Product

July 13, 2021

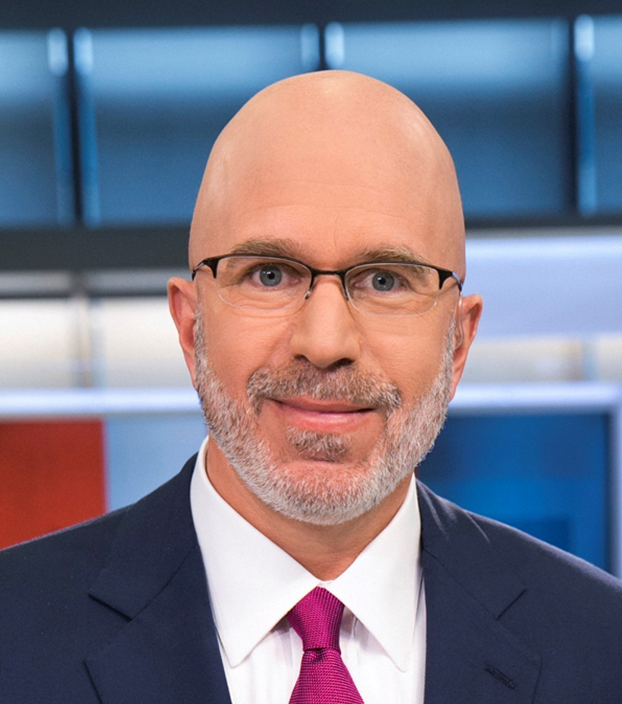

CNN Commentator to Deliver Keynote at SMU Summit

Written by Tim Triplett

Much like Steel Market Update, Michael Smerconish is not about taking sides, but rather is about expanding the conversation. “Our mission is to create a clearinghouse for non-ideological thinking. We want to give people a chance to contribute to, and consume, information that isn’t predicated on the usual, extreme talking points of the polarized media. Instead, we aim to promote independent thinking and diversity of thought,” says the author and commentator.

Smerconish will bring his blend of political analysis and humor to the podium on Monday, Aug. 23, as a keynoter at Steel Market Update’s Steel Summit in Atlanta. A lawyer by training, Smerconish is a nationally-syndicated Sirius XM Radio talk show host, newspaper columnist, and New York Times best-selling author. He hosts CNN’s Smerconish, which airs live on Saturday at 9:00 a.m. and 6:00 p.m. ET.

Smerconish will bring his blend of political analysis and humor to the podium on Monday, Aug. 23, as a keynoter at Steel Market Update’s Steel Summit in Atlanta. A lawyer by training, Smerconish is a nationally-syndicated Sirius XM Radio talk show host, newspaper columnist, and New York Times best-selling author. He hosts CNN’s Smerconish, which airs live on Saturday at 9:00 a.m. and 6:00 p.m. ET.

For more information and to register, click here.