Analysis

May 6, 2021

Final Thoughts

Written by John Packard

I have been “out” for the past few days as my daughter has received her shots and has been visiting us for the first time in well over a year. A special thank you to the SMU team for picking up the slack in my absence.

Jumping right back into the fray, as Michael mentioned in his Final Thoughts in Tuesday’s issue of SMU, the talk is about nothing but price, price, price.

As we look for signs of possible mill order book weakness, we are seeing conflicting signals. There are a couple of mills who have managed to find more tons for their contract customers or for their best spot customers. To say this is a trend would not be appropriate. Based on where the tonnage is being offered from, it may be a recognition of difficulties within the automotive segment due to the chip shortage and other issues. However, SMU will continue to probe to see if there are more spot tons being made available into the bigger players.

![]() Most steel buyers are telling us that the market remains very tight. A West Coast service center reported to SMU this week, “Even the mills we’ve ordered spot tonnage from month in and month out in the past are telling us, “sorry,” right now. Things remain very, very tight.” He added: “It’s wild to think that we’re closer to $2,000/ton than $1,000/ton. What a time to be alive!”

Most steel buyers are telling us that the market remains very tight. A West Coast service center reported to SMU this week, “Even the mills we’ve ordered spot tonnage from month in and month out in the past are telling us, “sorry,” right now. Things remain very, very tight.” He added: “It’s wild to think that we’re closer to $2,000/ton than $1,000/ton. What a time to be alive!”

Another comment that I found interesting was made by one of our survey respondents this week, “I had one supplier request that I place the orders we get from them for the balance of this year (out to December 2021) to protect ourselves.”

We also asked our data providers to give us their insights regarding returning to “normal” at their company. Many companies reported they were already back to the office, and in some cases back to visiting customers (although not all customers are allowing visitors quite yet). I thought this southern service center comment was noteworthy, “We’ve allowed travel, etc. throughout the entirety of the pandemic. However, we all work from home. Everyone’s enjoying it so much, and productivity has skyrocketed, that we’re not going back any time soon.”

Another comment from a service center executive regarding getting back to normal posed an interesting question about what normal will look like in the future. “We’re getting there, baby! I’m strongly encouraging our folks to get vaccines, as I have, but not mandating it. We are getting closer and closer to seeing some level of normalcy return. Now, will our Outside Sales Teams be popping in with a dozen donuts to our customers anytime soon? Probably not. But that also begs the question: Will those ‘old school’ tendencies ever return in full?”

Obviously, I hope that all of you will be able to travel to the SMU Steel Summit Conference in Atlanta in late August (Aug. 23-25). For those of you whose companies are not going to allow travel, we will offer a “hybrid” or virtual version of our conference as well as the live event. We will use our virtual platform, which will be available to both in-person attendees as well as those who are not allowed to travel. We are working on how the hybrid version of the conference will work, and I expect to have more details for you in the next couple of weeks.

![]() For those of you who are interested in attending the 2021 SMU Steel Summit Conference but have yet to make a final decision, here are some updates.

For those of you who are interested in attending the 2021 SMU Steel Summit Conference but have yet to make a final decision, here are some updates.

We are in constant communication with the Georgia International Convention Center (GICC) regarding what protocols and requirements will be in place at the time of our conference. Right now (subject to change) the only rules are three-foot spacing and attendees are required to wear masks. As vaccinations continue to roll out and the country gets closer to herd immunity, the expectation is the restrictions will moderate over time (they are following CDC guidelines). We also understand that the ventilation system is excellent within the building, and SMU is adding more breaks to allow attendees to move about. We are also looking at providing various seating options and potentially color coding badges for our attendees to express their preferences regarding social distancing and interacting with other attendees.

We will have much more to say regarding protocols as we get closer to the time of the conference. If you have specific questions, please send them to events@SteelMarketUpdate.com and we will respond as quickly as possible.

We have added new speakers to this year’s SMU Steel Summit Conference program. We recently added Barry Zekelman, Chairman and CEO of Zekelman Industries; Chris Shipp, Vice President Global Supply Chain, Priefert Manufacturing/Priefert Steel; Brian Coulton, Chief Economist, Fitch; John Catterall, Vice President Electric Vehicle Program, AISI; Paul Lowrey, President, Steel Research Associates; Andrew Lichter, Vice President Corporate Strategy and Development, Mobius Risk Group; and Ben Abrams, CEO, Consolidated Scrap. The balance of our speakers already confirmed can be found by clicking here. I will be producing an updated agenda for everyone in Sunday’s issue of Steel Market Update.

Registrations continue to grow for the 2021 SMU Steel Summit Conference as everyone in the industry is looking forward to the first “in-person” steel conference. Here are a few of the companies that have registered over the past few working days: Apex Tool Group, Berg Pipe, Charter Steel Trading, Evapco*, Illinois Tool Works (ITW)*, McNeilus Steel, Inc.*, POSCO America*, Pridgeon and Clay*, Tarter Farm and Ranch, UFP Industries*, Weyland GmbH. And those who added more people to their existing registrations: Heidtman Steel*, Steel & Pipe Supply* (those with an * denotes more than one person is attending from that company). You can join these companies by registering here.

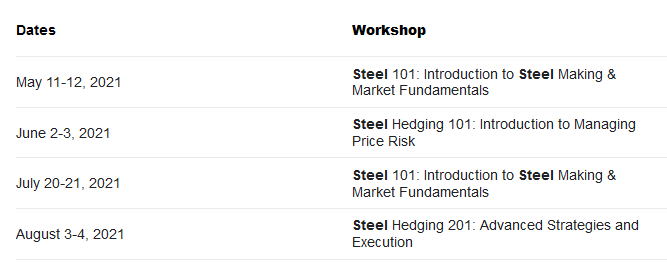

The next Steel 101: Introduction to Steel Making & Market Fundamentals Workshop will be held next week. That workshop is sold out and is closed to new registrations. The next time it will be conducted will be July 20-21. Here is a listing of the upcoming steel workshops (hedging & 101):

You can find more information about each workshop by clicking here or going to: https://events.crugroup.com/steel101/home

If you are new to SMU and you would like more information about how to become a subscriber, or if you are an existing member and would like to add more people or upgrade from Executive to Premium, please contact Paige Mayhair at Paige@SteelMarketUpdate.com or by phone: 724-720-1012.

As always, your business is truly appreciated by all of us here at Steel Market Update.

John Packard, President & CEO, John@SteelMarketUpdate.com