Market Data

February 18, 2021

Steel Mill Negotiations: Still in Steelmakers' Favor

Written by Tim Triplett

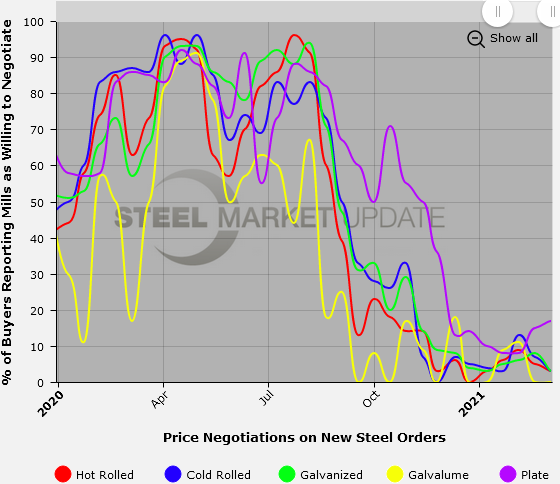

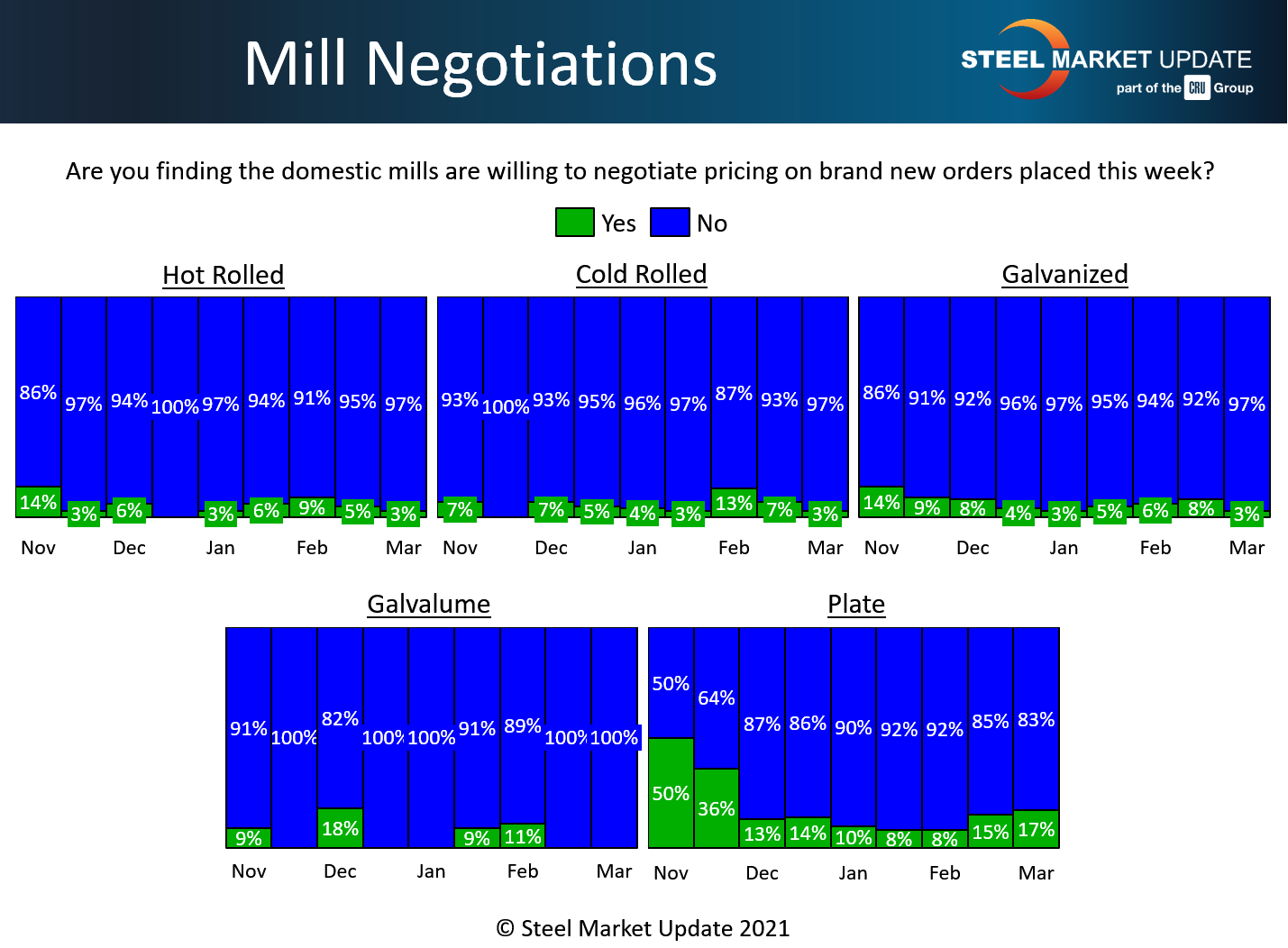

All but a tiny 3% of respondents to Steel Market Update’s questionnaire this week reported that the flat rolled mills remain unwilling to negotiate steel prices. Plate negotiations are only slightly more open, with 17% of buyers saying there is some wiggle room in price talks with the plate producers.

As long as steel demand continues to exceed supply by such a wide margin, steelmakers can easily sell all they produce and have no need to discount prices. Steel Market Update’s check of the market this week puts the current benchmark price for hot rolled steel at a new record of $1,240 per ton ($62/cwt), topping the former high recorded by SMU of $1,070 per ton ($53.50/cwt) in 2008.

Steel prices are likely to stay far above typical levels, and the mills in the dominant bargaining position, as long as the market is short of supply. As long as the mills keep capacity in check and many buyers remain reluctant to order foreign material that won’t arrive for 3-6 months, the negotiation dynamic can be expected to remain in the mills’ favor.

Note: These negotiations data are based on the average from manufacturers and steel service centers who participated in this week’s SMU market trends analysis. To see an interactive history of our negotiations data, visit our website here.

By Tim Triplett, Tim@SteelMarketUpdate.com