Prices

May 25, 2021

Weekly Raw Steel Production Edges Down

Written by David Schollaert

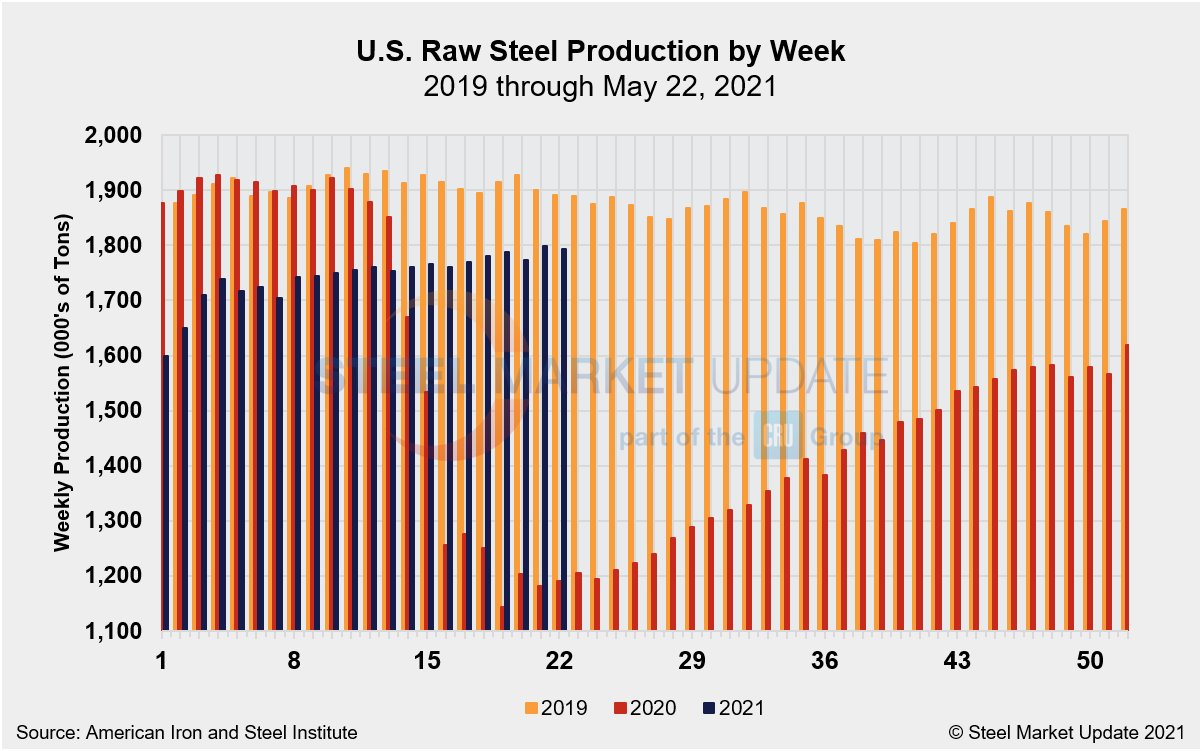

Raw steel production by U.S. mills totaled 1,793,000 net tons in the week ended May 22, down 0.3% compared to the week prior when production totaled 1,799,000 net tons, according to the American Iron and Steel Institute (AISI). The mill utilization rate last week averaged 79.0%, down from 79.2% the week before but up 46.6% from the same period last year when production was 1,223,000 net tons and mill utilization was just 54.6% due to COVID-related disruptions.

The market is still behind pre-pandemic levels, according the data compiled by AISI. When comparing the latest data to the same pre-COVID-19 period in 2019, current production is down 5.2%. Adjusted year-to-date production through May 22 was 35,681,000 net tons, at an average utilization rate of 77.6%. That’s up 8.7% from the same period last year when the utilization rate was 69.9% and production was 32,811,000 net tons, AISI said.

Following is production by district for the May 22 week: North East, 146,000 net tons; Great Lakes, 621,000 net tons; Midwest, 184,000 net tons; South, 762,000 net tons; and West, 80,000 net tons, for a total of 1,793,000. Production was down by 6,000 net tons compared to the week prior. All districts except for the West posted decreased outputs week-on-week.

Note: The Raw Steel production tonnage provided in this report is estimated. The figures are compiled from weekly production tonnage provided from 50% of the domestic producers combined with monthly production data for the remainder. Therefore, this report should be used primarily to assess production trends. The AISI production report “AIS 7”, published monthly and available by subscription, provides a more detailed summary of steel production based on data supplied by companies representing 75% of U.S. production capacity. Note: Capability for second-quarter 2021 is approximately 29.5 million tons compared to 29.1 million tons for the same period last year and 29.1 million tons for the first quarter of 2021.

By David Schollaert, David@SteelMarketUpdate.com