Market Data

March 19, 2021

SMU Steel Buyers Sentiment: Less Bullish on the Future

Written by Tim Triplett

Steel buyers are considerably more confident of their near-term than their future prospects, according to the latest findings from Steel Market Update.

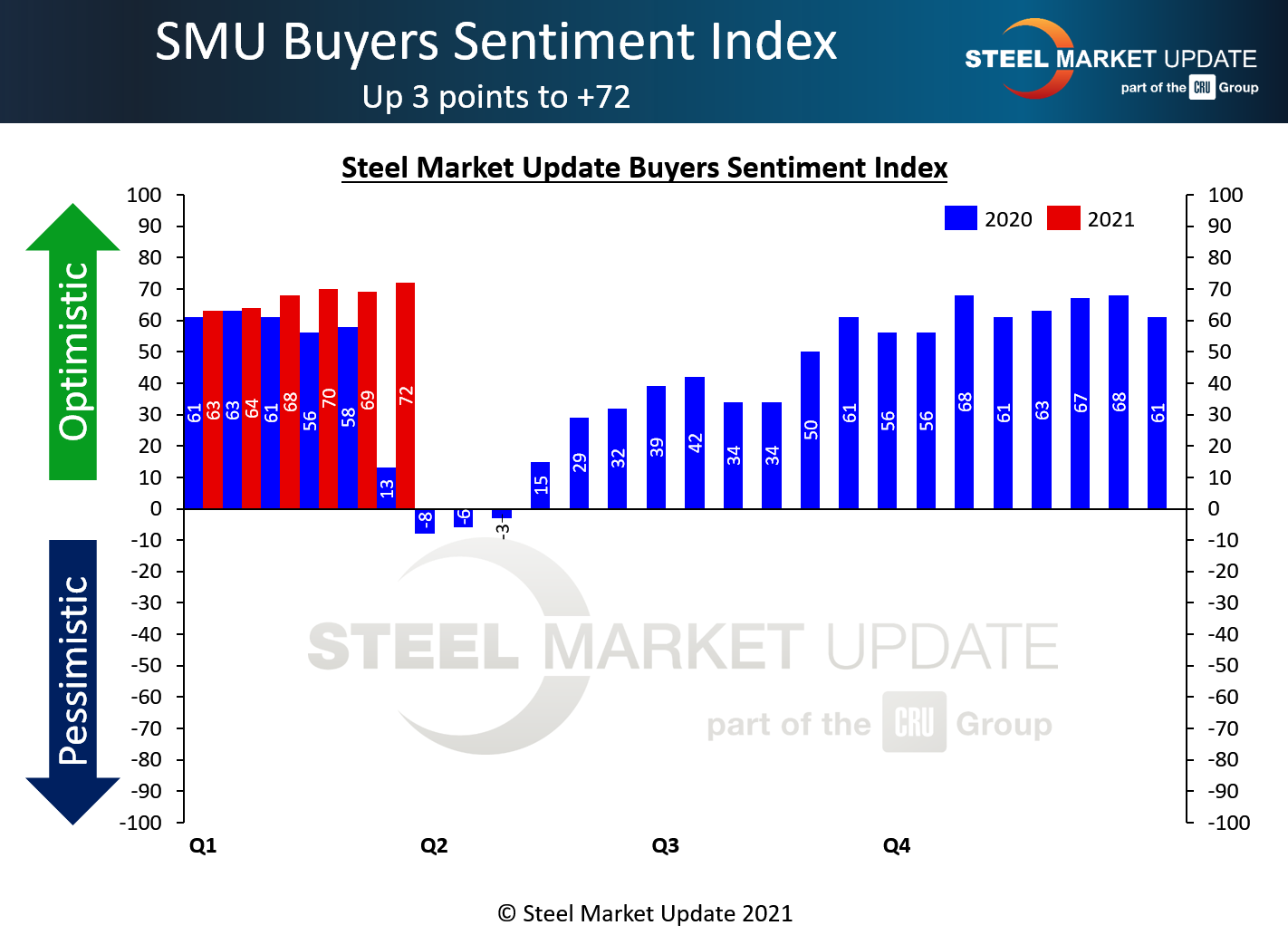

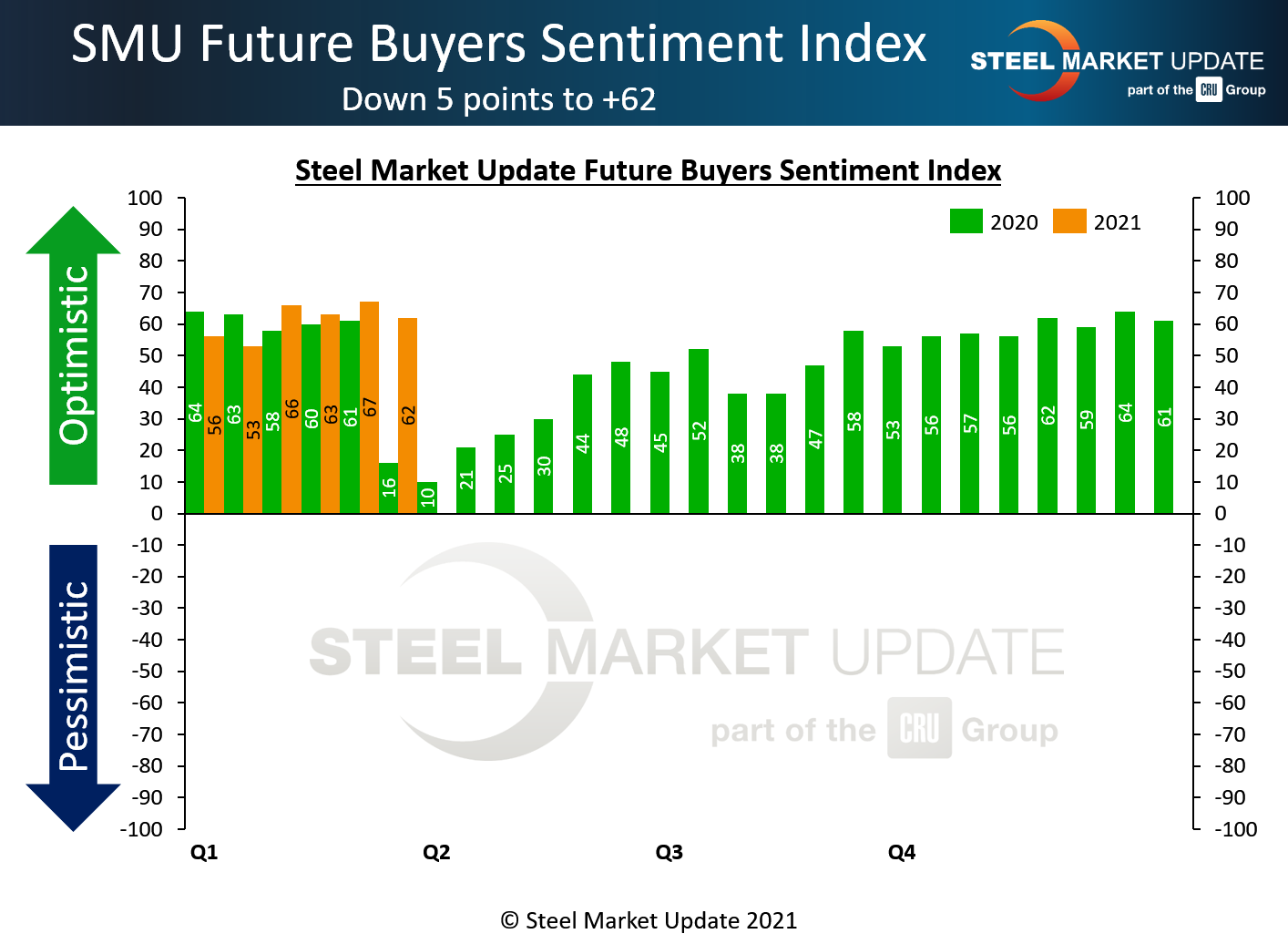

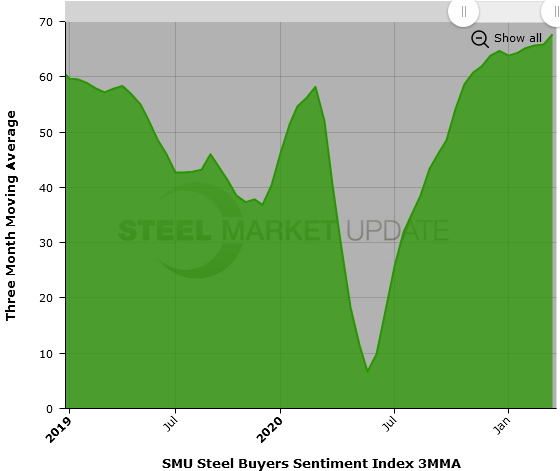

Every two weeks, SMU asks buyers how they view their company’s chances for success in the current environment, as well as three to six months in the future. SMU’s Current Buyers Sentiment Index measured a very optimistic +72 this week—its highest reading since May 2018 and an impressive rebound from the low of -8 registered in April 2020 right after the pandemic hobbled the economy. At +72, the index is just shy of its highest reading ever on the 200-point scale of +78 in January 2018.

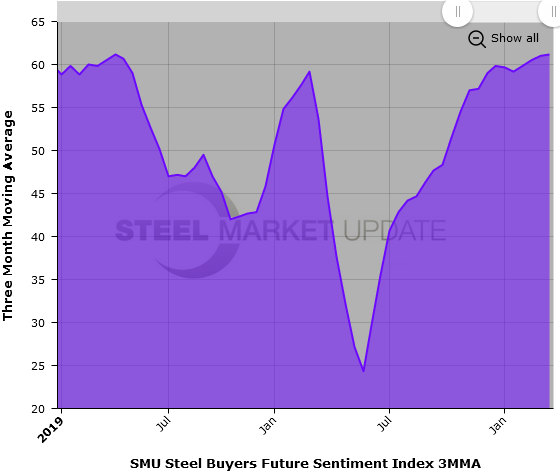

On the other hand, SMU’s Future Sentiment Index saw a five-point dip this month to a reading of +62—still very positive, but noticeably less bullish than Current Sentiment. To put that figure in perspective, it shows a big recovery from the low of just +10 in the early stages of the pandemic, but it’s still well shy of the highest reading ever at +77 in February 2018.

Measured as a three-month moving average (3MMA) to smooth out the variability, Current Sentiment hit +67.67 this week, while the Future Sentiment 3MMA was lower +61.17—both still well above average.

Why the 10-point difference between Current and Future Sentiment? Comments from respondents suggest it has to do with the different perceptions of current and future prices. SMU’s check of the market this week puts the average price of hot rolled steel at a new high of $1,300 per ton. Other flat rolled and plate products are flirting with new highs as well. At those prices, to put it simply, mills and service centers are making a lot of money. Thus the robust sentiment readings.

Will the market be as profitable six months from now? Most in the industry are doubtful. The consensus among executives responding to SMU polls recently calls for steel prices to peak in the next couple months at perhaps $1,350 per ton, then decline in the second half of the year as new mill capacity and import arrivals ease the squeeze on supplies. That, of course, is all speculation, and explains why buyers are less certain about the future.

What Respondents are Saying

Comments from respondents reveal ongoing concerns about the shortage of supplies and the potential for record-high steel prices to drop:

“I think we will create an artificial recession for our industry based on [the high] pricing and [lack of] availability.”

“Until the supply/demand balance is restored, and power is wrested from the self-serving hands of the mills, our ability to succeed will remain uncertain while the mills print money at our expense.”

“We’ve got a nice mix of contract and spot business, so we are pretty darned pleased with how the entire year is looking. But again, we are being very disciplined on the buy side and making sure we don’t get caught holding the bag if this thing does reverse course in Q3.”

“Any service center who isn’t enjoying this profitable chaos should hang up their holster.”

“It will be a wild ride up and a wild ride down.”

About the SMU Steel Buyers Sentiment Index

SMU Steel Buyers Sentiment Index is a measurement of the current attitude of buyers and sellers of flat rolled steel products in North America regarding how they feel about their company’s opportunity for success in today’s market. It is a proprietary product developed by Steel Market Update for the North American steel industry.

Positive readings will run from +10 to +100 and the arrow will point to the righthand side of the meter located on the Home Page of our website indicating a positive or optimistic sentiment. Negative readings will run from -10 to -100 and the arrow will point to the lefthand side of the meter on our website indicating negative or pessimistic sentiment. A reading of “0” (+/- 10) indicates a neutral sentiment (or slightly optimistic or pessimistic), which is most likely an indicator of a shift occurring in the marketplace.

Readings are developed through Steel Market Update market surveys that are conducted twice per month. We display the index reading on a meter on the Home Page of our website for all to see. Currently, we send invitations to participate in our survey to more than 600 North American companies. Our normal response rate is 100-150 companies; approximately 40 percent are manufacturers, 45 percent are service centers/distributors, and 15 percent are steel mills, trading companies or toll processors involved in the steel business. Click here to view an interactive graphic of the SMU Steel Buyers Sentiment Index or the SMU Future Steel Buyers Sentiment Index.

By Tim Triplett, Tim@SteelMarketUpdate.com