Analysis

July 9, 2021

North American Vehicle Assemblies Up in June Despite Chip Shortage

Written by David Schollaert

Auto assemblies in North America rose further in June despite a continued struggle with the global semiconductor shortage. Some automakers in the region—including GM and Toyota—were able to ramp up production and shipments after securing enough microchips, pushing the annual rate in the North American region up by 16.4% month on month, according to LMC Automotive (LMCA).

This was a welcomed sign after the annual production rate dipped in April and May. The recent increase may be short-lived, however, as many automakers are still struggling to source the essential chips, with the likes of Ford idling or reducing production at nearly all its North American assembly plants in July. In some instances, auto plant idlings reportedly could carry into early August because of a shortage of chips and other parts.

June’s vehicle production totaled 1.252 million units, up from 1.076 million units in May, a marked 16.4% increase. June’s total is the highest year to date and up 10.2% when compared with the same year-ago period. The impact of the chip shortage, however, cannot be understated, as June’s total is still 12.1% below the 2020 high of 1.424 million units last August. Declines are expected in automotive throughout the summer or until semiconductor production can catch up with demand.

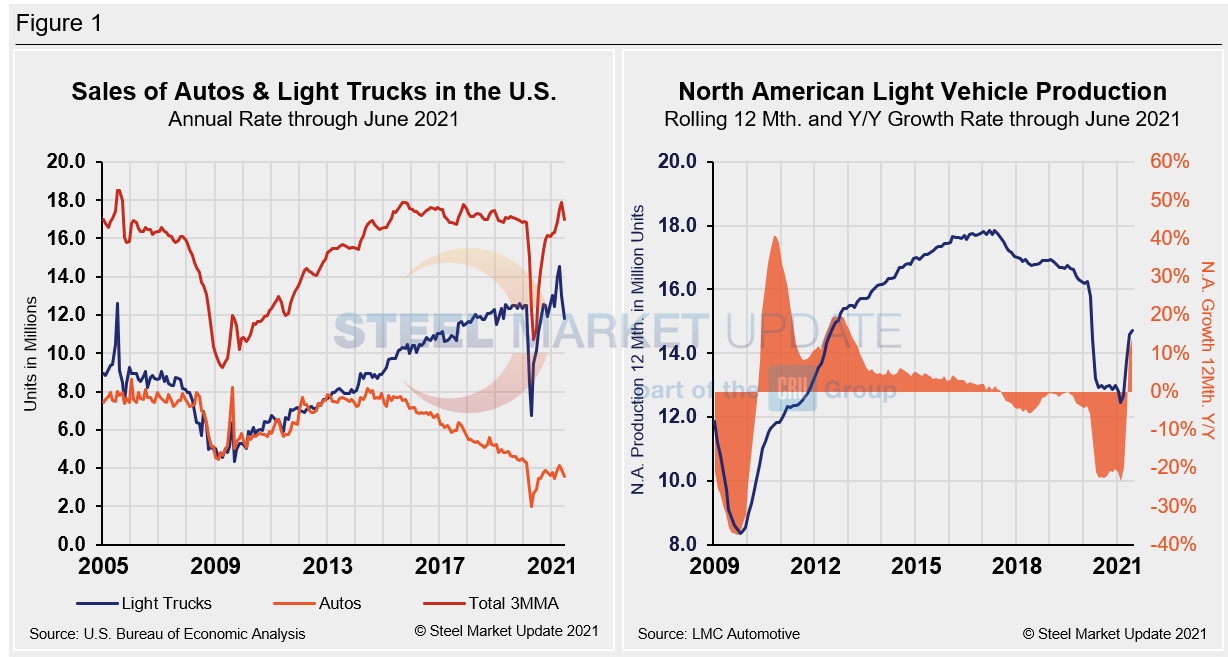

Although U.S. automakers continue to work through the effects of the pandemic, chip shortages and supply chain disruptions that have tightened vehicle inventories, demand for new vehicles remains strong. The selling rate for U.S. light vehicles in June was 15.4 million units, down from 17.0 million units in May.

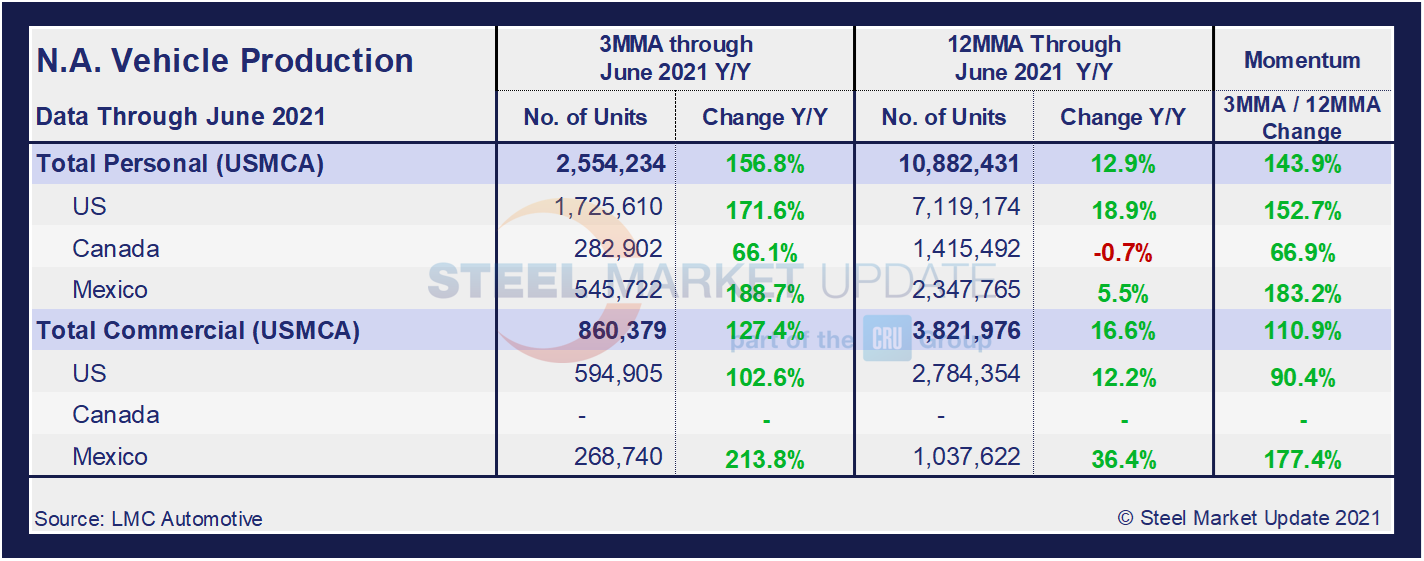

A short-term snapshot of assembly by nation and vehicle type is shown in the table below. It breaks down total North American personal and commercial vehicle production into the U.S, Canadian and Mexican components, along with the three- and 12-month growth rate for each. At the far right it shows the momentum for the total and for each of the three nations. In three months through June, total personal vehicle assemblies in the USMCA region grew by 156.8% year over year and commercial light vehicle assemblies grew by 127.4%, highlighting how far the market has come from the worst of the pandemic.

Personal Vehicle Production

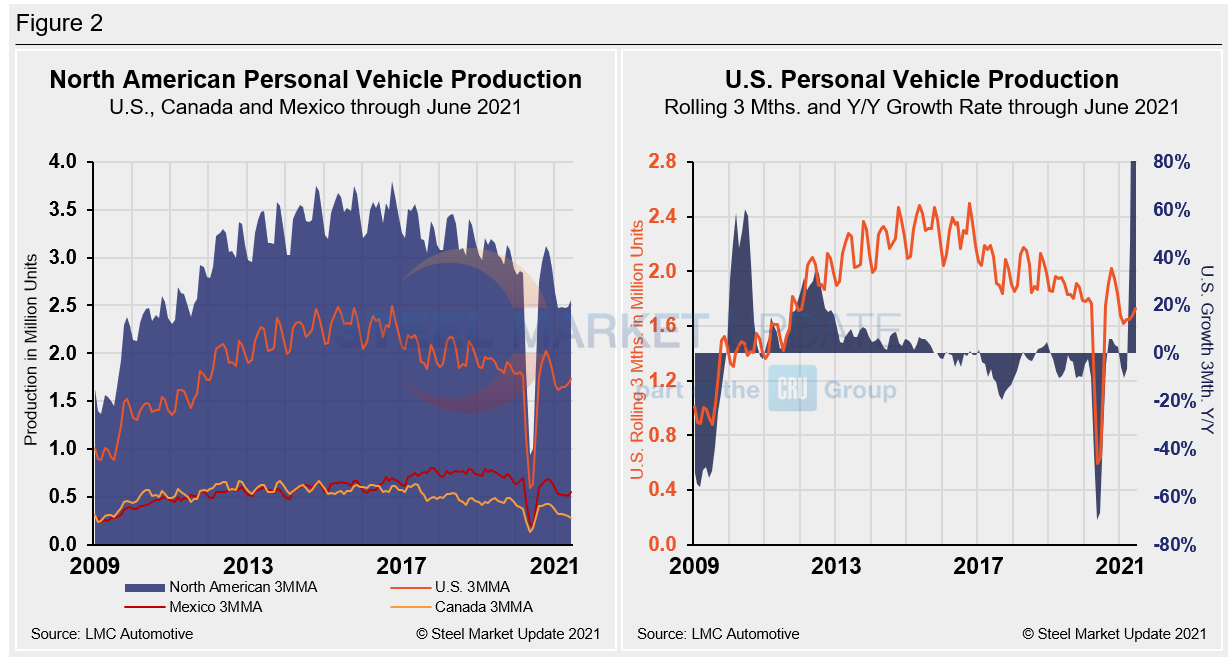

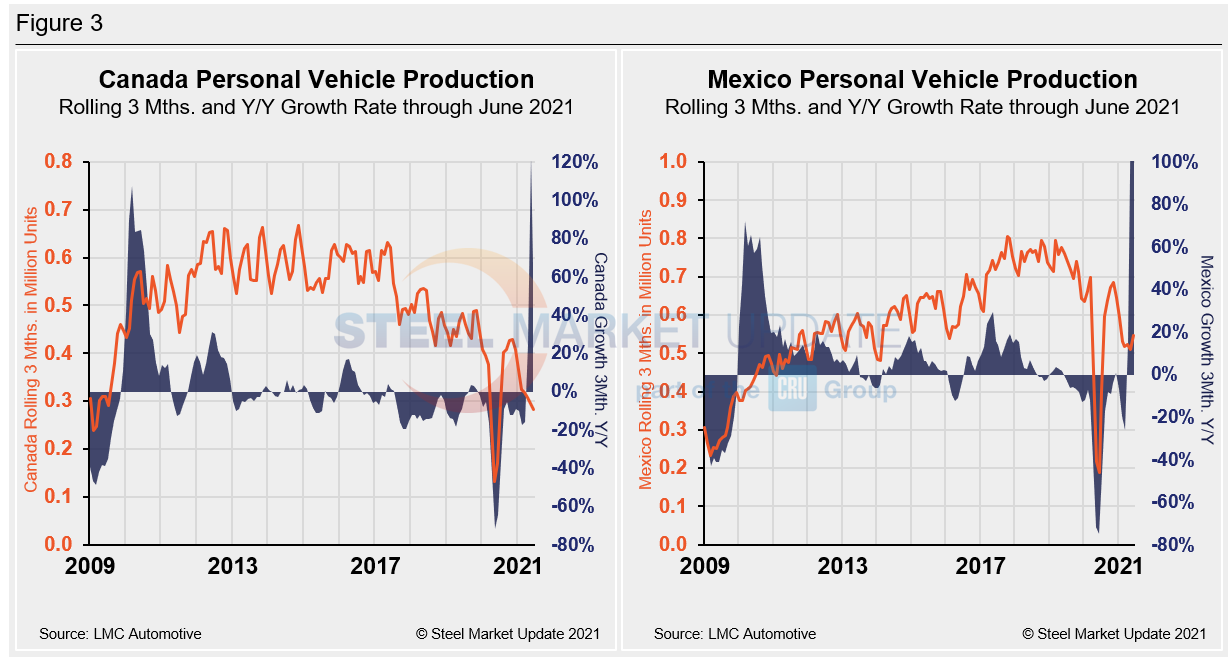

The longer-term picture on personal vehicle production across North America is shown below. The first chart in Figure 2 shows the total personal vehicle production for North America and the total for each nation. The production of personal vehicles in the U.S. and the year-over-year growth rate is displayed in the second chart. Figure 3 shows side-by-side the production of personal vehicles in Canada and Mexico, and the year-over-year growth rate.

In terms of personal vehicle production, Mexico, at 34.3%, saw the highest growth rate in June. Despite the continued effects of the chip shortage, the U.S. and Canada also saw increased annual growth rates in June, with the U.S. up 13.2% and Canada up 15.0%. Canada’s personal vehicle production share of the North American market dipped to 11.1% in June, down from 11.9% the month prior. Mexico carried 21.4% of the market share across the continent, up from 20.5% month on month. The U.S. had 67.6% of the North American production share, unchanged when compared to May.

Commercial Vehicle Production

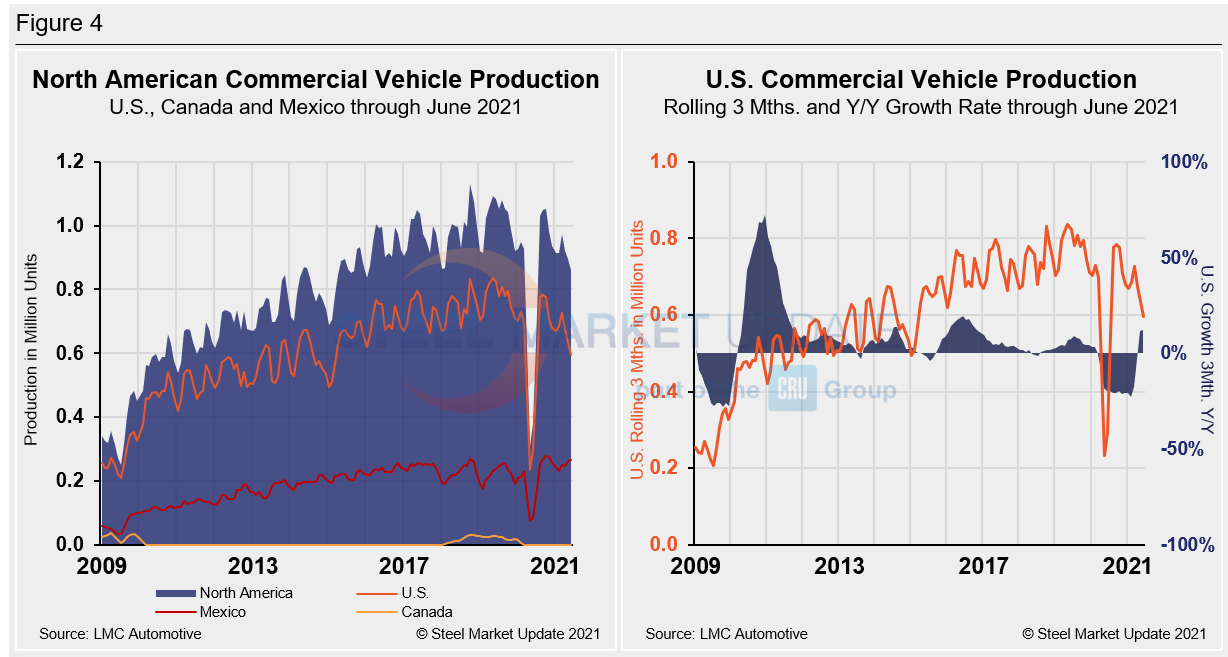

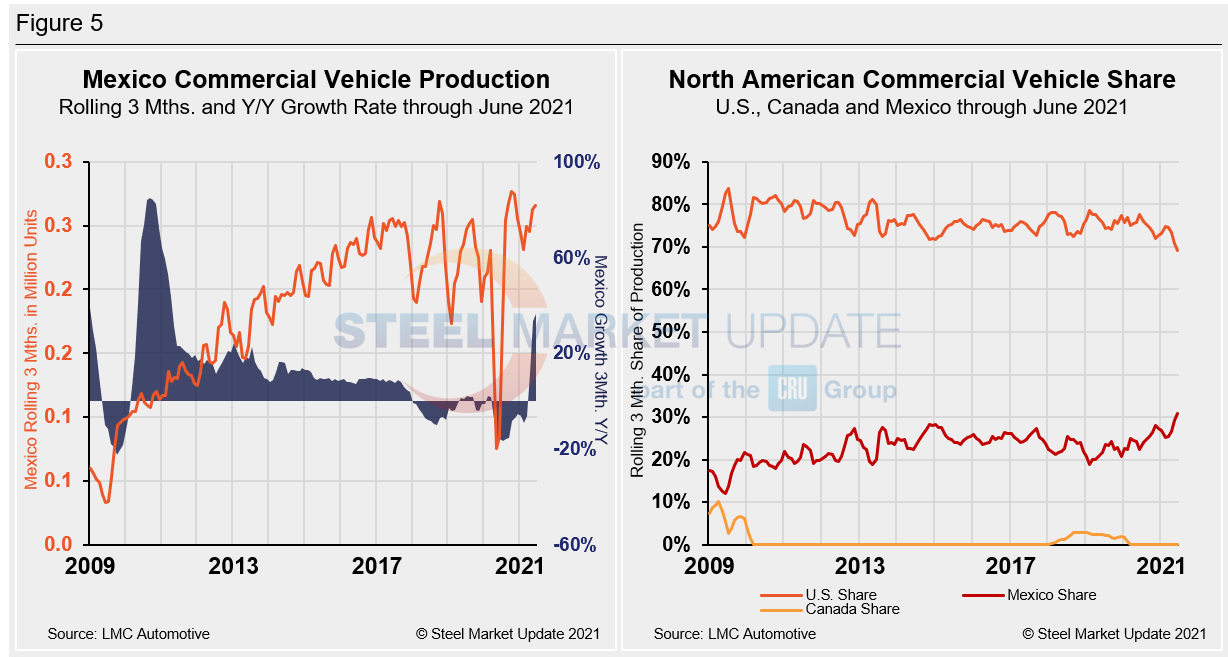

Total commercial vehicle production for North America and the total for each nation on a rolling three-month basis is shown below in the first chart in Figure 4, while the production of commercial vehicles in the U.S and the year-over-year growth rate is displayed in the second chart. Figure 5 shows the production of commercial vehicles and the year-over-year growth rate in Mexico displayed in the first chart, while the second chart shows the production share for each nation. Note that Canada has not produced a single commercial vehicle over the past 18 consecutive months.

North American commercial vehicle production was up 13.8% on an annual rate in June, compared to the month prior. Despite some production limitations due to the shortage of semiconductor chips, increased production was not impacted by COVID-19-related restrictions. The increase was driven exclusively by the U.S. market, which saw commercial vehicle production increase by 20.8% in June, while Mexico saw a decrease of 0.5% over the same period. The U.S. share was 71.1% in June, but still down from the most recent high of 77.6% in June 2020. Mexico’s share was 28.9%. Canada’s share was most recently as high as 3.0% in mid-2019, but has been at zero over the past 18 consecutive months, as Canada hasn’t produced any commercial vehicles over that span. Mexico currently exports about 80% of its light vehicle production, while the U.S and Canada are the highest volume destinations for Mexican exports.

Editor’s Note: This report is based on data from LMC Automotive for automotive assemblies in the U.S., Canada and Mexico. The breakdown of assemblies is “Personal” (cars for personal use) and “Commercial” (light vehicles less than 6.0 metric tons gross vehicle weight rating; heavy trucks and buses are not included). In this report, we describe light vehicle sales in the U.S. and report in detail on assemblies in the three regions of North America.

By David Schollaert, David@SteelMarketUpdate.com