Market Data

May 20, 2021

ISM Report Lifts Expectations for 2021 Manufacturing Sector

Written by Sandy Williams

The manufacturing sector can expect continued growth for the remainder of this year, says the Institute for Supply Management in their Spring 2021 Semiannual Economic Forecast. ISM raised its projections for several components of the survey that covers 18 manufacturing industries.

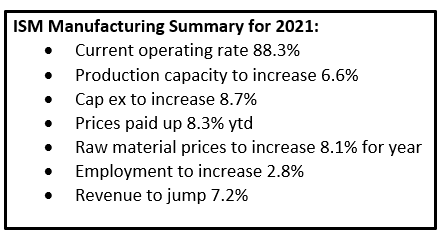

May 2021 operating capacity is at 88.3% of the normal rate and up from 76.9% a year ago. ISM predicts production capacity will increase 6.6% in 2021, up from the previous forecast of 5.3% and well over the marginal increase of 0.5% last year.

Revenue is expected to jump on average by 7.2%, a 0.3% increase from the prior forecast in December for a 6.9% gain in 2021. More than half (59%) of survey respondents said revenue for the year will increase, on average, 13.8% from 2020.

“It was not a bad manufacturing year in 2020, considering everything that (the sector) went through,” said Fiore during the ISM World 2021 Annual Conference. “So, a 7.2% revenue growth rate is a really good story, almost double the growth rate we thought we would see going into 2020. … Now, we’re looking at a strong year, and everything for 2022 looks positive as well.”

Survey respondents plan to invest more in their businesses this year. Capital spending is expected to jump 8.7% for 2021 compared to the 2.4% increase forecast in the December 2020 report.

In the December forecast, prices paid in the first four months of 2021 were expected to increase 2.5% but actually jumped 8.3% during the period. An average increase of 11.4% was reported by 74% of respondents. All 18 manufacturing industries expect prices will remain elevated with 74% expecting an 11.1% increase for the full year. ISM expects raw material prices to decrease about 0.2% during the remainder of the year for a projected net increase of 8.1% for 2021.

ISM forecasts a 2.8% increase in manufacturing employment during 2021. The industry was struggling with a labor shortage before the pandemic, which was exacerbated by COVID-19 restrictions last year.

Anthony Nieves, chairman of the ISM Services Business Survey Committee, noted that the labor pool has been restricted for years, citing in particular the shortage of skilled workers in the construction industry. Fiore echoed the concern adding that manufacturing’s employment projection is about “what [companies] can get, not what they need.”

The Institute of Supply Management Semi Annual Forecast includes survey responses from both the manufacturing and service sectors. Manufacturing includes the following industries: Food, Beverage & Tobacco Products; Textile Mills; Apparel, Leather & Allied Products; Wood Products; Paper Products; Printing & Related Support Activities; Petroleum & Coal Products; Chemical Products; Plastics & Rubber Products; Nonmetallic Mineral Products; Primary Metals; Fabricated Metal Products; Machinery; Computer & Electronic Products; Electrical Equipment, Appliances & Components; Transportation Equipment; Furniture & Related Products; and Miscellaneous Manufacturing.