Market Data

April 1, 2021

Mill Lead Times/Negotiations: HR Extends to Almost 10 Weeks

Written by Tim Triplett

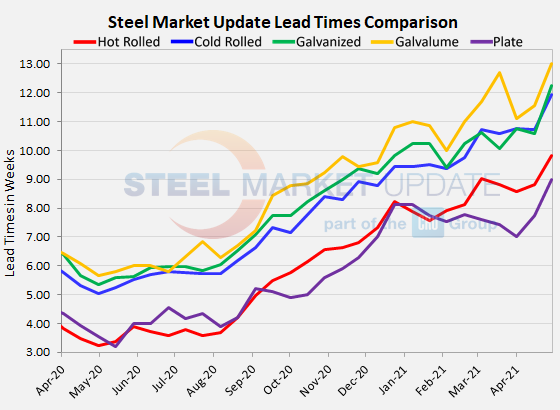

Steel Market Update’s latest lead times data shows a significant increase in delivery times for spot orders of flat rolled and plate from the mills. The average lead time for hot rolled is now nearly 10 weeks and coated products around 12 weeks—an increase of a week or more from the last survey in mid-April. Lead times have never been more extended in the decade that SMU has been gathering this data.

It’s unclear why such a big change has shown up in the data over the past two weeks. Buyers have been complaining that the mills are running late, often missing promised delivery dates by days or weeks. Perhaps more respondents included the lateness of deliveries in their lead time estimates. SMU also made a slight change to our survey methodology recently, introducing a “slider” bar that makes it easier for people to respond more precisely. That may have had a slight effect on the comparability of this week’s data to past history.

Another theory is that mills have run short of substrate to supply their own coating lines and so are buying steel from each other – something that has resulted in even more extended lead times for their customers.

But the conclusion that can be drawn from the numbers remains the same. The scarcity of supply has pushed lead times for spot orders well into the summer months, making it difficult for service centers and manufacturers to acquire enough inventory to service their customers’ needs.

Lead times are an indicator of steel demand—the longer the average lead time, the busier the mills, and the less likely they are to discount prices. According to the survey, current hot rolled lead times now average 9.81 weeks, up from 8.83 two weeks ago. Cold rolled lead times now average 11.95 weeks, up from 10.71 weeks in the last survey. In coated products, galvanized lead times jumped to 12.27 from 10.58 weeks. The current average Galvalume lead time moved up to 13.00 weeks from 11.57 earlier in the month. Plate lead times have jumped to 9.00 weeks, up from 7.75 weeks in mid-April.

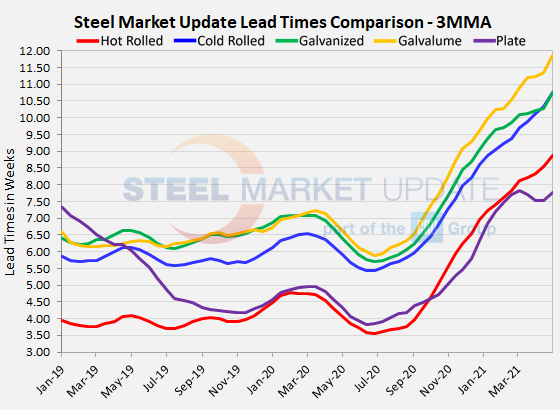

Viewed as three-month moving averages to smooth out the volatility, hot rolled lead times have continued to extend to 8.87 weeks, cold rolled to 10.75 weeks, galvanized to 10.75 weeks, and Galvalume to 11.85 weeks, while plate’s 3MMA is slightly higher at 7.76 weeks.

SMU’s check of the market this week puts the benchmark hot rolled steel price at $1,440 per ton, another all-time high, and in line with these unprecedented lead times.

Note: These lead times are based on the average from manufacturers and steel service centers who participated in this week’s SMU market trends analysis. Our lead times do not predict what any individual may get from any specific mill supplier. Look to your mill rep for actual lead times. Our lead times are meant only to identify trends and changes in the marketplace. To see an interactive history of our Steel Mill Lead Times data, visit our website here.

Negotiations

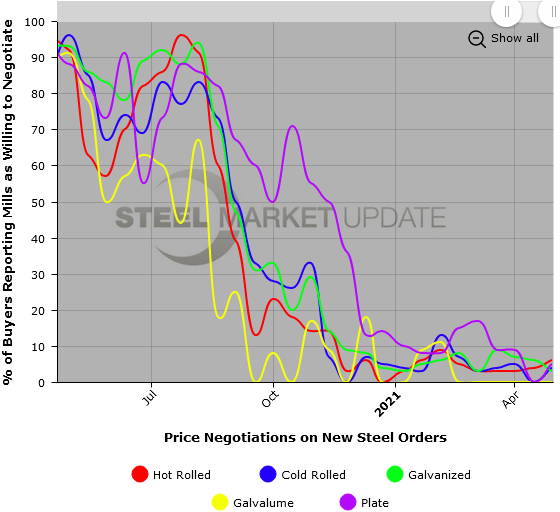

More than nine out of 10 respondents to this week’s survey reported that the mills are still unwilling to negotiate on steel prices. The combination of extended lead times and little or no bargaining between the mills and buyers points to even higher steel prices in the weeks ahead.

By Tim Triplett, Tim@SteelMarketUpdate.com