Prices

June 10, 2021

Hot Rolled Futures: Are We There Yet?

Editor’s note: SMU contributor Bryan Tice is a partner at Metal Edge Partners, a firm engaged in Risk Management and Strategic Advisory. In this role, he and the firm design and execute risk management strategies for clients along with providing process and analytical support. Before joining Metal Edge Partners, Bryan held a variety of commercial leadership roles involving purchasing, sales, and risk management for Feralloy Corporation, Cargill Steel Service Centers and Plateplus Inc. You can learn more about Metal Edge at www.metaledgepartners.com. Bryan can be reached at Bryan@metaledgepartners.com.

It has been over 90 degrees this last week here in Minneapolis. Hot rolled coil is firmly above $1600 per ton. Boy, is it is getting hot up here! With most schools out on summer break, it seems as good a time as any to take a vacation. Like many of you, I will travel this summer. Having lived far away from my childhood hometown for the last 15 years, my family is accustomed to long car rides. We hit the highway and spend 10+ hours in the car in pursuit of a week of quality time with parents, siblings and extended family. During those road trips when my kids were young, I was guaranteed to get at least four or five “are we there yet” questions from the back seat.

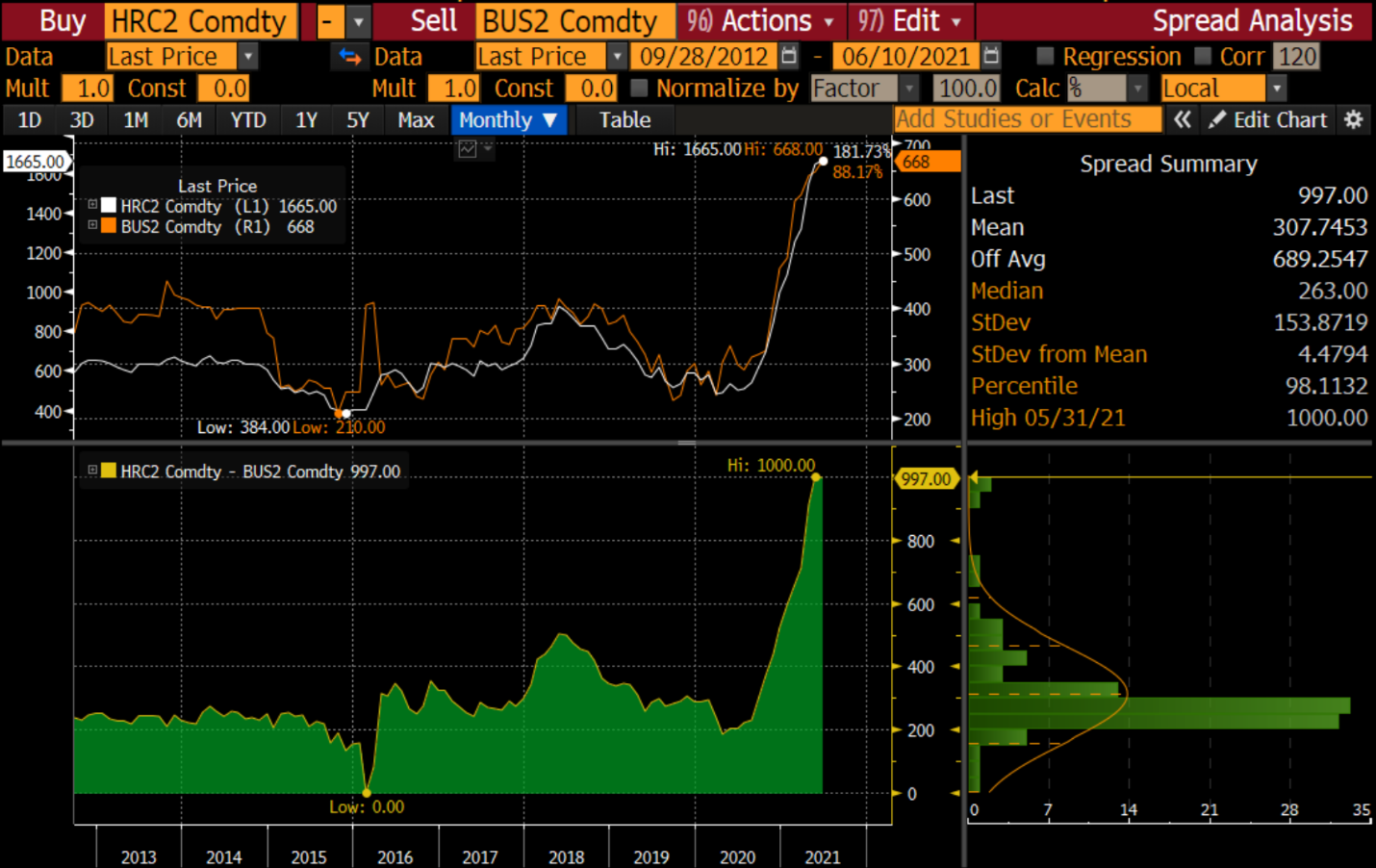

Conversations with steel market participants these days feel much the same. Nearly every conversation includes some inquiry as to when the market will peak. How much higher can this market go? Are we there yet? On road trips, there was always a definitive answer because we had a destination. If we had not arrived, I could reply “not yet” and buy an hour or so before the next query. It is unclear to me where we are on our journey in this meteoric price rally. Fundamentals have become folly. The following chart (Figure 1) shows the historical scrap price/HRC spread.

(Figure 1)

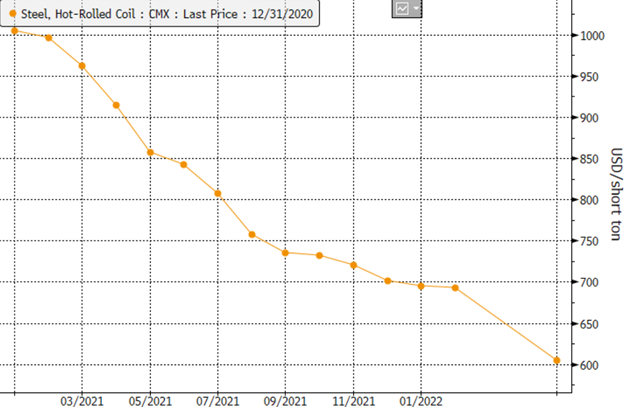

If you were in the camp of a $1,000-per-ton peak in HRC, as was the futures market was suggesting on Dec. 31, 2020 (Figure 2), then the answer is, “yes, we’re here”. And yet we are still driving.

(Figure 2)

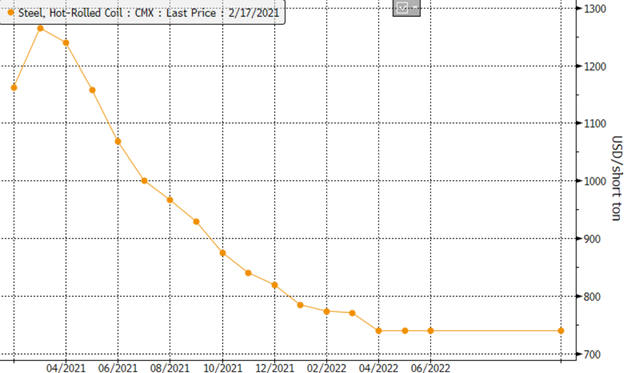

If you were bold enough to call for a $1,250-per-ton peak in HRC, as was the futures market on Feb. 17, 2021 (Figure 3), then the answer is also “yes, we’re here”. And the calls for a bathroom break are growing louder as we blow past yet another rest area.

(Figure 3)

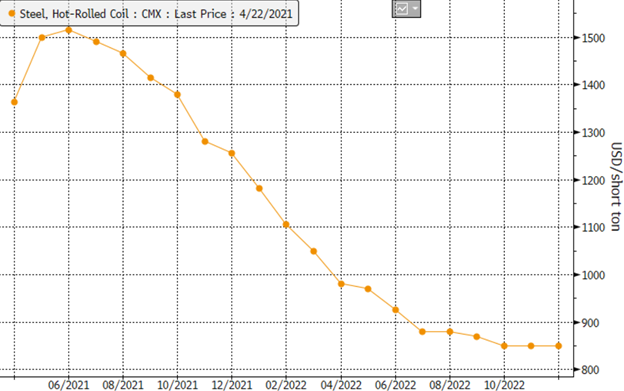

If you were willing to suggest a historic $1,500-per-ton peak price for HRC, as was the futures market on April 22, 2021 (Figure 4), then the answer is “yes, we’re here.” But the miles to empty gauge has read zero for the last 15 miles, and the check engine light has been on since we crossed the Indiana/Michigan border an hour and a half ago.

(Figure 4)

When I talk with market participants these days, it is not uncommon to hear $2,000-per-ton HRC being referenced as a possible peak. Now I can sit back and confidently reply “not yet,” at least not in the futures market. Given the tightness that exists in the physical market, I cannot rule out the possibility. But sellers in the futures market do not yet possess the conviction to pass up near-term profitable liquidity and miss an opportunity to hedge against downside price risk should the market be near an inflection point. Buyers of futures, meanwhile, may be unwilling to stick their necks out to lock up prices when spot prices are 5.15 standard deviations above the 10-year historical mean. So bid/offer levels remain wide. The shape of the curve can almost be interpreted as a gauge of fear implying that market participants see minimal upside and plenty of downside. The problem is, the forward futures curve has maintained a similar downward sloping shape “backwardation” during all the timeframes referenced in figures 2-4, only to be proven that it underestimated the strength and resilience of this current price rally. If you are a buyer and believe the market has potential to reach $2000 per ton and your business is exposed to this price risk, then the curve is offering a unique opportunity to take the guesswork out of what your steel costs will be in the 2nd half of 2021 or into 2022 – and at a decent discount to the current spot market, all while being well below $2,000 per ton.

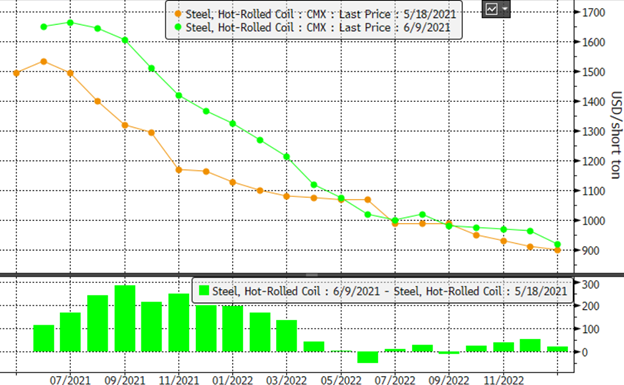

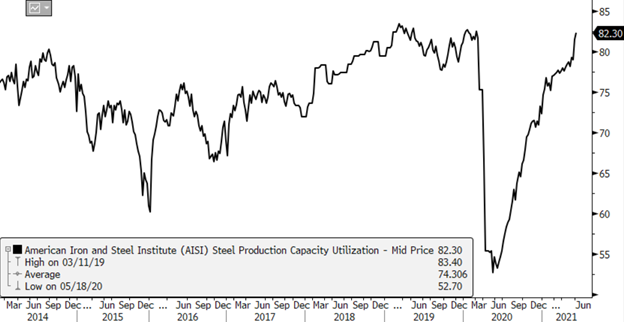

Futures have gapped higher since the three-day rout, following initial chatter of a U.S./EU tariff resolution, sent the futures market into freefall in mid-May (Figure 5). Recent press reports suggest that progress is being made ahead of the G7 meeting next week between the U.S. and EU and that the retaliatory tariffs will be removed between the allies by the end of the year. Even though this recent announcement seems much more credible than the speculation that spooked the market weeks ago, the news did not illicit the same sort of response in the futures market on Wednesday. Most of the selling pressure pushed down the nearby months while the q1/q2 2022 periods posted double-digit gains. Perhaps, based on increasing mill capacity utilization figures (Figure 6), increasing levels of import arrivals, and reports of inventory builds in the automotive segment at mills/service centers, conviction is growing that may lead to increasing spot availability and prices moderating. With many steel mill maintenance outages delayed until the 2nd half of 2021, coupled with the likelihood of a surge in automotive demand once the semi-conductor shortages abate, it is possible we could quickly see a reversal of the slightly improving availability trend seen recently.

(Figure 5)

(Figure 6)

The market still has lots of information to digest (new capacity, inflation fears, widespread shortages, and the Covid Delta variant to worry about) before a clearer trend develops. But most business leaders do not have the luxury of waiting around to make important business decisions. Trading HRC futures might be a solution for those looking to remove some of this unnerving uncertainty.

Are we there yet? Well… we will get there when we get there!

Disclaimer: The information in this write-up does not constitute “investment service”, “investment advice”, or “financial product advice” as defined by laws and/or regulations in any jurisdiction. Neither does it constitute nor should be considered as any form of financial opinion or recommendation. The views expressed in the above article by Metal Edge Partners are subject to change based on market and other conditions. The information given above must be independently verified and Metal Edge Partners does not assume responsibility for the accuracy of the information.