CRU

March 16, 2021

CRU: Zinc’s Price is Not Far from the Substitution Danger Zone

Written by Helen O’Cleary

By CRU Senior Analyst Helen O’Cleary from CRU’s Zinc Monitor.

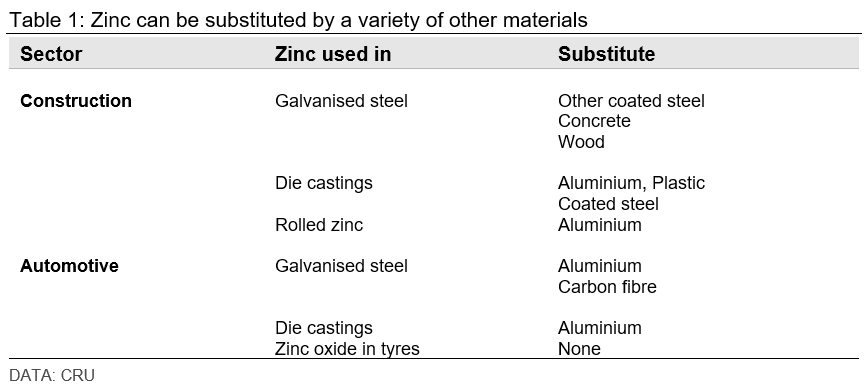

Zinc use has been optimized on an ongoing basis for decades as technological advances lead to lower raw materials usage and the development of higher-performing alloys with a lower zinc content. This is particularly true of the galvanizing industry, which accounts for around 60% of total zinc demand. While it is difficult to calculate exactly how much demand is lost to optimization due to the typically slow, long-term nature of the changes, there are circumstances in which a more pronounced switch away from zinc occurs; for example, to lower-cost materials in times of high prices or to lighter materials in the case of the automotive sector. Zinc’s superior technical properties mean it is difficult to substitute in many applications, but ongoing optimization and economization will continue to chip away at the amount of zinc consumed. In this Insight we look at the potential threats to zinc demand from price-induced and regulatory-driven substitution.

Zinc Coating Weights Have Declined in Recent Years

Zinc use per tonne of steel galvanized has declined over the past 10-15 years as coating weights have fallen due to improved manufacturing processes and the development of alloys with superior corrosion resistance to pure zinc. We understand that some galvanizers in developed economies are now consuming up to 15% less zinc than at the same galvanizing capacity 10-15 years ago, suggesting an optimization/economization loss of around 1% y/y in this sector alone.

The most recent period of price-induced demand loss in the zinc market was in late 2017/early 2018 when zinc’s price was trading in the low- to mid-$3,000s /t. While it is difficult to quantify the effect of this period of high prices on zinc demand, we collected plenty of anecdotal evidence from market contacts suggesting that the threat was real.

The galvanizing sector is relatively well protected from substitution by cheaper protective coatings for steel, such as paint, as the disadvantages of increased maintenance costs for alternative coatings versus the cost benefits of galvanizing are well understood, at least in developed economies. That said, if galvanizers get to the point where their customers refuse to accept zinc surcharges when zinc prices increase above a certain level, this will inevitably lead to demand destruction.

In developed economies, zinc is considered to be in the price-induced substitution danger zone when prices trade consistently in the $3,000-3,500 /t range (or higher) for several months. In less developed economies, where controlling up-front costs can be more important than life-time cost and quality standards are less rigorous, galvanization rates are generally lower and zinc demand is more vulnerable to sudden losses. This was the case in late-2017 when some small-scale fabricators in less economically developed parts of Asia simply ceased to operate when prices breached $3,000 /t as they were not able to pass on price increases to their customers. While we believe this was temporary in certain cases and even led to some pent-up demand once prices began to fall, in others it is likely that the losses were not regained.

High-Performing Galvanizing Alloys Threaten Zinc Demand

ZnMgAl alloys are now widely used to galvanize steel auto sheet and have identical anti-corrosion properties to more traditional zinc coatings at around 50% of the coating weight. Some galvanizing alloys, such as Galvalume, require investment in new equipment to produce, but the switch from zinc to ZnMgAl alloys or Galfan can be relatively easily made by most galvanizing lines with the use of dual, interchangeable pots.

A wholesale switch from pure zinc to Galfan (Zn 95%, Al 5%) would also cause a loss of zinc demand as only a very thin coating is required to give identical anti-corrosion properties to a thicker zinc coating. That said, Galfan has been around for many years and has not yet displaced pure zinc.

More widespread use of Galvalume (Zn 43.5%, Al 55%, Si 1.5%) in the galvanizing industry is a serious potential threat to zinc demand in a high price environment (where the zinc-aluminum price delta is favorable) due to its low zinc content. Galvalume coatings need to be thicker than some other coatings for optimum performance, but there is still a net loss of zinc demand when it is specified instead of pure zinc or high zinc-containing alloys. Although Galvalume capacity has seen little growth in Europe or the U.S. in recent years, it has grown elsewhere, for example in India, China and Vietnam.

According to the IZA, there were just 13 lines with Galvalume capability in the U.S. in 2020, out of a total of 76 operating hot dip galvanizing lines. There has been little or no investment in additional U.S. Galvalume capacity for several years, suggesting that a sudden, wholesale switch from pure zinc or alloys with a still-high zinc content is unlikely. But a wholesale switch could reduce zinc demand in certain galvanizing applications by up to 40%.

Outright Substitution Remains a Threat Due to High Prices or New Regulations

In addition to the threat of alloys containing less zinc, there is the threat of outright substitution for other materials.

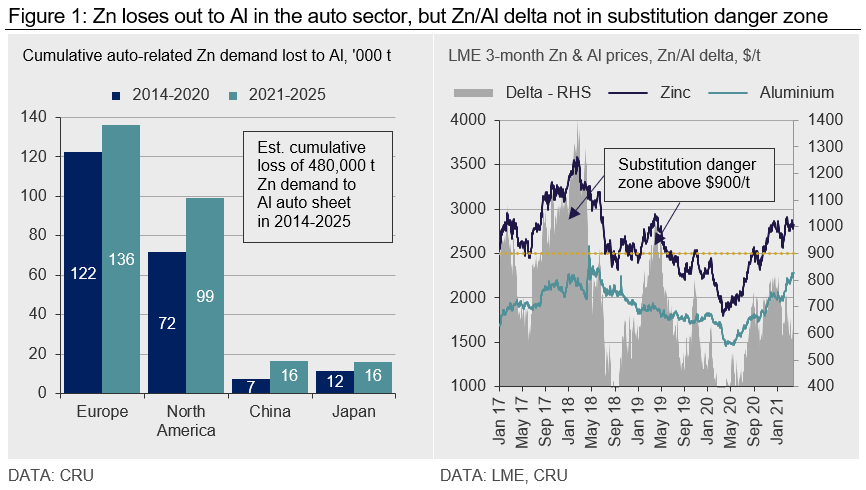

When zinc’s price increases, the immediate threat of price-induced substitution applies more to non-automotive demand, such as construction-related die casting demand, which can be lost relatively quickly to plastics, either partially or fully. If the zinc-aluminum price delta is favorable over an extended period of time, zinc die castings can also be substituted by aluminum, although there is a cost associated with switching. In 2017-2018, zinc’s price outperformed aluminum’s and the delta widened to $1,000 /t, which was widely considered to be in the substitution danger zone at the time. When both zinc and copper prices are high, as they are now, CuZn alloys like brass pipes also become more at risk of substitution, particularly in sanitary applications. Construction-related rolled zinc demand can also be hit, although the large replacement roofing sector (e.g. traditional, Parisian zinc roofs) is more likely to remain stable.

Auto-Related Zinc Demand Less Likely to See Sudden Decline

Zinc’s use in the automotive sector is better protected from the threat of sudden substitution due to long design cycles in the industry. However, that does not mean that substitution will not be an issue over the longer term, particularly as automakers have been trying to increase fuel efficiency to meet stringent emissions targets by light-weighting, among other solutions. Steelmakers have risen to the challenge by developing lighter-weight steels for the auto sector, but penetration by aluminum auto sheet looks set to continue.

Our automotive zinc demand model uses data from CRU’s Aluminum team to estimate the rate of substitution of galvanized sheet for aluminum auto sheet over time. We estimate that for every 1 t of aluminum auto sheet growth, 1.6 t of steel is lost, 0.64 t of which is galvanized. In the years 2014-2020, we estimate that a cumulative 200,000 t of auto-related zinc demand was lost to substitution by aluminum sheet in Europe, North America, China and Japan. In 2021-2025, as aluminum auto sheet penetration increases, we estimate that a further 270,000 t of cumulative zinc demand will be lost. We expect auto sector losses to be incurred irrespective of the delta between zinc and aluminum as material changes will be part of automakers’ long-term design plans. The good news is that, in the longer term, increased EV production may not hasten zinc’s auto-related demand loss as light-weighting may no longer be such a pressing issue for zero emissions vehicles. That said, a lighter vehicle is likely to improve battery life, and the risk of substitution by other materials remains.

For now, while zinc has been trading close to the substitution danger zone in pure price terms, the strength of aluminum’s recent rally means that it is not in danger in terms of price-induced substitution for aluminum in particular. But should zinc’s price breach $3,000 /t, there potentially will be danger from other, more cost-effective materials.

Request more information about this topic.

Learn more about CRU’s services at www.crugroup.com