Market Data

May 24, 2021

Global Steel Production Unable to Maintain Pace in April

Written by David Schollaert

World crude steel production in April was unable to sustain the recent surge in output, according to World Steel Association (worldsteel) data. As the globe works to recover from the economic blows inflicted by COVID-19 in 2020, global steel production is seeing mixed results. Following March’s month-on-month 12.7% jump, April’s underwhelming increase of 0.1% further highlights that the recovery from the pandemic is not over.

April’s results were disappointing compared to March output that saw nine of the top 10 global producers post increased production, in many cases by double digits. Despite decreased output in most regions in April, increased production in Brazil and China—10.7% and 4.1%, respectively—ensured the world’s steel production exceeded the prior month’s sum.

Global crude steel production totaled 169.4 million metric tons in April, up 23.3% from the same month last year when production totaled just 137.4 million metric tons due to pandemic-related disruptions. The April total was flat, though, up a slight 0.1%, when compared to the month prior. Compared to the same month in 2019–a more typical period prior to the pandemic–April’s production was up 7.5%.

Through the first four months of 2021, world crude steel production totaled 651.9 million metric tons, up by 12.8% compared with the same period in 2020 when production was 578.0 million metric tons. Production was also up 7.7% when compared to the same pre-pandemic period in 2019. Despite the positive report when compared to the previous 12- and 24-month periods, it’s important to note that the gains have been driven primarily by growth in Chinese crude steel output, while six of the top 10 global steel producers have posted lower totals.

The U.S. remained the fourth largest crude steel producer in the world in April, accounting for 6.9 million metric tons or 4.1% of the global total. U.S. production in April was down 2.8% when compared to the prior month, but up 43.1% when compared to the prior year when mills shut down production to stem the spread of COVID-19. Comparing U.S. crude steel production against 2019, a non-pandemic year, April’s output was down 6.2%. U.S. production through the first four month of 2021 totalled 27.2 million metric tons, 2.1% higher than the same period one year ago when output was 26.6 million metric tons. Although the domestic steel market is on the right track, it remains behind pre-pandemic levels by 7.8% when compared to the same 2019 period.

China continues to produce more than half of the world’s steel at 57.8% or an estimated 97.9 million metric tons in April, up from 55.5% or 94.0 million metric tons the month prior. China’s steel production was up 4.1% from the prior month and up by 15.1% compared with April 2020. As Chinese officials take steps to reduce harmful air emissions from the steel industry, the country’s total output and its role in global steel overcapacity may change over time.

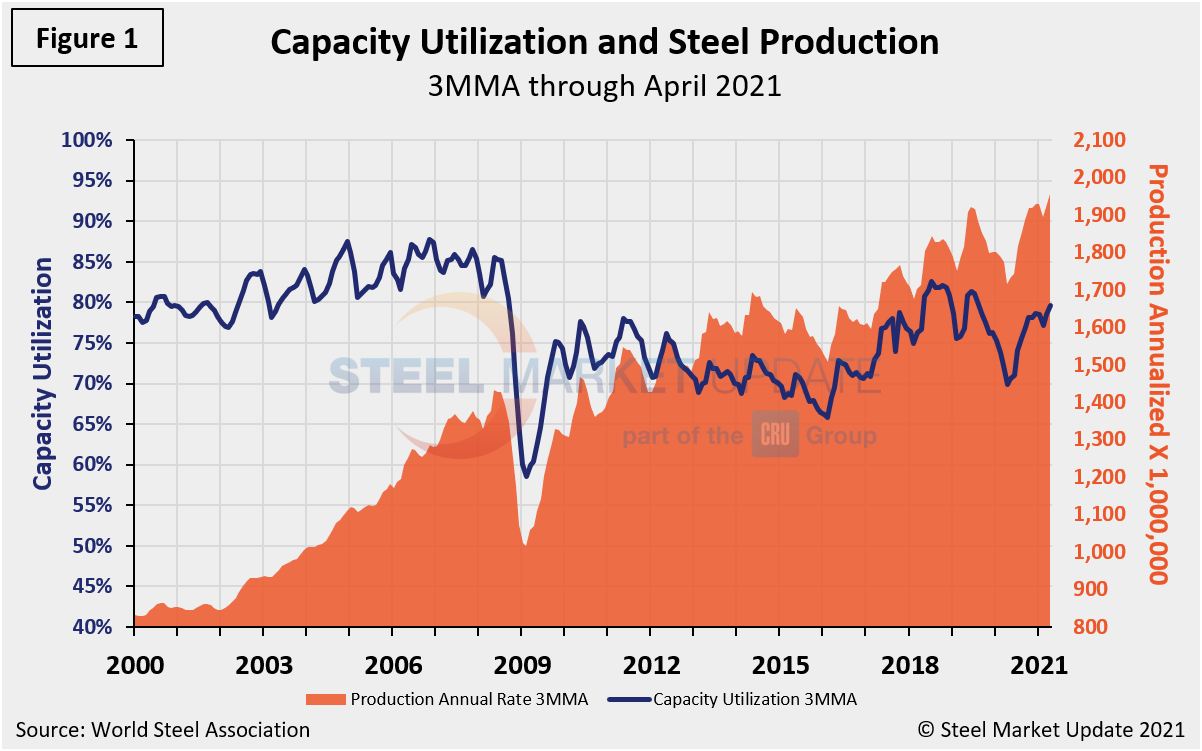

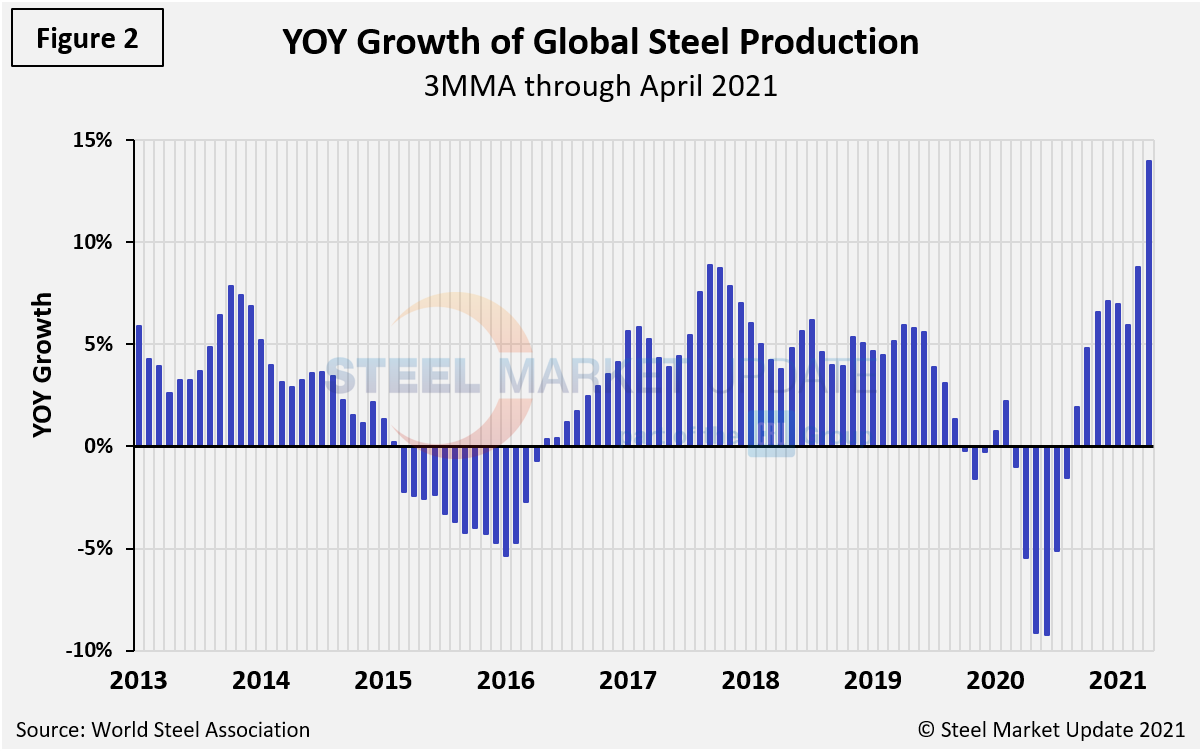

Shown below in Figure 1 is the annualized monthly global steel production on a three-month moving average (3MMA) basis and capacity utilization since January 2000 based on data from worldsteel, while Figure 2 shows the year-over-year growth rate of global production on the same 3MMA basis since January 2013. Capacity utilization in April on a 3MMA basis was 79.6%, up from 78.6% the month prior. On a tons-per-day basis, production in March was 5.650 million metric tons, up from 5.458 million metric tons the month prior, setting a record pace in daily production and outpacing March’s previous record rate. Prior to March’s recent high and April’s new record, the previous record was set in June 2019 at 5.318 million metric tons. Growth in three months through April on a year-over-year basis was positive 14.0%, up from 8.8% the month prior.

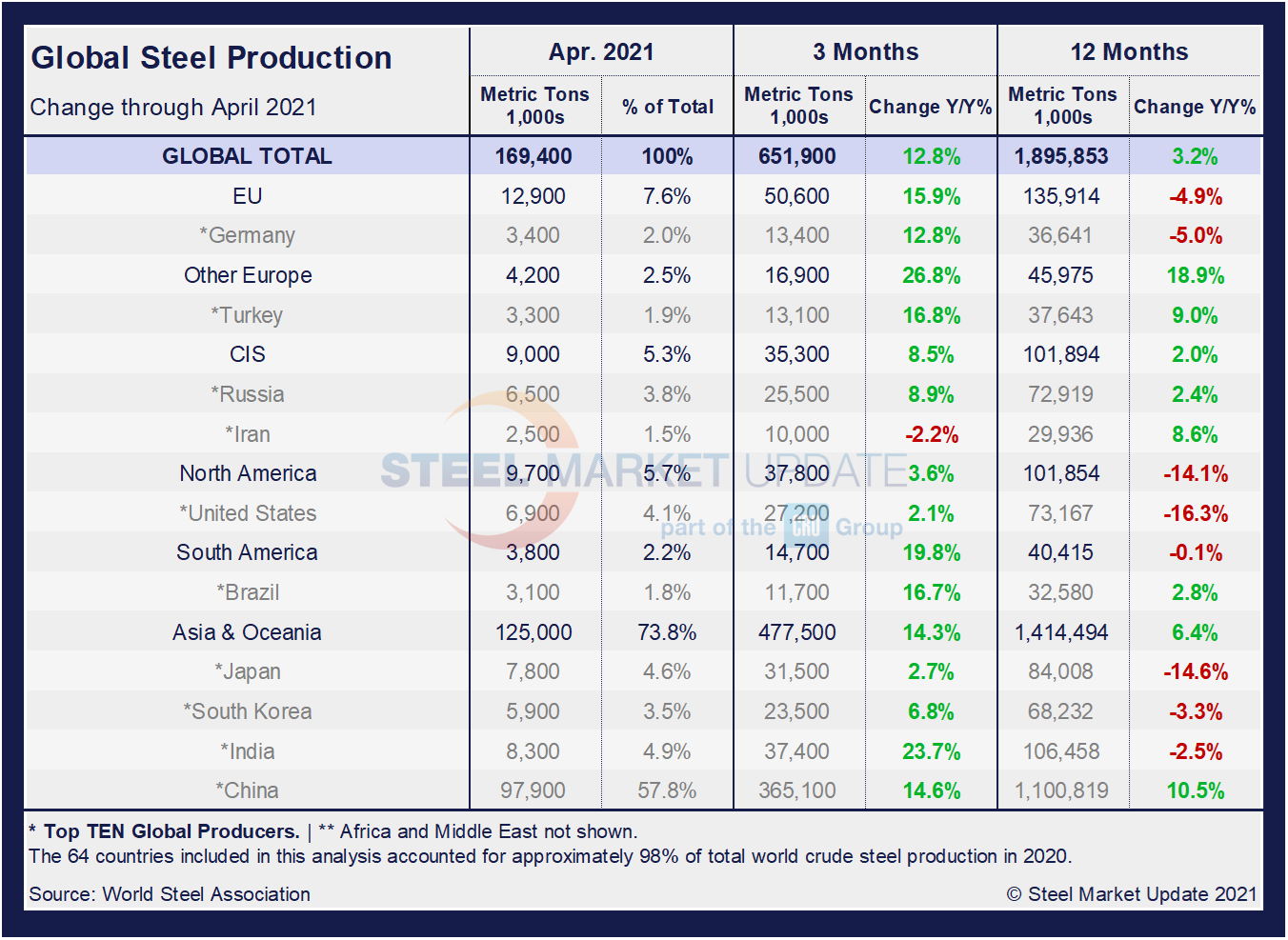

Displayed in the table below is global production broken down into regions, the production of the top 10 nations in the single month of April, and their share of the global total. It also shows the latest three months and 12 months of production through April with year-over-year growth rates for each period. Regions are shown in black font and individual nations in gray. The world overall had positive growth of 12.8% in three months and positive growth of 3.2% in 12 months through April. The market has maintained positive momentum, as the three-month growth rate is higher than the 12-month growth rate. On the same basis in April, China grew by 14.6% and 10.5%, also showing positive momentum. The table shows that North American production was up by 3.6% in the three months through April, compared to negative 4.7% the prior month. The positive momentum in the North American market is significant as the three-month growth rate of +3.6% is notably higher than the -14.1% in 12 months through April.

China’s Crude Steel Production

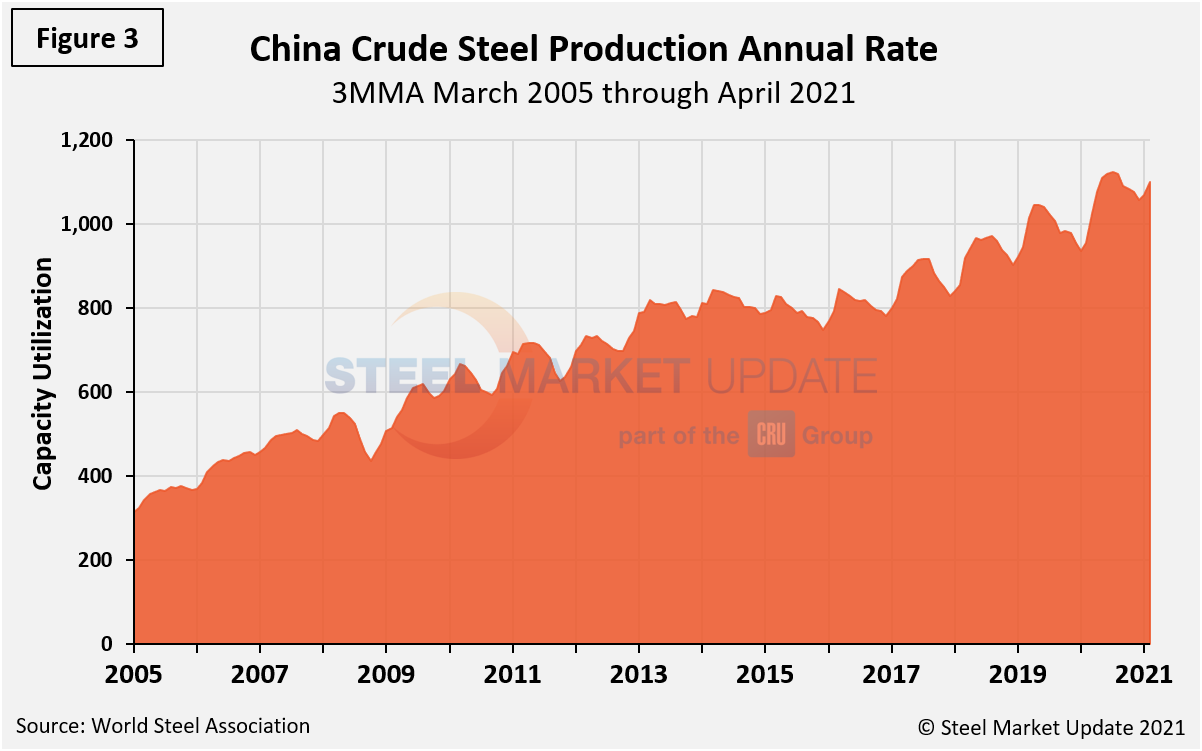

China’s monthly steel production was estimated at 97.9 million metric tons in April, up from 94.0 million metric tons the month prior and surpassing its all-time high of 94.8 million tons set in August 2020. Total output in China has generally declined since that record number, but March and April’s rise confirms the Chinese economy is pushing towards a strong post-pandemic recovery. On a 3MMA basis (Figure 3), the annual rate of China’s crude steel production maxed out at 1.123 billion metric tons in September 2020, but then dipped month on month through February to 1.057 billion metric tons. March and now April were the first increases since last September. April’s total reached 1.099 billion metric tons, up from 1.069 billion metric tons the month prior. China’s annual capacity is now 1.128 billion metric tons, a reduction from 1.164 billion tons in December 2017. China’s capacity utilization in April was 97.6%, up from 96.4% the month prior.

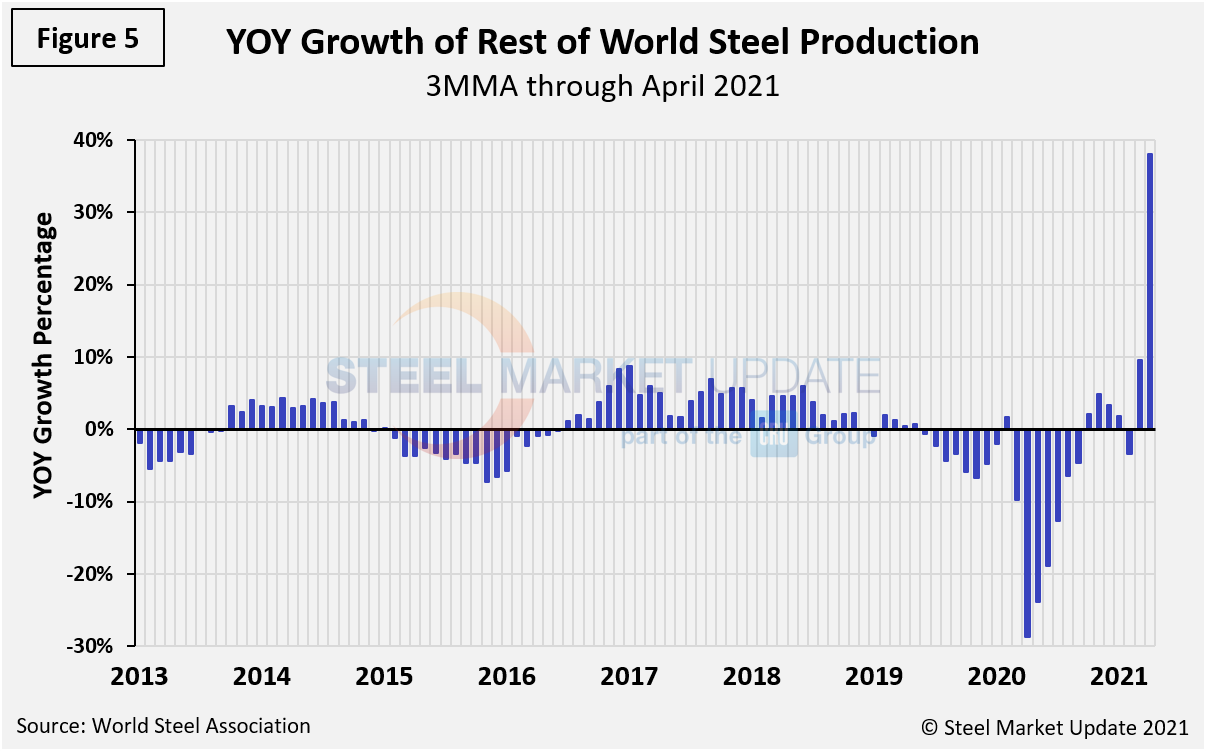

The fluctuations in China’s steel production since April 2013 are shown in Figure 4, while Figure 5 shows the growth of global steel excluding China, both on a 3MMA basis. From November 2020 through April 2021, the rest of the world’s production rose sharply by 38.0%, while China grew by 15.1%, both year over year. The growth for the rest of the world’s crude steel production in April is promising, as the globe continues to recover from the COVID-19-driven doldrums.

By David Schollaert, David@SteelMarketUpdate.com