CRU

March 16, 2021

CRU: Seasonal Slowness in Asian Sheet Markets

Written by George Pearson

By CRU Analyst George Pearson, from CRU’s Steel Sheet Products Monitor

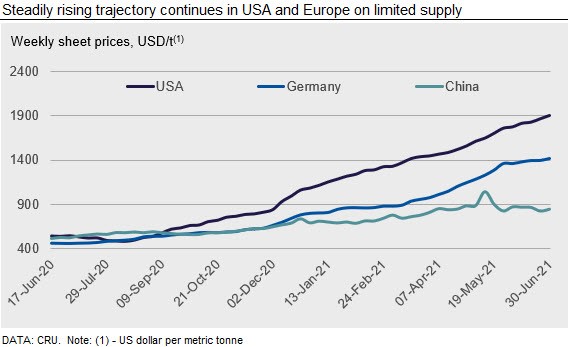

The seasonal slowdown in the physical Chinese sheet market is ongoing, with inventories rising and demand falling w/w. However, concerns about limited supply during the 100th anniversary of the Chinese Communist Party continue to boost the Chinese HR coil futures market. Prices are still edging higher in the U.S. and Europe. There is some import availability, but it is limited. Mill outages in the U.S. have reduced expectations of future supply, while a Russian export tax could also reduce quantities sold to Europe.

USA

In the U.S., steel sheet prices continued to increase with HR coil gaining $34 /s.ton w/w. News of an unplanned outage at SDI Columbus and a planned outage at Cleveland-Cliffs IH7 in September reduced buyer expectations of a near-term price peak. Unlike the last few weeks, spot offers were harder to find and mills were less willing to negotiate. Buyers reported that several mills were having production issues, causing deliveries to be delayed again, just when they thought on-time delivery was improving. New import offers were limited as companies were presented with the same offer from multiple traders, with some offers being pulled before buyers had a chance to bid on them. Demand remains robust, with buyers anticipating strong commercial conditions throughout 2021.

Sheet prices on the U.S. West Coast rose in the last week as mills began to book September orders. HR coil reached $1,850 /s.ton, an increase of $210 /s.ton m/m and base prices for CR and HDG coil passed the $2,000 /s.ton level. Mills are subject to a premium for electricity usage during daylight hours, when temperatures are elevated, forcing them to schedule production during the late afternoon and overnight hours to limit costs. This has caused further limitations on offered tonnage, with many buyers reporting their allocation for September was lower than previous months. New HR coil import offers were around $1,680 /s.ton delivered to port, with arrival expected in the latter part of 2021 Q4. Buyers were hesitant about committing to purchase material at this price with delivery so late in the year, especially with the logistical delays at U.S. ports.

Europe

European sheet prices increased by €5-28 /t w/w across all products. A gap has started to emerge again between German and Italian HR coil, for which this week’s differential is €36 /t with Italian HR coil assessed at €1,149 /t. German HR coil was assessed at €1,185 /t. ArcelorMittal increased its coil prices for the whole of Europe by another €30 /t this week, taking its offer for HR coil to €1,200 /t. Import offers into Europe have increased in the last few weeks, which appear to have affected the Italian market more than Germany. Although offered import volumes are higher than recent weeks, they are still lower than in previous years. Market feedback reports that some Italian mills have offered limited volumes on shorter lead times of July delivery. Various market participants believed this was due to automotive quantities becoming available to the market. A Russian export tax on steel products announced last week effective from August could also reduce import volumes from that point, particularly for HR coil.

China

The Chinese domestic sheet market remained weak in this assessment, with CR and HDG sheet prices edging down by RMB20-50 ($3-8) /t w/w. HR coil prices increased by RMB130 ($20) /t w/w, but this was sentiment-driven, following a rise in HR coil futures this Wednesday due to higher price expectations from stricter BF operations in Tangshan ahead of the Communist Party’s 100th anniversary celebration.

Overall, sheet demand has become seasonally slow. HR and CR coil inventories at major mills and warehouses kept increasing this week, rising by 2.2%. Sentiment was also subdued, with weakening end-use demand in the auto and home appliance sectors. Falling futures prices lately have deteriorated sentiment even further. However, raw materials prices are still elevated, and mill profitability continues to fall. Our cost model is now showing HR coil EBITDA below 9% compared with 10% last week. We expect sheet prices will continue to edge down on slower demand and weaker sentiment. With output restrictions in Tangshan and possibly other regions such as Jiangsu and more steel mills scheduling maintenance in the coming month, the supply side response is the major upside risk to our price forecast in the short-term.

Asia

Prices of imported sheet products in the Asia market fell again this week due to lack of buying interest. CRU assessed HR coil prices at $930 /t, CFR Far East Asia, down by $30 /t w/w. CR coil prices were assessed at $1,080 /t, down by $20 /t w/w, while HDG prices were assessed at $1,100 /t, down by $40 /t w/w.

For HR coil SAE1006, position cargoes of Chinese material were sold at $930-950 /t CFR Vietnam for July shipment. Offers from Indian mills dropped to $980 /t CFR Vietnam and no bids were heard. There was a rumor in the market that a big quantity of Russian material has been booked for September shipment at $850 /t CFR Vietnam. However, this material can only be used for pipe making.

For HR coil/sheet SS400, a major Chinese mill sold 20kt at $887 /t CFR Vietnam last week with the export tax risk borne by mills. Other mills were offering at $890-960 /t CFR Vietnam with buying indications at $850 /t CFR Vietnam.

India

Indian domestic sheet prices were unchanged w/w due to weak market activity. Spot buyers have adopted a wait-and-see approach ahead of official price announcements by major mills for July delivery. There are expectations that sheet and plate prices be revised down by steelmakers by around INR1000-2000 ($14-28) /t for July. However, CRU understands from mills that they are currently contemplating a rollover in price. In general, there is a downward pressure on sheet prices in the Indian market, particularly because export bookings have fallen for major Indian suppliers.

Currently, there is limited demand for Indian origin HR coil in the SE Asian market, with competitive offers coming in for CIS origin material. We have heard that Indian suppliers have slashed HR coil export offers by $40-50 /t w/w to $910-920 /t FOB, but are still not able to attract buyers due to seasonally weak demand and improved domestic supply in destinations such as Vietnam.

On the domestic demand front, auto contracts have been concluded for sheet products for Q2, at a price increase of an average INR7000 ($94) /t for HR coil and INR9500 ($128) /t for CR coil. Automakers are expected to cut down their sheet volume purchases during Q3, in line with their production schedules.

Request more information about this topic.

Learn more about CRU’s services at www.crugroup.com