Market Data

April 1, 2021

Mill Lead Times/Negotiations: Lateness Worsens Long Lead Times

Written by Tim Triplett

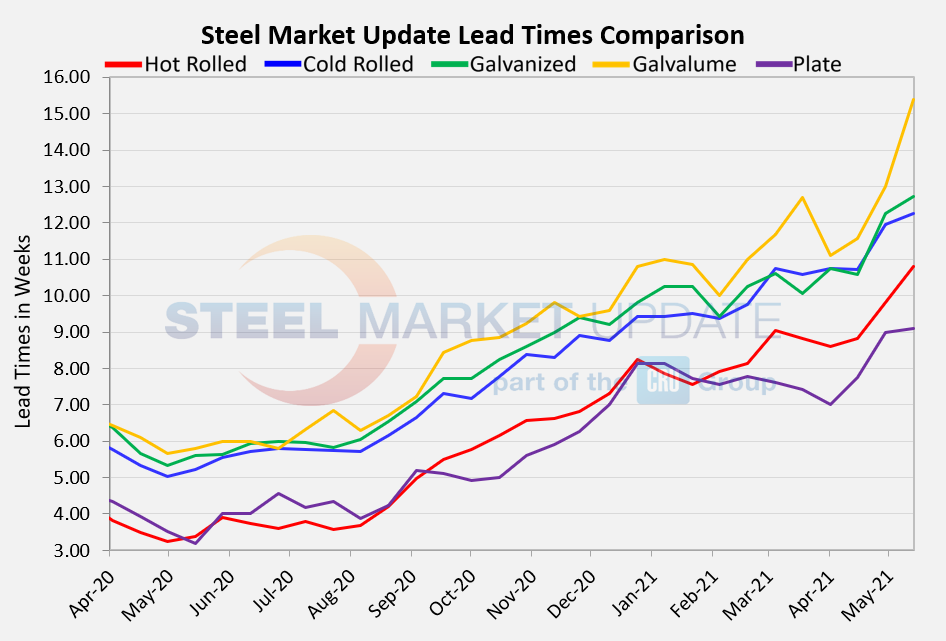

It’s hard to believe that lead times could get much longer, but that appears to be the case. Steel Market Update’s latest survey data shows that flat rolled delivery times have stretched by an additional one to two weeks over the past month.

Lead times are an indicator of steel demand—the longer the average lead time, the busier the mills. Busy mills have little incentive to negotiate on prices. Buyers report that mills are frequently late on promised delivery dates, due in part to the tight shipping capacity in trucking and rail, so that lateness may be reflected in the following lead times data.

According to SMU’s check of the market this week, lead times for spot orders of hot rolled now average 10.81 weeks, two weeks longer than the 8.83 weeks reported at this time last month. Cold rolled lead times now average 12.25 weeks, up from 10.71 weeks in mid-April.

In coated products, galvanized lead times jumped to 12.71 from 10.58 weeks. The current average Galvalume lead time has moved up to a whopping 15.40 weeks from 13.00 weeks last month.

Likewise, plate lead times have jumped to 9.10 weeks from 7.75 weeks in the middle of last month.

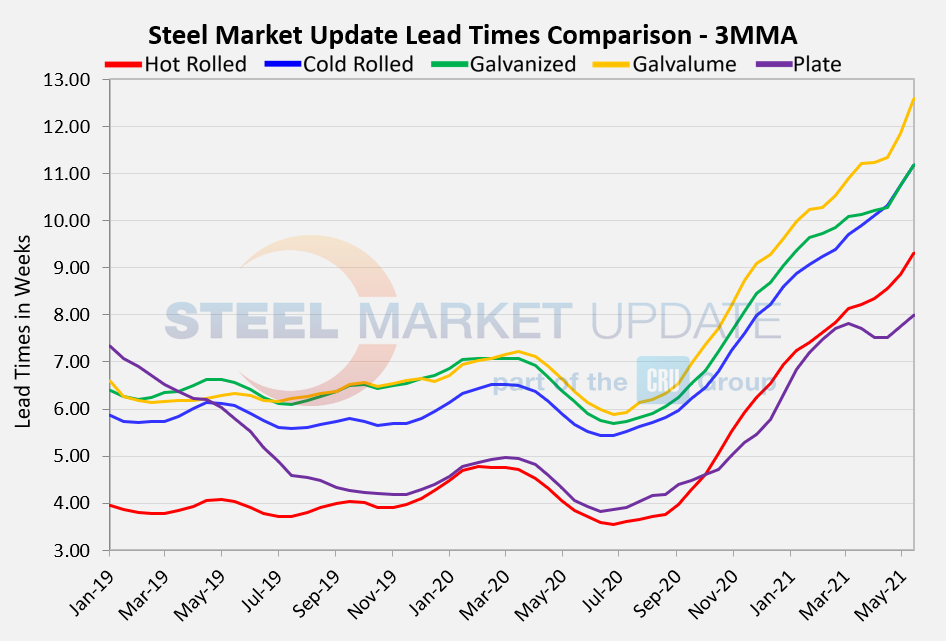

Lead times have been extending since last June, based on three-month moving averages which smooth out the weekly volatility. The 3MMA for hot rolled lead times now averages 9.31 weeks, cold rolled 11.16 weeks, galvanized 11.16 weeks, and Galvalume 12.58 weeks, while plate’s 3MMA is up to 7.98 weeks. Thus, lead times at roughly twice the historical averages have been the norm for an extended period and show no signs of reversing. Which suggests that steel prices may have more room to rise.

Steel mills are trying to catch up, but are sometimes more than four weeks behind schedule with deliveries, reported respondents to SMU’s survey. “Not only are the lead times extended way beyond historical averages, but pretty much every mill is either on allocation and/or running tardy on their shipments,” said one buyer. “The real question is not the lead time, but the delivery of already placed orders. It almost does not matter on the official lead time,” said another.

Note: These lead times are based on the average from manufacturers and steel service centers who participated in this week’s SMU market trends analysis. Our lead times do not predict what any individual may get from any specific mill supplier. Look to your mill rep for actual lead times. Our lead times are meant only to identify trends and changes in the marketplace. To see an interactive history of our Steel Mill Lead Times data, visit our website here.

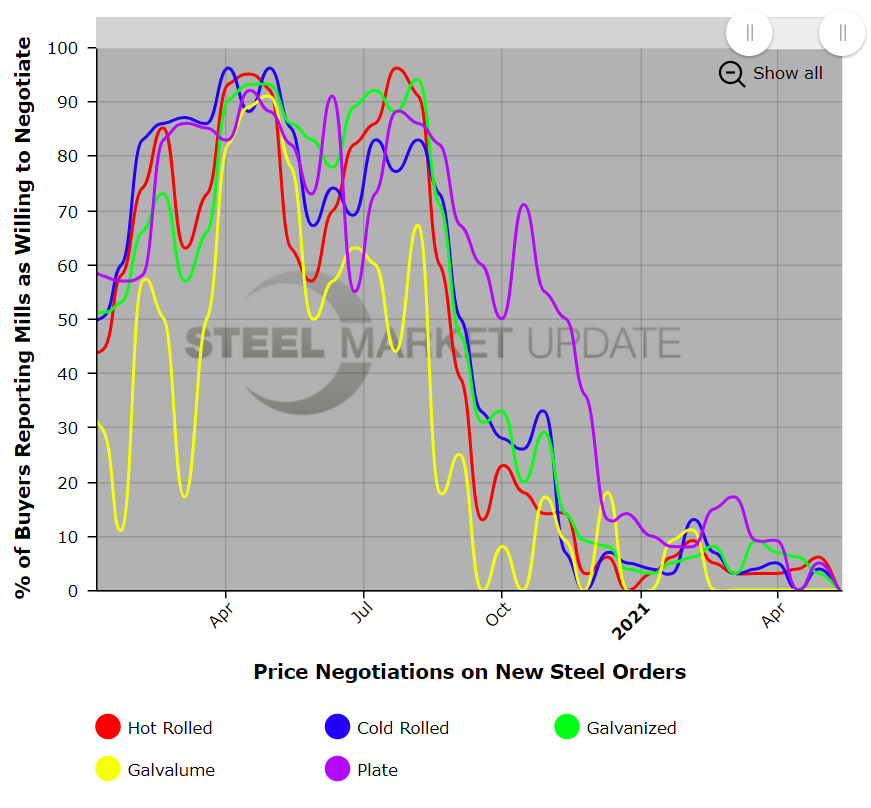

Negotiations

None of the respondents to this week’s survey reported any mills willing to negotiate on steel prices. Given the current high-demand, low-supply environment, the mills have all the leverage in price talks.

SMU asked: Are you finding the domestic mills are willing to negotiate hot rolled spot pricing on new orders placed this week? “Anyone who says yes must be delusional,” commented one service center executive. “The Midwest folks have pretty much no P&O, cold rolled or galv to sell on the West Coast. We aren’t getting any offers, period,” said another. “There might be a few more tons available (MIGHT BE),” added a third, “but mills definitely aren’t negotiating price.”

By Tim Triplett, Tim@SteelMarketUpdate.com