Analysis

March 5, 2021

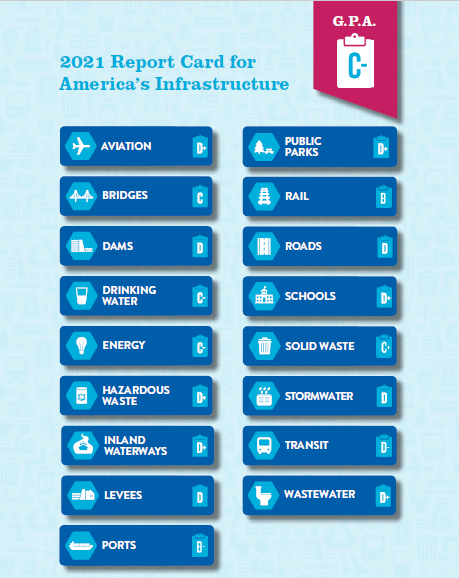

Infrastructure Gets a C- on ASCE 2021 Report Card

Written by Sandy Williams

It took 20 years, but the nation’s infrastructure GPA is no longer in the D range. The 2021 Report Card issued by the American Society of Civil Engineers gives America’s infrastructure a C-, a passing grade that still leaves plenty of room for improvement.

Rail transit was the brightest spot in this year’s report, receiving a solid grade of B followed by ports with a B-.

“The nation’s 140,000-mile rail network is its healthiest ever thanks to $25 billion on average in annual private investments,” said Ian Jefferies, president and CEO of the American Association of Railroads. “At the same time, ASCE’s report is an urgent reminder of the need for robust investment into the nation’s passenger rail lines, not to mention infrastructure more broadly.”

Amtrak carried 32.5 million passengers in 2019, primarily hosted on well-maintained freight lines privately funded through direct shipper fees. But dedicated passenger lines have been largely underfunded by state and federal government. Amtrak’s Northeast Corridor has a $45.2 billion state-of-good-repair backlog and lost 328,000 minutes in 2019 due to train delays from infrastructure issues. ASCE calls for “significant overdue investment in passenger rail infrastructure particularly in high-population centers.”

The nation’s 300-plus inland and coastal ports are a major driver of the U.S. economy supporting 30.8 million jobs in 2018 and 26% of total GDP. Many seaports have undertaken harbor dredging projects and infrastructure expansion to accommodate larger oceangoing vessels and increased tonnage. Freight distribution has been challenged with ports reporting longer wait times at docks, chassis shortages and congestion reducing efficiency.

Inland ports along the waterway system and on the Great Lakes are dealing with water level fluctuations, lock upgrades and general maintenance. The Soo Locks has finally begin a long-delayed project to add another Poe-sized lock to ensure reliable passage through the upper and lower lakes. ASCE projects a $15.5 billion funding gap for waterside infrastructure over the next 10 years with additional billions needed for landside infrastructure such as intermodal connectors.

Unsurprisingly, roads and highways again received a grade of D. ASCE said more than 40% of the U.S. road system is in poor or mediocre condition and woefully underfunded. The nation’s highways move 72 percent of freight, and significant congestion delays are common near U.S. cities. The American Trucking Association estimates the industry loses $70 billion per year sitting in traffic jams. ASCE said long-term underfunding of road maintenance has resulted in a $786 billion backlog of road and bridge capital needs. Of that amount, bridge repair will require $125 billion.

Bridges, a separate category of the report, received a grade of C. “There are more than 617,000 bridges across the United States,” said ASCE. “Currently, 42% of all bridges are at least 50 years old, and 46,154, or 7.5% of the nation’s bridges, are considered structurally deficient, meaning they are in ‘poor’ condition.” It is estimated bridge spending will need to increase from $14.4 billion annually to $22.7 billion per year. ASCE noted that at the current rate of investment, it will take 50 years to make the repairs already needed and further deterioration during the period will be “overwhelming.”

The vehicle for highway and bridge repair is primarily the Highway Trust Fund, which has been teetering on insolvency for 15 years. The Trust Fund is mostly financed through the federal motor fuel tax, which hasn’t been raised since 1993. ASCE recommends raising the fuel tax by five cents annually over the next five years as well as increasing funding from all levels of government and private sectors.

The ASCE Infrastructure Report Card includes 17 categories, 11 of which remain stuck in the D range. Although progress has been made from local to federal government to address infrastructure challenges, many sectors suffer from chronic underinvestment as well as insufficient data on infrastructure conditions.

Philip Bell, president of the Steel Manufacturers Association, said the ASCE Report Card is a “clear sign that our domestic infrastructure needs significant improvement.”

“It is our hope that any infrastructure package will include strong Buy America requirements to help ensure federal dollars are spent on American-made goods. Buy America requirements should apply to any infrastructure project funded in whole or in part with federal monies including public-private partnerships (PPPs). This will help ensure projects are not segmented for purposes of avoiding the Buy America requirements. For the steel industry, this would include requirements that domestically produced steel, used in federally funded projects, be melted and poured in the United States. American workers and products should be part of the solution to improve our country’s infrastructure.”

U.S. Steel CEO David Burritt agreed that “we’re long overdue for meaningful infrastructure funding.

“Until we take significant action, we will continue to fall behind our global competitors, while the drag on the economy continues to grow with every passing day,” Burritt said. “If Congress and the administration take decisive action and invest in infrastructure, they can create millions of jobs, make the domestic supply chain and manufacturing more competitive, and save families money. An infrastructure bill provides no-regrets stimulus, with lasting benefits to our society and economy.”

Nucor CEO Leon Topalian, in an interview with ASCE, said a $1 trillion or more infrastructure bill is needed. It is estimated that for every trillion dollars spent on infrastructure, 11 million jobs will be created.

“We operate our businesses in 40 states across this amazing nation of ours and every manufacturer in our country requires and needs a sustainable and efficient infrastructure system both for transportation as well as for energy infrastructure,” said Topalian. “I have had the opportunity over the last year as CEO of our company to talk to many of our elected officials in those 40 states, and one of the things that unites us all is the recognition that the investment needs to be brought back into this country; that we need a meaningful and significant infrastructure package and bill put forward by our leaders in Washington.”

He added: “This is a unique opportunity. Many of the roads and bridges we are driving on today were designed and built during the Eisenhower administration. We have to create the future for the next generation, and our time is now.”