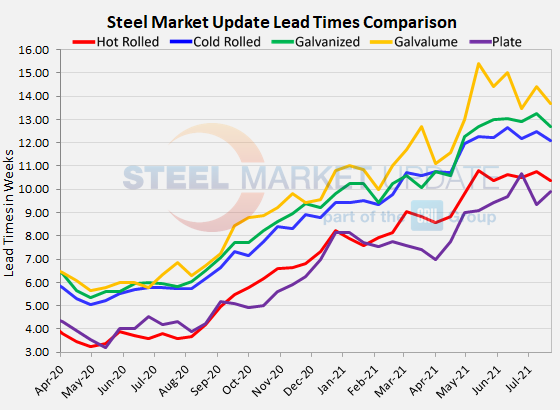

Steel Market Update’s check of the market this week shows that lead times for deliveries of spot orders from the mills have shortened slightly on all flat rolled products. The dip of a half-week or less is not highly significant, however, as average lead times for hot rolled orders remain above 10 weeks, while those for cold rolled and coated products are still above 12 weeks – more than double the historical norms. Unless these numbers are the beginning of a longer-term trend, they indicate buyers are seeing little relief yet from the tight supplies that continue to push steel prices higher week after week.

Lead times for hot rolled now average 10.36 weeks, down slightly from 10.74 weeks in the last survey. Cold rolled lead times dipped to 12.11 weeks from 12.46 two weeks ago. At 12.68 weeks, lead times for galvanized products inched down from 13.26 weeks early this month. Lead times for spot orders of Galvalume have declined to 13.67 weeks from 14.42.

Bucking the trend in flat rolled, average plate lead times stretched by about half a week, moving out to 9.90 weeks from 9.33 in SMU’s last poll as plate demand and prices have shown new strength of late.

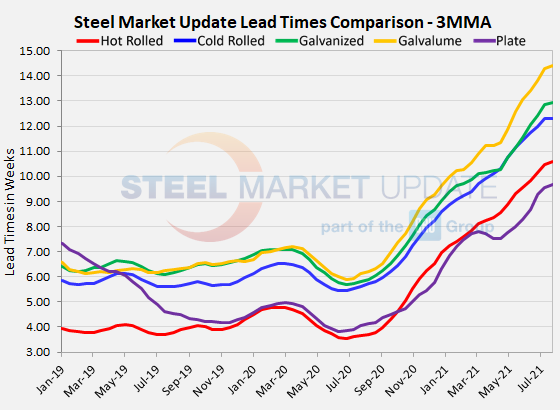

Based on three-month moving averages, which smooth out the weekly volatility, flat-rolled lead times have never been longer in SMU’s data history. The 3MMA for hot rolled lead times now averages 10.57 weeks, cold rolled 12.31 weeks, galvanized 12.93 weeks, and Galvalume 14.39 weeks. Plate’s 3MMA has risen to 9.69 weeks.

At some point in the future, lead times will begin to shorten, indicating that the mills are less busy and have more capacity to process and deliver orders. Mills that are less busy are more likely to consider discounting prices.

SMU parses the data out to two decimal points, but it won’t be apparent that change is afoot until lead times see swings of a full week or more.

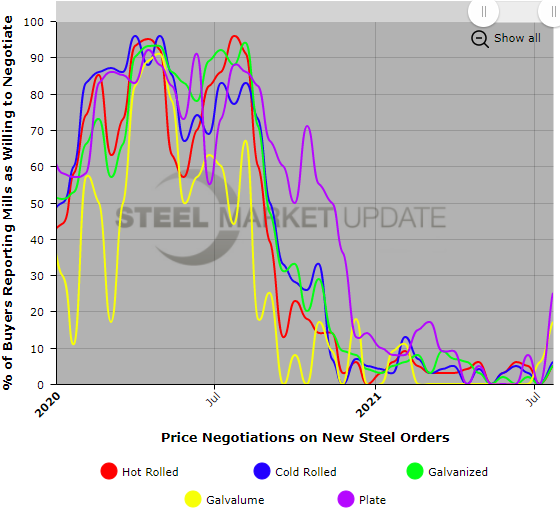

Negotiations

There’s nothing new to report on the climate in steel price negotiations. All but a tiny percentage of respondents to this week’s survey confirmed that the mills still feel no need to talk price when they can sell all the spot tons they have for a huge premium. “The mills are not even negotiating what tons we can get, let alone pricing. They definitely have the upper hand,” said one buyer. “There’s no negotiation, and that has been the case throughout this runup, especially on cold rolled and galvanized,” said another.

By Tim Triplett, Tim@SteelMarketUpdate.com