Market Data

April 1, 2021

Steel Mill Lead Times: Longest in a Decade

Written by Tim Triplett

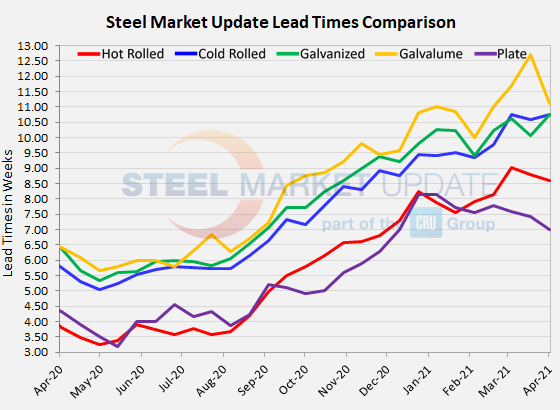

Steel Market Update’s lead times data has seen only small changes from week to week since early March. Average lead times for hot rolled steel remain highly extended at just under nine weeks, while deliveries of cold rolled and coated products now take nearly 11 weeks. Lead times are an indicator of steel demand—the longer the average lead time, the busier the mills, and the less likely they are to discount prices.

In the decade that SMU has been gathering this data, lead times have never been longer than in the first quarter of this year. Adding the times that mills are even later than promised, and lead times are about as long as they are likely to get, based on the historical record. Said one buyer to SMU: “Lead times remain stretched out, and they [mills] are all running tardy beyond that.”

The question on everyone’s mind: When will delivery times start to improve? So far, there’s no sign of any significant shortening.

Current hot rolled lead times now average 8.83 weeks, up from 8.59 two weeks ago. Cold rolled lead times now average 10.71 weeks, virtually unchanged from two weeks ago. In coated products, galvanized lead times dipped to 10.58 from 10.75 weeks in SMU’s last check of the market. The current average Galvalume lead time moved up to 11.57 weeks from 11.11 in the last survey. Plate lead times increased to an average of 7.75 weeks from 7.43 weeks earlier this month.

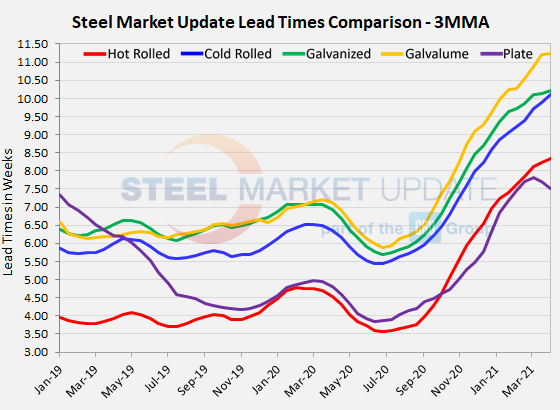

Viewed as three-month moving averages to smooth out the volatility, hot rolled lead times have continued to extend to 8.55 weeks, cold rolled to 10.32 weeks, galvanized to 10.28 weeks, and Galvalume to 11.35 weeks, while plate’s 3MMA was little changed at 7.52 weeks.

SMU’s check of the market this week puts the benchmark hot rolled steel price at $1,370 per ton, an all-time high, which makes sense given the unprecedented lead times.

Note: These lead times are based on the average from manufacturers and steel service centers who participated in this week’s SMU market trends analysis. Our lead times do not predict what any individual may get from any specific mill supplier. Look to your mill rep for actual lead times. Our lead times are meant only to identify trends and changes in the marketplace. To see an interactive history of our Steel Mill Lead Times data, visit our website here.

By Tim Triplett, Tim@SteelMarketUpdate.com