Product

February 19, 2021

SMU Steel Buyers Sentiment: Optimism on the Rise in 2021

Written by Tim Triplett

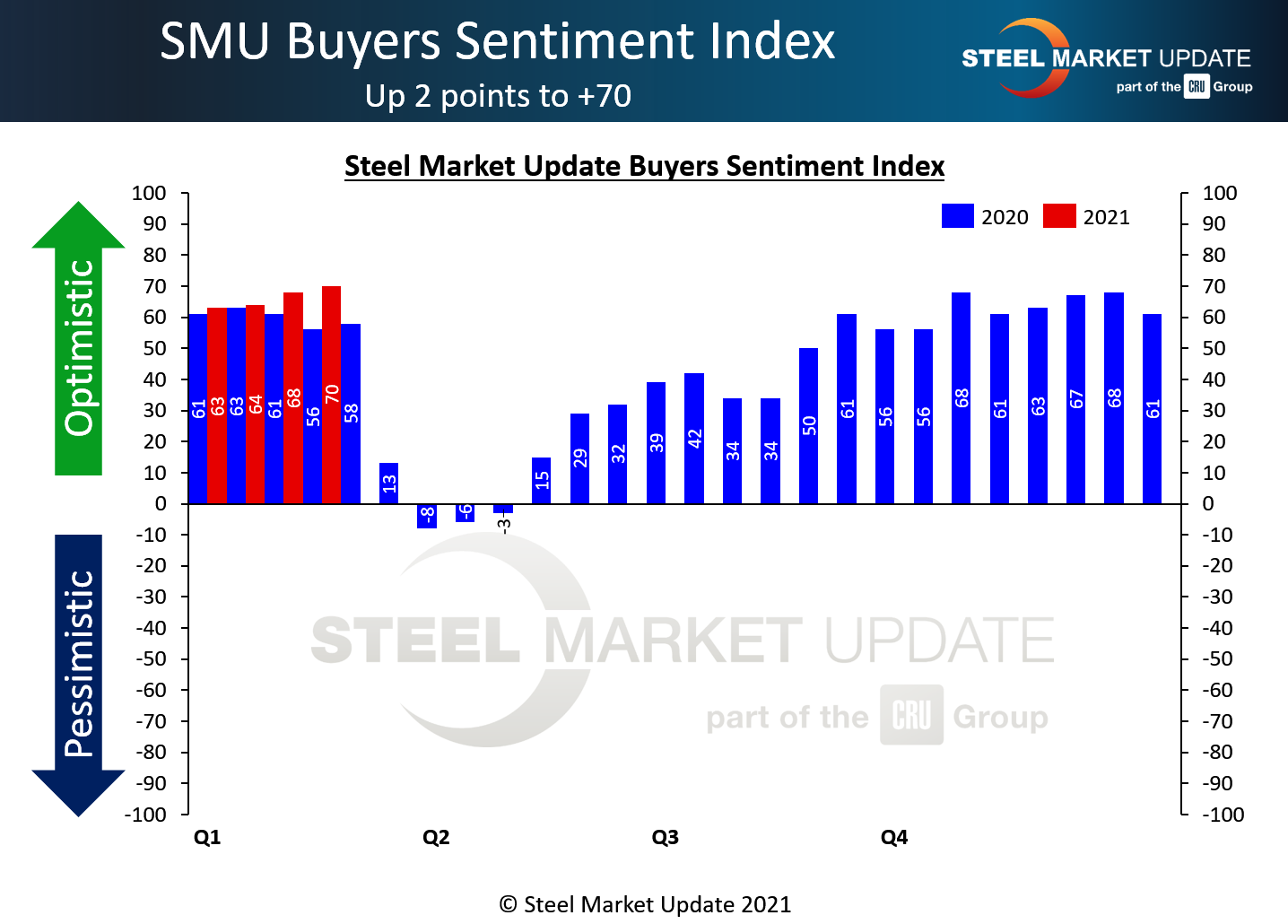

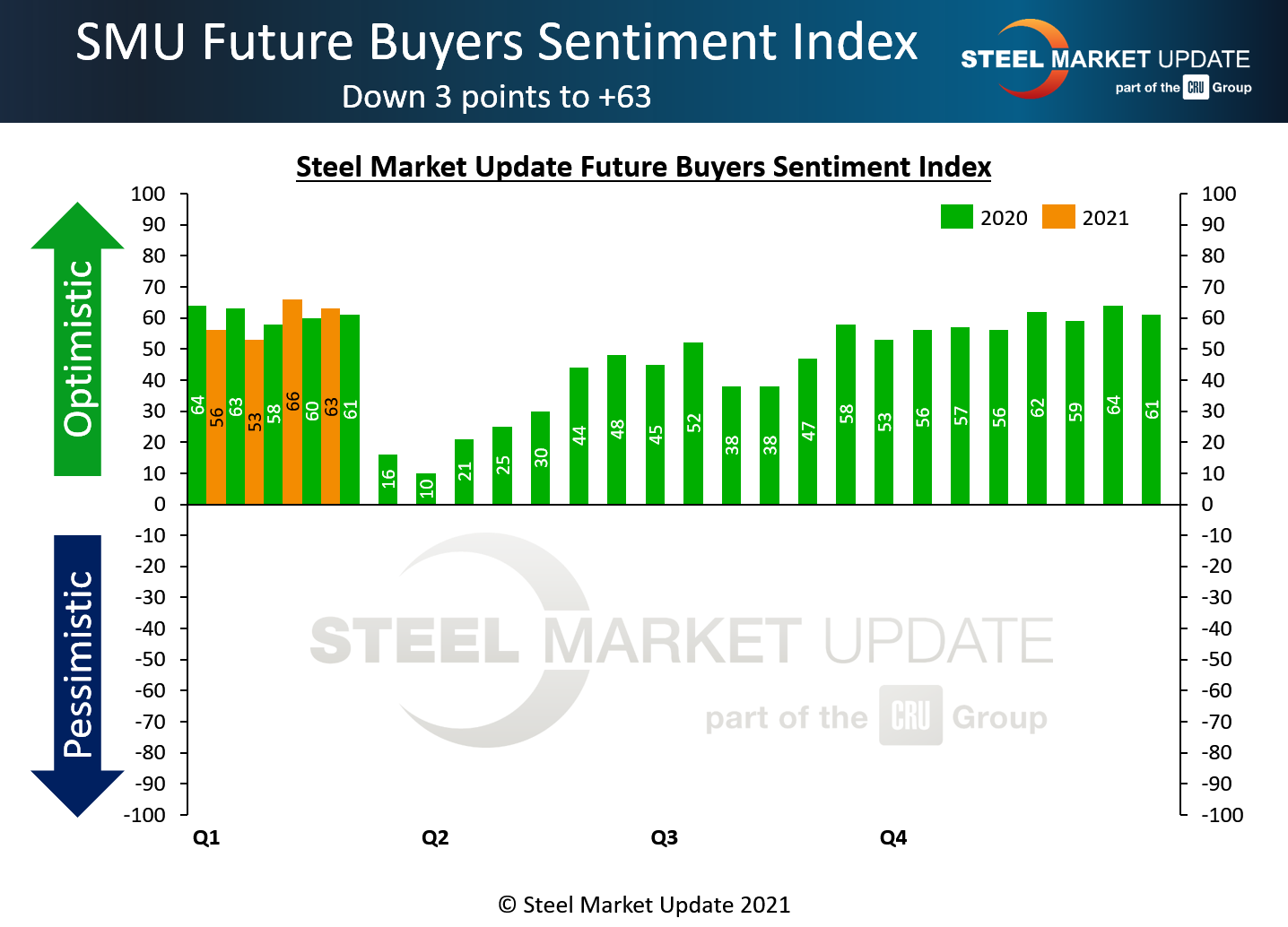

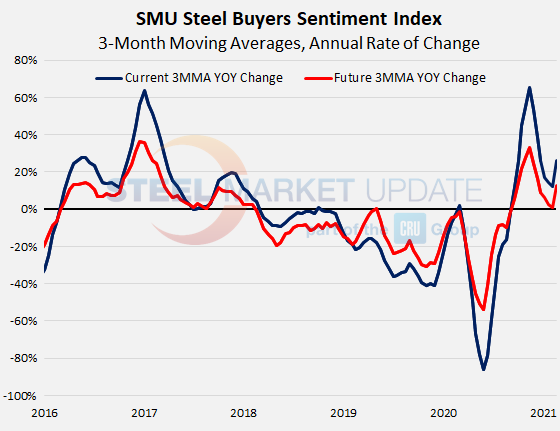

Steel Buyers Sentiment, as measured by Steel Market Update, hit a very optimistic +70 this week, not far from the highest reading ever recorded at +78 in January 2018. Future Sentiment was nearly as bullish at +63, just 14 points below its historical peak of +77, also in early 2018. Both Current Sentiment and Future Sentiment have made remarkable recoveries from near-record lows last April when the pandemic hit.

Every two weeks, SMU asks steel buyers how they view their company’s chances for success in the current environment, as well as three to six months in the future. Current Sentiment has inched steadily upward since the beginning of the year, likely reflecting the healthy demand and the staying power of record-high steel prices. While generally positive, comments from steel buyers show that many are concerned about the price correction expected to come sometime this year.

{loadposition reserved_message}

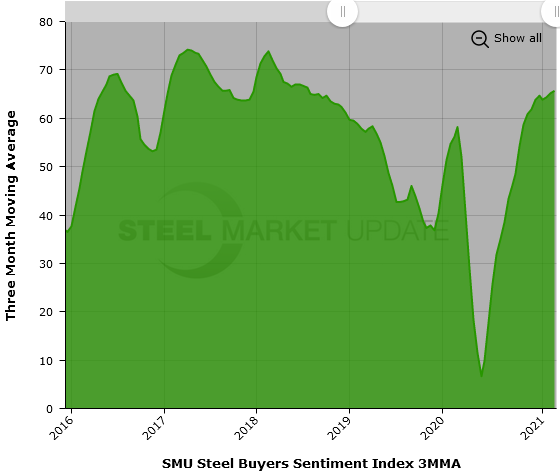

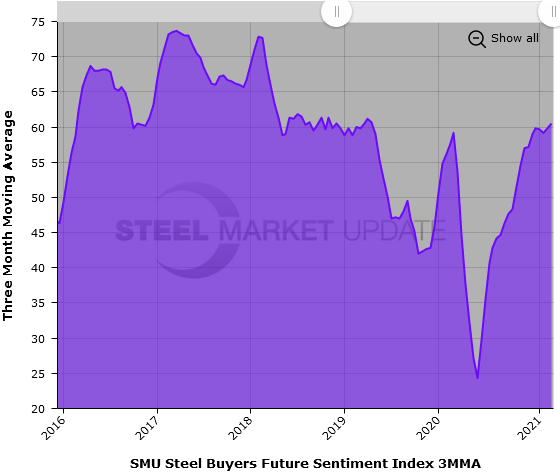

Three-Month Moving Averages

Measured as a three-month moving average (3MMA), Current Sentiment hit +65.67, its highest reading since July 2018, while the Future Sentiment 3MMA moved up to +60.50, its highest since April 2019. To give those numbers some perspective, the record high 3MMAs were around +74 in the spring of 2017; the record lows were about +40 in the fall of 2019.

What Respondents are Saying

“If you can’t succeed as a steel distributor in this market, your steel industry participation permit should be revoked.”

“I’d say our prospects are excellent, but the political unknown is a factor and you can’t account for its impact.”

“Transparency with customers about rising prices has been met with little resistance.”

“We are able to mitigate risk so far and still conclude new business, but when prices fall it will be another story.”

“The key is managing inventory and limiting it to what is absolutely essential to mitigate the pricing downside.”

“Steel is too expensive at this point.”

“We’re concerned about high-priced inventory.”

“The steel price correction that will come will challenge all steel users.”

“We don’t have enough HR and mid-range galvanized to sell.”

“Profits will be up, but overall volume is restricted by supply. No growth sales this year for sure.”

“Something has to give. We can’t keep having costs rise at this velocity and be short of supply at the same time.”

“Business is good, however, once we start to drop off the peak, nobody will make money—except the steel mills. Every service center and OEM will face declining inventory value.”

“We are not confident the market will get any better in the next six months and longer.”

“Shame on the mills!”

“We’re optimistic—after we dig out of all this snow and freezing temps in the South.”

About the SMU Steel Buyers Sentiment Index

SMU Steel Buyers Sentiment Index is a measurement of the current attitude of buyers and sellers of flat rolled steel products in North America regarding how they feel about their company’s opportunity for success in today’s market. It is a proprietary product developed by Steel Market Update for the North American steel industry.

Positive readings will run from +10 to +100 and the arrow will point to the righthand side of the meter located on the Home Page of our website indicating a positive or optimistic sentiment. Negative readings will run from -10 to -100 and the arrow will point to the lefthand side of the meter on our website indicating negative or pessimistic sentiment. A reading of “0” (+/- 10) indicates a neutral sentiment (or slightly optimistic or pessimistic), which is most likely an indicator of a shift occurring in the marketplace.

Readings are developed through Steel Market Update market surveys that are conducted twice per month. We display the index reading on a meter on the Home Page of our website for all to see. Currently, we send invitations to participate in our survey to more than 600 North American companies. Our normal response rate is 100-150 companies; approximately 40 percent are manufacturers, 45 percent are service centers/distributors, and 15 percent are steel mills, trading companies or toll processors involved in the steel business. Click here to view an interactive graphic of the SMU Steel Buyers Sentiment Index or the SMU Future Steel Buyers Sentiment Index.

By Tim Triplett, Tim@SteelMarketUpdate.com