Market Data

April 1, 2021

Steel Mill Negotiations: More of the Same

Written by Tim Triplett

No change to report in the latest Steel Market Update negotiations data. The dynamic between buyers and sellers remains virtually the same. “The mills don’t negotiate at all, and I don’t blame them one bit. Why should they negotiate when there isn’t enough tonnage to go around?” commented one respondent to SMU’s questionnaire this week.

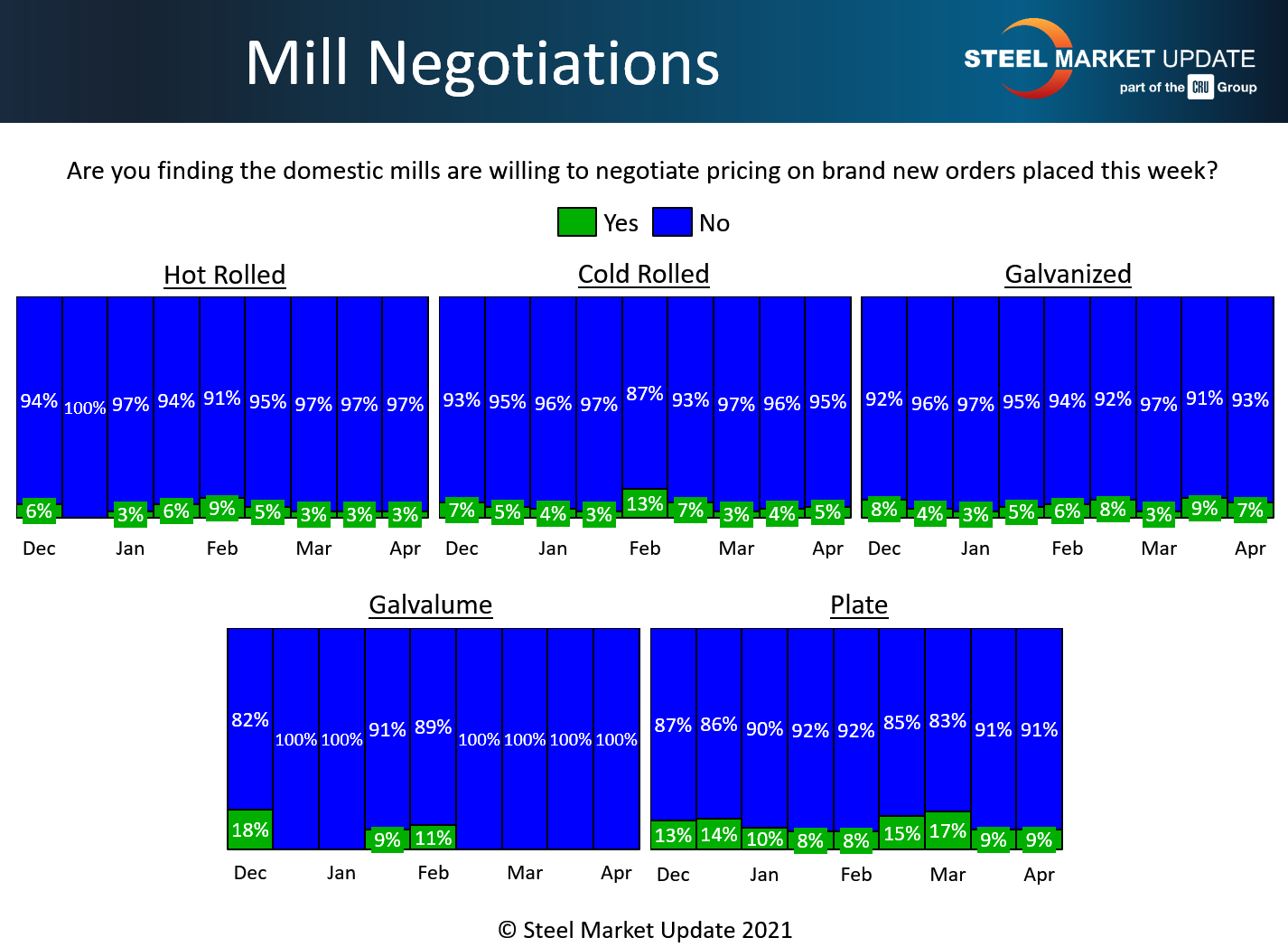

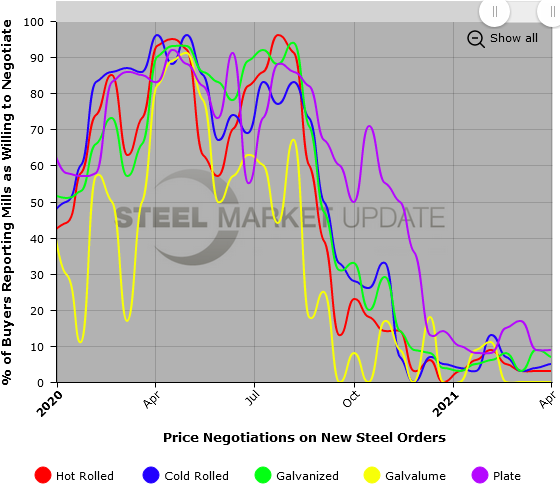

The percentage of buyers who reported some mills willing to negotiate is in the single digits (see the charts below), where it has been since November for most flat rolled products. Price talks for plate are nearly as one-sided in the current environment, with steel prices at historic highs.

Steel Market Update’s check of the market this week puts the current benchmark price for hot rolled steel at a new record of $1,330 per ton ($66.50/cwt). Most buyers polled by SMU this week speculate that prices will continue to rise to $1,350-1,400 or more before peaking and beginning to correct perhaps sometime in April or May. Until then, the mills are expected to enjoy the dominant bargaining position.

Note: These negotiations data are based on the average from manufacturers and steel service centers who participated in this week’s SMU market trends analysis. To see an interactive history of our negotiations data, visit our website here.

By Tim Triplett, Tim@SteelMarketUpdate.com