Market Data

April 16, 2021

Worldsteel Forecasts Firm Recovery in Demand

Written by Sandy Williams

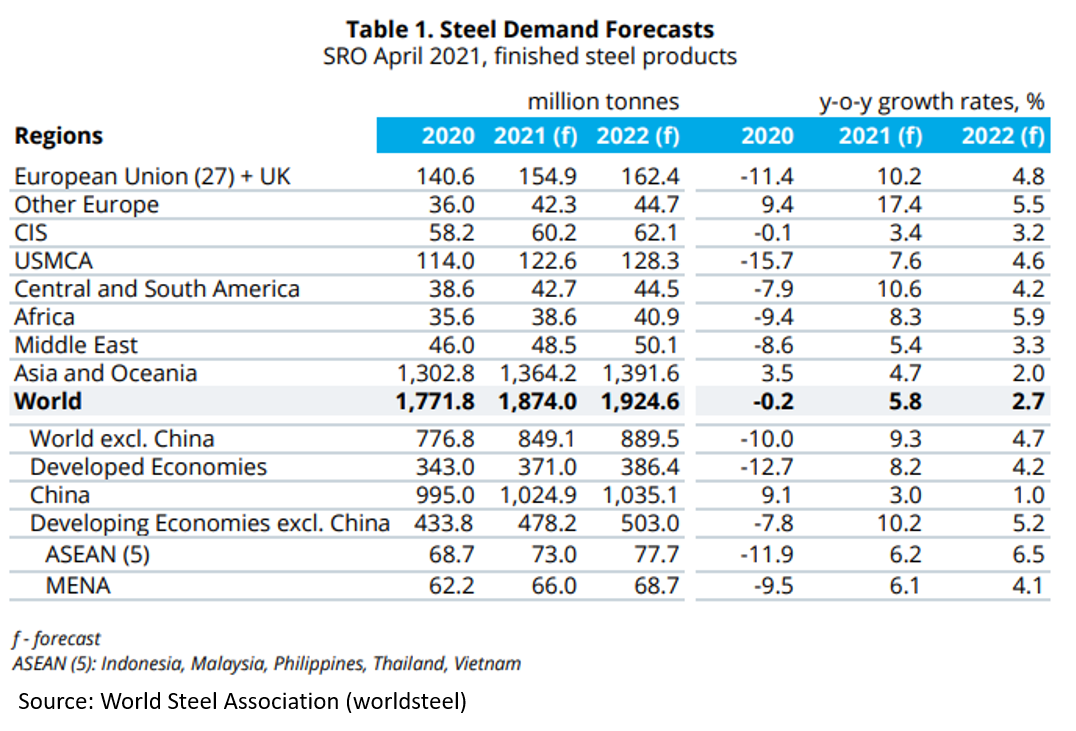

The World Steel Association was cautiously optimistic in its April 2021 Short-Range Outlook published last week. The association expects steel demand to grow 5.8% this year, reaching 1.874 billion metric tons, after declining 0.2% during the pandemic in 2020.

“Despite the disastrous impact of the pandemic on lives and livelihoods, the global steel industry was fortunate enough to end 2020 with only a minor contraction in steel demand,” said Al Remeithi, chairman of the worldsteel Economics Committee. “This was due to a surprisingly robust recovery in China, with growth of 9.1%. In the rest of the world, steel demand contracted by 10.0%. In the coming years, steel demand will recover firmly, both in the developed and developing economies, supported by pent-up demand and governments’ recovery programmes.”

Remeithi warned that a return to pre-pandemic levels of steel demand will take a few years for most developed economies. The forecast comes with the caveat that evolution of the virus, vaccination rates, withdrawal of supportive fiscal and monetary policies, geopolitics, and trade tensions could affect the recovery.

China

China, the first to feel the pandemic, was also the first to recover, resuming almost all economic activity by last May except for retail. China was fortunate to record annual GDP growth of 2.3% in 2020 after contracting 6.8% in the first quarter. Construction and infrastructure led the recovery and, following a 45% contraction during lockdown, the automotive industry quickly recovered with auto production down only 1.4% for the year. Worldsteel expects steel demand in China to grow by 3% in 2021 and 1% in 2022.

Advanced Economies

Advanced economies generally rebounded in the third quarter after a freefall in the second quarter, said worldsteel. Steel demand in developed economies fell 12.7% in 2020, but growth of 8.2% is forecast in 2021 and 4.2% in 2022. Steel demand in 2022 will likely not recover fully to pre-pandemic levels.

The U.S. and EU suffered severely from early lockdowns during the pandemic, but rebounded in the third quarter as regional economies reopened and governments provided fiscal support. Steel demand in the U.S. fell 18% in 2020, said worldsteel, but a substantial recovery is expected in 2021 thanks to the proposed infrastructure bill that could significantly increase steel demand over a multi-year period.

The EU and UK saw steel demand fall by 11.4% in 2020 with some nations in the region performing better than others. Recovery for 2021 and 2022 will be driven by the steel-using sectors, particularly the automotive sector and public construction.

Japan’s steel demand plummeted 16.8% last year due to broad interruption of economic activity despite lower COVID-19 infection rates than the U.S. and EU. Worldsteel predicts a moderate rebound driven by the automotive sector, along with recovery in exports and industrial machinery.

South Korea managed the pandemic better than most, resulting in positive momentum in facility investment and construction and avoiding a profound decline in GDP. Steel demand fell by 8% in 2020 due to reduced production in auto and shipbuilding. The two sectors are expected to lead the recovery in 2021 and 2022. Steel demand, however, is not expected to return to pre-pandemic levels before 2023.

Developing Economies

Lockdowns in developing economies combined with inadequate medical facilities, a collapse in tourism and commodity prices, and insufficient fiscal support, took its toll on steel demand last year. As a whole, steel demand dropped by 7.8% in 2020 with conditions varying by regions. Worldsteel expects a relatively quick rebound this year and next with growth of 10.2% and 5.2%, respectively.

India’s steel-using sectors were brought to a standstill last year, but began picking up in August. A growth-oriented government policy will help support steel demand. After dropping 13.7% in 2020, a rebound of 19.8% in 2021 will exceed the 2019 level.

ASEAN countries saw steel demand contract 11.9% in 2020, with Malaysia and the Philippines hardest hit. Vietnam and Indonesia had only modest declines in steel demand. Construction activity and tourism is expected to improve gradually this year and accelerate in 2022.

Latin American economies were among the most severely hit by the pandemic. Shutdowns were prolonged in Mexico, dropping steel demand by double digits. The strong recovery by the U.S. is expected to help support Mexican steel demand. Brazil’s economy dropped in Q2 but quickly rebounded with government support resulting in some steel demand growth in 2020. Brazil steel demand is expected to grow at a healthy pace in 2021 and 2022.

Demand decline in Russia was less severe than other developing economies due to government support of construction activity. Turkey, already in deep contraction due to a currency crisis in 2019, kept momentum going in 2020 with construction activity and is expected to return to pre -crisis levels in 2022.

Steel demand in the MENA region began recovering toward the end of 2020 due to a rebound in oil prices and resumption of construction activity. Steel demand fell 9.5% in 2020 and will have a moderate recovery due to infrastructure investments in 2021, said worldsteel.

Steel-using Sectors to Lead Global Recovery

The decline in global construction was 3.9% in 2020 compared to 1.9% during the 2009 global financial crisis. Although in some countries construction continues to be curtailed by COVID restrictions, worker shortages and a private investment hesitancy, most regions will see construction activity support the recovery in steel demand. Worldsteel expects global construction to reach 2019 levels during 2022.

The automotive industry ground to a halt during the pandemic, but pulled off a surprisingly robust recovery. Pent-up demand, safety concerns and extra household cash will return the global automotive industry to the 2019 level in 2022, predicts worldsteel. A shortage of semiconductors and other parts is currently playing against a positive increase in hybrid and electric vehicles for the industry.

Global machinery declined less during the pandemic than it did during the financial crisis and is expected to recover at a faster pace as well. Supply chain disruptions have initiated reviews of sourcing to improve flexibility and reliability. The trend toward sustainable production and renewable energy will also be a growth factor for the sector.