Market Data

May 10, 2021

Steel Product Shipments and Inventories Through March

Written by David Schollaert

U.S. steel product shipments rose by 1.9% in March after slipping by 1.7% the month prior. The rebound follows February’s decline—the first decrease since bottoming out in April 2020—which was attributed to seasonal factors. Shipments of manufactured durable goods saw a similar blip. March steel shipments posted a 9.9% increase when compared to March 2020, surpassing pre-pandemic levels, according to Census Bureau data on inventories, shipments and new orders for total U.S. manufacturing and steel products.

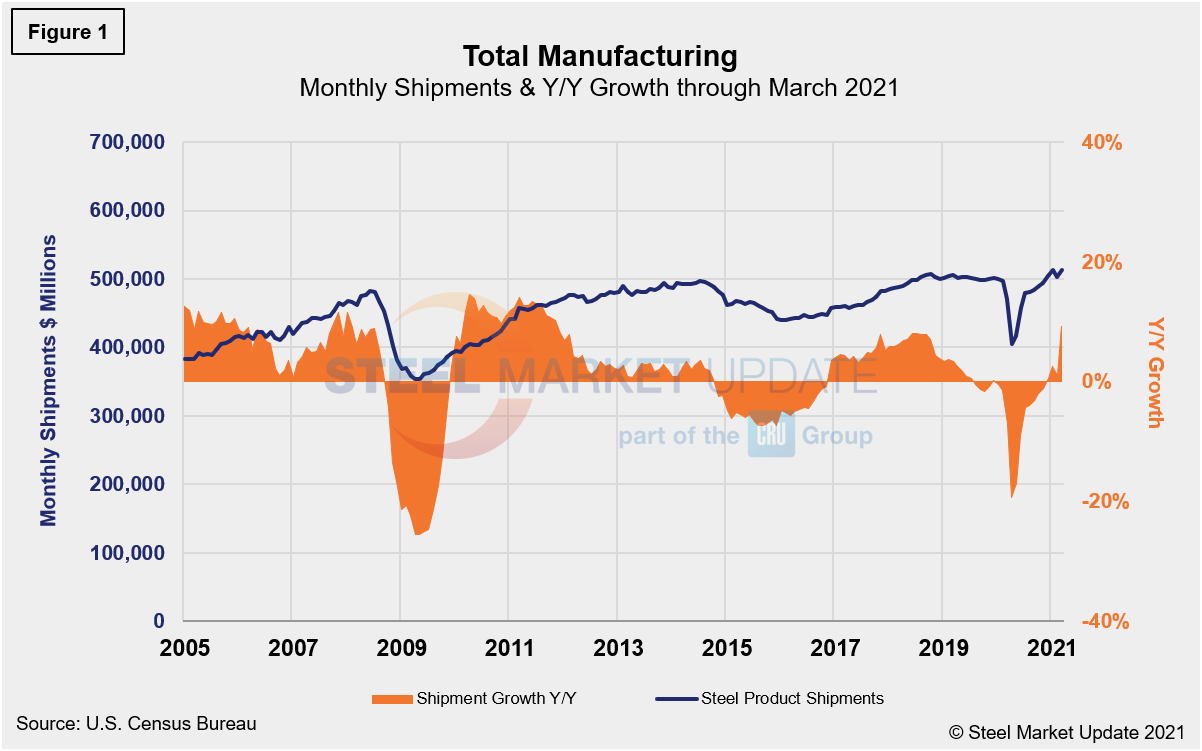

Total shipments and inventories are reported in millions of dollars, seasonally adjusted. Year over year through March, total manufactured product shipments rose by 9.2%, the strongest increase since November 2011 and up 8.2% from the month prior. However, year-ago comparisons may be misleading due to the impact COVID-19 on the marketplace. When compared to the same pre-pandemic period in 2019, total manufactured product shipments were up 1.6% in March.

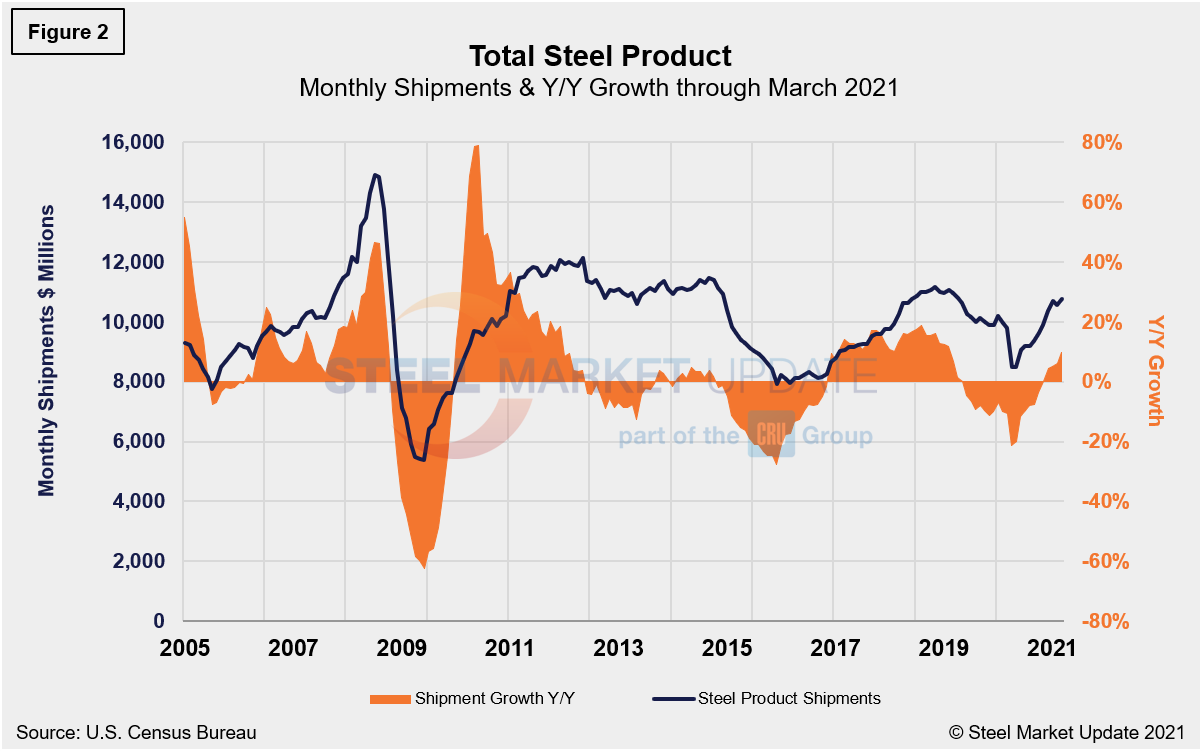

Steel product shipments rose from 6.0% growth in February to 9.9% in March, year on year. Figure 1 and Figure 2 show the history of both since 2005. During the first wave of the global pandemic last April, total manufacturing shipments plunged by 19.4% and steel product shipments fell by 21.4% compared with the prior year. Both have steadily recovered since, though steel product shipments are still 1.8% below the same period in the more typical year of 2019.

Monthly steel product shipments in millions of dollars with the year-over-year growth through March are detailed in Figure 2. Shipments of steel products totaled $10.758 billion in March, up from $10.512 billion in February, and up from year-ago levels when shipments were $9.788 billion. Shipments of steel products most recently peaked in November 2018 at $11.2 billion, then began a 17-month decline through April 2020. Although the growth rate has declined from 18.6% in August 2018 to 9.9% through March 2021, shipments of steel products are up 31.3% since reaching bottom last April.

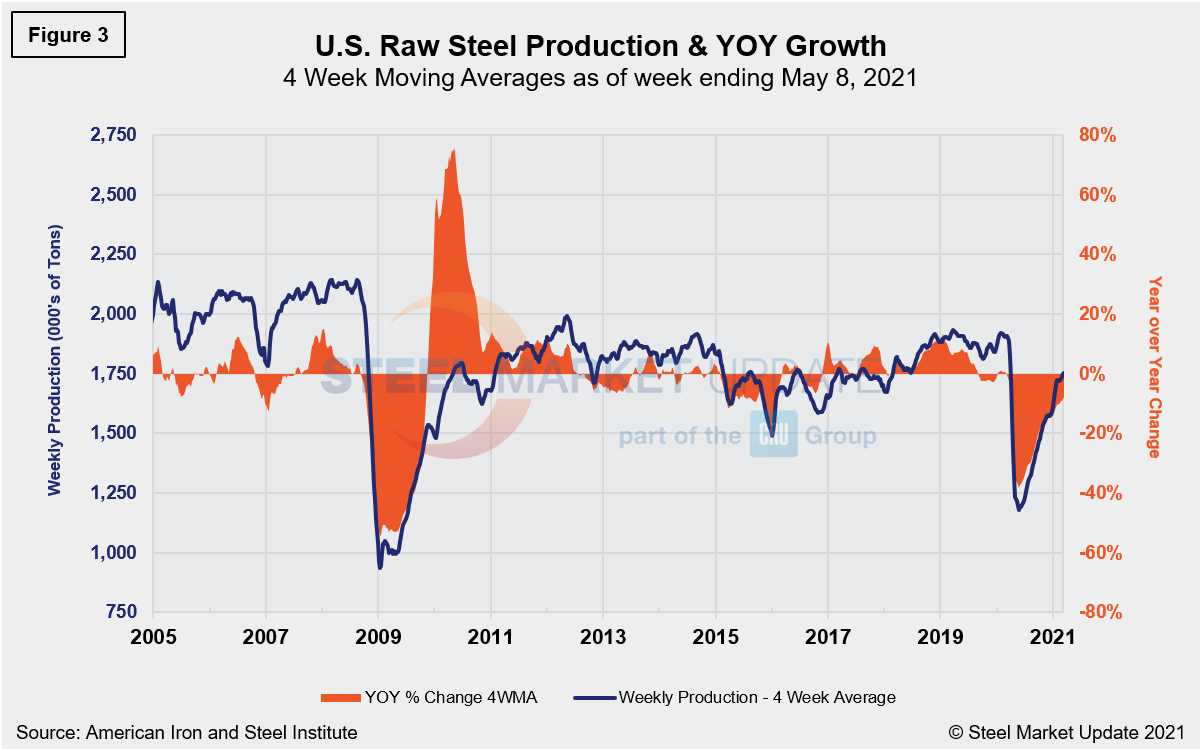

The Census data in Figure 2 compares well over the long term with the American Iron and Steel Institute weekly crude steel production shown in Figure 3. Figure 2 is in dollars and Figure 3 is in tons, yet they paint a similar picture. Since the freefall from the first wave of the pandemic that came to an end in late May 2020, steel production has been on the rebound, according to AISI data shown on a four-week moving average basis. Compared with the COVID-19-related slowdowns one year ago, crude steel production was up 48.4% in the week ending May 8 year over year.

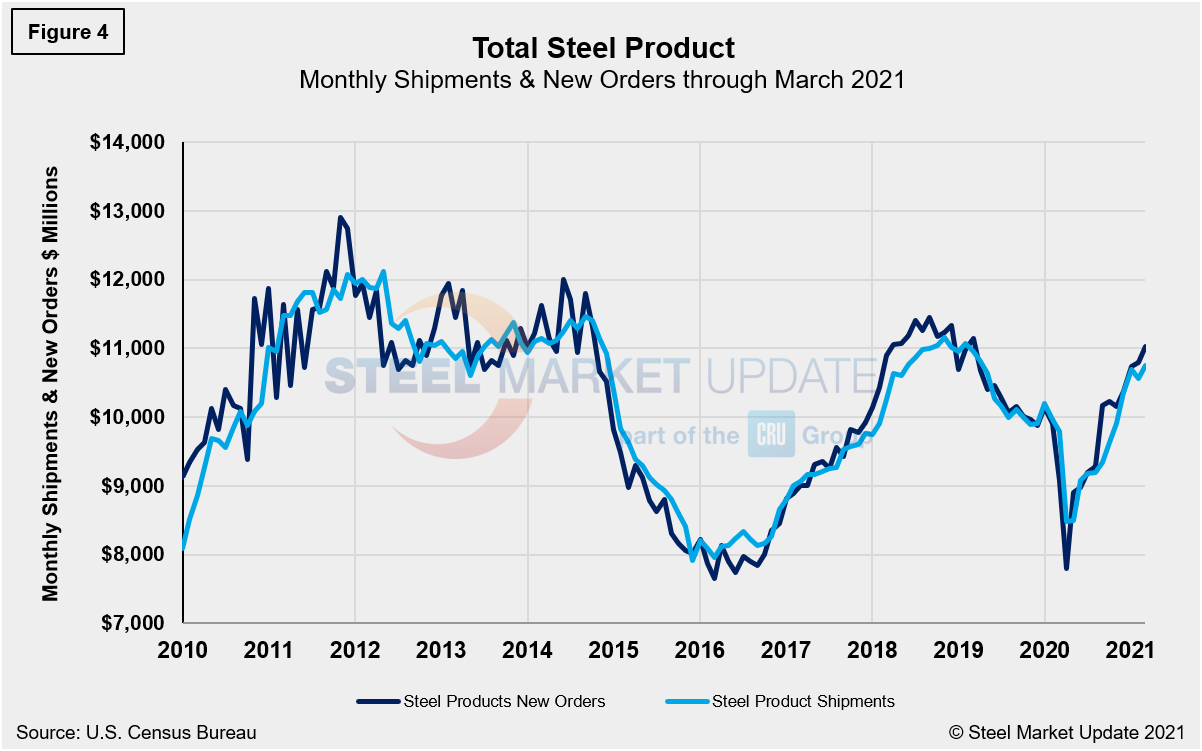

Steel product shipments and new orders on a monthly basis since 2010 are shown in Figure 4. New orders declined much more than shipments last April, but were back in balance by June and have now exceeded shipments. There was a slight curtailment in shipments in February as inventories are tight and lead times continue to extend. New orders, however, have increased steadily month over month, posting a 2.1% increase in March. Despite the recent slip in shipments, the uptrend and tighter gap between new orders and shipments reflects the continued growth in steel demand.

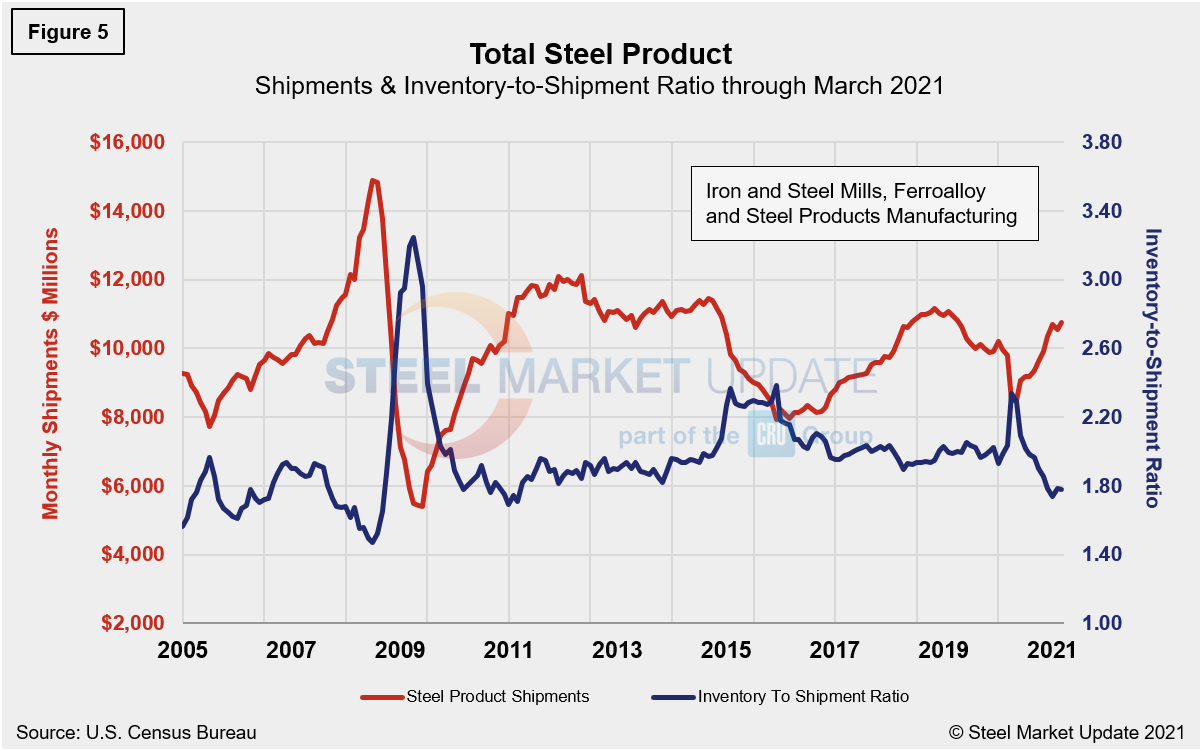

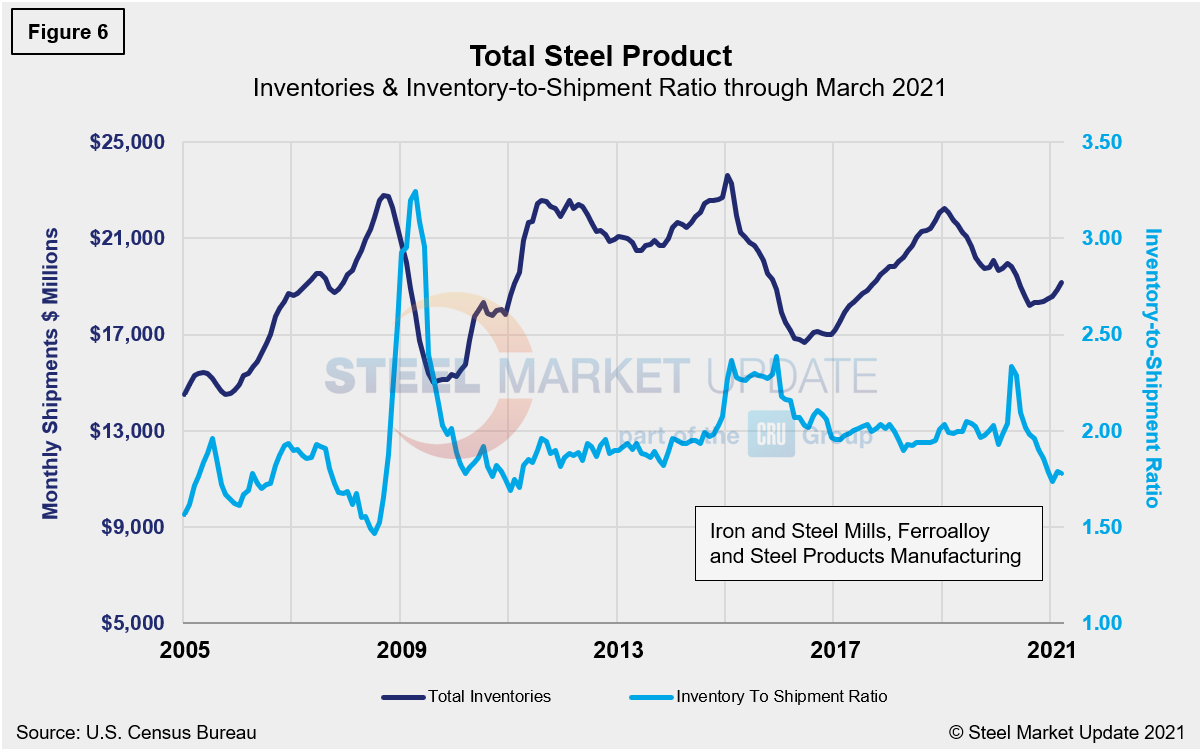

The same total shipment line as in Figure 2 is shown below in Figure 5, but now includes the inventory-to-shipment (IS) ratio. The IS ratio is a measure of how much inventory is necessary to support the level of shipments, thus the lower the IS ratio the better. The IS ratio shot up in April 2020 to 2.34% as shipments declined due to shutdowns to stop the spread of COVID-19. Through March, the IS ratio was at 1.78%, down slightly from 1.79% the month prior. The decrease, albeit marginal, indicates the resumption in steel product shipments after weather-related delays slowed shipments the month prior. Inventories were up 1.5% in March when compared to February, while shipments were up 1.9% during the same period. These dynamics further highlight the continued tight availability of steel on the spot market. Overall, steel shipments have improved by nearly 32.0% since March 2020. Total inventory in millions of dollars is displayed in Figure 6 and repeats the inventory-to-shipment ratio shown in Figure 5.

By David Schollaert, David@SteelMarketUpdate.com