Prices

June 29, 2021

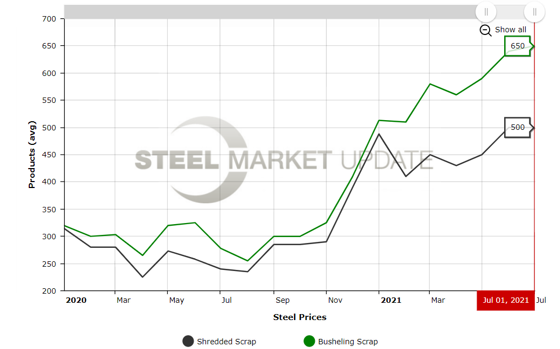

Scrap Price Increases Likely to Pause in August

Written by Tim Triplett

Ferrous scrap prices, like finished steel prices, have been on the rise for most of the year (see chart), but could see a pause in August. Sources tell Steel Market Update they expect obsolete grades to trade $20/GT lower next month, while prime prices will most likely remain unchanged.

![]()

“Obsolete grades should trade in the direction of the export market (down $20) and primes will hold steady because steel mills do not want their customers to see prices drop for busheling, potentially tipping their hand to weaker steel prices ahead,” said a dealer in the Northeast. “Most market participants believe lower scrap prices will be short-lived as inbound flows will decrease and dealers will begin eyeing stronger autumn prices.” Prime scrap supplies are still being affected by the microchip shortage that is hobbling automotive production.

Weakness in export demand over the past month is the main reason for the decline in shred prices, but the export market most likely has found a bottom. Turkish mills should be back in the market this week and next needing to purchase cargoes for August and September shipment, said another scrap executive.

Also affecting foreign scrap demand are economic factors in China and India. Chinese steel exports have ground to a halt due to government restrictions. Indian exports are still being offered, at cheaper prices, because of a COVID-induced lack of demand in that country. “So, we expect export pricing to stabilize and rise slightly over the next few weeks,” said the scrap exec. “And if U.S. domestic prices follow the same trend since late last year, then any decline in August will either be a bottom or a launching pad to higher prices sooner than later.”

Domestic demand for scrap remains very strong, especially in the U.S. Midwest, though transportation issues making it difficult to secure trucks and railcars are really hurting scrap dealers who still have to deliver many of their July orders. “It does not look like those bottlenecks are going to get better any time soon [limiting supplies], and that is another stabilizing force for U.S. scrap prices as we get further into August,” he added.

Another SMU source believes the U.S. scrap market has peaked for the time being. “The efficiency of the U.S. scrap industry and persistently high prices over the last several months have produced a bumper crop of obsolescent scrap. Despite record demand for ferrous scrap in both the domestic and export markets, our scrap industry has tapped the U.S. reservoir and processed enough scrap to sate this demand. This has sent the signal to U.S.-based scrap buyers that there is finally no reason to raise prices, and they can start to drop them somewhat. The prospect of a $20/GT drop in August will incite more selling as dealers look to avoid larger declines in the months ahead. The mills, after next month’s decrease in prices, will have a hard time dropping much further given the demand for steel worldwide, much less in the U.S. So, it’s safe to say, the market will have resurgence between September and December.”

Pig Iron Prices

Regarding prompt industrial scrap, which is in ever-short supply, prices for these grades cannot fall, at least not much, said one respondent to SMU’s query. The decline in pig iron prices, which are still at 10-year highs, may offer some respite to the high busheling prices.

In order to take advantage of the obsolescent overhang, domestic EAF producers will have to use more pig iron and HBI (if they can find it) in lieu of scarce prime grades, he explained. Prices for pig iron have fallen from $665/MT to $620/MT delivered to U.S. ports. This is mainly due to Russia’s implementation of duties of $115/MT for exports of pig iron from that country. This has been reduced to $54/MT, but it will render exports of pig iron from Russia untenable going forward. As a result, Russian producers have offered lower prices to U.S. buyers if they agree to prompt shipment to avoid the Russian duties. It’s unclear after these shipments are completed how pig iron pricing and sourcing will be affected, he said.

“There’s a fire sale happening ahead of the Russian export tax that takes effect Aug. 1. If that restricts Russian pig iron exports, we could see upward price pressure again, especially since prime scrap grades are so hard to get right now,” said another expert.

By Tim Triplett, Tim@SteelMarketUpdate.com