Market Data

April 15, 2021

SMU Analysis: Key Market Indicators Still Improving

Written by David Schollaert

Steel Market Update’s latest analysis of the monthly Key Market Indicators shows that our Present Situation markers have seen little change when compared to the month prior, while the Trend change saw a visible shift upward during the same period. Overall, the marketplace continues to recover from the pandemic as key metrics show further improvement.

SMU’s Key Market Indicators include a host of data on the economy, raw materials, manufacturing, construction, and steel sheet and long products, offering a snapshot of current sentiment and the near-term expected trajectory of the economy.

As a point of reference, at the onset of COVID-19 a year ago, the impact of the pandemic on the economy was delayed, as only 3 of 38 Present Situation indicators reflected the dire situation the United States was facing. At no point did more than 18 of 38 indicators shift negative. In the data released through April 15 this year, only 8 of the 38 indicators are negative, highlighting the ongoing rebound.

SMU’s Present Situation and Trends analysis in the table below are based on the latest available data as of April 15, 2021. Readers should regard the color codes in the “Present Situation” column as a visual summary of the current market condition. The “Trend” columns are also color coded to give a quick visual appreciation of the market’s direction. All data included in this table was released within the past month. The month or specific date to which the data refers is shown in the second column from the far right. Click on the below table to expand it.

Present Situation

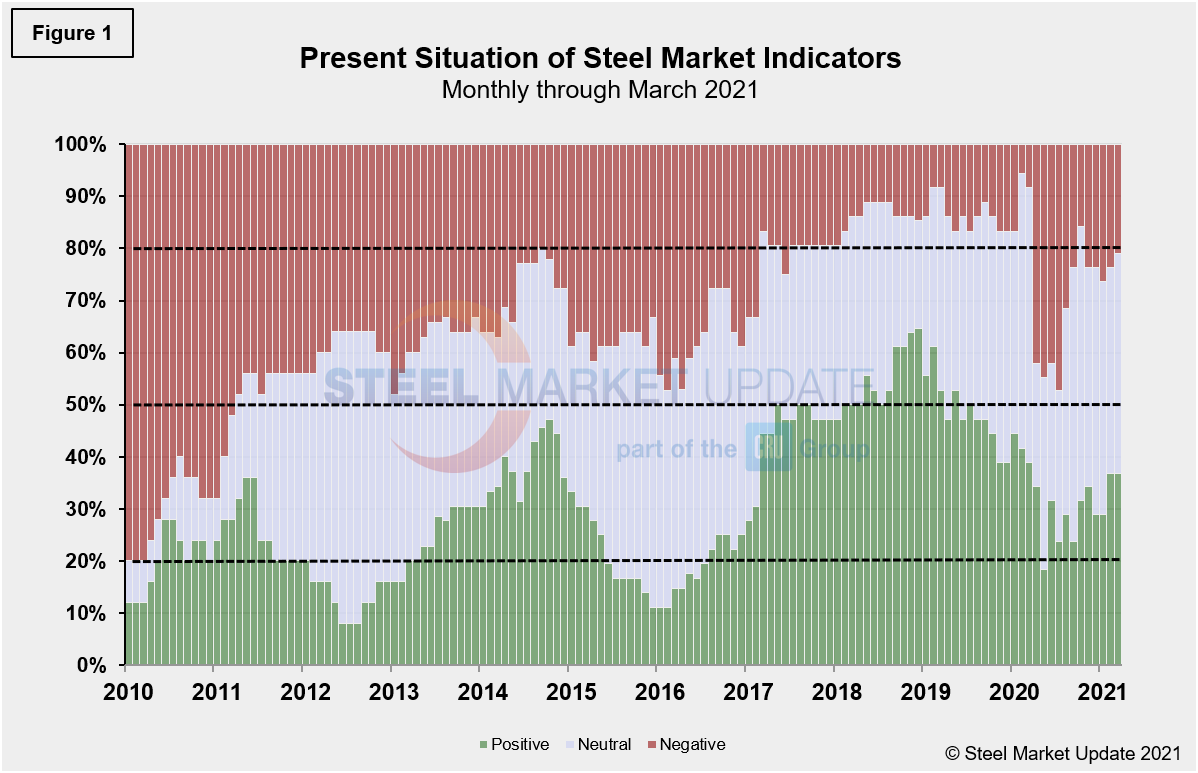

SMU’s present situation indicators below show that the worst of the fallout from the COVID-19 pandemic was relatively brief, but the recovery process has been prolonged. Additionally, when compared to the impact of the 2008-2009 economic recession, the financial and commercial harm suffered this past year has been far less. In 2010, as the market was working itself out of the recession doldrums, the present situation was 80.0% negative and only 12.0% positive. At its worst during the COVID pandemic, negative sentiment reached a low of 47.4%, while 23.7% remained positive. In that comparison, the Great Recession was far worse for the economy than the current pandemic.

We currently view 14 of the 38 indicators as positive, 16 as neutral and 8 as negative. These results are largely unchanged when compared to last month’s data. There was no change in value on the positive view; however, the negative indicators shifted to neutral by one point. The marketplace has continued to respond to reopening efforts and mass vaccinations, as our most recent assessment indicates a 36.8% positive situation; however, nearly 42.1% remain neutral as they keep a watchful eye on the economic progress. Our monthly assessment of the present situation since January 2010 on a percentage basis is shown in Figure 1. Although early on in the pandemic a shift in our indicators from positive to negative was clearly seen, of late the shift has been toward the neutral category. We believe this reflects the cautiously optimistic attitude in the marketplace.

Trends

Unlike the Present Situation, SMU’s Trends indicators saw sharp changes from month-ago values. Most values in the trends columns are three-month moving averages (3MMA) to smooth erratic monthly data. Trend changes in the individual sectors since the beginning of March data are described below, with some general comments. (Please note that in many cases this is not April or March data, but data that was released in March and/or April for previous months). Compared to month-ago data, the negative trend fell to 23.7% at present, compared to 36.8% last month. Additionally, the positive trend rose from 60.5% to 76.3% during the same period, the highest positive mark since March of 2018. The positive momentum should continue as vaccination totals rise and counter recent COVID-19 positivity surges. The recovery continues, but recent progress may indicate that the worst is behind us. Figure 2 shows the recent movement of the trends as well as the post-recession situation at the far left of the chart for comparison.

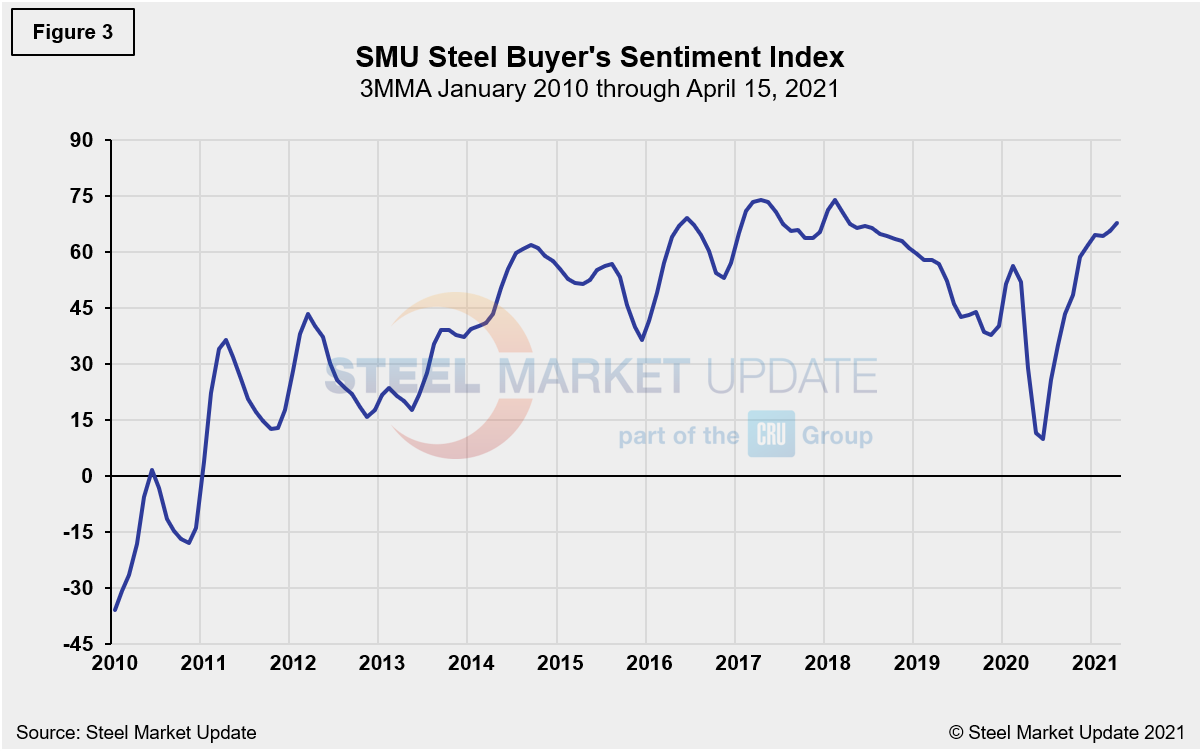

The SMU Steel Buyers Sentiment Index is a measure of the current attitude of North American buyers and sellers of flat rolled products regarding their company’s chances for success in today’s market. The single value of the index fell from +58 in early March 2020 to -8 less than a month later. It has since rebounded to a healthy +70 as of April 15, up from +69 in last month’s analysis, and nearing historic highs. A reading above the neutral point of zero indicates that buyers have a positive attitude about their prospects. Rising demand and historically high steel prices should keep the Steel Buyer’s Sentiment Index at a highly optimistic level for the foreseeable future. Figure 3 shows the 3MMA of the index since 2010.

By David Schollaert, David@SteelMarketUpdate.com