Market Data

April 1, 2021

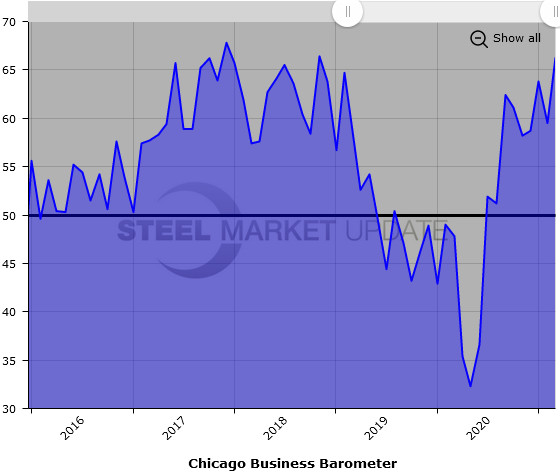

Chicago Business Barometer Soars in March

Written by Sandy Williams

The Chicago Business Barometer reached its highest level since July 2018, soaring to 66.3 in March from 59.5 in February, reports MNI indicators. For the first quarter of 2021, the index gained 4.4 points for a reading of 63.2, the best result since Q3 2018.

The production index soared 10.1 points to 72.0 in March for a three-year high. The new orders index climbed 7.1 points to 62.3. Firms in the survey were optimistic and noted a pick-up in business. Employment expanded above 50 for the first time since June 2019, gaining 5.5 points.

The March order backlogs index fell six points after reaching its highest level since October 2017 in February. Inventories remained above the 50-mark for a third month, gaining 5.1 points, and were mainly driven by supply chain issues, said MNI Indicators. Supplier deliveries lengthened to a 47-year high.

Prices increased at the factory gate for a seventh month putting the index at its highest level since August 2018. Prices for the first quarter rose to an index reading of 76.9. Higher steel prices were noted in March.

Nearly 68 percent of survey respondents said they are planning changes to their inventory levels due to supplier lead times, while 43.2 percent cited logistical issues as a reason.

Below is a graph showing the history of the Chicago Business Barometer. You will need to view the graph on our website to use its interactive features; you can do so by clicking here. If you need assistance logging in to or navigating the website, please contact us at info@SteelMarketUpdate.com.