Market Data

March 2, 2021

Global Steel Production Up Nearly 5.0% in January

Written by David Schollaert

Global crude steel production totaled 162.9 million tons in January, up 1.3% from the month prior and up 4.8% year over year when total production was 155.5 million metric tons. The U.S. was the fourth largest producer, accounting for 5.6% of total global crude steel produced in January at 9.6 million metric tons, while China produced more than half of the world’s total crude steel at 55.4% or 90.2 million metric tons. January’s total is especially notable because it’s compared to pre-pandemic figures from 2019. Additionally, the rebound in world crude steel production is particularly remarkable considering that global growth prospects nearly collapsed in early 2020 following the implementation of stringent containment measures to curb the spread of the COVID-19.

Despite the noted year-on-year improvement in U.S. crude steel production, there are still clear signs that the domestic market is on a corrective course, as production was down nearly 12% in the three months through January compared to the same period one year ago. By contrast, world crude steel production was up 6.3% in the same three-month period in 2020, according to data from the World Steel Association. Nevertheless, the United States’ rate of growth among the 10 major steel-producing nations was 12.7% in the three months through January, outpaced only by Russia at 14.4%.

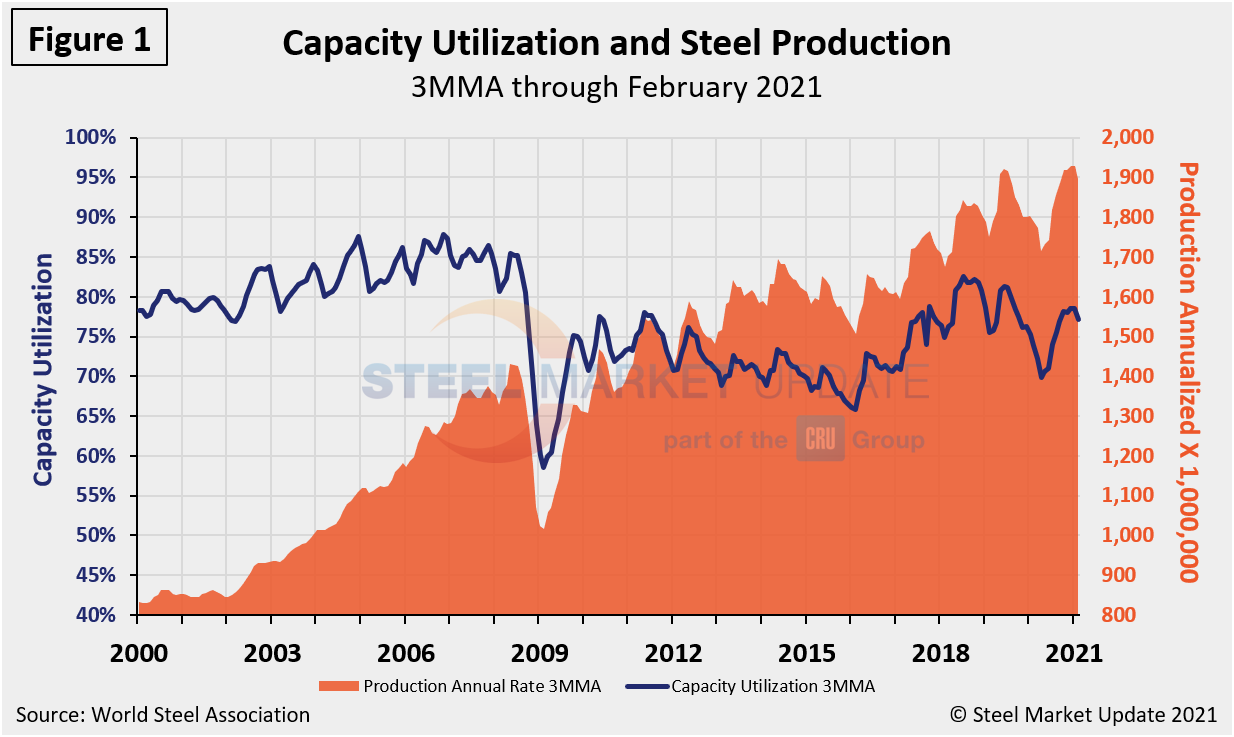

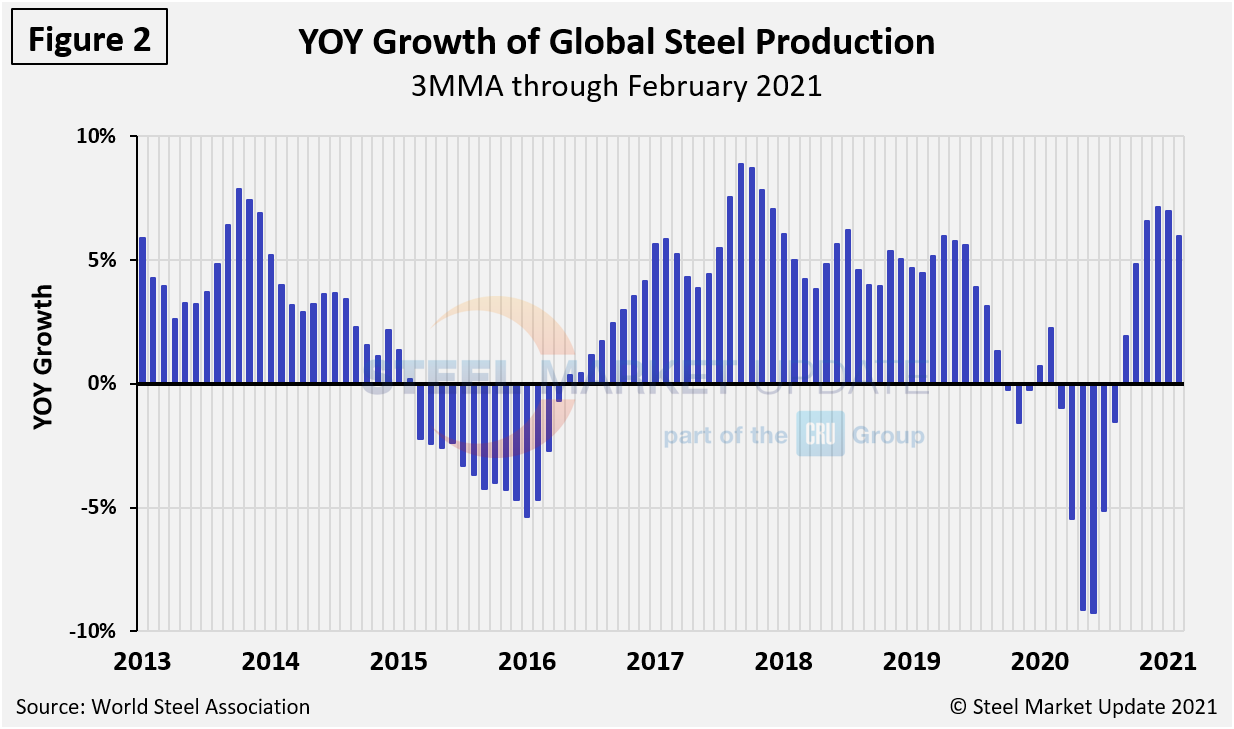

Figure 1 shows annualized monthly global steel production on a three-month moving average (3MMA) basis and capacity utilization since January 2000 based on data from the Organization for Economic Cooperation and Development (OECD), while Figure 2 shows the year-over-year growth rate of global production on the same 3MMA basis since January 2013. Capacity utilization in January on a 3MMA basis was 78.5%. On a tons-per-day basis, production in January hit 5.255 million metric tons, up from 5.189 million metric tons the month prior, but still behind the record set in June 2019 of 5.318 million metric tons. Growth in three months through January on a year-over-year basis was positive 7.0%, down 0.1% from the month prior.

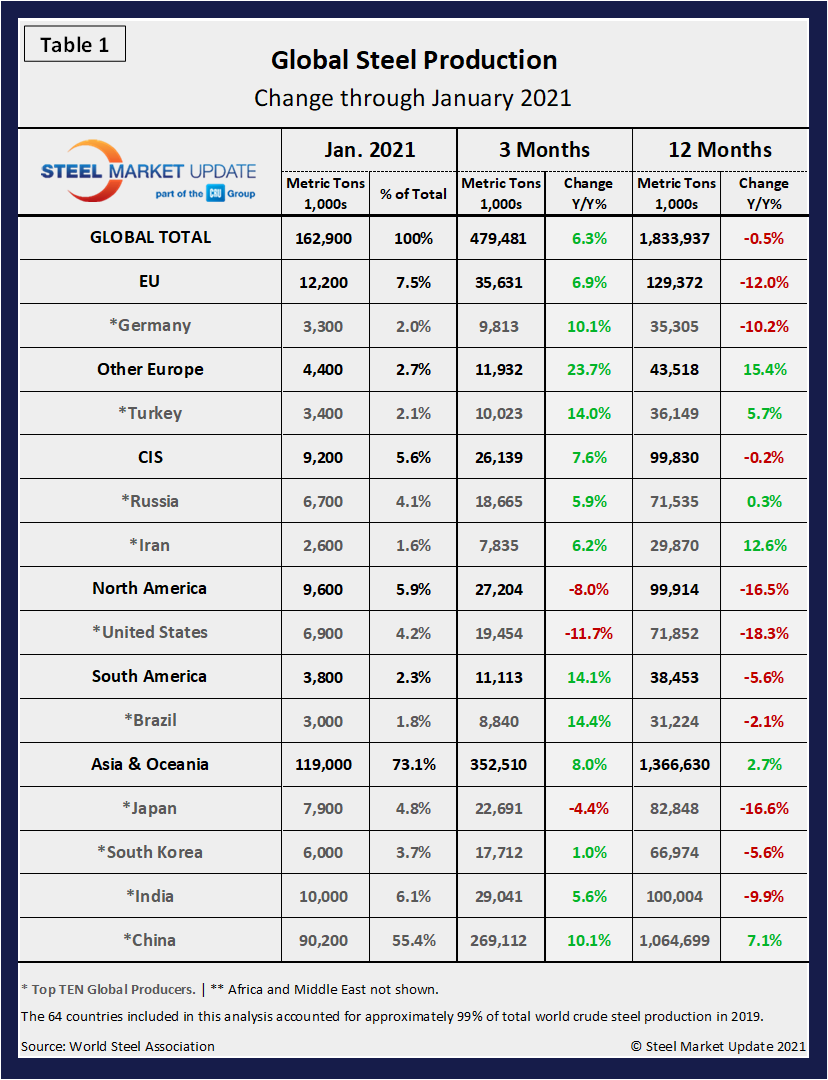

Table 1 shows global production broken down into regions, the production of the top 10 nations in the single month of January, and their share of the global total. It also shows the latest three months and 12 months of production through January with year-over-year growth rates for each period. Regions are shown in black font and individual nations in gray. The world overall had positive growth of 6.3% in three months and negative 0.5% in 12 months through January. When the three-month growth rate is higher than the 12-month growth rate, as it was in January, we interpret this to be a sign of positive momentum. On the same basis in January, China grew by 10.1% and 7.1%, and therefore also had positive momentum. Table 1 shows that North America was down by 8.0% in the three months through January, yet saw an improvement of 5.4% month on month. Of the top 10 nations shown in Table 1, the U.S. had the worst growth performance at the three-month level.

In the 12 months through January 2020, 99.9 million metric tons of steel were produced in North America, including 71.9 million tons in the U.S. Based on the latest available data from the OECD (2020 is still pending), U.S. capacity in 2019 was 109.7 million metric tons and capacity utilization in that year was 80.0%.

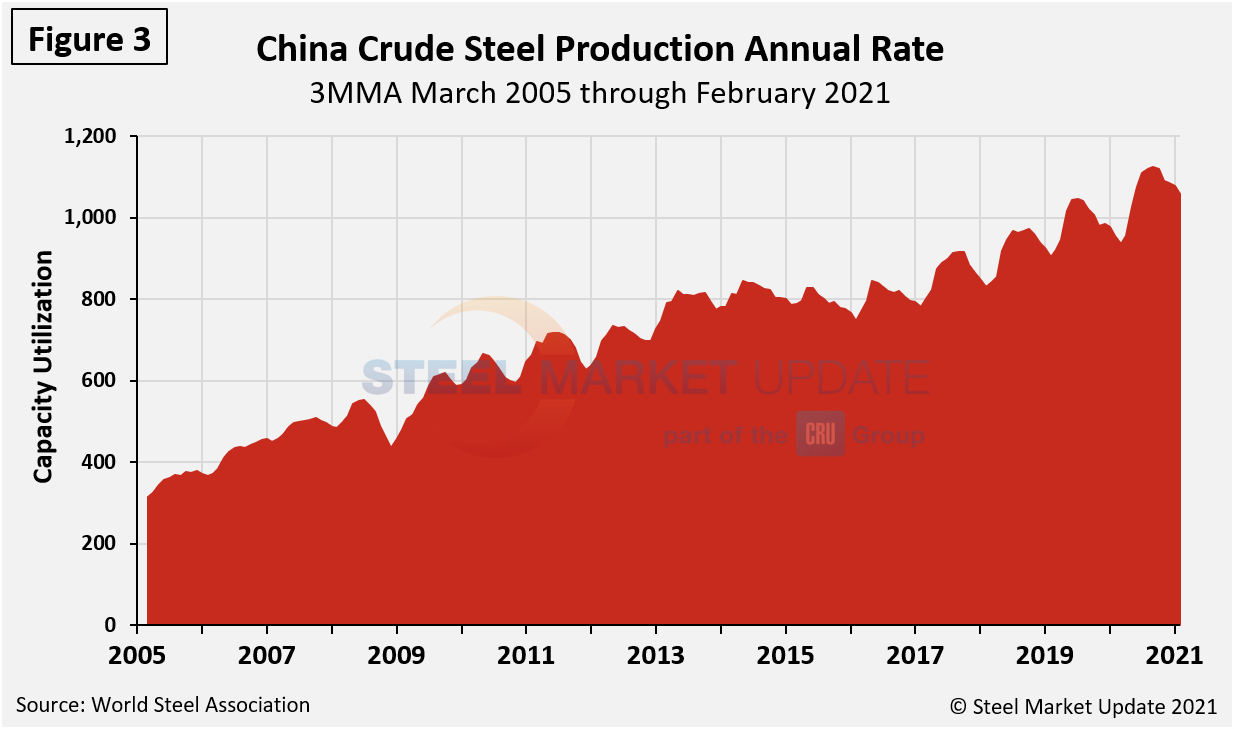

Figure 3 through 6 are devoted to China’s crude steel production. In the single month of August 2020, China’s steel production hit an all-time high of 94.8 million tons (Figure 3); however, production declined each month thereafter through November to 87.7 million tons. Since then, it has rebounded to 91.3 million tons in December and then down to 90.2 million tons in January. China’s capacity is now 1.152 billion metric tons, a reduction from 1.215 billion tons in January 2015. China’s January capacity utilization was 94.4%, up from 67.3% in January 2015 because of the capacity reduction and production increases.

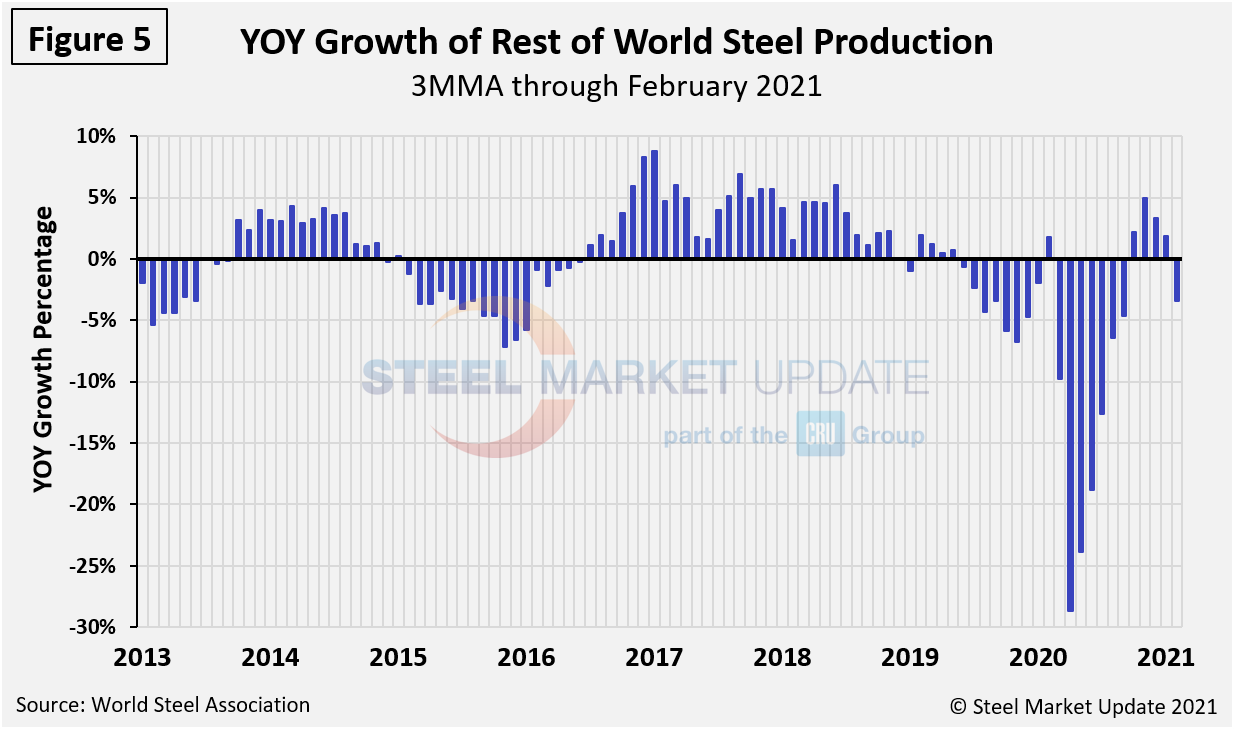

Figure 4 shows the growth of China’s steel production since March 2013 and Figure 5 shows the growth of global steel excluding China, both on a 3MMA basis. In October through January, the rest of the world’s production expanded by 3.1% as China grew by 10.1%, both year over year. This was an abrupt turnaround for the rest of the world, which contracted by 4.6% in three months through September. Turkey, Ukraine, Brazil and Iran were key drivers of this increase.

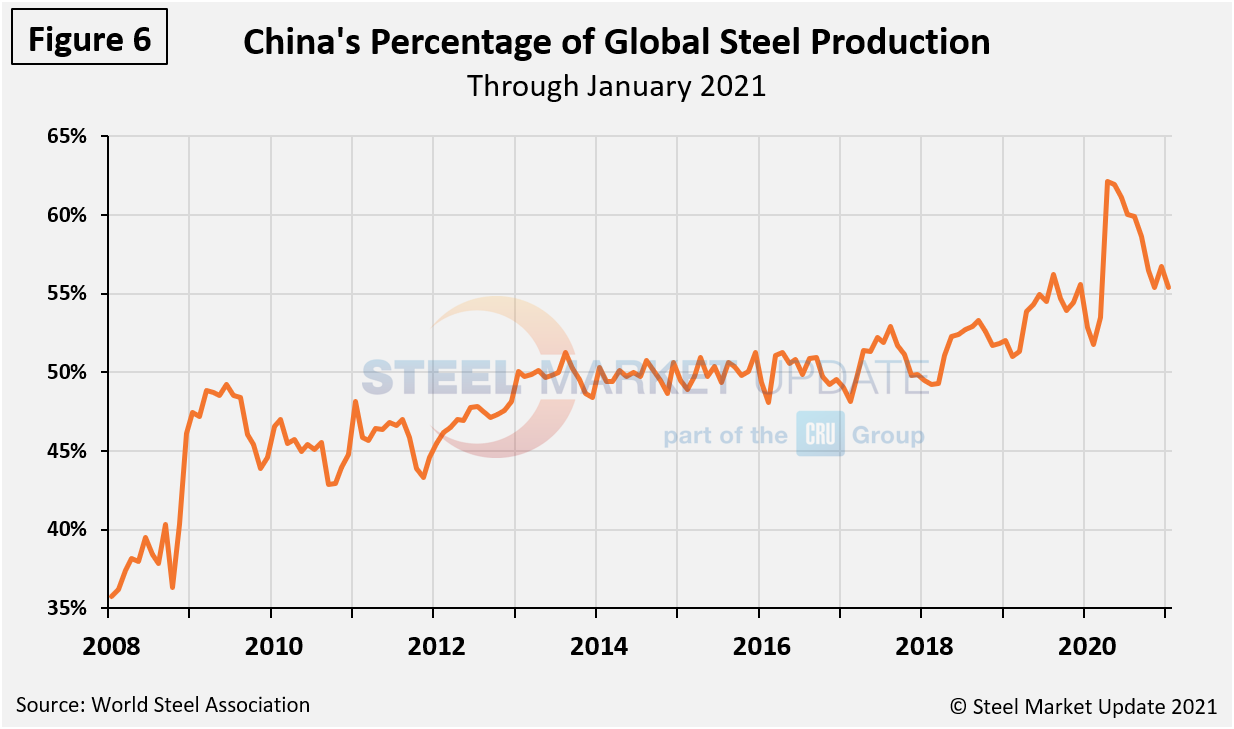

Figure 6 shows China’s share of global steel production, which in the single month of January was 55.4%, down from the most recent high of 62.1% this past August.

By David Schollaert David@SteelMarketUpdate.com