Product

June 11, 2021

SMU CEO Talks About Steel Prices Over the Past Year

Written by John Packard

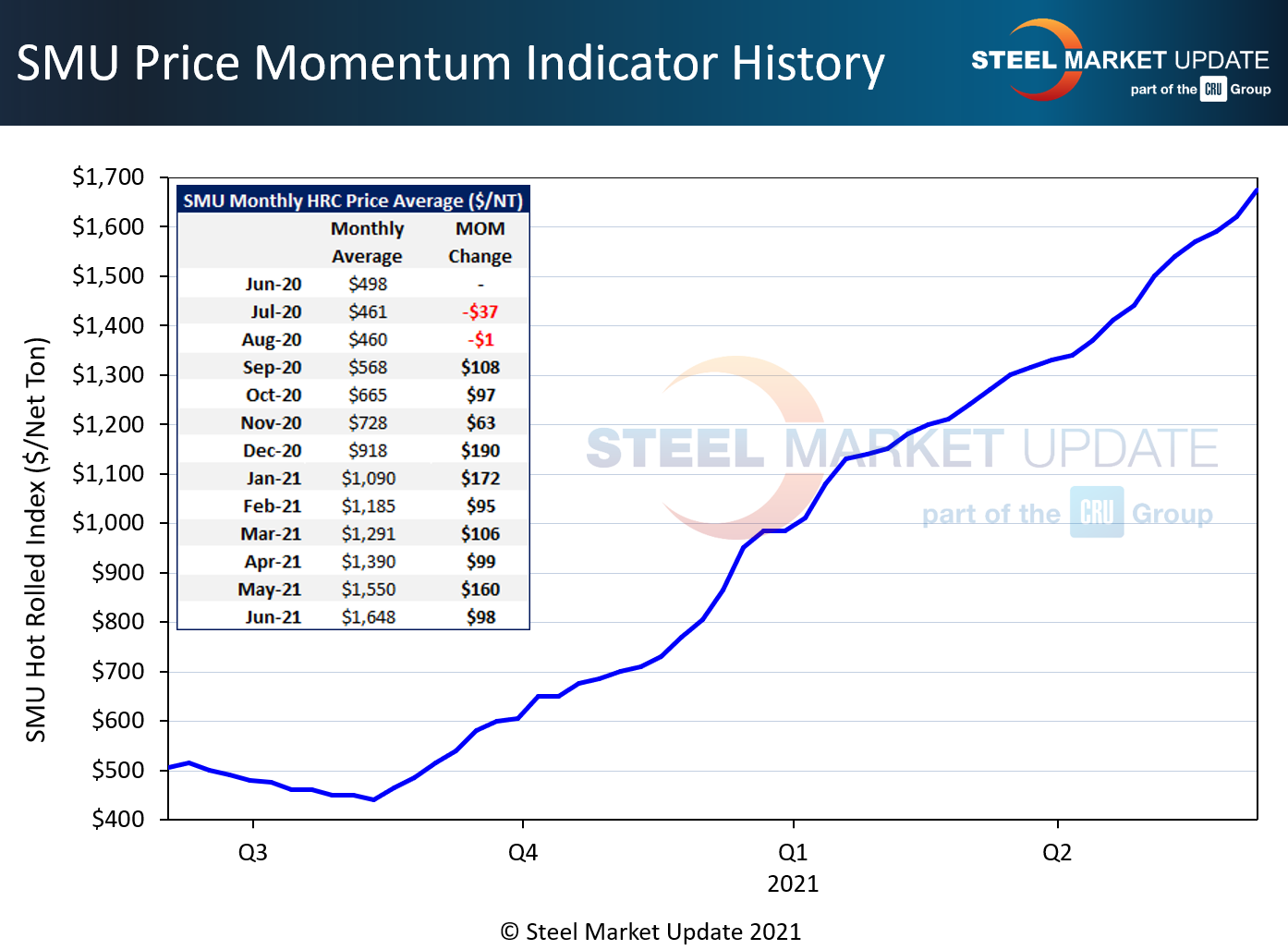

I thought it would be an interesting exercise to take a look at benchmark hot rolled pricing over the past 12 months. I thought I would compare the numbers on a month-over-month basis to give everyone an idea of how steep the price increases have been. At the same time, we can think about the road back from whence they came and how quickly prices could collapse should that be the case.

HRC prices bottomed during August 2020 as the economy quickly bounced back after the initial shock of the Covid-19 pandemic. SMU’s HRC price not stands at $1,675 per ton ($83.75 per cwt), which is up $135 per ton from $1,540 per ton a month ago. All told, we have had 10 straight months of higher prices. The average increase over those ten months is $121.50 per ton ($6.075/cwt each month).

I do not recall any time during my 44-year career in steel when flat rolled prices continued to move higher for 10 straight months. SMU began collecting pricing data just prior to 2008 (see below), and the last market approaching the bullishness of this one was in 2007-2008. As you can see, that one was short-lived compared to what we are living through now.

A second trend to note is this: Every time there has been a big move up in steel prices, there has been a drop of roughly equal magnitude. In other words, prices either fall back to where they were when the rally started – or they fall even lower than that prior bottom.

The question we have ask ourselves now is this: Do domestic steel mills have enough control over their organizations to keep prices from eroding too far, too fast?

If you want to know the answer to that question, I suggest you register for the 2021 SMU Steel Summit Conference because we will have many of the key players speaking: Lourenco Goncalves from Cleveland-Cliffs, Mark Millett from Steel Dynamics, Leon Topalian from Nucor, Timna Tanners from Bank of America, and Josh Spoores from CRU. Plus, we will get the big picture from Dr. Alan Beaulieu of ITR Economics.

You can learn more about our conference program, speakers, NexGen Leadership Award (please take some time to nominate a quality individual from your company), costs to attend (live and virtual), and how to register by clicking here.

I am looking for suggestions… Every year we have a theme to the SMU Steel Summit Conference. I have not yet selected one for this year and I would like our readers to throw me their suggestions. So, what shall it be? You can send you suggestions directly to me at John@SteelMarketUpdate.com

This will be another interesting week for the steel industry. We will publish our Service Center Shipments and Inventories data (final report) to data providers tomorrow and to Premium customers on Tuesday. I can leak a head’s up. After getting all data providers in we saw inventories of flat rolled increase for the month of May. If you would like to learn more, you can do so by becoming a Premium member. Or, if you are a service center, you can be added as a confidential data provider by sending an email to Estelle.Tran@crugroup.com.

If you would like to become a Premium subscriber, you can do so by contacting Paige Mayhair at Paige@SteelMarketUpdate.com.

As always, your business is truly appreciated by all of us here at Steel Market Update.

John Packard, President & CEO, John@SteelMarketUpdate.com