Analysis

May 13, 2021

Final Thoughts

Written by John Packard

Honest answer: I don’t know…

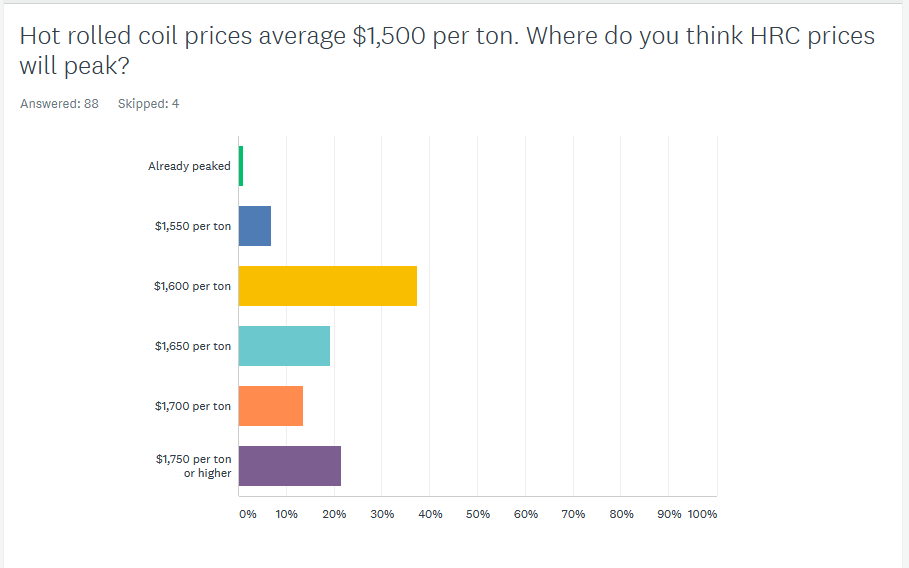

One of the questions asked in last week’s flat rolled and plate steel market trends analysis has been repeated many times over the past five months. The phrasing of the question changes as steel prices continue to rise and surprise those taking our steel market survey. We asked last week, “Hot rolled coil prices average $1,500 per ton. Where do you think HRC prices will peak?” Here is a breakdown of the data collected:

The numbers continue to move higher each time we conduct this survey. As you can see, only 1% of the respondents reported prices as having already peaked, while 92% are now of the belief prices will reach $1,600 per ton or higher.

Here are a few of the comments left behind with this question:

“The mills appear to be now raising prices weekly, and with no notice either.” Manufacturing company

“I think it is a lock that we hit $1,600/ton. And so far everytime I’ve [made a prediction], it has only gone higher; $1,700/ton is very doable at this stage.” Service center

“Throw the dart? I really have no idea how high this can go.” Trading company

“Who knows. This is a futile exercise because we have no idea where it is going to peak.” Service center

When the same data providers were asked what month they think prices would finally hit their peak, there was no clear-cut consensus. We found 19% believing June would be the peak, 23% July, 19% August, 17% September and 18% October of later.

When asked if steel prices were nearing a tipping point, we found an evenly split group of respondents as 49% said they believe prices are at a tipping point, while 51% said we are not there yet. They left a few interesting comments here as well:

“They have to be. We have noticed in the last week a gradual downturn in our roll forming footages, which is a welcomed sign at this point.” Manufacturing company

“Yes, I think by the end of June we will start seeing some holes on light gauge acrylic Galvalume first, then continue to migrate to HRC.” Service center

“By end July we will begin to see some supply relief thanks to the new capacity, ie Ternium and perhaps SDI in August?” Steel mill

“We’re always waiting and listening for the music to stop. And we are still hearing it blaring. Maybe the volume is dying a little, but it isn’t stopping yet – that is for sure.” Service center

The SMU Price Momentum Indicator continues to point toward higher flat rolled and plate steel prices over the next 30 days.

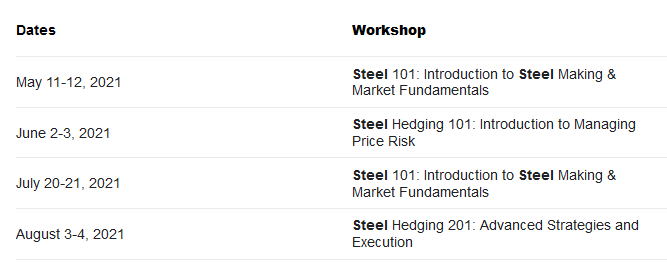

Steel Market Update Events

Here are the upcoming SMU steel training workshops:

To learn more about each workshop, our instructors, agenda and the cost to attend as well as how to register, please click here.

We’ve gotten good news on the mask mandates for those who have been fully vaccinated. SMU continues to encourage everyone to get their shot(s) if you plan on attending the 2021 SMU Steel Summit Conference in Atlanta on Aug. 23-25. The agenda and speakers are filling in nicely; you can view the agenda by clicking here. You can learn more about costs to attend and how to register by clicking here.

As always, your business is truly appreciated by all of us here at Steel Market Update.

John Packard, President & CEO, John@SteelMarketUpdate.com