Market Data

June 11, 2021

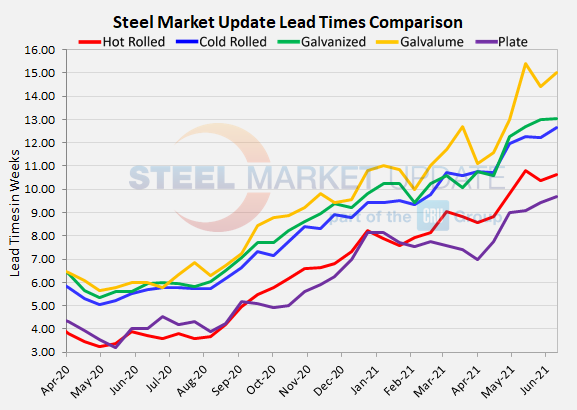

Mill Lead Times Extend to Record Lengths

Written by John Packard

Flat rolled and plate steel mill lead times continue to extend, according to the results of this week’s flat rolled and plate steel analysis conducted by Steel Market Update. Hot rolled lead times have sustained 10 weeks or more for a month – the first time that has happened in the history of our records, which go back to 2011. We are also seeing record extended lead times on cold rolled, galvanized, Galvalume and plate steels.

![]() Hot rolled lead times are now averaging 10.63 weeks, according to the manufacturing companies and service centers participating in this week’s survey. To put this into perspective, the 10.63 weeks is 2.76 weeks longer than what was being reported to SMU at the beginning of January 2021. One year ago, HRC lead times were 7 weeks shorter than what we are reporting today. The historical average HRC lead time (measured prior to the beginning of the current cycle, which began in August 2020) has been 4 weeks (3.98 weeks) based on our past survey data.

Hot rolled lead times are now averaging 10.63 weeks, according to the manufacturing companies and service centers participating in this week’s survey. To put this into perspective, the 10.63 weeks is 2.76 weeks longer than what was being reported to SMU at the beginning of January 2021. One year ago, HRC lead times were 7 weeks shorter than what we are reporting today. The historical average HRC lead time (measured prior to the beginning of the current cycle, which began in August 2020) has been 4 weeks (3.98 weeks) based on our past survey data.

Cold rolled lead times exceeded 12.5 weeks for the first time in the history of our records. This week lead times on cold rolled coil reached 12.65 weeks. At the beginning of 2021 CRC lead times were more than 3 weeks shorter (3.22 weeks) than what we are reporting today. One year ago, CRC lead times were 5.71 weeks, or about 7 weeks shorter than today. The historical average prior to the current up cycle is 6 weeks (5.98 weeks), or half what they are today.

Galvanized lead times are being reported today as being 13.02 weeks (essentially unchanged from two weeks ago) and almost 3 weeks longer than the 10.25 weeks we reported at the beginning of 2021. Last year GI lead times were at 6 weeks (5.95 weeks). The historical average prior to the current up cycle, which began in August 2020, is 6.30 weeks, or about half what they are today.

Galvalume lead times are being reported to be at 15.00 weeks this week. This is slightly less than the record 15.40 weeks reported on May 13, but well above the 11 weeks we reported at the beginning 2021. One year ago, AZ lead times were 6.00 weeks, or 9 weeks shorter than today. The historical average prior to the current up cycle, which began in August 2020, is 6.58 weeks, more than half of what they are today.

Plate steel lead times are also at record extended levels at 9.70 weeks. At the beginning 2021 we reported plate lead times as being 8 weeks (8.13 weeks), which is about two weeks shorter than today’s levels. One year ago, plate lead times averaged 4 weeks, less than half what we are reporting them to be today.

The SMU Mill Lead Times are based on the average of responses received from manufacturing companies and service centers in this week’s survey. Actual mill lead times will vary by producer and individual rolling mills. To get the exact lead time being quoted by an individual steel mill, please contact your mill representative. To see an interactive history of our Steel Mill Lead Times data, visit our website here.

By John Packard, John@SteelMarketUpdate.com