Market Data

April 1, 2021

SMU Steel Buyers Sentiment: Steadfastly Positive

Written by Tim Triplett

The prevailing sentiment among steel buyers remains as steadfastly positive as steel prices are steadfastly high. Steel Market Update’s Steel Buyers Sentiment Index saw only minor changes since SMU’s last check of the market.

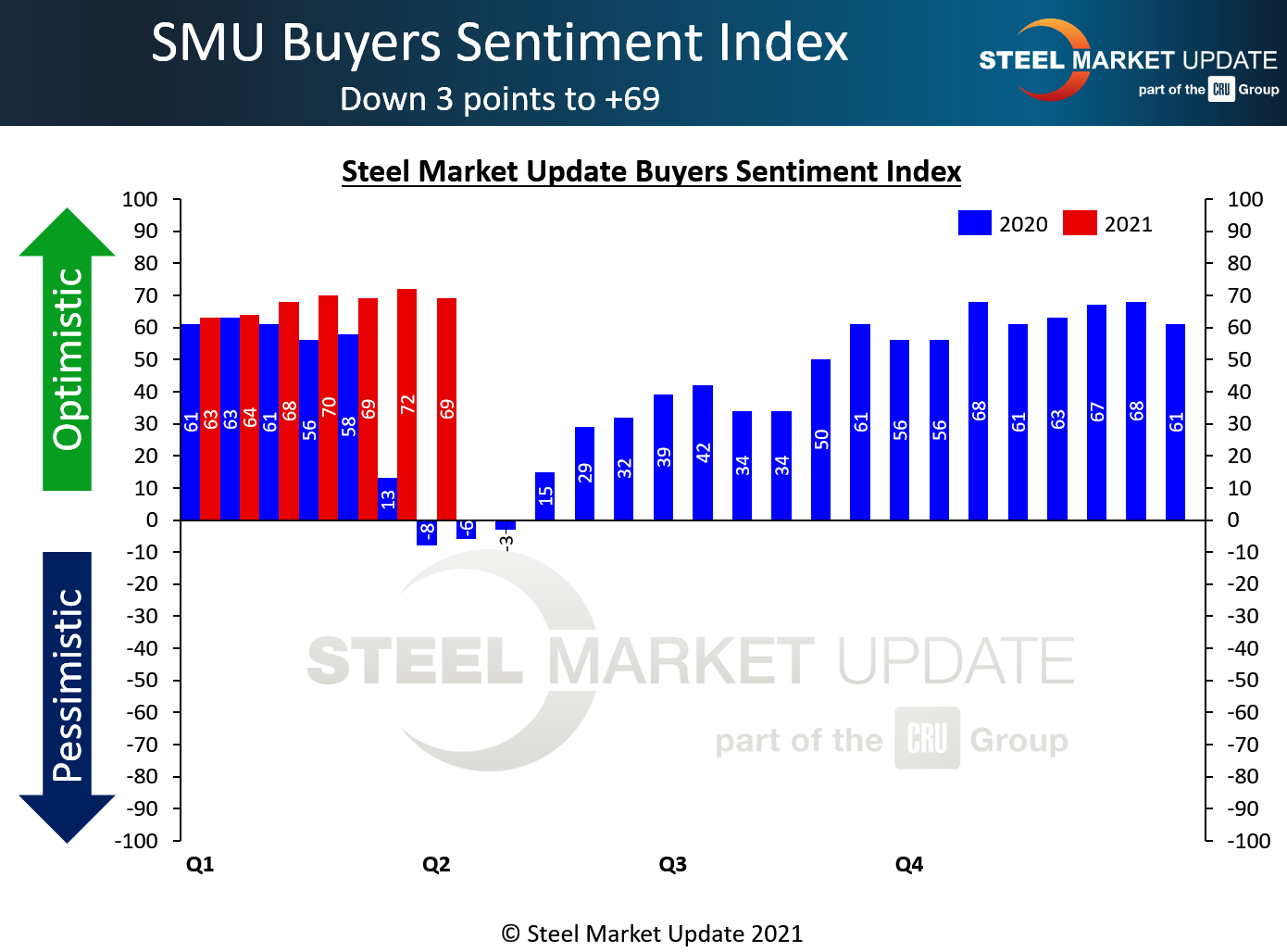

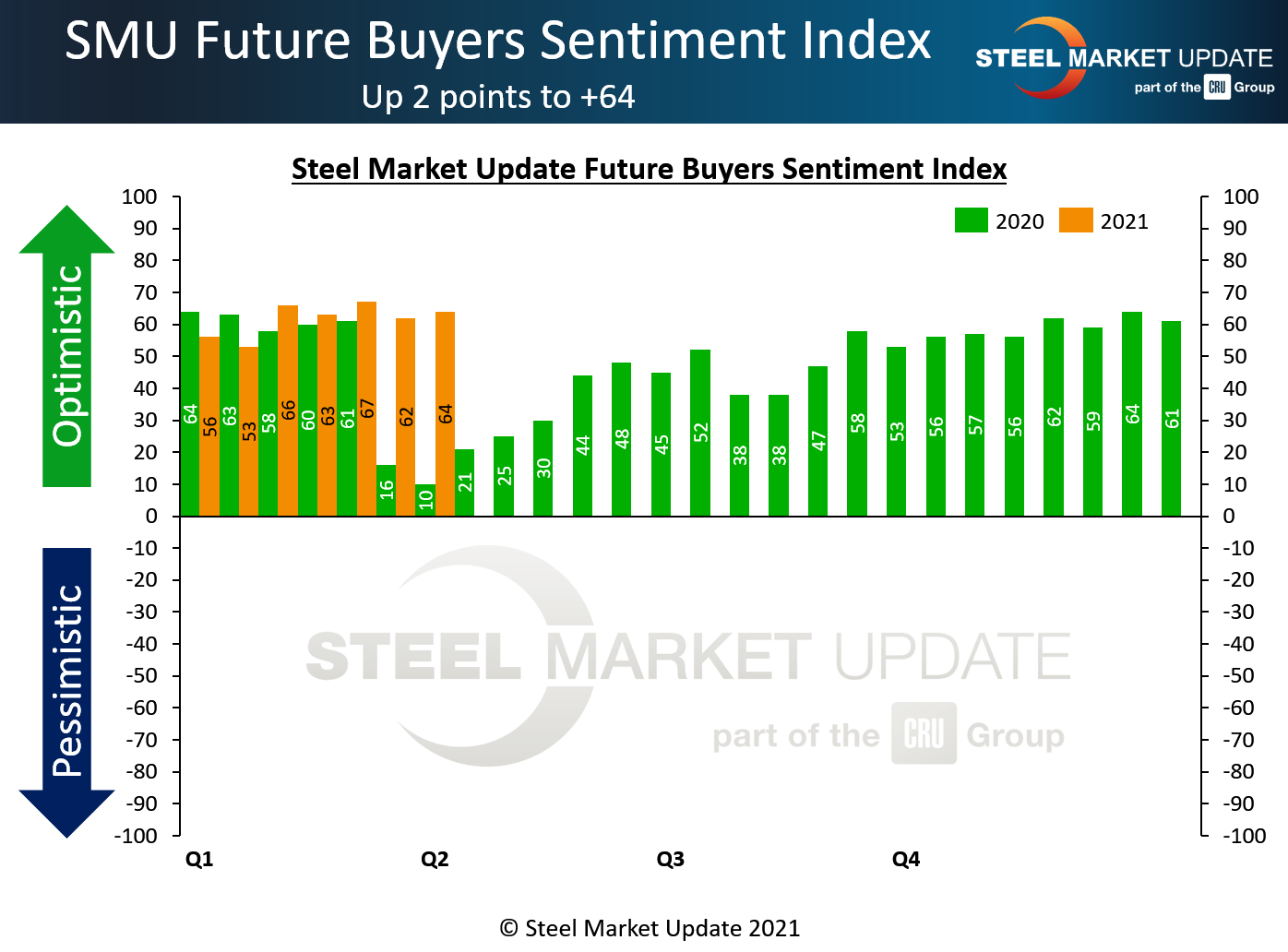

Every two weeks, SMU asks buyers how they view their company’s chances for success in the current environment, as well as three to six months in the future. SMU’s Current Buyers Sentiment Index measured a very optimistic +69, down three points from a +72 earlier in the month, which was its highest reading since May 2018. SMU’s Future Sentiment Index saw a two-point uptick to another very positive reading of +64.

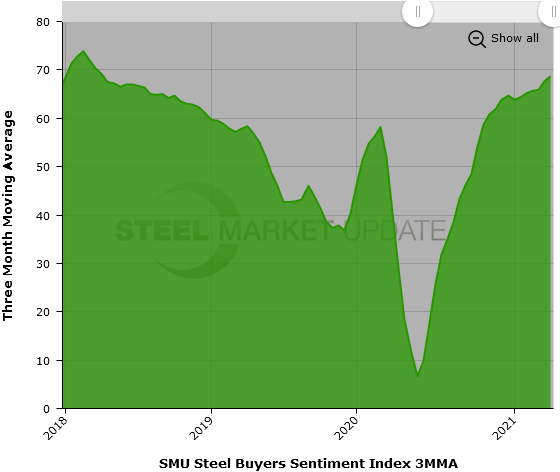

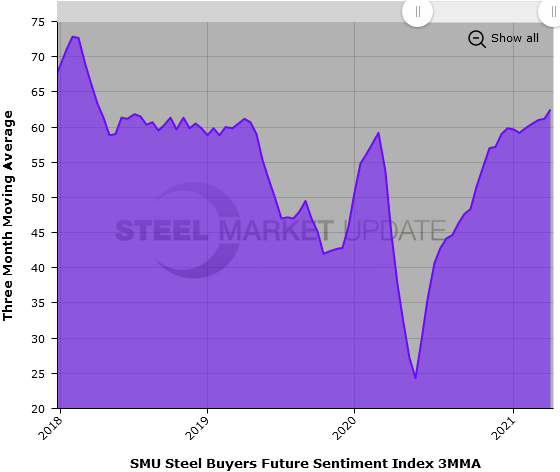

Measured as a three-month moving average (3MMA) to smooth out the variability, Current Sentiment hit +68.67 this week, while the Future Sentiment 3MMA rose to +62.50—both still well above the historical averages.

SMU’s check of the market this week puts the average price of hot rolled steel at a new high of $1,330 per ton. Other flat rolled and plate products are at record levels as well. The profitability of such high price levels is apparent in buyers’ bullish sentiment.

What Respondents are Saying

“As long as our supply stream continues, we will be good. If it were to increase, we’d be excellent.”

“Good for a short time, but you know the mills will chase each other to the bottom.”

“Bookings are stronger, but how long will it last?”

“January was a record-setting month with regards to profitability, only to be outdone by February, which will be outdone by March. Looking ahead, I have no doubt that April will then surpass March’s figures as well. Needless to say, this is a fun run and something every service center needed/deserved.”

“Profit-wise good, volume-wise we could be selling at least 10-15% more if we could get our hands on it.”

“Will have to make very difficult decisions about this business and customers being serviced if we cannot digest the barrage of increases coming at us.”

“Our second quarter is always stronger than the first. We’re concerned that pricing is going to slow demand further and availability will hurt us even more if we have less steel available in the second quarter.”

“Things should still be good [six months in the future], as we aren’t anticipating a drastic fall-off like ’09 and ’19, but realistically it won’t be as rosy as current conditions. That being said, Uncle Joe’s [President Biden’s infrastructure/jobs] speech come Wednesday could change that a bit.”

About the SMU Steel Buyers Sentiment Index

SMU Steel Buyers Sentiment Index is a measurement of the current attitude of buyers and sellers of flat rolled steel products in North America regarding how they feel about their company’s opportunity for success in today’s market. It is a proprietary product developed by Steel Market Update for the North American steel industry.

Positive readings will run from +10 to +100 and the arrow will point to the righthand side of the meter located on the Home Page of our website indicating a positive or optimistic sentiment. Negative readings will run from -10 to -100 and the arrow will point to the lefthand side of the meter on our website indicating negative or pessimistic sentiment. A reading of “0” (+/- 10) indicates a neutral sentiment (or slightly optimistic or pessimistic), which is most likely an indicator of a shift occurring in the marketplace.

Readings are developed through Steel Market Update market surveys that are conducted twice per month. We display the index reading on a meter on the Home Page of our website for all to see. Currently, we send invitations to participate in our survey to more than 600 North American companies. Our normal response rate is 100-150 companies; approximately 40 percent are manufacturers, 45 percent are service centers/distributors, and 15 percent are steel mills, trading companies or toll processors involved in the steel business. Click here to view an interactive graphic of the SMU Steel Buyers Sentiment Index or the SMU Future Steel Buyers Sentiment Index.

By Tim Triplett, Tim@SteelMarketUpdate.com