Market Data

June 30, 2021

Global Steel Production Keeps Expanding

Written by David Schollaert

World crude steel production kept its upward momentum in May with another record-breaking month, according to World Steel Association (worldsteel) data. Global output, at an estimated 174.4 million metric tons, was 16.5% higher than the year-ago period and 2.8% higher than April.

Since March’s historic 12.7% jump, world crude steel production has been trending up. May’s total established a new record high, the third time in as many months, and was 6.8% higher than the most recent high of 163.1 million metric tons in May 2019.

Although May’s total, according to worldsteel data, was heavily impacted by China’s estimated 99.5 million metric tons produced—a nearly 2.0% increase from the month prior and a 7.8% surge year on year—the growth was also marked by increases in all regions and in nine of the top 10 steel-producing countries month on month.

Through the first five months of 2021, world crude steel production totaled 826.2 million metric tons, up by 13.3% compared with the same period in 2020 when production was 729.1 million metric tons. Production was also up 7.5% when compared to the same pre-pandemic period in 2019. The positive report is noteworthy when compared to the previous 12- and 24-month periods. Although much of the increase has been driven primarily by growth in Chinese crude steel output, nine of the top 10 global steel-producing counties reported increases when compared to the month prior. In fact, China’s 1.6% month-on-month increase was the second lowest increase of the top five global steel-producing nations. India saw a 10.8% increase in May when compared to the month prior at 9.2 million metric tons, and Japan a 7.7% increase at 8.4 million metric tons. The U.S. saw the third-largest monthly growth at 4.4% or 7.2 million metric tons of crude steel production in May.

The U.S. remained the fourth largest crude steel producer in the world in May, accounting for 7.2 million metric tons or 4.1% of the global total. U.S. production in May was up 4.3% when compared to the prior month, and up 46.6% when compared to the prior year when COVID-related disruptions were in full effect. Comparing U.S. crude steel production against 2019, a non-pandemic year, May’s output was down 4.7%. U.S. production through the first five months of 2021 totaled 34.4 million metric tons, 9.0% higher than the same period one year ago when output was 31.6 million metric tons. Although domestic steel production is on the right track, it remains behind pre-pandemic levels by 7.2% when compared to the same 2019 period.

China continued to produce more than half of the world’s steel at 57.1% or an estimated 99.5 million metric tons in May. Even though Chinese production was up 1.6% month on month, its share of global steel production decreased from 57.8% in April due to increased output from the rest of the world. China’s steel production was up 7.8% when compared with May 2020.

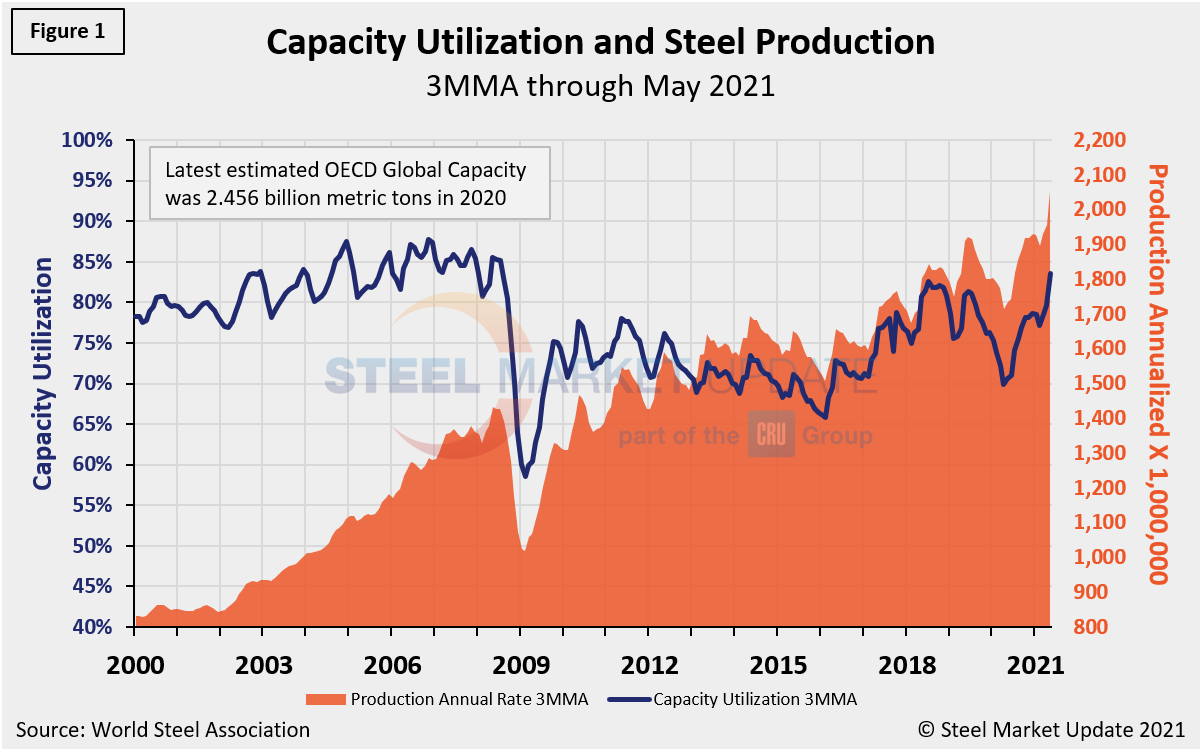

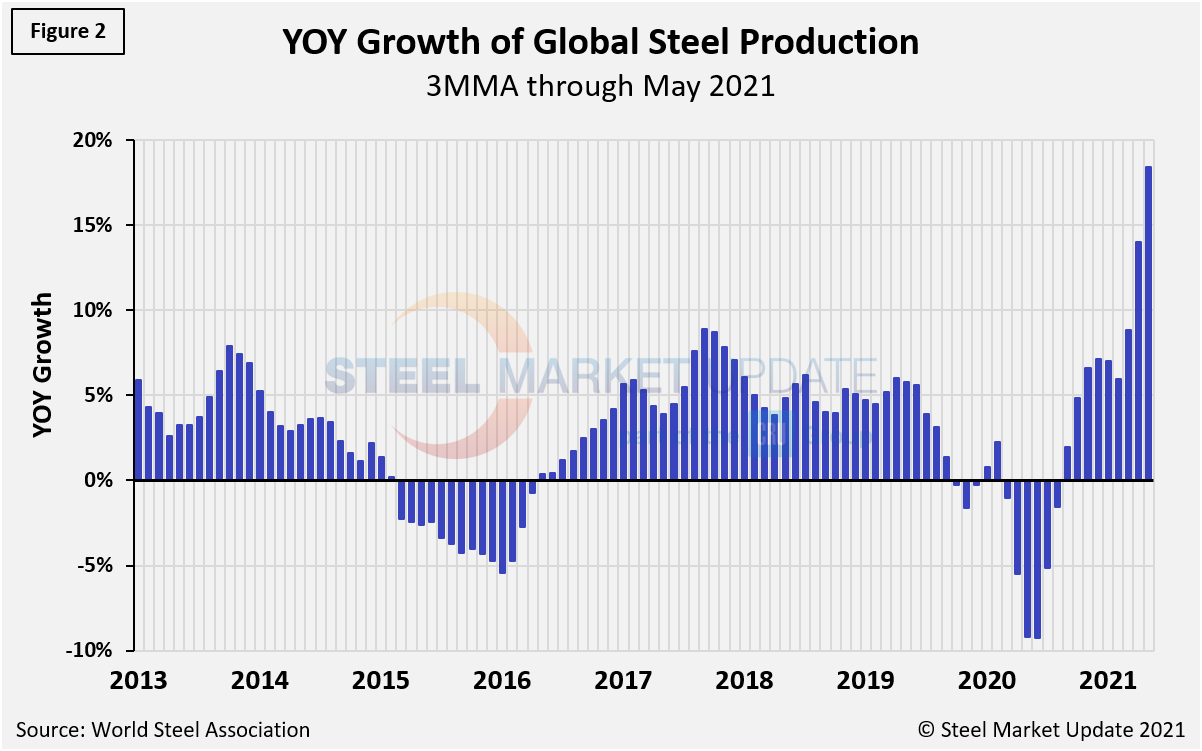

Shown below in Figure 1 is the annualized monthly global steel production on a three-month moving average (3MMA) basis and capacity utilization since January 2000 based on data from worldsteel, while Figure 2 shows the year-over-year growth rate of global production on the same 3MMA basis since January 2013. Capacity utilization in May on a 3MMA basis was 83.6%, up from 79.6% the month prior. On a tons-per-day basis, production in May was 5.626 million metric tons, down slightly from April’s record rate of 5.650 million metric tons per day. Growth in three months through May on a year-over-year basis was positive 18.4%, up from 14.0% the month prior.

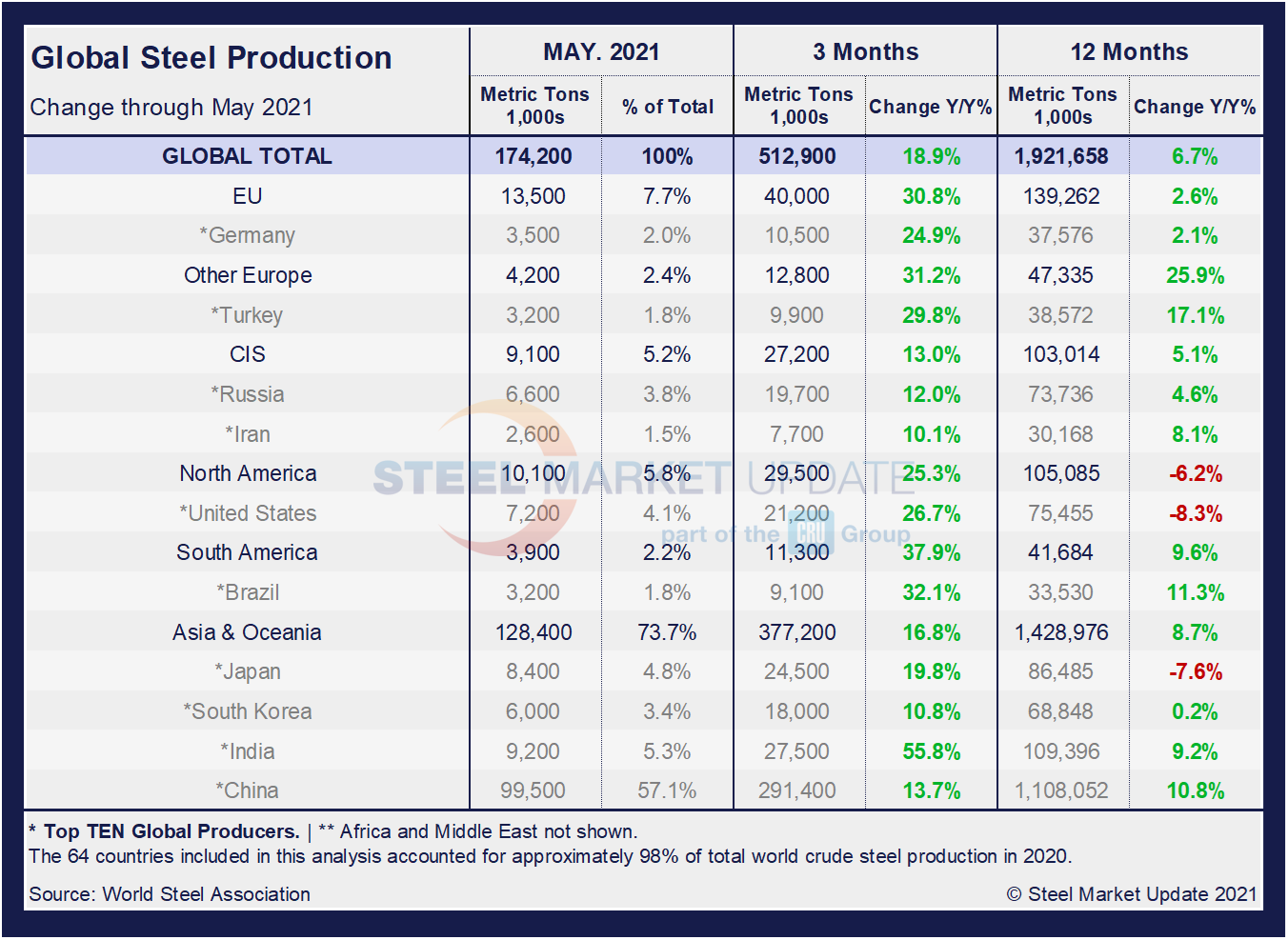

Displayed in the table below is global production broken down into regions, the production of the top 10 nations in the single month of May, and their share of the global total. It also shows the latest three months and 12 months of production through May with year-over-year growth rates for each period. Regions are shown in black font and individual nations in gray. The world overall had positive growth of 18.9% in three months and positive growth of 6.7% in 12 months through May. The market has maintained positive momentum, as the three-month growth rate is higher than the 12-month growth rate. On the same basis in May, China grew by 13.7% and 10.8%, also showing positive momentum. The table shows that North American production was up by 5.8% in the three months through May, compared to a positive 3.6% the prior month. The positive momentum in the North American market is significant as the three-month growth rate of +5.8% is notably higher than the -6.2% in 12 months through May.

China’s Crude Steel Production

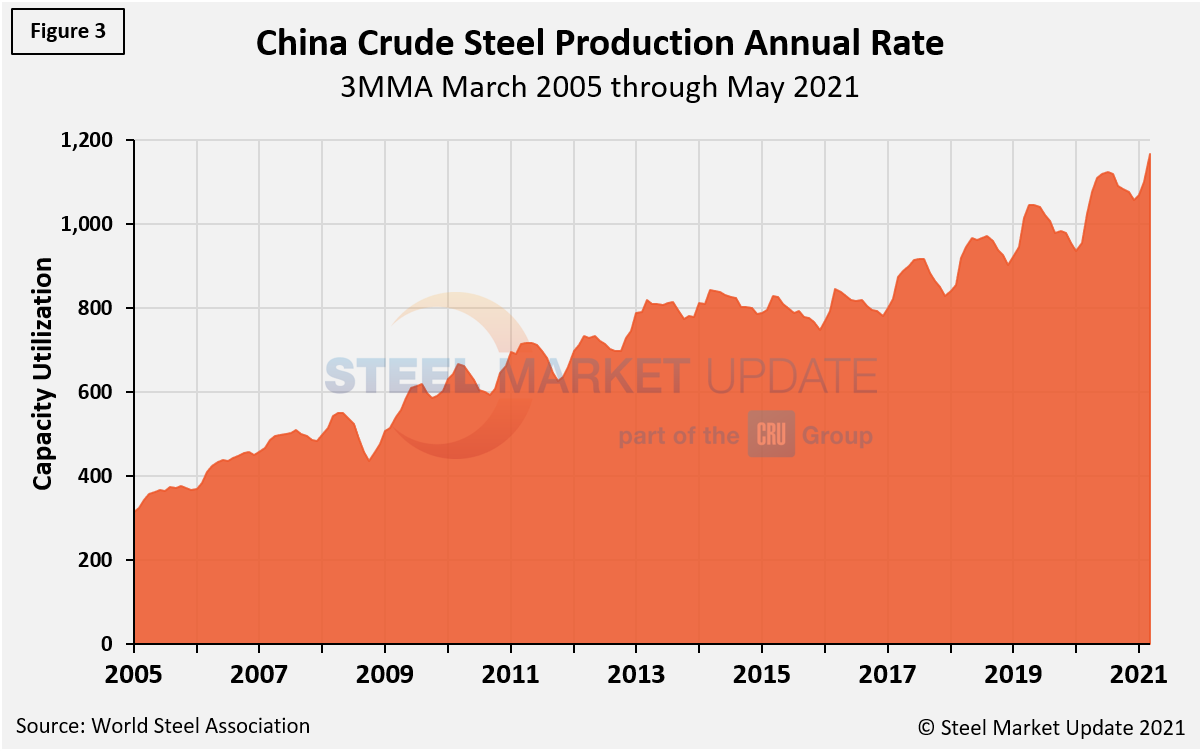

China’s monthly steel production was estimated at 99.5 million metric tons in May, up from 97.9 million metric tons the month prior and continuing to obliterate its previous all-time high of 94.8 million tons set in August 2020. Total output in China has generally declined since that record number, but March through May’s repeated rise confirms the Chinese economy is recovering from the coronavirus pandemic at an accelerated rate. On a 3MMA basis (Figure 3), the annual rate of China’s crude steel production had maxed out at 1.123 billion metric tons in September 2020, then dipped month on month through February to 1.057 billion metric tons. March through May were the first increases since last September. May’s total of 1.166 billion metric tons has surpassed the previous 3MMA high. China’s annual capacity is now 1.128 billion metric tons, a reduction from 1.164 billion tons in December 2017. China’s capacity utilization in May was 98.2%, up from 97.6% the month prior.

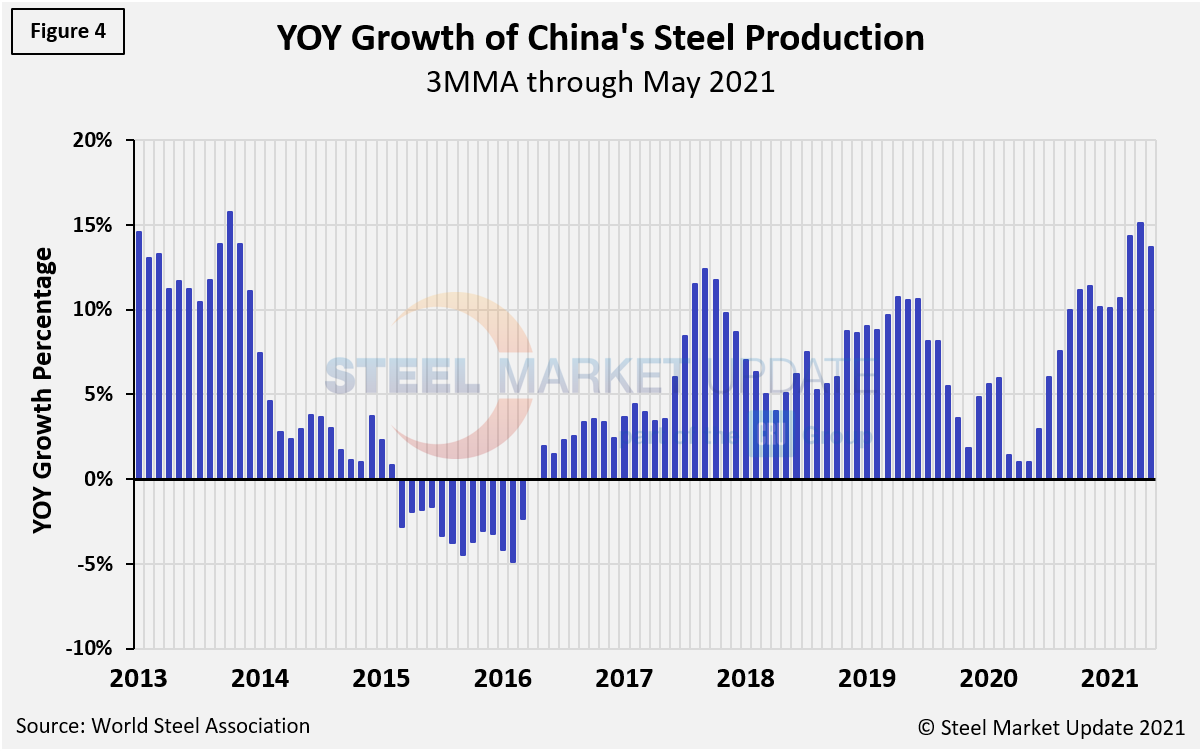

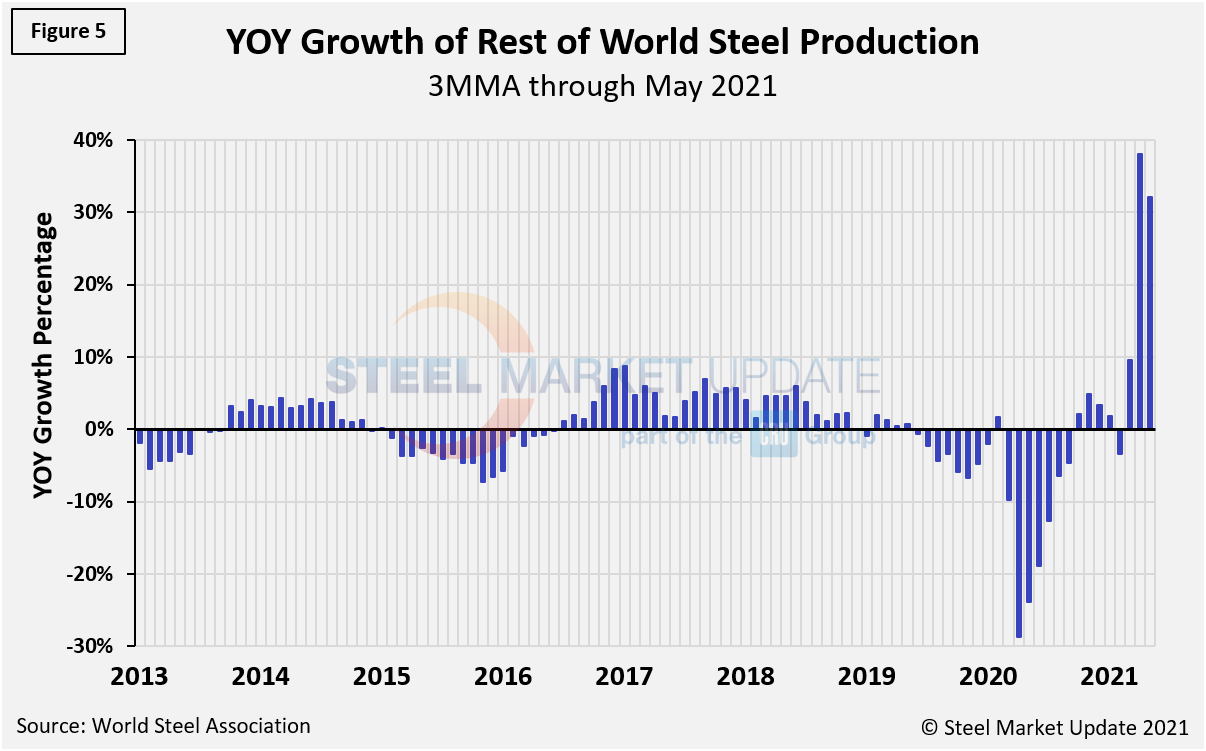

The fluctuations in China’s steel production since April 2013 are shown in Figure 4, while Figure 5 shows the growth of global steel excluding China, both on a 3MMA basis. From November 2020 through May 2021, the rest of the world’s production rose sharply by 32.2%, while China grew by 13.7%, both year over year. The growth for the rest of the world’s crude steel production in May is promising, as the globe continues to recover from the COVID-19-driven doldrums.

By David Schollaert, David@SteelMarketUpdate.com