Analysis

June 4, 2021

April CPIP Data: Residential Construction Keeps Leading the Way

Written by David Schollaert

The construction sector continues to gain momentum, but the effects of the COVID pandemic linger. Growth remains uneven as most sectors are still struggling to rebound from the doldrums seen last year.

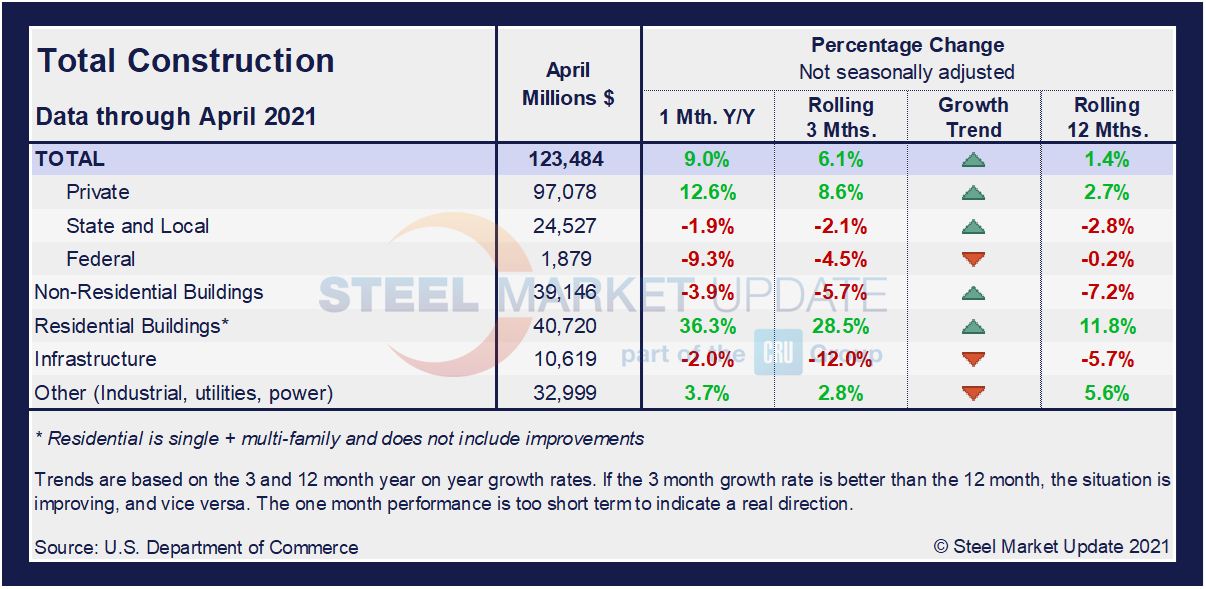

Total construction spending during April 2021, at a seasonally adjusted annual rate, was $1.524 trillion, up 0.2% from March’s revised estimate of $1.521 trillion, reported the U.S. Census Bureau. Total construction was also up 9.8% compared to a year ago when spending was $1.388 trillion. Year-to-date construction spending amounted to $452.3 billion, 5.8% above the $427.3 billion for the same period in 2020.

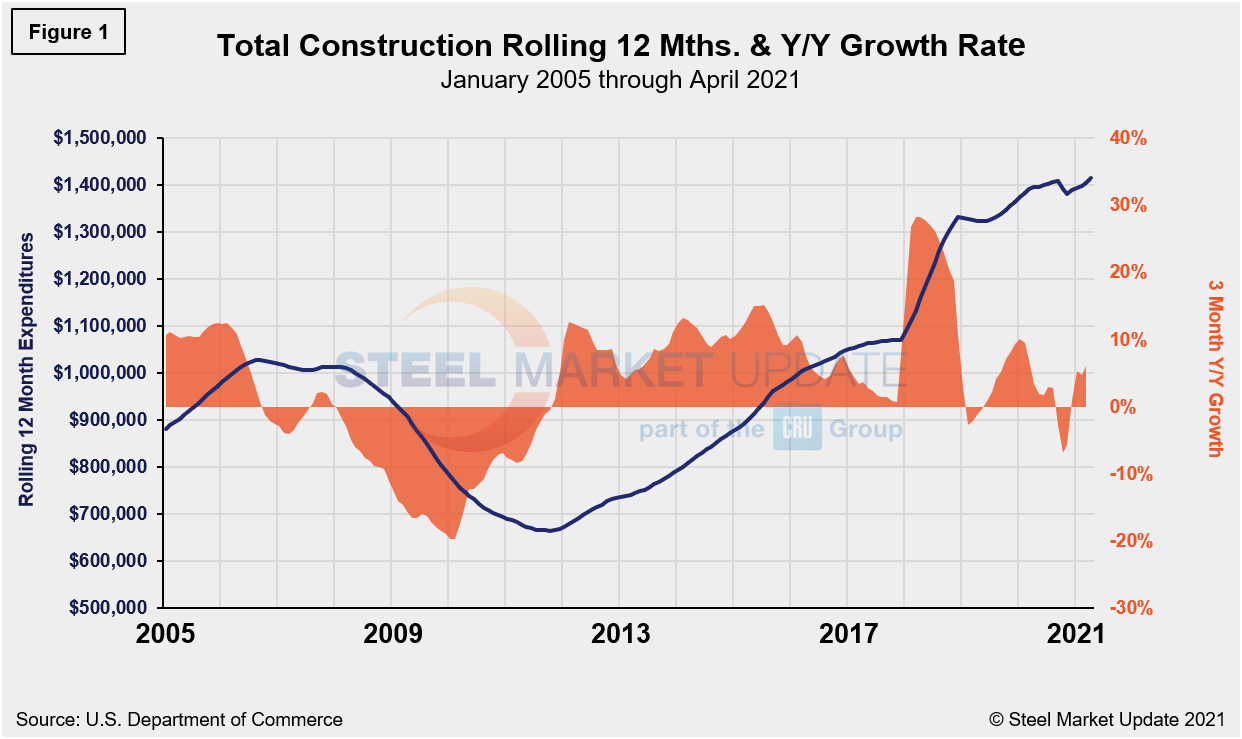

The private sector continues to be the primary driver of growth. Total construction spending is up year on year, driven almost singlehandedly by residential building, which grew by nearly 12.0% over the past 12 months, and is up 28.5% on a rolling three-months basis. Nonresidential spending is down more than 7% over the same period. Total construction expenditures are also shown in Figure 1.

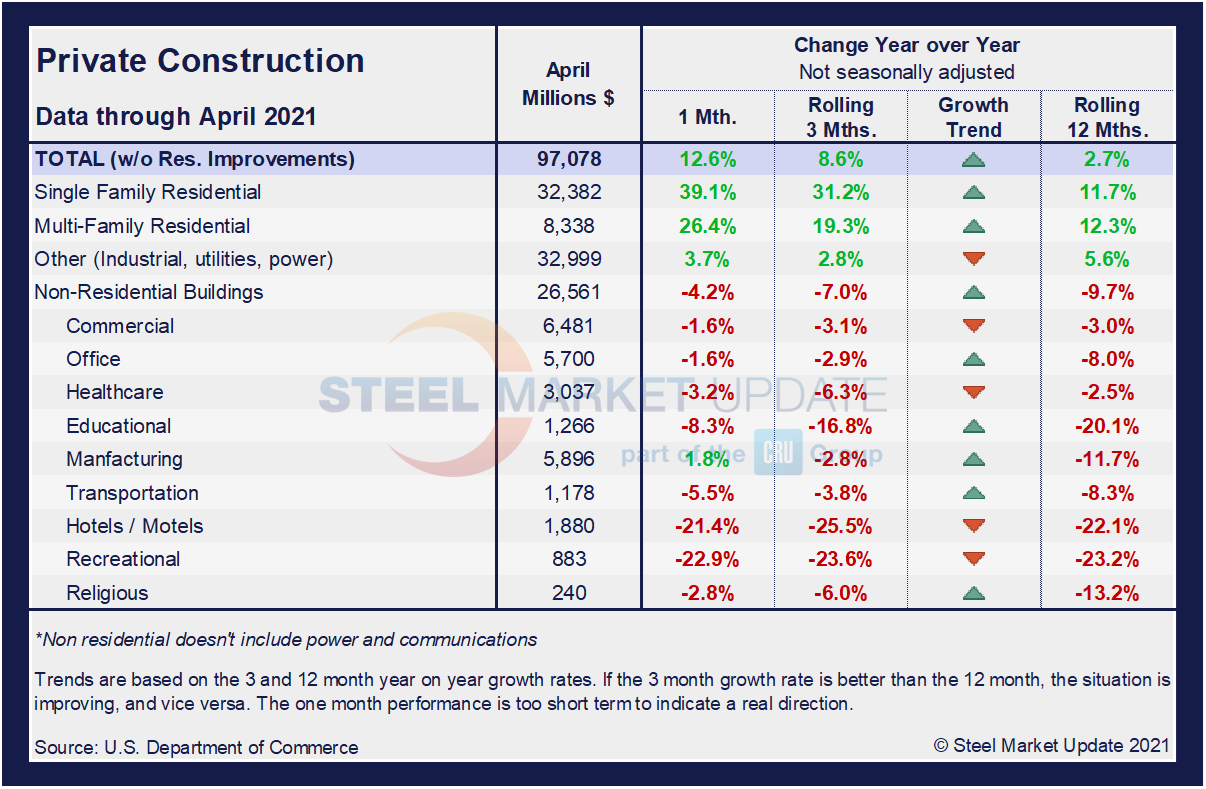

Private Construction

The breakdown of private expenditures into residential and nonresidential and their subsectors are highlighted in the table below. Residential construction has been the driving force in the private construction sector, as only two nonresidential subcategories are reporting any near- or long-term growth. Not surprising are the nonresidential subcategories hit hardest by the pandemic shutdowns, such as recreational, hotels and educational construction, all down by more than 20% on a rolling 12-month basis. Single-family and multi-family residential construction are up 11.7% and 12.3%, respectively, on a rolling 12-month basis. Single-family residential construction posted an astonishing 39.1% growth rate in April.

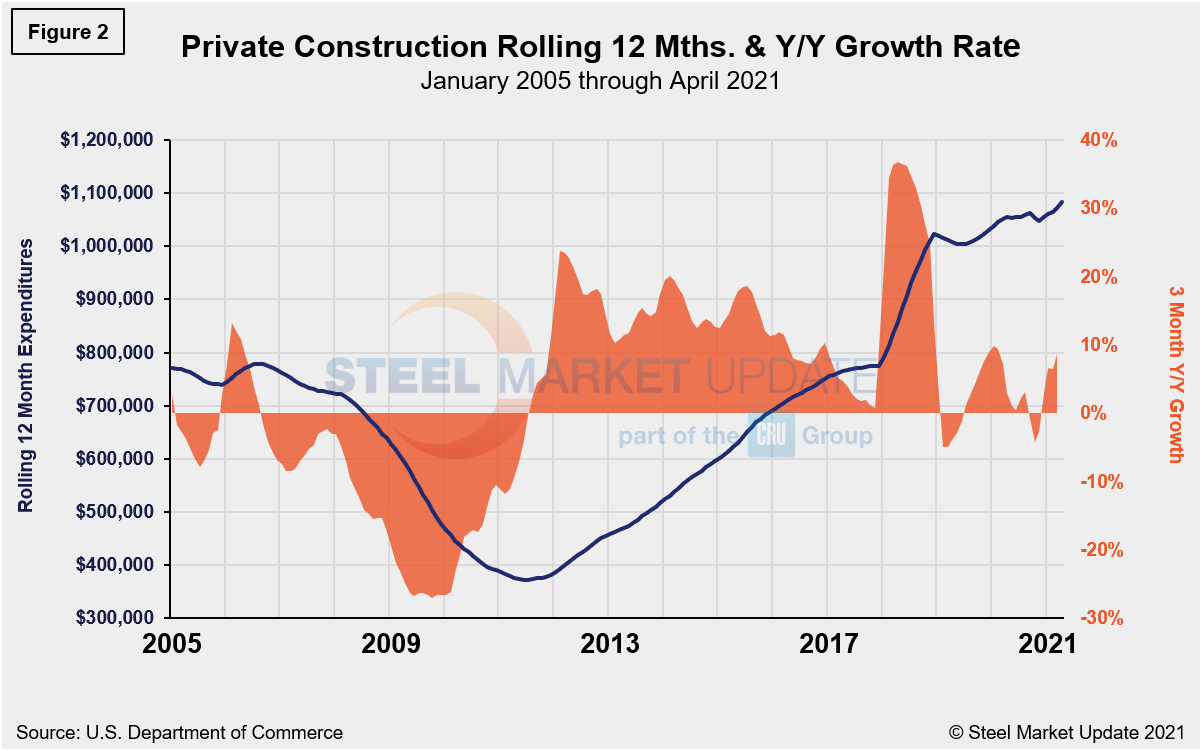

Spending on private construction in April hit a seasonally adjusted annual rate of $1.181 trillion, 0.4% above the revised March estimate of $1.175 trillion, Census reported (Figure 2). Residential construction was at a seasonally adjusted annual rate of $729.2 billion in April or 1.0% above the revised March estimate of $721.8 billion. Nonresidential construction was at a seasonally adjusted annual rate of $451.4 billion in April, 0.5% below the revised March estimate of $453.7 billion.

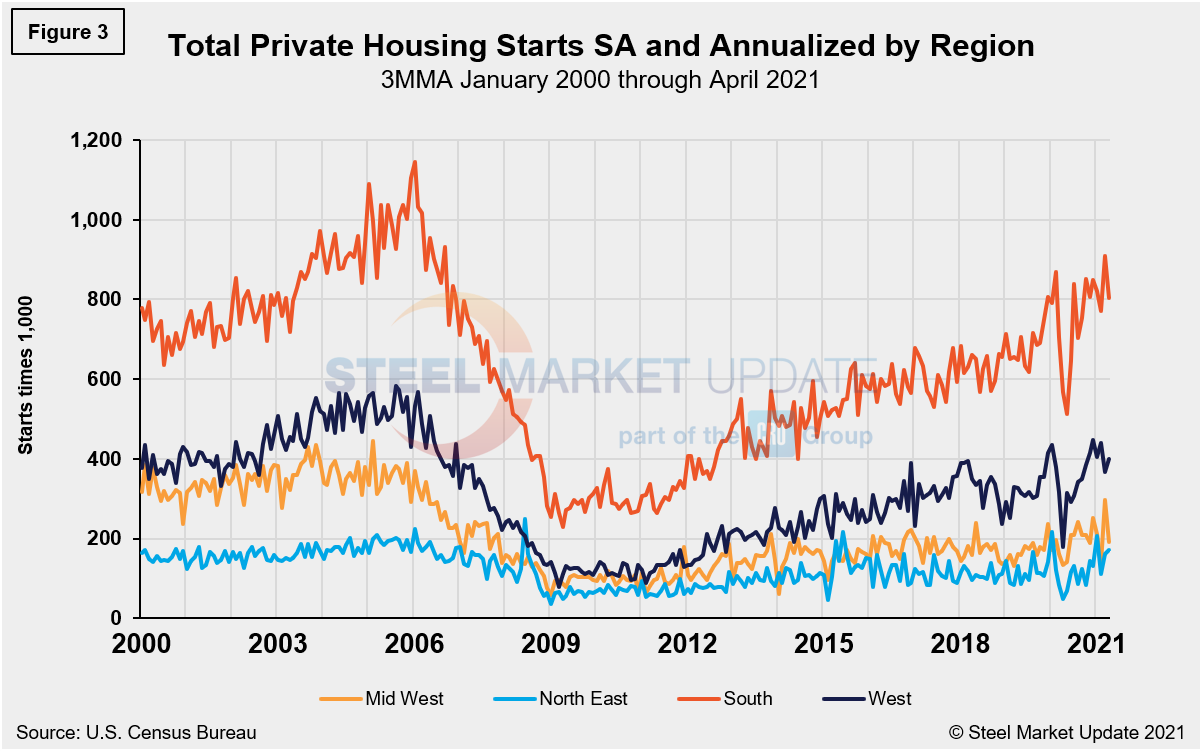

Total housing starts in the four regions are displayed below (Figure 3). Privately‐owned housing starts in April were at a seasonally adjusted annual rate of 1.569 million, down 9.5% from the revised March estimate of 1.733 million. Despite the month-on-month decrease, April’s rate is 67.3% above the year-ago rate of 938,000. Single‐family housing starts in April were at a rate of 1.087 million, down 13.4% from the revised March figure of 1.255 million. The April rate for units in buildings with five units or more was 470,000.

The South region continues to be the strongest for housing starts, while the Northeast trails the other three. All four regions were directly impacted by the widespread COVID-19 shutdowns last year, causing housing starts to fall sharply. Since then, however, they have nearly recovered to pre-pandemic levels, but have been edging down compared to the month prior.

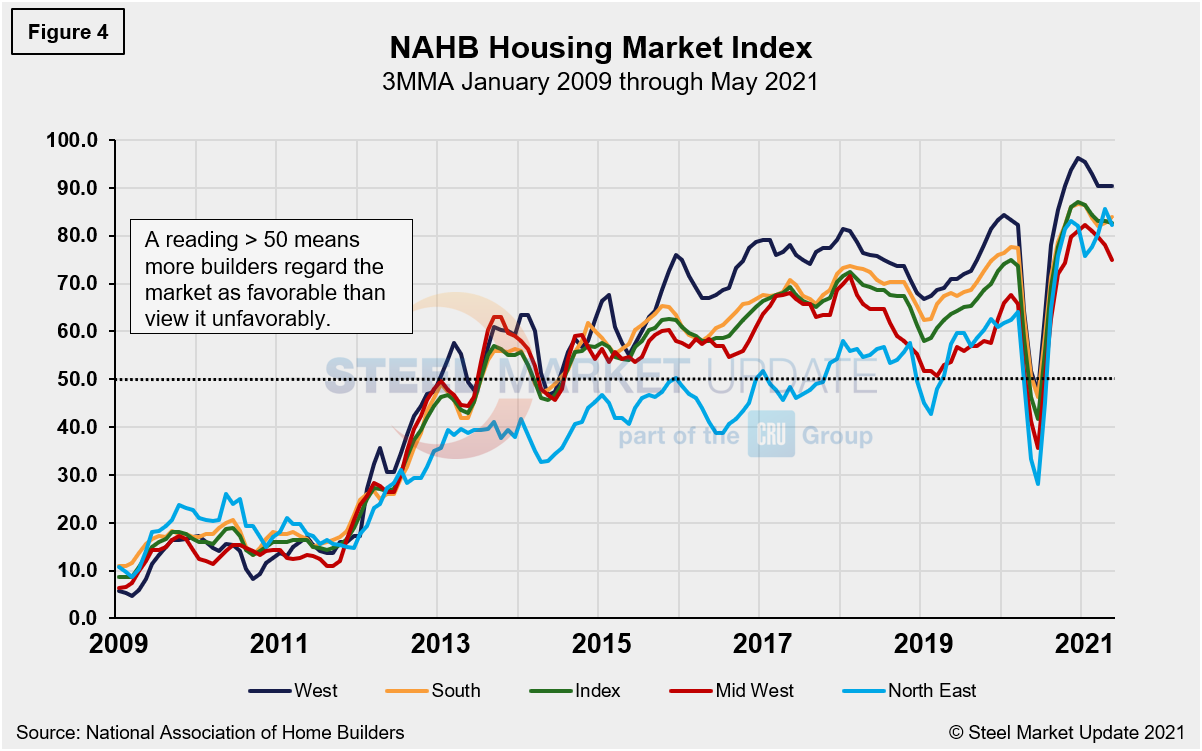

The National Association of Home Builders optimism index plummeted in April 2020 at the onset of COVID-19, but then recovered from May through December last year. Since the beginning of 2021, optimism among home builders has fluctuated up and down within a small range—possibly due to the short supplies and high costs of lumber and other building materials—but remains in very positive territory (Figure 4).

State and Local Construction

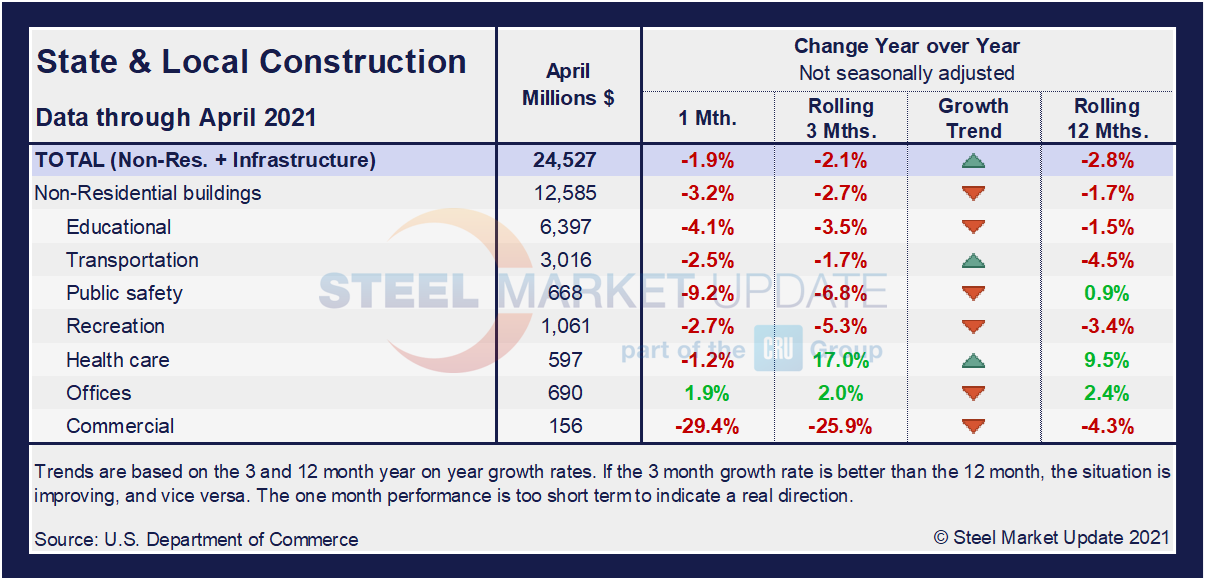

Construction expenditures on a state and local level remain the most impacted by the year-long health crisis. Notably, on a year-on-year and rolling three-month basis, these construction categories and subcategories are still behind pre-pandemic levels. The table below details what in most cases are declining growth rates, except for health care, office and public safety construction.

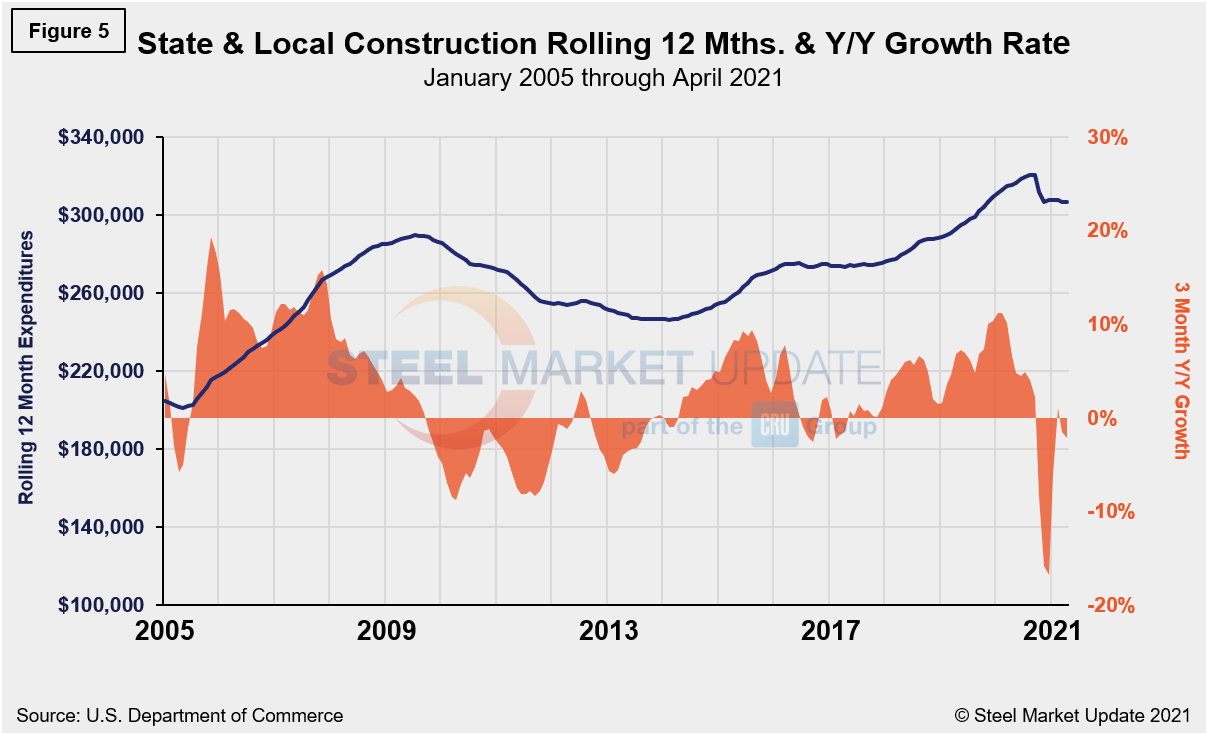

In three months through April, overall state and local construction was down 2.1%, with six of the eight subcategories still trending down. In April, the estimated seasonally adjusted annual rate of public construction spending was $343.5 billion, 0.6% below the revised March estimate of $345.6 billion. Educational construction was at a seasonally adjusted annual rate of $84.8 billion, 0.5% below the revised March estimate of $85.2 billion. Highway construction was at a seasonally adjusted annual rate of $99.8 billion, 0.6% above the revised March estimate of $99.2 billion. Figure 5 shows the history of total S&L expenditures.

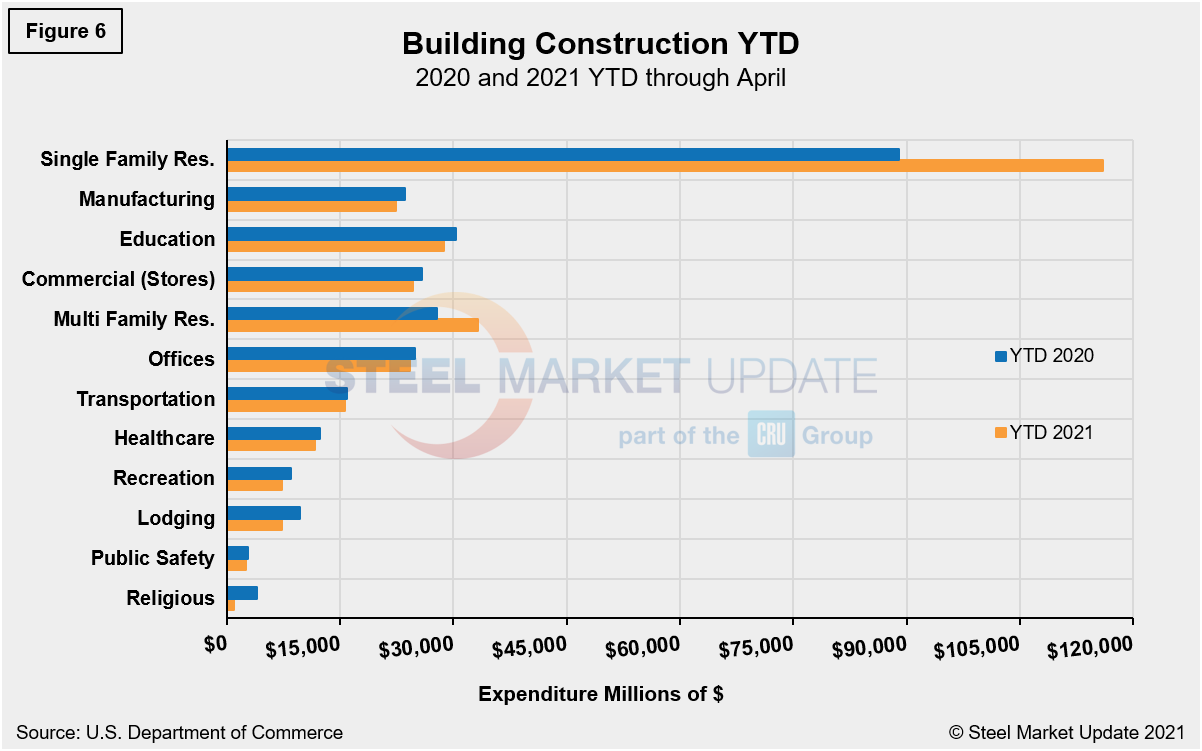

Year-to-date expenditures for construction of the various building sectors for 2020 and 2021 is compared in Figure 6. Single-family residential construction was dominant in 2020 with expenditures totalling $301.9 billion annualized, and it has not let up in 2021. Through April, expenditures for single-family construction were $116.0 billion or 30.3% above year-ago levels when expenditures were $89.1 billion. The only other sector indicating a positive delta year-on-year is multifamily residential at a positive 19.5%. All other sectors are still lagging on a year-to-date basis.

Explanation: Each month, the Commerce Department issues its Construction Put in Place (CPIP) data, usually on the first working day covering activity one month and one day earlier. There are three major categories based on funding source: private, state and local, and federal. Within these three groups are about 120 subcategories of construction projects. SMU analyzes the expenditures from the three funding categories to provide a concise summary of the steel-consuming sectors.

By David Schollaert, David@SteelMarketUpdate.com