Product

April 16, 2021

SMU Steel Buyers Sentiment: Even COVID Can't Dampen Optimism

Written by Tim Triplett

Steel Market Update’s Steel Buyers Sentiment Indexes show buyers still very optimistic about their prospects for the rest of the year despite lingering concerns over COVID-19 and the possibility of a sharp correction in record-high steel prices. Both Current and Future Sentiment Index readings are even more bullish than they were in the first quarter last year before the pandemic hit.

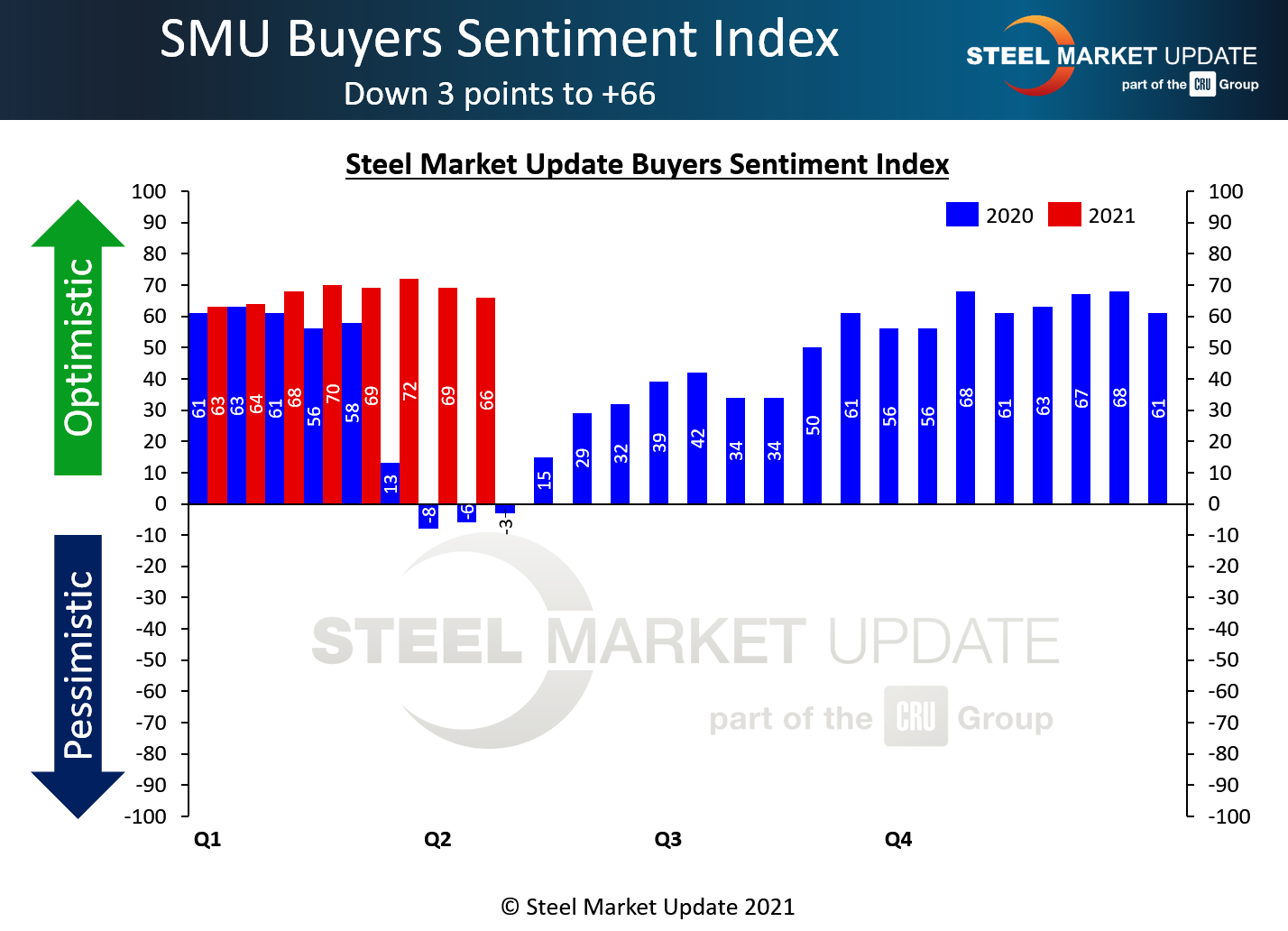

Every two weeks, SMU asks buyers how they view their company’s chances for success in the current environment, as well as three to six months in the future. SMU’s Current Buyers Sentiment Index declined by a modest three points to a still very optimistic reading of +66. That’s not far from the index peak of +78 in January 2018 and represents a huge recovery from the reading of -8 last April shortly after the coronavirus outbreak rocked the economy.

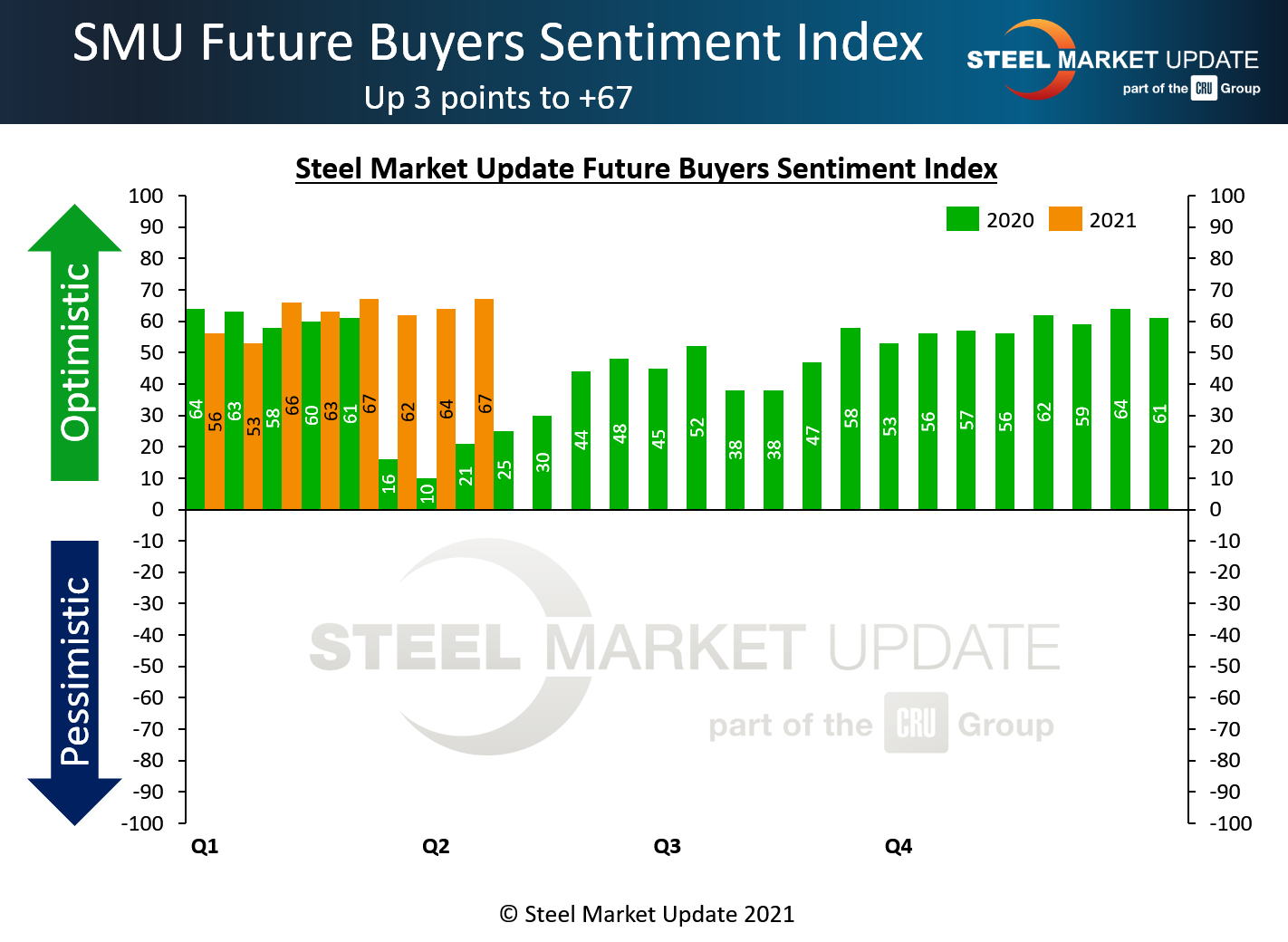

SMU’s Future Sentiment Index saw a three-point uptick to another very positive reading of +67, just 10 points shy of the highest reading ever at +77 in February 2018. That’s also a 77-point rebound from the pandemic-induced low of +10 one year ago.

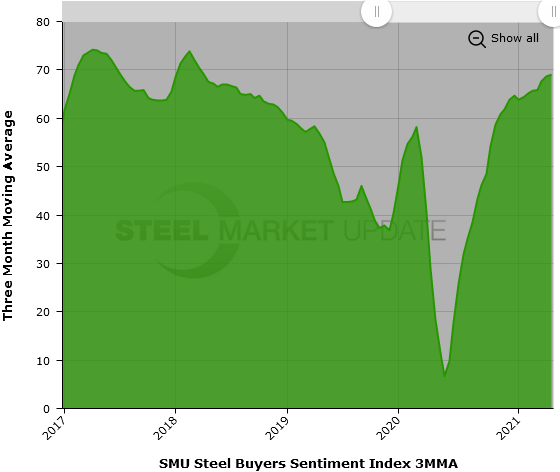

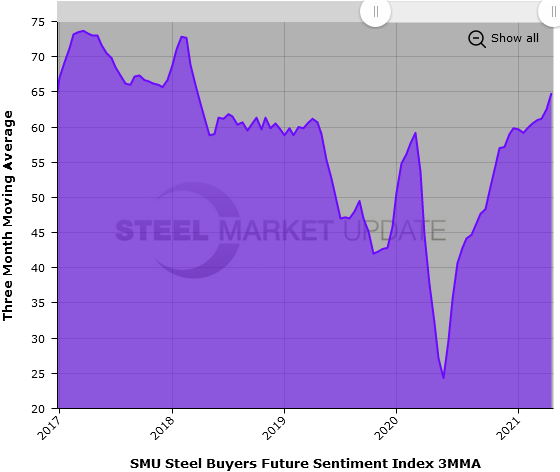

Measured as a three-month moving average (3MMA) to smooth out the variability, Current Sentiment hit +69.00 this week, while the Future Sentiment 3MMA rose to +64.83—both still well above the averages in the mid-50s over the past five years.

What Respondents are Saying

“Demand is still good, but we have no idea what we can offer or when for much of our product line. I think demand will stall over lack of availability and ridiculous prices.”

“Not sure if our competition is going to be in a better place for inventory or not. Looking out, these prices are not justified or sustainable long term, so at least a minor correction will occur later this year. Will the Biden administration continue to protect the domestic mill industry and let them play games with idled facilities and maintenance outages to keep supply tight?”

“We’re worried about the crash.”

“We have foreign material hitting the shores over the next several months.”

“At three months, our prospects are “excellent.” At six months, there are just too many variables, so I would say “good.” However, we’ll look back at 2021 as a whole as a truly excellent and record-breaking year.”

“Any service center or mill that doesn’t check the “excellent” circle here needs to check themselves. This chaos is very fun and very profitable.”

SMU’s check of the market this week put the average price of hot rolled steel at a new high of $1,370 per ton. Other flat rolled and plate products are at unprecedented levels as well–making this one of the most profitable periods for steel on record. Should COVID surge or prices plummet, however, sentiment could follow suit.

ARTICLE CONTINUES BELOW

{loadposition reserved_message}

About the SMU Steel Buyers Sentiment Index

SMU Steel Buyers Sentiment Index is a measurement of the current attitude of buyers and sellers of flat rolled steel products in North America regarding how they feel about their company’s opportunity for success in today’s market. It is a proprietary product developed by Steel Market Update for the North American steel industry.

Positive readings will run from +10 to +100 and the arrow will point to the righthand side of the meter located on the Home Page of our website indicating a positive or optimistic sentiment. Negative readings will run from -10 to -100 and the arrow will point to the lefthand side of the meter on our website indicating negative or pessimistic sentiment. A reading of “0” (+/- 10) indicates a neutral sentiment (or slightly optimistic or pessimistic), which is most likely an indicator of a shift occurring in the marketplace.

Readings are developed through Steel Market Update market surveys that are conducted twice per month. We display the index reading on a meter on the Home Page of our website for all to see. Currently, we send invitations to participate in our survey to more than 600 North American companies. Our normal response rate is 100-150 companies; approximately 40 percent are manufacturers, 45 percent are service centers/distributors, and 15 percent are steel mills, trading companies or toll processors involved in the steel business. Click here to view an interactive graphic of the SMU Steel Buyers Sentiment Index or the SMU Future Steel Buyers Sentiment Index.

By Tim Triplett, Tim@SteelMarketUpdate.com