Market Data

June 10, 2021

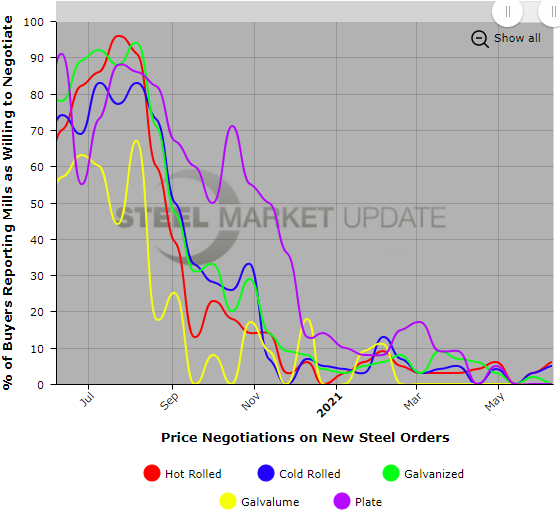

Steel Mill Negotiations Essentially Non-Existent

Written by John Packard

Steel buyers reported to Steel Market Update this week that the trend for steel mills to limit or totally remove any negotiations on spot steel prices continues.

![]() Steel pricing power is totally in the hands of the steel mills as supply continues to be less than the demand for mill products.

Steel pricing power is totally in the hands of the steel mills as supply continues to be less than the demand for mill products.

Steel Market Update went out to steel buyers representing manufacturing companies and steel service centers, and they reported (again) almost unanimously that prices were being held firm with no wiggle room.

When we look at negotiations by product, we found 94 percent of our hot rolled respondents reporting no ability to negotiate with their steel mill suppliers. Cold rolled was 95 percent reporting no ability to negotiate. Galvanized, Galvalume and plate steel buyers were unanimous (100 percent) that there was no ability to negotiate spot pricing with their steel mill suppliers.

One major reason for the hard line taken by steel mills: extended lead times. In other words, mills have strong order books and do not need to entice spot buyers with lower prices to place new orders.

The SMU Steel Mill Negotiation data is derived from our flat rolled and plate steel market trends analysis survey which we conduct every other week. If you would like to become a confidential data provider please contact us at info@SteelMarketUpate.com. To see an interactive history of our spot price negotiations data, visit our website here.

By John Packard, John@SteelMarketUpdate.com