Analysis

April 18, 2021

Final Thoughts

Written by John Packard

Buyers of flat rolled and plate steels continue to complain of their inability to get enough steel in order to supply their customers. In the latest analysis conducted by Steel Market Update last week, 47% of the respondents to our survey reported they were unable to get enough supply. We have seen a small improvement over the past month as 54% of steel buyers reported they were unable to get enough steel when we conducted our survey the week of March 15. Since then, it improved to 50% the week of March 25 and now sits at 47% as of last week.

Demand remains quite strong as 43% of the total respondents reported demand as improving. We saw 52% reporting demand as remaining the same and only 5% reported demand as in decline.

When looking at specific market segments, we had 59% of the manufacturing companies reporting demand for their products as either increasing marginally (38%) or significantly (21%). Only 10% reported demand as declining marginally (the balance reported demand as remaining the same).

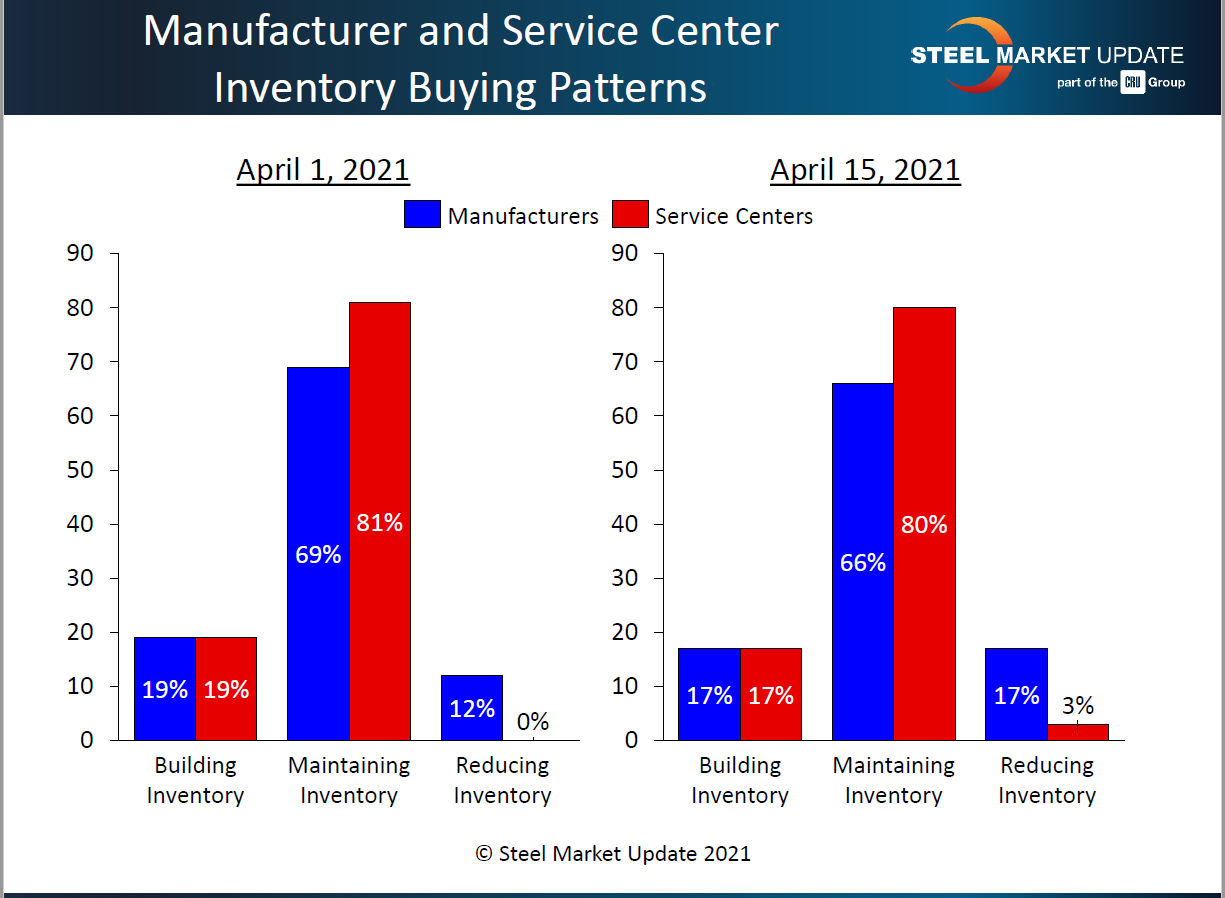

Since the beginning of the month of April, both manufacturing companies and service centers have been unable to build inventories (see graphic below).

There is one area of concern affecting both service centers and end users equally. That would be mill lead times. We saw 75% of manufacturing companies and 69% of service centers reporting mill lead times as being “highly extended” with another 18% of manufacturing and 31% of service centers reporting “slightly longer than normal” lead times. No one reported short or extremely short lead times.

All of the information shared above is available to our Premium level members as we post a 54-page PowerPoint presentation after each survey (done every other week). You can learn more about how to upgrade to Premium by contacting Paige Mayhair at Paige@SteelMarketUpdate.com or by phone at 724-720-1012.

On Wednesday of this week Steel Market Update will host our first steel hedging workshop, which is focused specifically on products other than hot rolled steel (cold rolled and coated steels). We call this our Galvanized Steel Hedging Workshop. It is a half-day workshop featuring Spencer Johnson of StoneX, the CME Group and CRU. The workshop cost is $500 per person and there are discounts available for SMU/CRU members at $35 each. Companies that register more than one person will receive an additional $35 per person discount. You can learn more by clicking here.

As always, your business is truly appreciated by all of us here at Steel Market Update.

John Packard, President & CEO, John@SteelMarketUpdate.com