Prices

February 25, 2021

Hot Rolled Futures: China—Redux

Written by Tim Stevenson

SMU contributor Tim Stevenson is a partner at Metal Edge Partners, a firm engaged in Risk Management and Strategic Advisory. In this role, he and his firm design and execute risk management strategies for clients along with providing process and analytical support. In Tim’s previous role, he was a Director at Cargill Risk Management, and prior to that led the derivative trading efforts within the North American Cargill Metals business. You can learn more about Metal Edge at www.metaledgepartners.com. Tim can be reached at Tim@metaledgepartners.com for queries/comments/questions.

The Chinese steel market has changed rather dramatically over the past few weeks. Looking back to early March, inventories of HRC and rebar were increasing, as they do normally at this time of year. The China PMI had been trending lower and was barely over 50. Steel prices had been consolidating. Note on the below HRC chart that since December, steel prices in China were stuck in a channel just under $700 (green support line) and maybe $775 on the high side (red resistance line). Inventories peaked on March 4 and started moving lower. Recently, you can see that prices ripped up through resistance to make fresh highs for this cycle.

Here is the China PMI data. Note that the five-year average is roughly 50.5, so the recent surge is pretty significant. This series had fallen with the December, January and February readings before moving back up.

As far as steel futures, the Chinese prices have really had an upward surge. It’s one thing when just the spot month or the nearby months move up, but in this case the whole curve has pushed higher over the past two weeks by $90-$140 per ton!

In our mind, there are several reasons for the move. First, we’ve seen that the Chinese seem to be taking a more proactive stance on cutting pollution. They’ve been stricter with enforcement of production cuts in Tangshan, including penalizing mills that apparently didn’t comply with the first round of cuts by insisting on further production curbs. Second, manufacturing activity has come back solidly as measured by the PMI, and this also dovetails with some on-the-ground anecdotes we’ve heard. Third, talk of ending or cutting back the export tax rebates has resulted in other parts of Asia that are dependent on Chinese substrate to get a bit nervous about being able to secure tons. To us, disincentivizing exports makes some sense from a pollution standpoint. Why import millions of tons of ore from elsewhere in the world, produce steel that is not needed domestically, and then export a relatively low-labor-content good, all while emitting large amounts of pollution? The problem is many parts of the world have been pretty dependent on Chinese steel exports, hence the new sense of nervousness.

Looking at other forward curves over the same interval may give some added perspective. Turkish scrap has moved up:

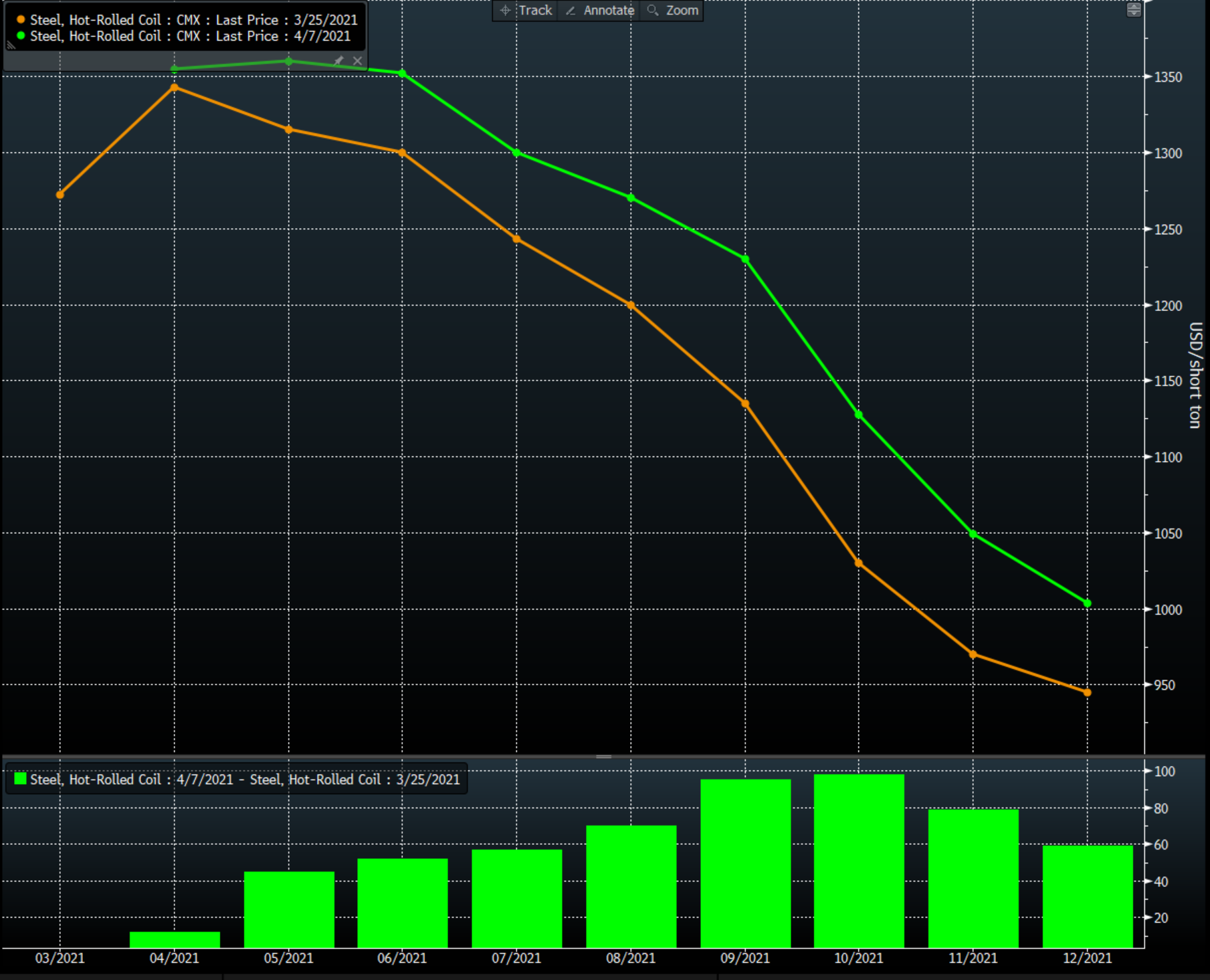

And U.S. HRC has also firmed. Note that some of the bigger moves in the U.S. were in the Q3 and Q4 periods.

Busheling, on the other hand, has been pretty steady. We’ve seen secondary grades weaken here in the U.S., which is not uncommon coming out of winter. Busheling has been supported in part by the chip-shortage-induced automotive production shutdowns.

From a volume perspective, the CME HRC contract is continuing to show solid growth. Note that the last bar is low as it is only partial month data.

What can we make of all this? Clearly, any careful observer of the steel markets has to pay attention to what is going on in China. Import levels have increased into the U.S. to some degree, but with international prices firming and U.S. import offer prices along with them—will those import flows really be large enough to spoil the party here in the U.S.? Only time will tell.

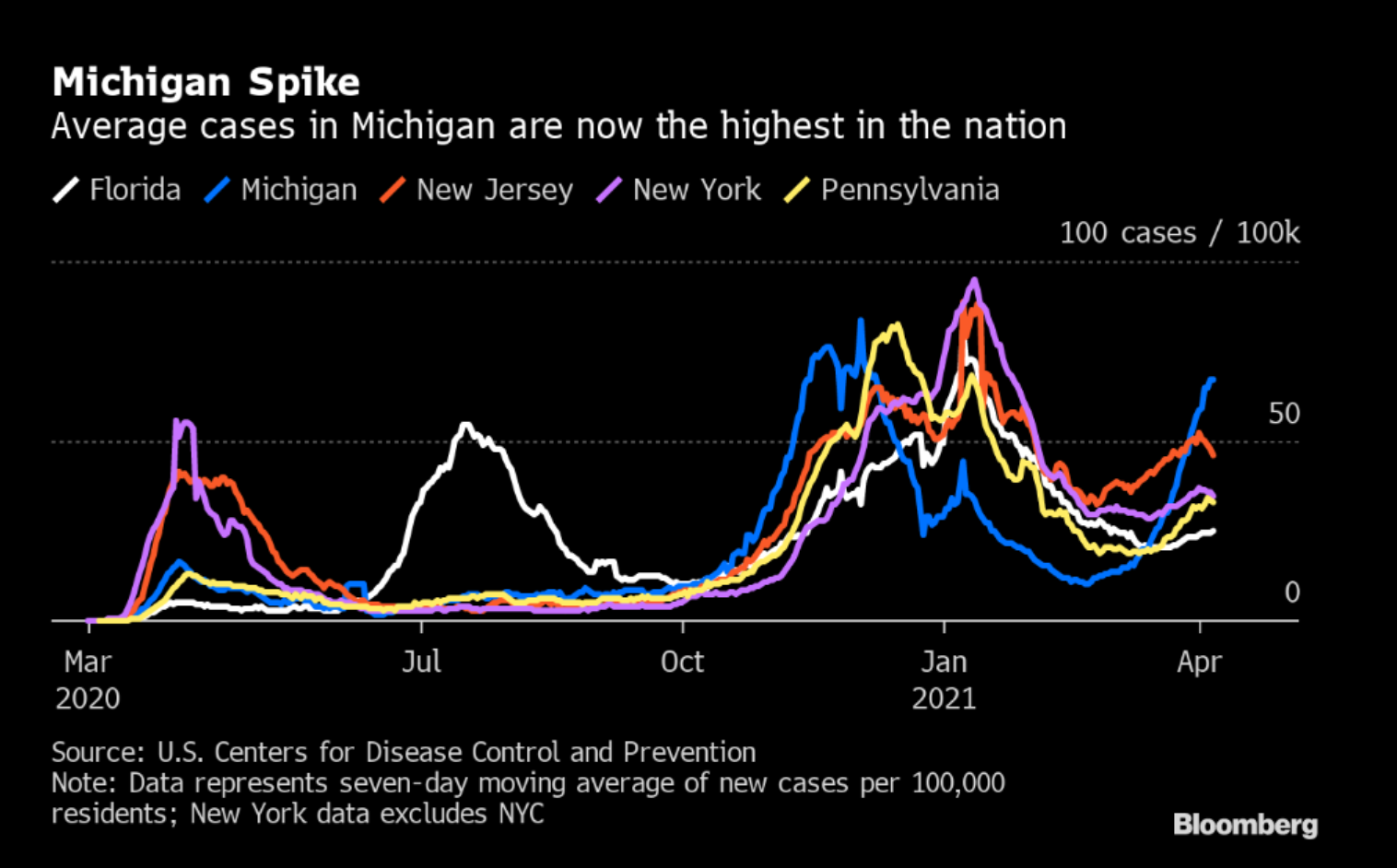

On a final note, we’ve seen mostly good news on the virus lately in the U.S. (while not the case globally), but overall case growth in the U.S. has now flattened out at a stubbornly high level. The Michigan situation in particular is worth watching. Supposedly one of the new variants is causing some real issues. You can see from the below chart that the situation there has worsened significantly, and average cases are approaching the old highs. Hopefully this is NOT a sign of things to come more broadly.

Thanks for reading, and stay healthy!

Disclaimer: The information in this write-up does not constitute “investment service,” “investment advice” or “financial product advice” as defined by laws and/or regulations in any jurisdiction. Neither does it constitute nor should be considered as any form of financial opinion or recommendation. The views expressed in the above article by Metal Edge Partners are subject to change based on market and other conditions. The information given above must be independently verified and Metal Edge Partners does not assume responsibility for the accuracy of the information