Market Data

June 24, 2021

Mill Lead Times/Negotiations: Flat Rolled Sees Small Dip

Written by Tim Triplett

The market is watching anxiously for a sign that rising lead times have finally turned and will begin to shorten as mill production catches up with demand. Indeed, Steel Market Update data shows a slight dip in the average lead times for spot orders of flat rolled steel products this week. But the same has happened three other times since the beginning of the year only to see delivery times extend further once again. So the latest data may or may not prove to be the beginning of a change in the trend.

![]()

According to SMU’s check of the market this week, lead times for spot orders of Galvalume have shortened up the most at 13.45 weeks, down from 15.00 two weeks ago. Lead times for hot rolled now average 10.50 weeks, down slightly from 10.63 weeks in the last survey. Cold rolled lead times dipped to 12.18 weeks from 12.65. At 12.92 weeks, lead times for galvanized products declined slightly from 13.02 weeks earlier in June.

Plate lead times continued to extend, averaging 10.67 weeks, up from 9.70 weeks in SMU’s last check of the market.

Lead times have been extending since last June, based on three-month moving averages, which smooth out the weekly volatility. The 3MMA for hot rolled lead times now averages 10.16 weeks, cold rolled 12.00 weeks, galvanized 12.42 weeks, and Galvalume 13.81 weeks. Plate’s 3MMA has risen to 9.27 weeks.

For comparison, the 3MMA for hot rolled was 3.56 weeks, cold rolled 5.44 weeks, galvanized 5.69 weeks and Galvalume 5.89 weeks at this time last year, while plate was at 3.87 weeks. In other words, lead times remain more than twice as long as they were in June 2020 when the economy was just beginning to move past the COVID disruptions.

SMU is hearing a few comments from some buyers who see a subtle change in the market. Said one service center executive: “Lead times are extended but shrinking, and mills are getting closer to being on time.” But such views are still in the minority.

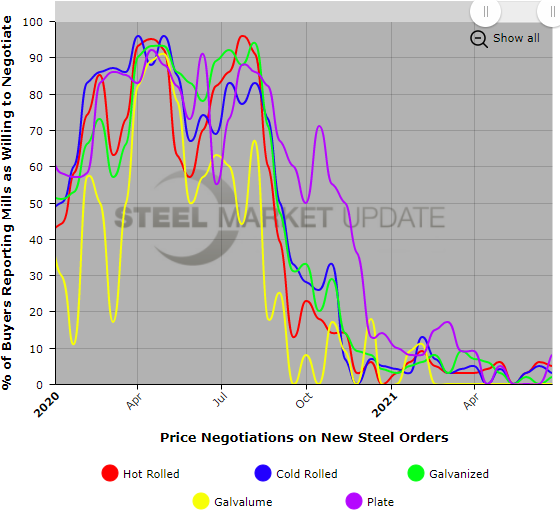

Negotiations

Lead times are an indicator of steel demand—the longer the average lead time, the busier the mills. As the lead times above indicate, the mills are extremely busy and have no need to discount prices to sell all the material they can make. Almost none of the respondents to this week’s survey reported any mills willing to talk price. “Absolutely not. There are zero negotiations going on, and I don’t blame the mills at all,” said one buyer. “Just be happy if you get a quote back,” said another. “We’re mainly looking offshore, but they aren’t negotiating either,” added a third.

By Tim Triplett, Tim@SteelMarketUpdate.com