Analysis

July 20, 2021

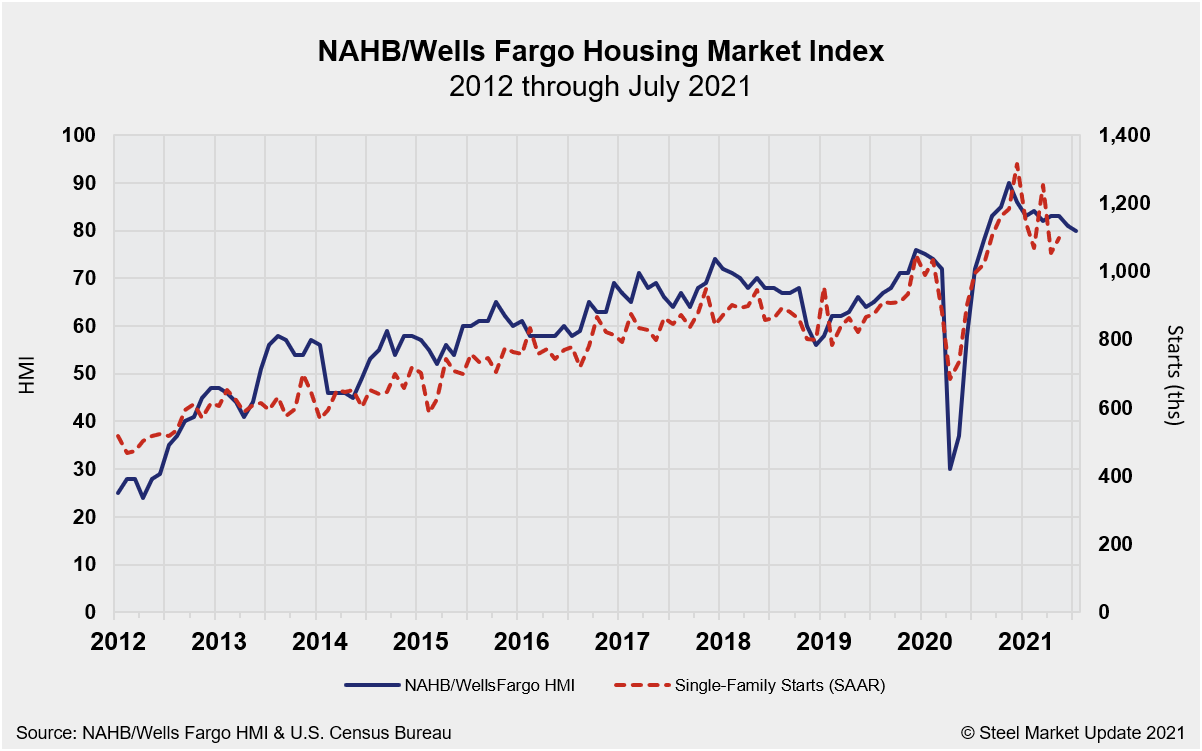

NAHB: Supply-Side Challenges Weighing on Builder Confidence

Written by David Schollaert

Builder confidence slip modestly in July on high raw material costs and a shortage of skilled labor, according to the National Association of Home Builders (NAHB)/Wells Fargo Housing Market Index (HMI). The index edged down one point to a reading of 80 last month. The dip in the index – a measure of builder confidence in the new single-family home market – reflects a continued slow decline from record-highs earlier in the year.

Sustained demand from new home buyers continues to offset the impact of the industry’s struggles, particularly supply-side challenges relating to building materials, regulation and labor. “Builders are contending with shortages of building materials, buildable lots, and skilled labor as well as a challenging regulatory environment,” said NAHB chief economist Robert Dietz. “This is putting upward pressure on home prices and sidelining many prospective home buyers even as demand remains strong in a low-inventory environment.”

The three major indices that make up the HMI displayed mixed results in June. The HMI gauging current sales conditions fell one point to 86, the component measuring traffic of prospective buyers dropped six points to 65, and the gauge charting sales expectations in the next six months posted a two-point gain to 81. (Any number over 50 indicates that more builders are optimistic in their view of current conditions.)

At the regional level, the Northeast’s three-month moving average HMI fell four points to 75 in July, while the Midwest’s fell one point to 71. The West posted a two-point decline to 87, and the South was sideways at 85.

“Builders continue to grapple with elevated building material prices and supply shortages, particularly the price of oriented strand board, which has skyrocketed more than 500 percent above its January 2020 level,” NAHB chairman Chuck Fowke said. “We are grateful that the White House heeded our urgent plea to hold a building materials meeting with interested stakeholders on July 16 to seek solutions to end production bottlenecks that have harmed housing affordability.”

By David Schollaert, David@SteelMarketUpdate.com