Prices

July 22, 2021

Hot Rolled Futures: Work Hardened or Metal Fatigue

Editor’s note: SMU contributor Bryan Tice is a partner at Metal Edge Partners, a firm engaged in Risk Management and Strategic Advisory. In this role, he and the firm design and execute risk management strategies for clients along with providing process and analytical support. Before joining Metal Edge Partners, Bryan held a variety of commercial leadership roles involving purchasing, sales, and risk management for Feralloy Corporation, Cargill Steel Service Centers and Plateplus Inc. You can learn more about Metal Edge at www.metaledgepartners.com. Bryan can be reached at Bryan@metaledgepartners.com.

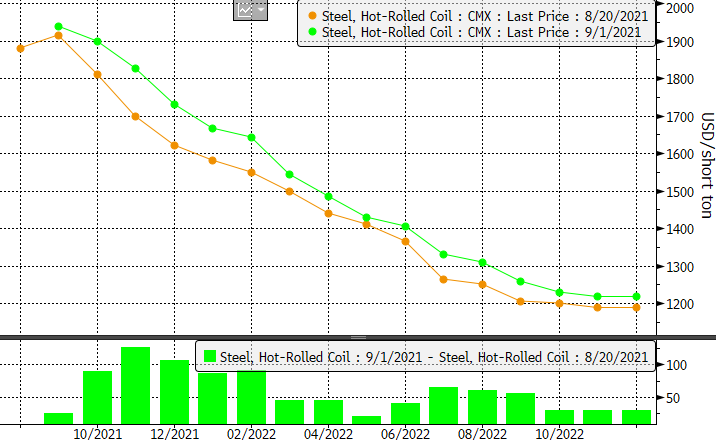

Last week at this time, many SMU readers had returned from an informative three-day session at the Steel Market Update conference in Atlanta, attempting to crystalize the many divergent views of what the market will look like in 2022. A week removed, most market participants that I talk with are still processing and formulating opinions or challenging assumptions of the analysts and CEOs who spoke. The contrast of opinions reminds me of the metallurgical terms “work hardening” and “metal fatigue.” Work hardening is a process whereby metal hardness increases through repeated deformations. Metal fatigue on the other hand occurs when repetitive stresses result in fracture and possible structural failure. I am no metallurgist, but I do know that these outcomes are typically a function of chemistry, time and temperature. With carbon flat rolled prices near or above (depending on product) $2,000/t, I’m having a hard time classifying whether we are witnessing work hardening or metal fatigue. Looking at the reaction of the forward curve from the Friday before the conference to yesterday, it seems the market might be leaning toward the bull case. We have seen some of the nearby months move up over $100/t with some 2nd half months in 2022 having gapped +$50/t higher in just the last few weeks.

On one hand, several accomplished and tenured steel mill CEOs described a “new normal” whereby steel prices will remain elevated as a result of strong demand outlooks, industry consolidation, diligent trade policy, market discipline and monetizing their advantages of producing the greenest steel in the world. On the other hand, several respected analysts described an environment where steel prices eventually revert back to the mean due to record metal spreads correcting, import penetration, U.S. capacity expansions and elimination of selective Section 232 tariffs. Using the metallurgical analogy, I suppose this may be a function of chemistry between the bullish/bearish predispositions of those experts and the collective audience they addressed.

Just as popular a topic of discussion at the conference was the “when” or the timing of when the market would inflect. Steel mill CEOs suggested “stronger for longer,” while analysts warned of a more imminent correction. Clearly this is another example of whether the market has been hardened by the repeated price increases and can become more immune to their forces, or the market buckles under the fatigue of the repeated blunt force trauma of rising prices week after week.

Lastly, taking the attendees’ temperature on absolute price predictions showed massive variation with lows in the $600s and at least one reference suggesting higher yet from the ~$1,900 levels as assessed by various indices at the time of the conference. As well attended as the conference was this year, it appears Goldilocks was not in attendance, since it seems there was a lack of a “just right” market portrayal of 2022.

Perhaps the closest we got to a “just right” preview for 2022 prices was from Cleveland-Cliffs CEO Lourenco Goncalves who publicly rebutted the comment during the conference’s fireside chat made by a manufacturer describing their inability to compete globally with prices at these elevated levels, and a follow-up question from SMU Publisher John Packard as to what is a reasonable price that the market can bear. Mr. Goncalves’ response was essentially at a market price where everyone can sustain their business and make money. Sounds good in theory, but good luck building a 2022 business plan around that guidance. Looking at global prices (converted to metric tons) the U.S. is clearly on an island and at a price spread to other countries that looks quite precarious for manufacturers to remain globally competitive.

Whether you’ve become hardened or fatigued by the higher prices in the U.S., the likelihood of volatility and uncertainty will surely continue well into next year. Last night’s HRC futures settled at $1,395/t for calendar 2022. For now, that may be one of the few certainties for those attempting to plan for what is shaping up to be an interesting next year in the steel industry!

Disclaimer: The information in this write-up does not constitute “investment service,” “investment advice,” or “financial product advice” as defined by laws and/or regulations in any jurisdiction. Neither does it constitute nor should be considered as any form of financial opinion or recommendation. The views expressed in the above article by Metal Edge Partners are subject to change based on market and other conditions. The information given above must be independently verified and Metal Edge Partners does not assume responsibility for the accuracy of the information.